Note: Data in tables and charts refer to Friday closing prices (not overnight moves)

Global markets

A month or so ago the main worry on global markets was that there didn’t seem much to worry about (i.e. investors were complacent). We’ve now shifted to markets having a litany of things to worry about – and not knowing what to focus on! We’ve got Evergrande/China slowdown fears, U.S. debt ceiling squabbles, Fed tapering, delta and pesky inflation/supply chain bottlenecks. Ultimately, however, the potentially negative demand forces (China and delta) have not been enough to offset tapering and inflation concerns, such that bond yields have moved higher, which in turn has especially dragged down growth/technology stocks.

Oil prices, meanwhile, continue to strengthen, thanks to rising re-opening demand, a sluggish OPEC supply response and tightening global gas supplies (in part due to a range of untimely weather events that have disrupted European renewable energy supply). Higher oil prices, along with rising bond yields, have helped support ‘value’ sectors such as energy and financials.

But for all the talk of a ‘bloodbath’, so far at least the U.S. S&P 500 is still down only 5.2% from its daily closing high in early September. The NASDAQ-100 is down 7.6%. Of course, equities could still drop lower, especially as it still seems likely the Fed will proceed with tapering next month and bond yields could therefore also move higher – with U.S. 10-year yields potentially re-testing their highs earlier this year at around 1.75%.

My base case, however, remains that U.S. 10-year bond yields won’t make new highs this year (and critically stay below 2%), so we should still be only looking at a garden variety global equity market pullback of around 10% or so. After all, the global demand and corporate earnings outlook still appears robust, thanks to the ongoing vaccine rollout and economic re-opening. As for China and U.S. debt issues, I still suspect these will resolve themselves in coming weeks without undue global carnage. And while supply chain inflationary bottlenecks may persist, central banks should remain alert but not alarmed given still ample lingering spare capacity in labour markets which should keep broader wage growth in check.

The key global highlight this week will U.S. payrolls on Friday, which are expected to show still reasonably healthy job gains in September of around 488k. Markets will also be watching for a potential restructuring of China’s Evergrande and any U.S. agreement with regard to lifting the debt ceiling.

Australian market

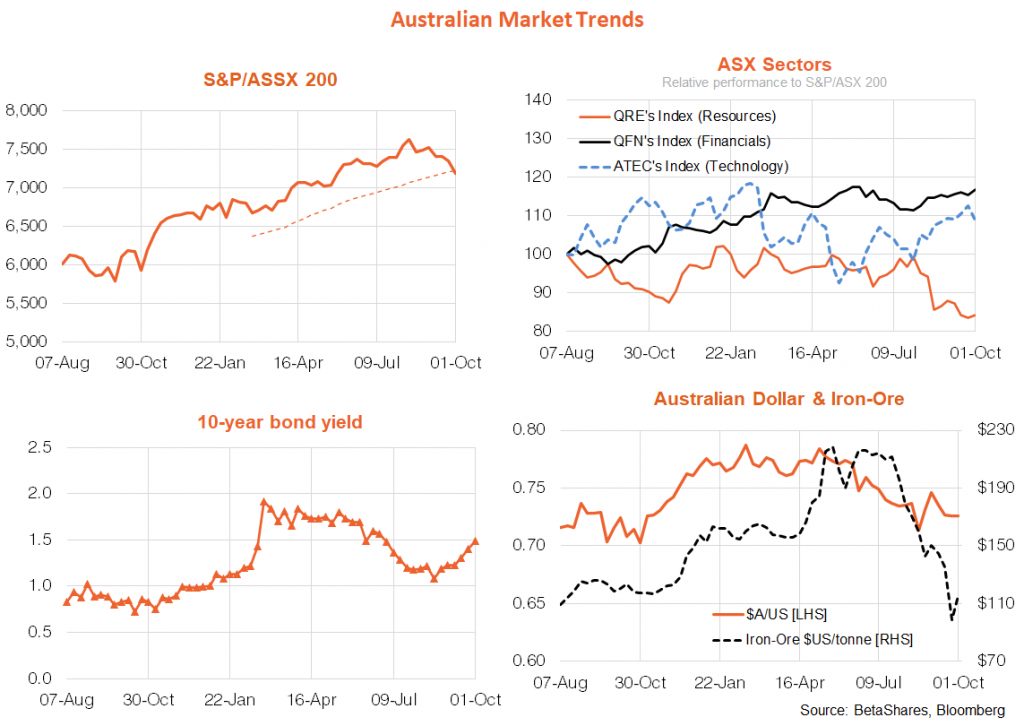

As is usual, Australian stocks have not been spared from the global pullback, even though we saw a moderate bounce back in iron-ore prices last week. The main local item of economic interest last week was growing talk of macro-prudential home lending controls being reinstated to take the heat out of the housing market. Given the RBA’s adamant stance about not lifting interest rates for years, a red hot property market and new ‘macro-pru’ controls have long been my base case.

Local economic data was mixed, with a surprise bounce back in home building approvals (after several months of decline) and lockdown-related weakness in retail sales. Either way, local data is still largely irrelevant for markets or policy makers and we continue to patiently count down to re-opening in Sydney and Melbourne.

Tomorrow’s RBA meeting should hold few surprises, apart from what the Bank might signal with regard to its views on macro-pru. Local stocks, bond yields and the $A await global direction.

Have a great week!

-

CATEGORY