by Stephen Milch – Consulting Economist

For the first time in over a decade, a new economic cycle may be underway – a ‘reflation’ cycle characterised by faster economic growth, higher inflation and ongoing monetary and fiscal stimulus.

Economics and investing are, of course, inextricably linked, and this unique backdrop implies a shift in financial markets, as the trends that defined the post-GFC period make way for new themes.

Looking ahead

Looking ahead, astute investors should anticipate quality assets that have been underappreciated for some time again becoming sought after. Specifically, the following themes are expected to become features of the investment landscape.

- In a durable economic upturn, improved profitability is likely to provide Value stocks with the ‘scarcity’ factor previously enjoyed by Growth stocks. At the same time, rising bond yields will leave the questionable valuations of Growth stocks vulnerable.

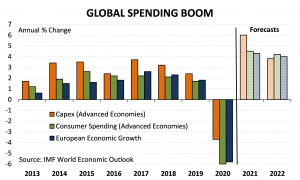

- The greater breadth of economic activity, across and within economies, will allow smaller businesses to benefit – particularly those leveraged to the forecast strength in consumer and capital expenditure (illustrated below).

- Stronger economic and market performances are anticipated beyond the US – notably in Europe where there remains ample scope for an extended growth phase. Indeed, official projections are for European growth to outpace that in the US over the next 5 years. [1]

Looking back – crises boost share markets!

Who would have thought that a global crisis or two would actually benefit equity investors? It’s 13 years since the GFC and almost 2 years since the onset of COVID and, in each case, investors have reaped strong gains following the initial ‘shock’.

In the case of COVID, global central banks simply dusted off the successful GFC playbook: Quantitative Easing resumed, bond yields registered new lows and markets rebounded. Meanwhile, the future was brought forward, as the take-up of digital technology accelerated. COVID, therefore, intensified two of the most pronounced themes that have driven investment returns since the GFC:

- lower bond yields and weak growth reinforced the market bias in favour of Growth stocks (those with favourable long term profit prospects) over Value stocks (those with high profitability today), and

- the technology revolution, in which businesses involved in hardware, software, streaming services, social media and internet shopping – especially the dominant US names – have flourished.

The new economic cycle

However, as the global COVID threat eases, the economic disruption of 2020 is giving way to other powerful forces.

- A combination of massive policy stimulus, a surge in house prices, high rates of precautionary saving and pent-up demand has created a potent cocktail for consumer spending across the major economies.

- Infrastructure spending plus bottlenecks in industries from semiconductors to healthcare and transport are igniting an investment boom. Indeed, Standard & Poor’s estimate that the world’s largest companies will undertake capex worth $US3.7 trillion in 2021[2] while The Economist states that the capex boom “may only be getting started”.[3]

- Global growth has become strongly synchronised as authorities have adopted a clear ‘pro-growth’ stance. Moreover, policymakers are likely to err on the side of caution in removing stimulus, with the IMF urging supportive monetary and fiscal policy “wherever possible” and “until the pandemic ends”.[4]

Search for value

Under unique circumstances, investors shouldn’t assume that the strategies of recent years will continue to deliver. Strategies and portfolio positioning must adapt to the new environment and while absolute returns may be a little harder to find, a quote by billionaire Berkshire Hathaway investor Charlie Munger highlights the importance of searching for value: “all intelligent investing is value investing – acquiring more than you pay for”.

Today, that value is likely to lie in previously ‘unloved’ places. We favour exposures in quality smaller companies in Europe. We also encourage investors to look to businesses that are likely to benefit from the release of pent up consumer demand and the capex surge.

Finally, although these themes are expected to play out over an extended period, short term indications are already supportive. European markets have outperformed the US over recent months – including smaller companies, as shown below – while there are early signs of a rotation to value and relative gains within the industrial and consumer sectors. It’s early days, however, and investors still have time to capitalise.

The Pengana Global Small Companies Fund is an actively managed portfolio of global small-cap stocks.