Was July as good as it gets so far as our trade performance is concerned?

The Reserve Bank’s Commodity Price Index on Wednesday sent a message that many economists missed – that Australia’s record-breaking series of trade surpluses is over.

The RBA’s index and its 4% plus fall in August (from July’s all time high) came a day before the Australian Bureau of Statistics revealed that Australia’s trade surplus hit a record in July (the first month of the new financial year) as exports of iron ore, coal and liquefied natural gas all rose strongly.

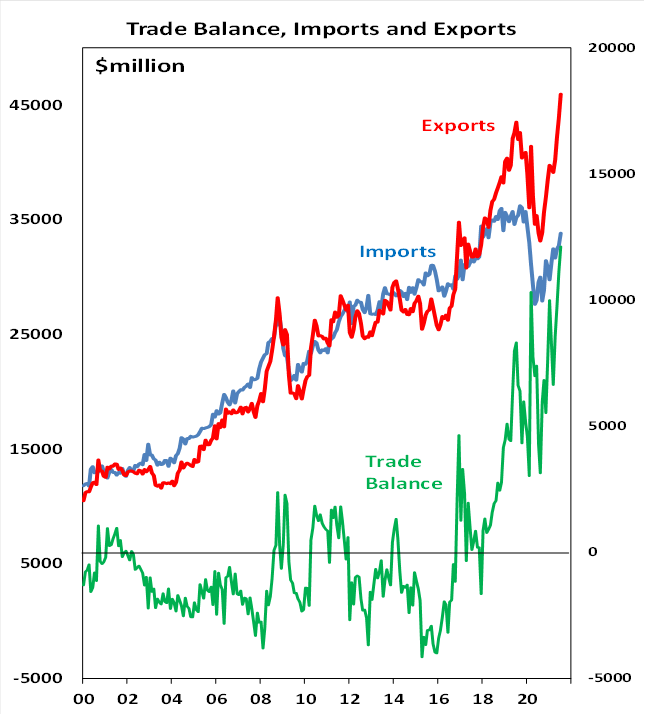

The Australian Bureau of Statistics reported that July’s trade surplus climbed to $12.1 billion in July, from an already high $11.1 billion in June, beating forecasts of $10.2 billion.

Exports jumped 5% to a record of nearly $46 billion on the back of Asian demand for LNG and thermal coal, combined with higher prices for iron ore.

Imports rose 3%, largely due to a sharp increase in parts and accessories for telecommunications equipment.

Exports to China also hit a record of $19.4 billion, having climbed 72% from July last year when pandemic restrictions were curbing global trade flows and commodity prices had yet to start the recovery that saw many peak in April and May this year and continue near those highs into July.

The 21% plus slide in iron ore prices in August will start showing up in the trade data, but because of timing lags, the impact won’t be apparent until the 4th quarter.

But with still solid prices for coal, and LNG, plus aluminium at 10-year highs and tin, lead and zinc also solid, the decline in the size of the surplus will be slow.

The RBA still sees our terms of trade up by around 9% by the end of this December – that will be sharply lower than the 24.1% surge in the year to June.

The AMP’s chief economist Shane Oliver said in a note on Thursday that “the 30% or so plunge in the iron ore price since its May high feeds through with a lag, it’s likely that we have now seen or come close to the peak in the trade surplus.”