by Julian Howard – Lead Investment Director, Multi-Asset Solutions

1990s alt-rock sensation Garbage were the product of years of patient effort among their four original members. They were the archetypal rock latecomers, aged 42 (Duke Erikson), 40 (Butch Vig), 36 (Steve Marker) and 29 (Shirley Manson) when they finally made it. Emerging market (EM) equities have felt stuck in a similarly prolonged ‘hustling’ stage; the potential is all there but the figurative breakthrough album has still not been produced. Covid-19 and the response to it have only made that day seem even more distant for EMs, exacerbating structural and cultural features that have conspired to hold back emerging economies and equity markets relative to their developed counterparts. In the 12 months to 27 July 2021, the MSCI World Index (USD) posted a 35.6% return, but the MSCI EM Index (USD) could only manage 18.6% while the MSCI China A Index (USD) of onshore shares delivered just 13.2%. Investors are right to question how long they will realistically need to wait for the breakthrough, if indeed it is coming at all.

EM equities face three particular headwinds. First, central banks globally are feeling pressurised to tighten interest rates amid rising inflation. Brazil has increased its main lending rate three times this year alone to deal with inflation and it now stands at 4.25%, which is where it was in early 2020. Amid a pandemic which Brazil’s healthcare system is struggling with, this tightening is unsurprisingly hurting economic activity and feeding into underperformance of the Bovespa Index. Similarly, unappetising policy choices face many other emerging economies. But it is perhaps expectations of higher US interest rates that are even more problematic for EM equities generally. This is because the prospect of higher rates in the US attracts global capital and places upward pressure on the US dollar. This is important, because thanks to a process of ‘dollarisation’ over the years, a high proportion of both global trade receipts and EM debt issuance is denominated in US dollars. For example, 60% of Turkey’s imports are invoiced in dollars, while only 6% of its total imports actually come from the US. Meanwhile, according to the Bank for International Settlements (BIS), non-US corporate borrowing is also dominated by US dollars despite revenues not being so. This means that today’s US dollar strength is exerting a tremendous tightening pressure on economic activity in EMs.

The second main headwind has been Chinese regulatory intervention. The authorities have been cracking down on the tech sector for some time now but the latest edict to ban educational firms from making profits in tutoring core subjects has alarmed investors and saw a fall in excess of -4% in a single day for the MSCI China A Index earlier in July. This aggressive approach reflects the more robust tone set by the Chinese leadership generally of late. A speech on 1 July by Xi Jinping to mark 100 years since the founding of the Chinese Communist Party revealed both a certain wariness towards the West as well as a jealous defensiveness of China’s “firm leadership”. Given China represents over a third of the MSCI EM Index, the prospect of a partially functioning Chinese equity market has quite rightly dragged down the EM complex as a whole versus its developed market peers.

Third is the spectre of continued Covid-19 infections across an economic block with generally low vaccination rates. In Brazil again, the daily death toll reached nearly 4,000 earlier in the year while India has suffered grievously. Lockdowns across EMs have been especially blunt and damaging. Research by Goldman Sachs revealed that Latin America had the toughest virus response (as measured by restrictions and compliance) globally, with movement nearly twice as constrained as it was in North America. Frustratingly for policymakers, aggregate health outcomes were not always better for it, but economic ones were definitely worse. EMs by their nature are more contact-sensitive as the potential growth of economies built around ideas and intellectual capital – taken for granted in the West – is still in the process of being realised. Vaccinations are the obvious way to unlock this unhappy situation, but according to the World Bank, the world’s poorest 29 economies have seen only 0.3% of the population receive just one dose of vaccine.

