by Andrew Macken – Chief Investment Officer

If a Martian arrived on planet earth today, the global stock market would freak them out. This market is full of peculiarities. Mr Market – the personified term value investing legend Benjamin Graham used to describe the emotional swings of the market – is currently excited about narrative stocks, particularly ‘reopening’ and ‘defensive’ companies, and rewarding them with rich valuation multiples despite questionable fundamentals. At the same time, it is punishing companies with reliably growing profits and cash flows, particularly the world’s leading mega techs, because of overblown concerns about inflation and regulation.

On any given day, the market appears to be swept up in the prevailing narrative. What is missing is an objective outside examination of the facts that anchor sound investment decisions and underpin strong, long-term performance.

Three examples of stocks in the reopening, defensive and mega tech narratives highlight a market that would baffle a rational Martian.

Are ‘reopening up’ stocks good investments?

The first thing the Martian would see when he arrived on earth is that, as COVID-19 cases subside around the world, ‘reopening’ stocks are trading at very generous valuations. One is Royal Caribbean Cruises, the Florida-based cruise company that was severely impacted by the pandemic. When ‘no sail orders’ were introduced last year, its revenue literally fell to zero.

With the reopening, around two-thirds of the company’s fleet are now sailing and that should move to 100% over time. But the company’s stock price is still one-third lower than pre-pandemic. The ‘reopening up’ narrative is often persuasive to Mr Market. Surely this investment represents easy money for the taking?

Our Martian would say no.

For a start, the company’s balance sheet has become financially stretched: the ratio of net-debt-to-book-equity has more than doubled from 0.9 times to 2.2 times. So while its stock price is below pre-pandemic levels, its enterprise value (EV) – the company’s total value including borrowings – has well and truly reflated back to pre-pandemic levels. So the company is not as cheap as one might think.

Royal Caribbean Cruises

Source: Bloomberg

If our Martian assumed that earnings will return to pre-pandemic levels relatively soon (the company is currently loss-making), they would see that based on its current enterprise value, the company has an EV ratio of 20 times this recovered level of earnings (EBIT).

A rational Martian would be bewildered that the market has put such a high valuation on this company. Why would Mr Market be willing to pay such a high multiple of fully-recovered earnings for a heavily-indebted cruise business that remains years away from pre-pandemic profitability – in an industry that will also expand capacity at double-digit rates over the coming years, adding downward pressure to ticket prices?

All kinds of ‘reopening-exposed’ businesses, from airlines, travel agents, and live entertainment businesses, have seen their EVs fully-recover to pre-pandemic levels, despite earnings being years away from their fully recovered levels.

Are ‘defensive’ stocks safe?

Meanwhile, our Martian would also hear a narrative around markets being ‘stretched’ and observe some investors turning to defensive stocks which have become similarly irrationally overvalued. In California, The Clorox Company, a large producer and marketer of branded household cleaning products has a great, defensive business. Households continually buy their bleach, sanitizer, and stain removers irrespective of the natural ebbs and flows of the economy.

It makes sense to Mr Market, therefore, that if the markets are feeling toppy, hiding out in companies like Clorox provides some safety.

But our Martian would not think this company’s stock is particularly safe at all.

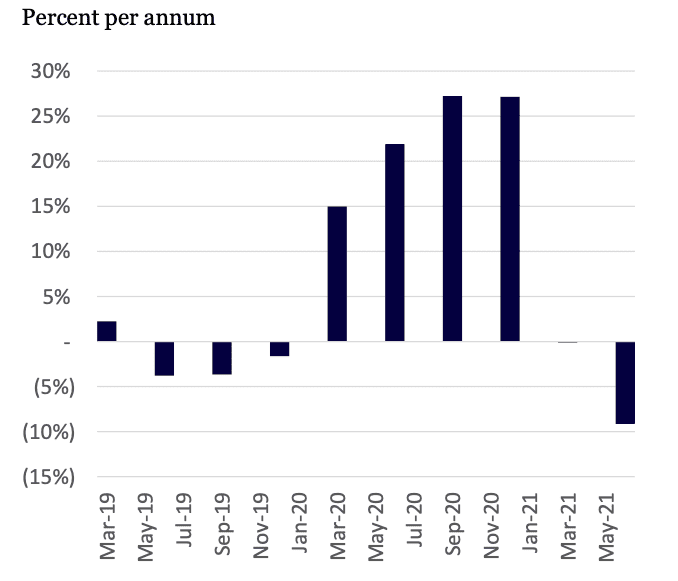

Its growth has recently turned negative. During the pandemic, its business grew rapidly when Americans rushed to stock their homes with cleaning products. But today that growth is naturally much harder to come by. It is hitting the inevitable ‘air pocket’ that follows such a drastic pull-forward in demand.

The Clorox Company – Revenue Growth

Source: Company Filings

The company is also being hit by higher costs. The rising costs of commodity inputs and transport are materially impacting on profitability. In the company’s most recent quarter, for example, its gross margin fell 10 percentage points relative to the same period in the prior year.

