The Australian June half profit reporting season wraps up today and tomorrow with another 20 major companies due to report.

Leading the way will be full year figures from Crown Resorts, Fortescue Metals, Harvey Norman and Freedom Foods today.

Fortescue’s earnings will be enormous, a record and unlikely to be reached again for a while. Harvey Norman will also report record figures, but its current trading performance will be of more interest with the rise of Covid Delta infections in NSW and Victoria.

Crown and Freedom Foods will be blobs of red ink.

Other companies due to report include Booktopia, Beston Global Foods, Aussie Broadband, Rex, Helloword, Nuix and Shaver Shop.

Nuix will report a massive loss, while Rex has already forecast a loss of around $18 million.

In the past couple of weeks, the big results have come to be overwhelmed at times by worries about the impact of Covid Delta on trading in the first two months of the December half year.

The AMP’s Dr Shane Oliver says that “while the lockdowns are weighing on outlook statements with many companies providing no guidance and we have seen the usual softening as reporting season proceeds, the results have been solid.”

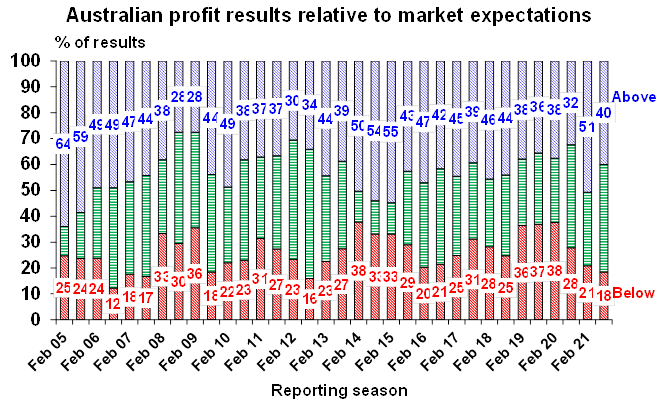

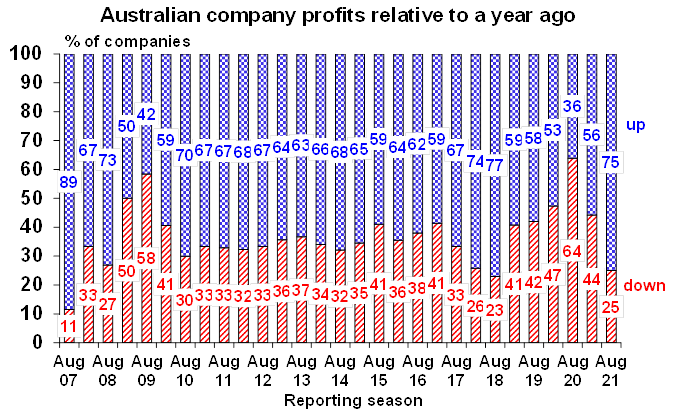

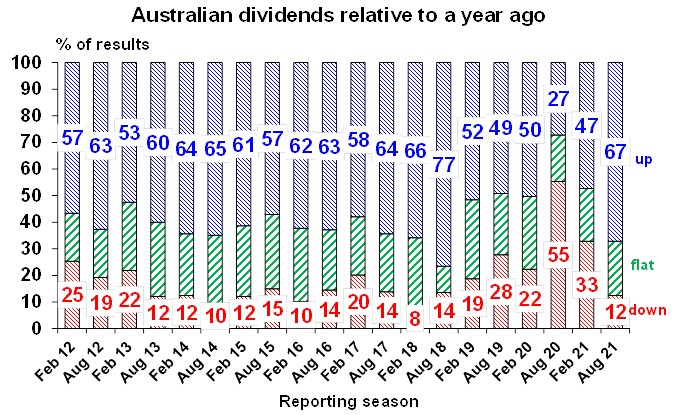

He wrote at the weekend that 40% of results have surprised on the upside which is just below the norm of 44% but only 18% surprised on the downside which is well below the norm of 26%, 75% have seen earnings up on a year ago and 88% have increased or maintained dividends.

The return of capital to shareholders will be big with a record $30 billion in dividend payments already declared and over $20 billion in buybacks – the latter dominated by Commonwealth Bank’s $6 billion, The NAB’s $2.5 billion and Woolies $2 billion.

Wesfarmer’s $2.3 billion in dividends on Friday also stands out while the CBA also lifted dividend and Telstra did likewise. BHP, Rio Tinto and Oz Minerals boosted returns to shareholders – BHP’s was more than $US15 billion for the year and Rio’s was $US9.1 billion for the six months.

Dr Oliver says that the consensus earnings growth expectations for the June 30 financial year have now increased to +50.6% from +49.1% at the start of the reporting season and those for the current financial year have only fallen from +8.6% to +7.5%.

Resources are seeing a 97% rise in earnings and bank profits are up by 58%. Dividend growth is coming in at around 57%.

Source: AMP Capital

Source: AMP Capital

Source: AMP Capital