by Lachlan Mackay

Many investors know the unprecedented opportunity that has emerged in US online sports betting. The sector is expected to grow from US$1 billion in 2019 to US$30-50 billion in revenues by 2030.

As we’ve noted before, two operators, FanDuel and DraftKings, have a significant head start. But after expanding to a 45% market share of US online sports betting in the second quarter of 2021, it is clearly Flutter Entertainment’s FanDuel that is best positioned to dominate the market.

We believe that FanDuel is following the playbook of another one of Flutter’s highly successful businesses: dominant Australian operator, Sportsbet.

It is uncertain what the US competitive landscape will look like after years of newly regulated states and competitive customer acquisition still to come, but if Flutter can replicate Sportsbet’s success with FanDuel, it will help to unlock the huge valuation upside that makes Flutter such a compelling investment today.

The Secrets of Sportsbet’s Dominance

Sportsbet commands 50% market share of Australian online sports betting. It has expanded in recent years, helped by its popular recreational brand, unmatched product quality, and a fierce customer focus that has been reinforced by data science.

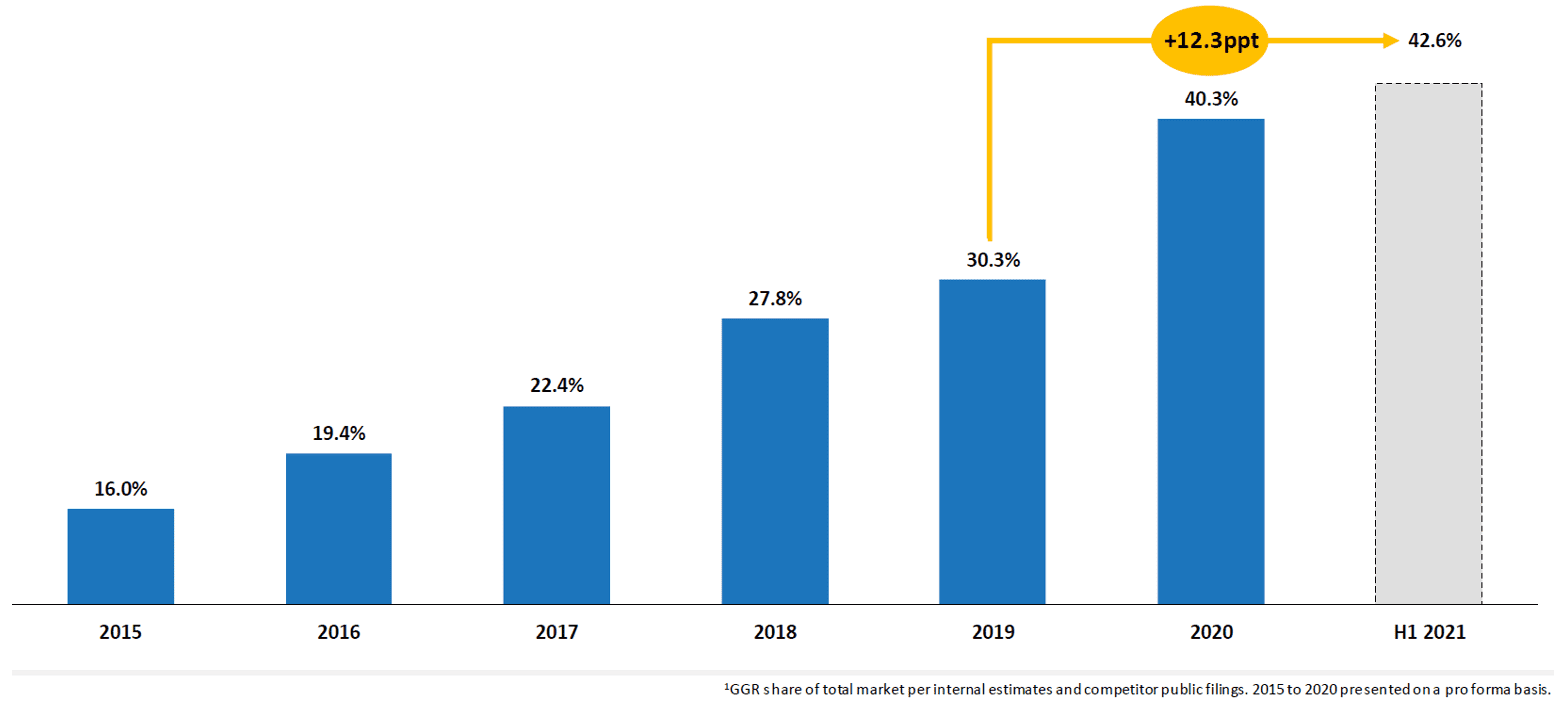

As you can see in the chart below, Sportsbet has been taking more share of the total Australian sports betting market, with retail sports betting (the TAB monopoly) steadily declining for years. Consumers have been shifting to superior mobile products such as Sportsbet, a process accelerated by 2020-21 lockdowns.

Sportsbet Pro forma share of Total sports betting market

Source: Sportsbet 2021 Investor Day

Sportsbet recently hosted an Investor Day where they outlined how they acquire and retain customers as well as the complex data systems that have enabled them to grow dramatically.

We identified three key developments that are unique to Sportsbet and highlight their dominance, and which point to FanDuel’s potential success in the US.