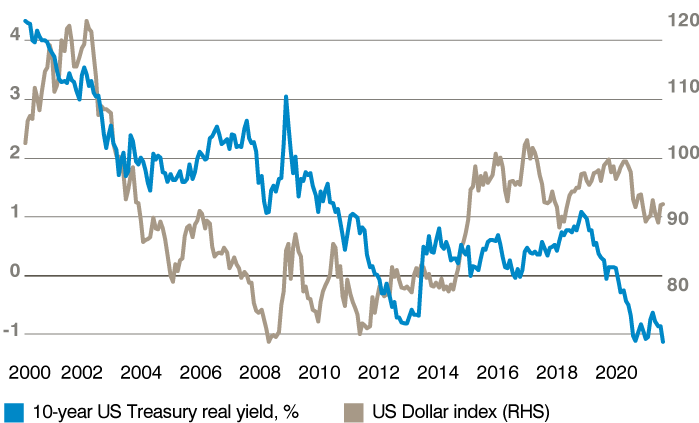

Crucially, all of these challenges have a certain transience about them which serious equity investors can rightly be expected to sit out. There is unlikely to be any near-term fix to the global dominance of the US dollar but US interest rates are not a dead cert to keep rising. A natural slowing down in the post-pandemic recovery, as well as some caution around the so-called Delta variant of Covid-19, has seen long-term US growth expectations as measured by real bond yields fall to -1.1% as at 28 July. Bets on US interest rate hikes in the futures market have also collapsed in recent weeks, with speculators cutting more than 347,000 contracts that would have benefited from near-term interest rate rises in the week to 20 July alone. While any Covid-19 resurgence is hardly welcome, a cooling of the US economic expansion could well give EMs the breathing space they need by making the US dollar a little less attractive to global capital.

Chart 1: Cooling off – falling US real yields should pull the US dollar down:

Turning to China, local investors have not been deterred by the recent market interventions, taking out margin loans to buy equities that foreigners were so keen to dispose of in recent weeks. This reveals the faith in the market leveraged investors have, that they are prepared to buy the dip despite incurring borrowing costs too. Perhaps these investors have noted that valuations have become relatively attractive as a result of the panic, with China’s technology sector in particular now looking like good value versus global peers. And, from a broader perspective, an equity market that has undergone a recalibration to align with the long-term objectives of the party leadership on issues like wages (logistics sector), accumulation of executive power (tech sector) and youth policy (education sector) is surely better positioned to deliver sustainable returns. From an international investor standpoint, it remains a tantalising fact that China’s equity markets represent only 5% of the MSCI AC World Index but nearly 20% of the global economy. This, along with the authorities’ firm view that ‘guided’ markets should play a bigger role in the efficient allocation of capital in China, should provide reassurance that the country remains a vital part of any portfolio.

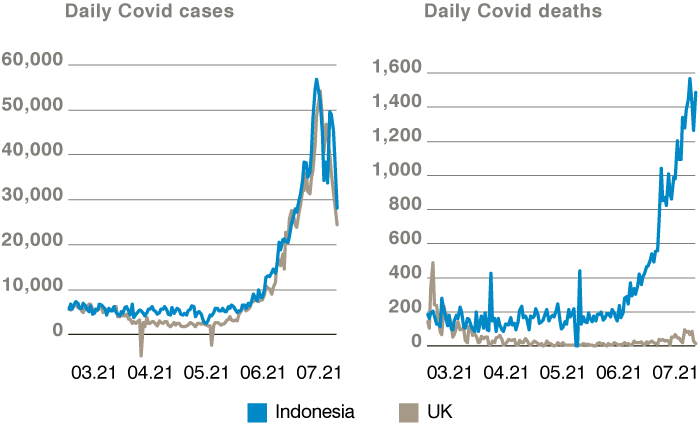

Finally, on vaccination in EMs there are belated signs of progress which bode well for future. Singapore, China and Hong Kong are starting to make headway in terms of meaningful vaccine penetration, while initial horror at what was seen as premature reopening in the US and UK may give way to a profound policy reassessment among emerging economies relying heavily on a strict zero-Covid-19 policy that is delaying re-opening and recovery. This is perhaps best demonstrated by the startling contrast between the number of confirmed Covid-19 deaths in Indonesia and the UK in recent months, despite both having similarly sized outbreaks. Indonesia’s tough experience may yet have a silver lining for EMs if the country demonstrates that only vaccinations can facilitate proper reopening and the abandonment of economy-strangling social restrictions. In a positive sign, Singapore’s traditionally strict authorities have in recent days started to draw up plans on easing restrictions.

Chart 2: Nudge – Indonesia’s lesson will encourage other emerging markets:

The long-term case for EMs remains rock solid, in our view. Higher growth rates, younger populations, urbanisation, the rise of the middle classes, innovation and under-representation in global capital markets are chief among these. Investors should therefore not be put off by what has been a perfect storm for the asset class in the form of a strong US dollar, Chinese regulatory intervention and a controversial Covid-19 response. These are likely to give way as the US economic recovery naturally cools, China completes the planned re-alignment of its corporate culture and vaccinations finally start to replace social restrictions as the main defence against Covid-19 deaths. For those investors waiting for a compelling entry point, now seems as good a time as ever given the recent battering described and the better valuations resulting from it. If this was the history of the band Garbage, it might just be the moment when Shirley Manson was chosen for the role of lead singer.