As we predicted Woolworths has today announced a $2B off-market buy-back.

Off-market buy-backs are a tax effective mechanism for returning franking credits to shareholders who most value them. The buy-back will have a $4.31 capital component, with the balance being a fully franked dividend. The buy-back will be based on a tender, with investors tendering to sell shares at a discount of between 10% to 14% below market price. Shareholders who don’t participate will still benefit from the buy-back, to the extent that shares are effectively bought back at a cash discount to market price. This compares with on-market buybacks, where companies buy-back stock at market price.

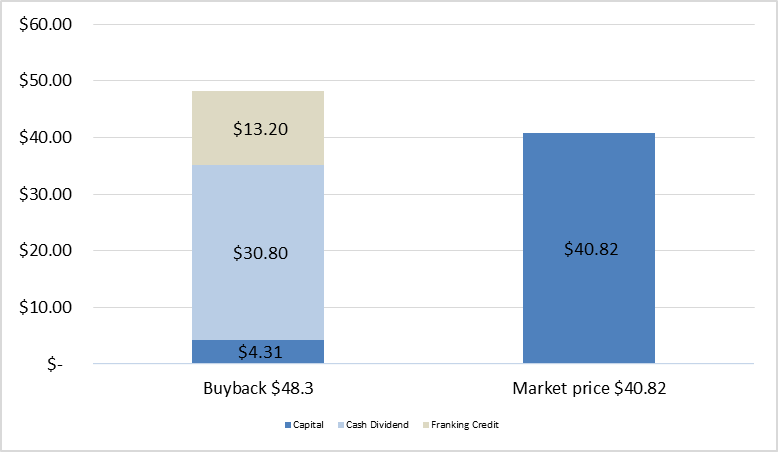

We have analysed the value of the buy-back for tax-exempt investors such as charities, foundations, pension phase superannuation and individuals below the income tax threshold using the market price of Woolworths on August 25 of $40.82 – see Chart 1 below. Using $40.82 as a guide (the actual price used for the buy-back will be the volume weighted average price of Woolworths shares in the five trading days up to and including October 15, 2021) the maximum 14% discount would equate to a $35.11 buy-back price. With the capital component being $4.31, the other $30.80 would represent a fully franked dividend, which would have a $13.20 franking credit attached. For a tax-exempt Australian investor, we estimate the buy-back at a 14% discount would be worth approximately $48.30 (disregarding the time value of money), representing an after-tax profit of $7.48 or 18% compared to the market price of Woolworths today. Please note that the buy-back is expected to be completed on October 18, 2021, based on volume weighted prices from the previous week.

Source: Plato, Woolworths buy-back announcement 26 August 2021.

The value of the buy-back for other investors will depend on the tax situation of each investor. We would expect the buy-back to be of some value for 15% tax rate Australian investors, but significantly less that the 18% number for tax-exempt investors. The precise value will be determined by investor circumstances, the deemed capital value that the ATO will issue after the close of the buyback and the final buy-back price relative to the closing market price.

Given that we estimate the buy-back is valuable for both tax-exempt and 15% tax rate Australian investors at the maximum discount rate, and given the moderate size of the buy-back relative to Woolworths’s current market capitalisation (approximately 4.6%), we would expect the final buy-back price to be set at the maximum 14% discount to market price. We would also expect, based on similar buy-backs, that the buy-back will be oversubscribed and thus investors would be likely subject to potentially large scale-back – that is only a small portion of shares tendered would be successfully bought back in the buy-back. So whilst we expect the buy-back to be quite valuable for tax-exempt Australian investors for every share successfully tendered, any scale-back will reduce the overall value of the buy-back at the portfolio level.

Plato expects to tender all Woolworths shares owned by the Plato Australian Shares Income Fund into the buy-back as this fund is managed from the perspective of tax-exempt Australian investors. This means that investors in both the Plato Australian Shares Income Fund and Plato Income Maximiser Limited (PL8.AX) should benefit from the Woolworths buy-back. We believe opportunities such as this Woolworths buy-back highlight the importance of tax-exempt investors like pension phase superannuants having their investments managed from their tax perspective.

Please note that this analysis depends very much on the particular tax status of the investor. We would suggest individual investors should seek professional tax advice based on their individual tax circumstances.