After more than 100 days, NSW is finally emerging from its protracted lockdown and with a hint of nervousness, we begin to make some tentative plans, remember how to make reservations, or plan a much-needed holiday. However, further north the future looks far less certain for indebted Chinese property developer, Evergrande and its peers. The question for Australian investors, including ourselves, is to what extent the industry’s woes should concern us and what impact it may have on markets? This extends to our local miners, who are heavily exposed to our largest trading partner and of course have already been on the nose in recent months.

Grand problems

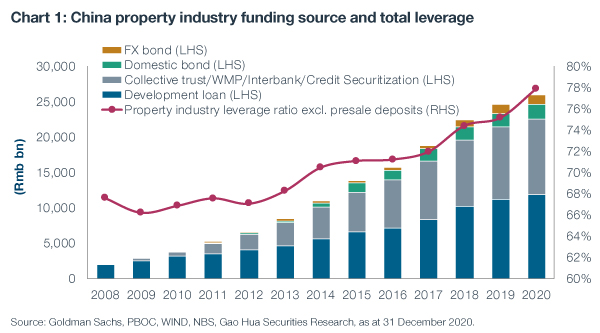

The grand (pardon the pun) scale of the Chinese property market should not be understated. At US$60tn, it is one of the largest asset classes globally. Further, it drives roughly a quarter of Chinese GDP growth. Similarly, the size and growth of property developers’ leverage over the past ten years has been enormous. Total property developer liabilities have grown ~600% over the past decade and total leverage has climbed to 78% (Chart 1).

Importantly from a social stability standpoint, roughly two thirds of Chinese household wealth is tied to property, which is even higher than our property-obsessed selves (Australians have 56%), while the US has less than half of that at 23%. Moreover, Evergrande alone has approximately 70,000 Wealth Management Products attached to it, which have been marketed largely to Chinese retail investors.

Together it is easy to see why many are drawing the comparison of Evergrande’s demolition to China’s ‘Lehman-like’ moment. However, at this stage we liken it more to of a Bear Sterns situation, in that this represents the canary in the coal mine, rather than the collapse of the mine itself. Evergrande’s liabilities are also far lower than Lehman’s at US$302bn versus US$613bn (1.8% of Chinese GDP versus 4.1% of US GDP back in 2008).

Stronger headwinds for iron ore

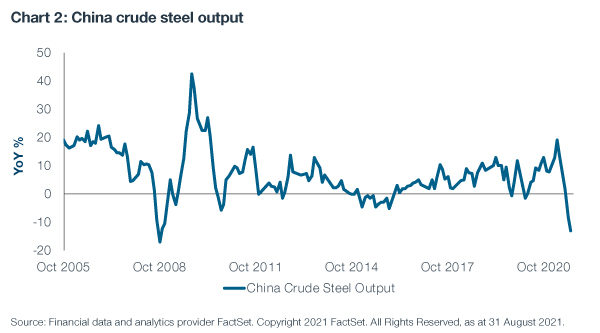

So while we believe the problems posed by Evergrande do not pose the same level of systemic risk as Lehman, they do add to the headwinds facing many of the Australian miners. This is given the Chinese property market accounts for roughly 20-25% of total steel consumption, where of course iron ore is the key input. With property sales already lower by 20% year-on-year in August, we will also see a soft pipeline of new starts and land sales. Ultimately, this translates to weaker steel production (which is already negative year-on-year – Chart 2) and weaker iron ore demand.

It should be noted that the developer debt debacle is a fluid one and considerable uncertainty remains. Policymakers may step in, as they like, to bail out Evergrande and reverse some of the restrictions designed to contain leverage in the industry. However, with that same power Beijing is also pushing a clearer agenda for decarbonisation for the world’s largest carbon emitter, as well as, espousing “common prosperity” to deal with the significant inequality in the country. These factors make a bail out or fall back on the old stimulus methods very difficult, representing structural headwinds for iron ore.

A different China versus the past three decades

China today, is a very different country relative to any time in the past 30 years, not only economically, but also in terms of policy directions and foreign relations. This is evident in its decarbonisation shift with President Xi’s commitment to peak emissions by 2030 and the country’s goal of becoming carbon neutral by 2060. The commodities that have benefitted over the past three decades will likely be very different from those that will benefit in the next three.

Steel production for example accounts for roughly 15% of China’s emissions. This is largely because 90% of that steel is produced using traditional blast furnace technology. As such the process is under significant pressure to pivot to the more environmentally friendly electric arc furnace technology, which produces far fewer carbon emissions, but also requires far less iron ore. Electric arc furnaces also require 10 times as much electricity, which in turn requires significant investments in nuclear power and renewables stoking demand for commodities such as uranium, copper, nickel and lithium.

Game changer for the miners

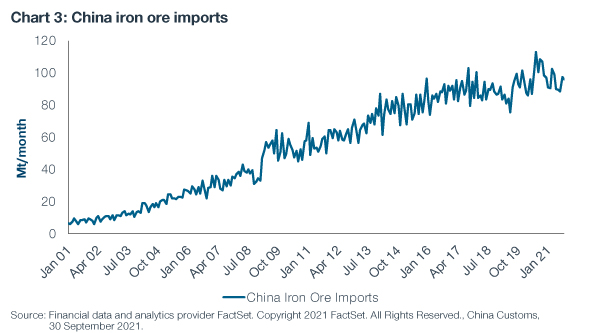

Ultimately, this may mean the ride that many of the miners have enjoyed from climbing Chinese iron ore imports may have peaked. Certainly, chart 3 below highlights that climb has plateaued. This will pose challenges for the purer iron ore players in Australia. So while we do not believe the issues facing Evergrande or the broader Chinese policy agenda will define broader Australian equity market returns, the latter will be a game changer for the miners.

The T. Rowe Price Australian Equity Fund invests in high-quality Australian companies undervalued by the market. The objective of the Fund is to provide long-term capital appreciation.