1. Sportsbet’s ‘scale economics shared’ model

Firstly, Sportsbet is successfully reinvesting its revenues to attract new customers and grow rapidly.

‘Scale economics shared’ is a term coined by famous investor Nicholas Sleep. Sleep identified retailer Costco’s ‘flywheel’, where the company lowered prices to attract more customers, which increased volumes and customer loyalty and lowered per-unit costs, and then reinvested those gains back into customers by lowering prices again. Like a physical flywheel, repeating this cycle builds momentum that is harder to stop with each turn. Sleep later noticed the same phenomenon at Amazon. That insight, and the realisation that scale economics shared is a far stronger model on digital platforms, led him to bet big on the ‘overpriced’ Amazon in 2007.

Sportsbet, likewise a digital platform, has taken a leaf out of Amazon’s book by relentlessly focusing on their own customer ‘generosity’ flywheel. They reinvest their revenue growth back into customers in the form of promotions (i.e., lower prices), increasing volumes and customer engagement, which drives further revenue growth that gets reinvested again to restart the cycle.

As a result, Sportsbet’s gross gaming revenue (GGR) margin – the percentage of total bets staked that are lost; i.e., bets that Sportsbet keeps as revenues – has more than doubled over the past ten years. In the first half of 2021, GGR was at an unprecedented 16.1%.

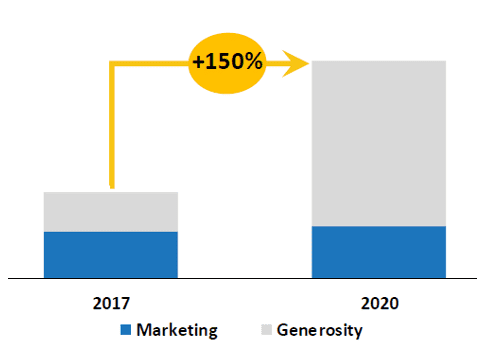

As gross revenues have doubled, so too has Sportsbet’s ‘generosity’ – the percentage of revenues earned using promotions such as boosted odds or risk-free bets and therefore financed by Sportsbet. As a result, Sportsbet’s net revenue margin has remained steady.

But that ‘generosity’ has allowed Sportsbet to significantly grow its customer base. Average monthly players have grown at a 21% compound annual growth rate (CAGR) since 2015. Greater engagement has meant those customers have placed more bets, growing net revenues at a 32% CAGR over the same period.

