by Michael Price – Portfolio Manager, Active Dividend Income Fund

Dividend investors need to be more selective.

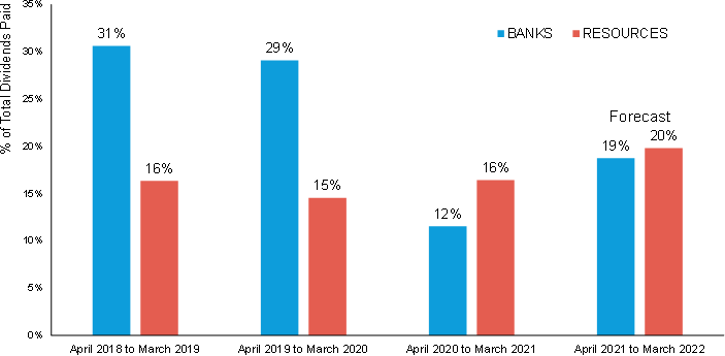

The recent boom in resources has seen dividends from resources companies take share from the usually dominant banks.

Banks had a tough few years, and in the pandemic they had to cut (cancel in Westpac’s case) dividends to help provision for potential bad and doubtful debts (which did not eventuate to anywhere near the level projected). Recent dividends show the switch to growth momentum in bank earnings as the economy surges.

Banks, resources companies and the broad market are now looking at multi-year earnings upgrades that we forecast will result in multi-year dividend upgrades.

An active approach to dividends can optimise the opportunities this brings, including capturing more franking credits across the year from this fundamental earnings growth.

Banks ceded their traditional dividend dominance in 2020 (% of market dividends paid)

Source: Ausbil

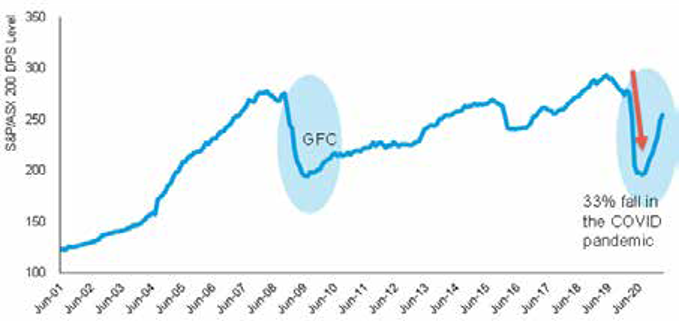

Dividend yields set for a rerate

Source: Ausbil, Fact Set

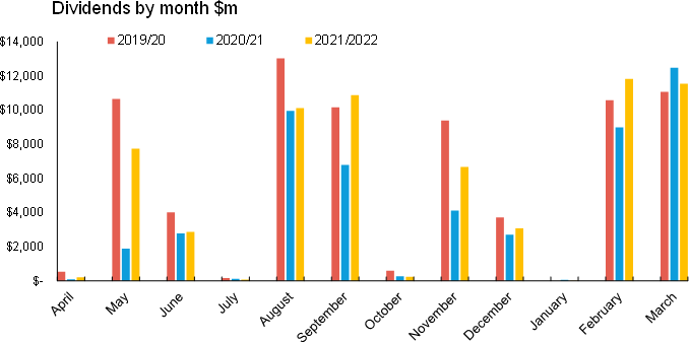

Outlook for dividends this financial year

The consensus outlook for dividends has risen, showing growth not just for thecoming year, but also into 2022 and 2023.

The two key sectors where we see the potential for earnings surprise are the banks and resources sectors.

While we are not expecting another big dividend boom from the iron ore sector, we see a recovery economy and increasing corporate earnings benefiting the broader sector.

Banks, which offer primary exposure to a recovering economy, entered the pandemic after heavy barrage from the Hayne Inquiry and having already been sold down. The pandemic saw them sold down further on fears that the recession and COVID job losses would impact their lending books.

All the banks provisioned majorly for the potential for credit loss, and APRA further enforced capital retention through limiting the dividends they were allowed to pay. Looking at the banks in the 2021 New Year, it was evident that the bad and doubtful debt experience was nowhere near predictions, and that the banks had over-provisioned for losses.

Recovery and a new dividend growth story

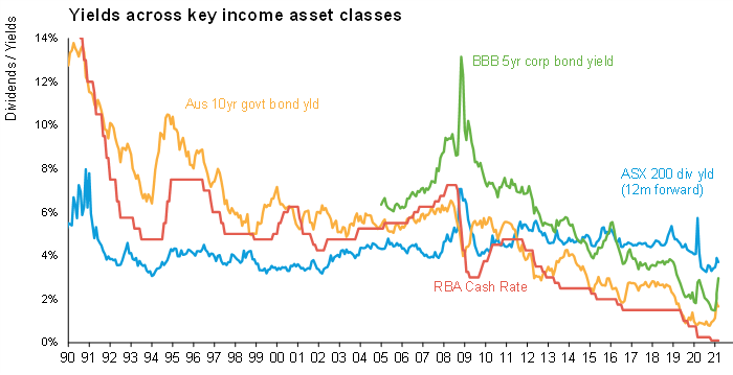

Investors continue to look to equity yields as an anchor for income strategies

Source: Ausbil, Fact Set, Refinitiv, MST Marquee

With APRA allowing a return to more commercial dividend levels, and the economy resurging from the 2020 lows, we could see banks were in a position to reduce these provisions and grow their books further in a renewing real estate market. The result is thatover the next few years, the unwind of this over-provisioning will see a rerating of earnings,ahead of the consensus expectation at the time we began up-weighting into banks.

Ausbil’s view is that economies will run ‘hot’ for some time, with the support of policymakers, and are delivering the best growth figures since 1983, across a multi-year growth profile.

While inflation will remain an ongoing source of worry as the perennial flipside to growth, it is important to understand whether inflation spikes are intermittent or if they are moves to a higher sustained level. It is our view, and indeed that of most global central banks, that inflation will not be a problem for some years as the world economy returns to health.

Ausbil’s house view is that consensus is still under-estimating the rebound in earnings that will occur in the prevailing economic conditions, with rates to remain low, and with the world economy providing a tailwind to Australia’s current expansion. This will only further benefit the dividend payers on the market, and most benefit investors who are able to actively allocate to the best blend of dividend and franking credits across the market, across each month of the year.