An important consideration for Australian equity investors are the credit headwinds currently facing banks. During the past month APRA, “ensuring the financial system remains safe, and that banks are lending to borrowers who can afford the level of debt they are taking on,” increased the loan serviceability buffer.

The impact on banks was immediate with the share price of the big four banks falling on the day of the announcement. This is another tailwind supporting equal weight investing. Given the potential outcomes from reopening and tighter bank regulations, it is important that your core Australian equities exposure is well diversified to help capture earnings recovery across both companies and sectors.

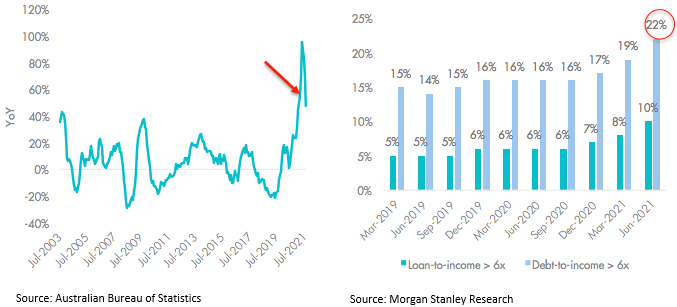

APRA increased the loan serviceability assessment buffer from 2.5% to 3% this month and it has indicated further prudential measures might be implemented amid growing concerns about residential loan serviceability. Australian housing loan approvals and percentage of debt more than six times income increased by 47% and 6% respectively over 12 months.

Impact on Australian banks

The growth in home loan approvals since mid-2020 helped fuel Australian bank share returns. Australian housing loans account for more than 60% of CBA’s total loan balance. New housing loan approvals drive housing loan growth, which in turn drives bank revenues and earnings, influencing trading multiples.

Any further prudential measures that slow down loan approvals could see pressure on the price of Australian banks, similar to the fallout from 2018 Hayne Royal Commission. During that time, the S&P/ASX 200 Banks Index underperformed S&P/ASX 200 Index by 8.53% between announcement and final report release1.

The other factor to consider in regards to Australian banks are their valuations. They are expensive. Australia’s largest bank, CBA is also the most expensive bank in the OECD at 21x price to earnings ratio2. An equal weight strategy equally weights the largest and most liquid stocks on the ASX at each rebalance. As a result, it is underweight the broader big banks and other mega-caps, relative to the S&P/ASX 200 Index. Given the potential outcomes from tighter bank regulations, it is important your core Australian equities exposure is well diversified to help capture earnings recovery across both companies and sectors. MVW offers broad exposure to the Australian share market and it is well placed as a core Australian equity exposure into 2022. Both academic and empirical research demonstrates equal weighting’s value tilt and MVW outperformed the S&P/ASX 200 Index during the last quarter of 2020.

Source: Bloomberg, Australian Bureau of Statistics

Any further prudential measures that slow down loan approvals could see pressure on the price of Australian banks, similar to the fallout from 2018 Hayne Royal Commission. During that time, the S&P/ASX 200 Banks Index underperformed S&P/ASX 200 Index by 8.53% between announcement and final report release1.

The other factor to consider in regards to Australian banks are their valuations. They are expensive. Australia’s largest bank, CBA is also the most expensive bank in the OECD at 21x price to earnings ratio2. An equal weight strategy equally weights the largest and most liquid stocks on the ASX at each rebalance. As a result, it is underweight the broader big banks and other mega-caps, relative to the S&P/ASX 200 Index. Given the potential outcomes from tighter bank regulations, it is important your core Australian equities exposure is well diversified to help capture earnings recovery across both companies and sectors. MVW offers broad exposure to the Australian share market and it is well placed as a core Australian equity exposure into 2022. Both academic and empirical research demonstrates equal weighting’s value tilt and MVW outperformed the S&P/ASX 200 Index during the last quarter of 2020.

ENDNOTES

1 Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry was announced 14 December 2017 and final report was released 4 February 2019.

2 Goldman Sachs Research