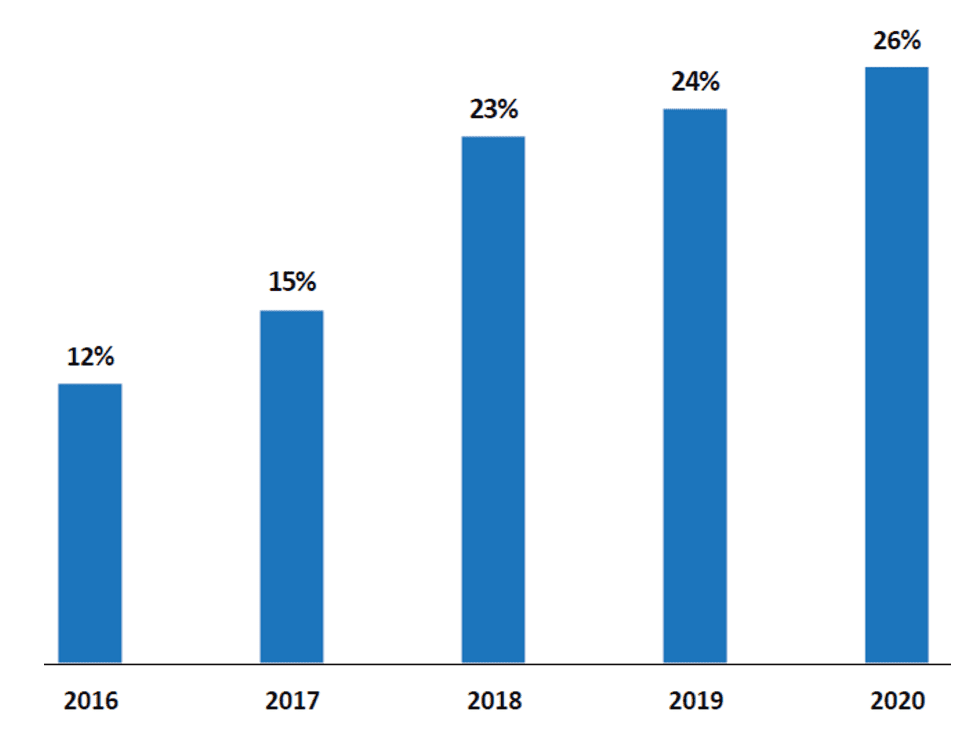

Generosity % of GGR

Source: Sportsbet 2021 Investor Day

2. Sportsbet’s customers are loyal

Sportsbet is also successfully keeping customers loyal to its brand.

It is notoriously difficult (read: expensive) to retain sports betting customers. A 2018 Victorian government study found the average weekly bettor had 5.5 separate betting accounts. Yet Sportsbet’s market tracking survey showed the number of their customers who only bet with Sportsbet increased from 47% in 2018 to 59% in 2020, way above the 39% of their nearest competitor.

Sportsbet does three things differently:

– Sportsbet have utilised their scale to reinvest in customers directly through personalised promotions. They have developed machine learning algorithms that offer customers personally boosted odds based on their prior betting activity. This is only possible because of Flutter’s superior global risk and trading platform, used by both Sportsbet and FanDuel, which matches bets across platforms and adjusts odds in real-time. Bettors shopping around for the best odds will land on Sportsbet more often, and increasingly so as algorithms learn how to efficiently promote to them.

– Despite spending double their nearest competitor on marketing – Aussies will understand when I say their ads are unique in bringing to life their broad product range and customer focus – Sportsbet’s increased scale means that as a percentage of revenue marketing spend has more than halved in the last four years.

Generosity and marketing spend ($m)

Distribution of net revenue

Source: Sportsbet 2021 Investor Day

– These excess revenues have been invested in Sportsbet’s product and technology. Sportsbet have moved their platforms onto Amazon Web Services (AWS) cloud servers and significant technology investments have led to best-in-class app functionality and record up-time. Meanwhile, innovations such as ‘Same Game Multi’ and ‘Bet With Mates’ have increased customer engagement and the amount of high-margin multi-bet wagers placed.

The flywheel of personalised promotions, marketing efficiency and innovative technology has formed a moat around the business that protects it from competitors. No other Australian operator can afford to invest enough in any one of these areas to catch Sportsbet. Meanwhile, Sportsbet will keep reinvesting, customers will get stickier and the flywheel will keep spinning.

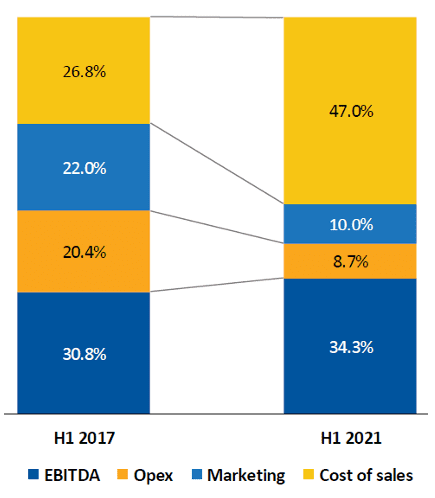

3. Regulation entrenches incumbents

Thirdly, gambling is a natural target for increased regulation. As you can see in the ‘cost of sales’ bucket in the chart above, Australia has taxed betting companies increasingly as the sector matures. This has led to significant consolidation as subscale operators cannot afford to compete. Sportsbet only counts six material competitors left today of the sixteen that have been present since Flutter (then Paddy Power) first acquired a controlling stake in 2009.

