It is our view that the Magellan Global Fund (Closed Class) (MGF) is underpriced at an 11.5% discount to the net asset value. The Manager undertakes extensive fundamental analysis on individual companies and the industries in which they operate, seeking to purchase investments when they are trading at a discount to their assessed intrinsic value. The resulting portfolio is a long-only focused composition of 20-40 high quality defensive assets and structural growth businesses. Magellan’s global equity strategy has delivered a compound annual return of 11.7% p.a. since inception in July 2007, outperforming the MSCI World Net Total Return Index (A$) by 3.9% p.a. while preserving capital and capturing just 43.5% of market downside. We believe that a general myopic attention on managerial cyclicality may present a compelling long-term investment case for the recently underperforming Magellan Global Fund (Closed Class).

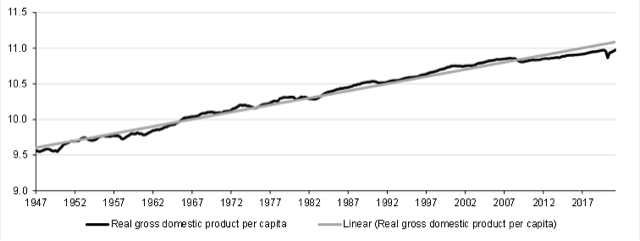

Under the neoclassical Solow-Swan model of long-run economic growth, a nation’s standard of living exhibits diminishing marginal returns to both labour and capital accumulation. Based on the assumption that an economy has reached its steady state, growth in per capita GDP can be explained by exogenous technological innovation. For equity investors however, the fundamental driver of asset prices is earnings growth. By taking the aggregate corporate profits from income tax returns in the United States and apportioning this to GDP, there is no discernible long-term trend. Globalisation may account for the slight upward trajectory in the earnings to GDP ratio over the last two decades. Given that the growth rate of corporate profits is almost identical to that of GDP, aggregate earnings must account for a stationary fraction of GDP. This would imply that subdued long-run growth rates of GDP place a damper on prospects for accretion in corporate earnings.

Magellan continues to feature long duration assets within the portfolio that are able to compound revenues at a multiple of world GDP (e.g. Microsoft, Netflix).

Figure 1 – United States log real GDP per capita

SOURCE: BUREAU OF ECONOMIC ANALYSIS. DATA AS AT Q2 2021

Figure 2 – United States corporate profits as a percentage of GDP

SOURCE: BUREAU OF ECONOMIC ANALYSIS. DATA AS AT Q2 2021

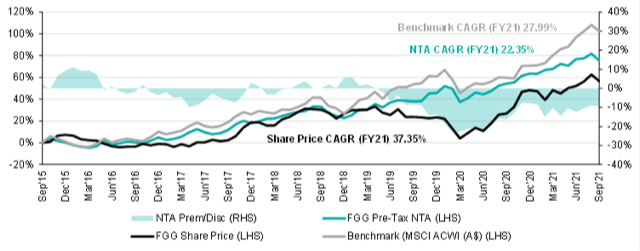

Another, more diversified angle to play

Magellan also features as a significant allocation (11.8%) within the Future Generation Global Investments (FGG) portfolio, second only to Cooper Investors (12.7%). Contained within the December 2020 Annual Report, FGG’s Investment Committee Report highlighted key risk estimates for the portfolio with a beta of 0.82 and an active cash position of 21.0%. Based on the net tangible asset value (after tax and before tax on unrealised gains), the company has delivered a compound annual return of 11.7% p.a. since inception in September 2015, slightly underperforming the MSCI All Country World Index (A$) by 2.6% with a standard deviation 1.7% lower. This is while holding a fluctuating direct cash exposure, cash on a look-through basis within the underlying funds and due to the effects of drag via taxation. During the half-year ended 30 June 2021, the Board reassessed the accounting classification of the investments held. As a result of the change, the company’s distributable profits reserve to shareholders have increased, providing additional flexibility on dividend and capital management decisions. The company currently distributes income to shareholders annually. This is irregular. Expect this to change and superior franking out of the vehicle.

Figure 3 – FGG performance and premium/discount since inception

SOURCE: COMPANY REPORTS, IRESS, BLOOMBERG

Bell Potter’s Indicative NTA tracks the ‘indicative’ movement of a LIC’s underlying NTA each month by monitoring the percentage movements of the disclosed holdings and using an index to track the movement of the remaining positions. The Indicative NTA works best with LICs that have a high percentage of investments concentrated in its Top 20, regular disclosure of its Top 20, lower turnover of investments, regular disclosure of its cash position and the absence of a performance fee. We have also included an adjusted indicative NTA and adjusted discount that removes the LIC distribution from the ex-dividend date until the receipt of the new NTA post the payment date. This report is published each Monday prior to the market open and is available on a daily basis. Intraday indicative NTAs will be available on request through your adviser.

For full details refer to the detailed report below or click here to download your copy.

[wonderplugin_pdf src=”https://www.sharecafe.com.au/wp-content/uploads/2021/10/LIC-Weekly-Report-Indicative-NTA-15-October-2021.pdf” width=”100%” height=”900px” style=”border:0;”]