Yet Mr Market has awarded the company a valuation that implies strong performance for years to come. Its ratio of EV to next year’s earnings (EBIT) is 23 times – a materially higher ratio than even before the pandemic. Our Martian would once again be confused: this hardly feels like a safe investment offering protection from ‘stretched’ stock prices.

Again, this dynamic is not isolated to Clorox. We are seeing similar dynamics in a wide range of branded consumer packaged goods businesses, as well as utilities – all of which are considered by Mr Market to be ‘defensive’ today.

Are mega-tech’s best days in the past?

While our Martian sees ‘reopening up’ and ‘defensive’ stocks trading high, they would also see mega tech companies with great fundamentals being punished amid the ‘mega-tech is dead’ rotation due to concerns about inflation, regulation or other reasons that seem to justify the narrative

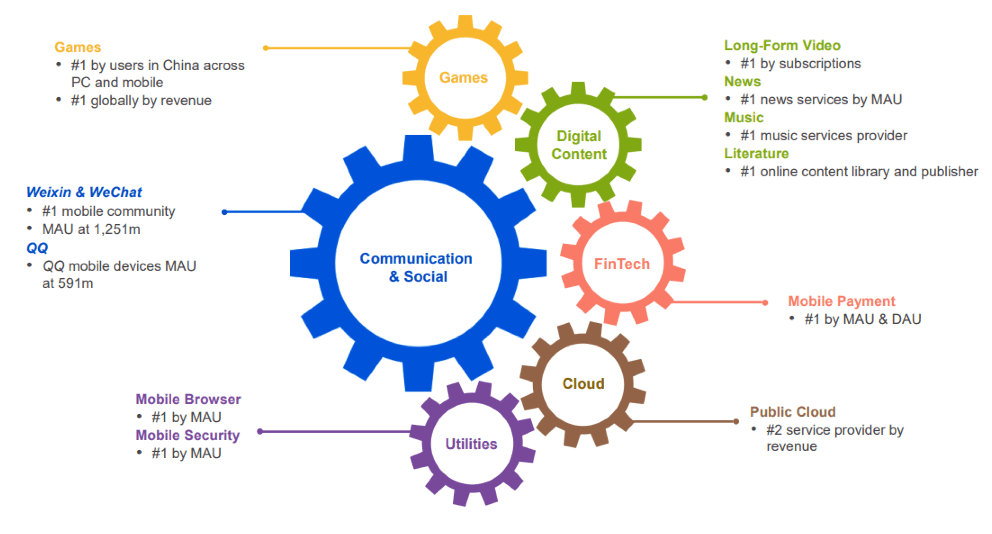

Shenzhen-based Tencent is one example. It owns the most widely used digital communications applications in China. With 1.2 billion members in its mobile community, this business owns a privileged platform for social communication (both personal and professional) as well as gaming, news, music, video, e-commerce, and payments.

Tencent – A Platform of Platforms

Source: Company Presentation

This company also happens to own China’s second-largest cloud computing business. It is rapidly building out leading enterprise applications and platform tools, which are the Chinese equivalent of Salesforce, Shopify, Zoom and Microsoft Office. These are not monetised today and, instead, represent valuable future growth options.

But despite this powerful position, our Martian would see the stock is seriously undervalued. The ratio of enterprise value (excluding a large portfolio of equity investments) to next year’s operating earnings (EBIT) is just 16 times.

Unlike the reopening-up and defensive stocks above, our Martian would find this stock very interesting. A business of this quality, growing 15-20% per annum for at least the next five years and beyond, with an attractive collection of large, high-probability future growth options, yet trading at a reasonable price.

And it’s not just in China where these disconnects between the valuations of mega techs and their high business quality are occurring. In the US, for example, Mr Market is willing to sell you Facebook at less than 18 times next year’s operating earnings.

To our Martian, buying Tencent and Facebook from Mr Market – and selling him Royal Caribbean and Clorox seems logical.

What is an investor to do?

So how should an investor play a market that would baffle a rational Martian?

It depends on your investment time horizon. Investors looking to make money next week, next month, or even next year have their work cut out for them. Anticipating Mr Market’s mood swings – which change on a dime – is not easy and may well be impossible to do on a sustainable basis.

But for investors, like us at Montaka, who are seeking to compound capital over the long-term – think ten, 20 years and beyond – the answer is to always let your investment decisions be guided by the facts, such as the strength of business advantages, the long-term growth of industries and the fair mappings of business earnings drivers to present values today.

As Benjamin Graham famously told Warren Buffett:

“In the short run, the market is a voting machine but in the long run it is a weighing machine.”

Let the facts liberate you from the short-term mood swings of Mr Market. In the current market that means not getting sucked into short-term reopening and defensive narrative trades and focusing on owning the long-term winning businesses in the world’s most attractive markets.

Investing for the long-term by looking through the short-term noise means that your portfolio will perform differently to that of your peers but staying the course – as challenging as that can be – will yield the long-term rewards.

Montaka owns stocks in Tencent.