Regulation is important to encourage safer gambling, fundamental to the future of sports betting as an entertainment product. Flutter is especially proactive on this front, with each division working with local regulators to ensure appropriate controls are in place. Flutter is conscious of problem gambling issues and have introduced bet limits and internal controls, using customer data to efficiently identify concerns before they can cause damage. Ironically, increasing regulatory costs further entrenches the incumbent scale operators, such as Sportsbet.

FanDuel: Uniquely Positioned to Replicate Sportsbet’s Success

While Sportsbet’s growth is astounding and likely to continue, the most important takeaway is that FanDuel are uniquely capable of replicating this success in the US as part of the broader Flutter Group.

Fundamental to Sportsbet’s flywheel of customer generosity is Flutter’s global risk and trading platform, which prices odds efficiently and enables the machine-learning algorithms that optimise personalised generosity.

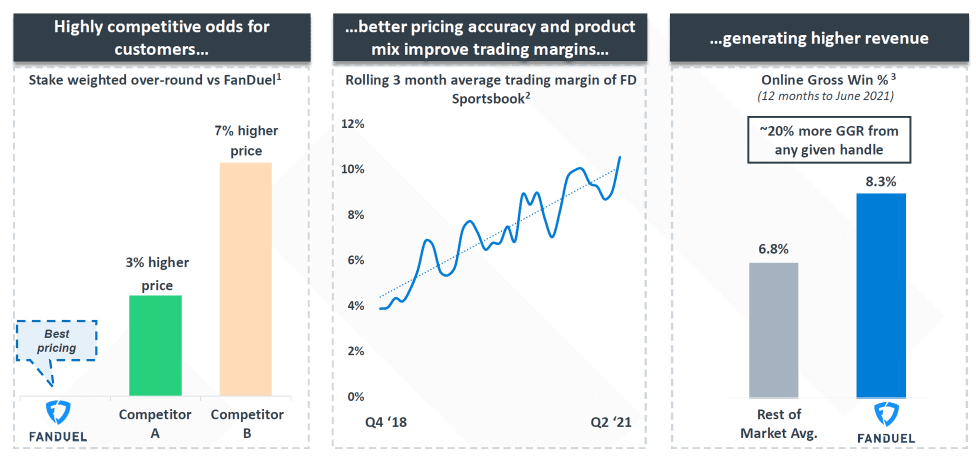

FanDuel utilise the same platform and can deploy any current or future innovations at other Flutter divisions seamlessly. In fact, FanDuel are already showing evidence that they are on track to replicate Sportsbet’s ‘scale economics shared’ flywheel.

Source: Flutter H1 2021 Earnings Presentation

Furthermore, teams across the Flutter Group are incentivised to collaborate with one another. All senior staff have a portion of remuneration tied to Group outcomes. FanDuel’s risk and trading leader is a Sportsbet veteran. Sportsbet even told investors that they work especially closely with FanDuel due to their similar platforms and the popularity of US sports in Australia. Sport-specific product innovations are a result of daily collaboration between these teams.

There are 5,000 engineers across the Flutter Group who are helping to support the FanDuel business. By contrast, DraftKings has around 1000 employees in total, not to mention questionable back-end technology. FanDuel are widely regarded to have the best product technology among US operators.

Evidently, FanDuel are fortunate to be part of Flutter as they seek to dominate the US market. While barriers to entry are low, barriers to success are far higher than many appreciate.

Sportsbet’s winning flywheel model has provided a playbook FanDuel are uniquely positioned to replicate. The US market is still at a very early stage of rapid growth, and we are excited to have found what we believe is a high probability winner.

Longer-term, there are emerging markets around the world beyond the US which Flutter may use the same playbook to conquer.

Montaka owns stocks in Flutter and Amazon.

Lachlan Mackay is a Research Analyst with Montaka Global Investments.