Key takeaways

- The hawkishness of central banks has mobilised aggressive pricing of near-term rate hikes while uncertainty over the global economic recovery has suppressed long-term yields.

- In the UK, the flatness of the yield curve at this point in the cycle is at extreme levels with the market expecting near-term tightening to be reversed in the medium term and longer-term natural interest rates to be lower post the pandemic.

- As developed markets begin to tighten, we expect a normalisation of yield curve dynamics, particularly in the UK, in 2022 that could advantage bond investors.

Higher yields, but flatter curves

Government bond yields ended 2021 well above where they started the year in most developed markets, but perhaps a more striking statistic is that yield curves have flattened meaningfully in recent months leaving the 2s10s slope – the difference in basis points between the 10-year and 2-year Treasury yield – below levels seen at the start of the year. This narrowing marks a remarkable rally from the wides in spreads seen in March 2021. A flattening in yield curves can occur when short-term rates increase faster than long-term rates.

Yield curve (10 year – 2 year) slopes

Source: Bloomberg, 5 January 2022. Basis point (bp) equals 1/100 of a percentage point. 1 bp = 0.01%, 100 bps = 1%.

This phenomenon has been persistent across global markets, as shown in the chart above. Historically, this level of flattening would normally be seen towards the end of a tightening cycle, rather than at the beginning where we are now as developed markets begin to raise interest rates. Moreover, the curve is priced to flatten further by the end of the year, with US 2s10s – a common market indicator of yield curve steepness – at 47bp based on 1-year forward rates.

As central banks have turned more hawkish in response to the persistence of inflation, this has been reflected in rising yields at the front end of the yield curve as the market prices in a series of interest rate hikes. The long end of the curve has not seen a commensurate upward pressure, leading to flattening. The recent Federal Open Market Committee (FOMC) meeting revealed an increased urgency to tighten financial conditions with the pace of tapering doubled (now expected to end three months earlier in March 2022), and the potential for three rate hikes by the end of the year.

With the addition of earlier hikes, there is an expectation that the hiking cycle may end sooner and at a lower funds rate. While we have some sympathy with the assumption that the neutral rate of interest – the interest rate that supports the economy at maximum output while keeping inflation steady – post COVID may be lower (and below the 2.5% implied by the Fed dot plot) given accelerated disinflationary forces such as technology, this appears to be well priced already. Despite a notably hawkish turn, the terminal rate (or neutral rate of interest) in this cycle has declined to 1%-1.5%*, as shown in the chart below. One could argue that the market is signalling that rate hikes won’t get very far in time or would need to be reversed from over-tightening.

The US terminal rate has declined despite central bank hawkishness

*Based on 5-year overnight index swap rates, 5 years forward. Source: Bloomberg, as at 5 January 2022. There is no guarantee that past trends will continue, or forecasts will be realised.

Pricing a policy mistake?

One of the more extreme examples of such yield curve dynamics is evident in the UK. In December 2021, the Bank of England (BoE) Monetary Policy Committee (MPC) hiked the bank rate by 15bps to 0.25%. While growth expectations for both Q4 2021 and Q1 2022 were revised down, the focus was on the trajectory of inflation and combatting this. Consumer Prices Index (CPI) inflation is expected to hit 6% per annum early this year according to the BoE’s projections.

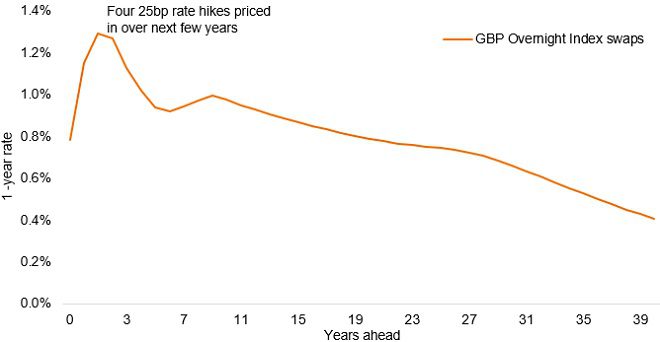

This opens up a range of possibilities for 2022. Uncertainty over the economic impact from Omicron will prevail for the time being, but we believe the recent rise in the bank rate is unlikely to choke off the economic recovery. What it does obtain for the BoE though is optionality, or the flexibility for different choices. Namely, if the bank rate was increased again in Q1 and the assessment of the “economic circumstances at the time” allow for it, the BoE could stop fully or partially the reinvestment of its nearly £28bn of gilts which mature on 7 March. This flexibility allows the bank to be proactive in policy direction in tandem with its assessment of the economy as it evolves. The BoE’s emphasis on hikes over the forecast horizon and emphasis on agile policy is at odds with the market extrapolating a quick succession of rate hikes to nearly 1.3% (seen in the chart below). We believe a proactive bank, that has the option to potentially reduce its balance sheet in Q1, will take some of the need away from market expectations of bank rate increases, both in magnitude and timing.

Markets appear to be pricing in a policy mistake, as the forward curve is inverted, implying that rate hikes over the next 18 months to combat inflation will subsequently need to be reversed, as shown on the chart below. Over the medium term, we expect this trajectory to normalise through a combination of the BoE delivering fewer (or slower) rate hikes, and a reassessment of longer-term rates higher, closer to 1.5% (which still implies heavily negative real yields)1. This normalisation could see a steepening in yield curves as less aggressive near-term rate hikes are priced and long-term yields drift higher.

UK yield curve signals alarm – markets don’t expect near-term rate hikes to last

Source: Bloomberg, as at 5 January 2022. There is no guarantee that past trends will continue, or forecasts will be realised.

With central bank intervention in bond markets, the predictability of the shape of the yield curve as a harbinger of economic conditions, as well as asset returns, has waned since the Global Financial Crisis. While the Fed directly influences the short end of the yield curve, it inevitably has its thumb on the long end too as a driver of investor sentiment and buying activity. Flatter yield curves traditionally indicate weaker returns for riskier assets. While there are reasons to believe the power of this signal may be reduced in this cycle in comparison to history, we believe investors may be better placed to be cautious and take steps to moderate risk in 2022. We are reminded of the common refrain that history doesn’t repeat, but it often rhymes.

Flatter yield curves tend to make longer-dated bonds less attractive to investors owing to the reduced advantage over cash and shorter-term rates. Positioning for steeper yield curves in the forward rate market could offer attractive “roll down” gains to investors, as yields tend to fall as their prices converge towards par value at maturity. However, patience is key as better returns from such a strategy are on offer once the curve is inverted.

The UK is one such market that appears to potentially offer attractive returns for patient investors. While traditionally the yield curve inverts when the hiking cycle is relatively mature, we believe that the inverted curve in the UK is unsustainable in the medium term in either a scenario of significantly more hikes being delivered than currently expected or where fewer are delivered. This is particularly true in the shorter-dated curves, such as the 2-5s (5-year versus 2-year yield) or 2-10s (as described earlier). While very long-dated yields can trade below medium-term bond yields due to specific investor demand, it is rare for sustained curve inversions further down the curve, and unprecedented at such low yields. So at the least the rhyme of history may serve as a guide and a patient, but nimble, approach to capturing such opportunities as they emerge will be key to returns in 2022.

1 According to Janus Henderson calculations as at 5 January 2022.

Glossary

Funds rate – The Federal Funds rate is the target interest rate set by the central bank at which commercial banks borrow and lend their excess reserves to each other overnight.

Roll-down returns – With steep yield curves, bonds should benefit from seeing yields “rolling down” the curve. Meaning that, as the security’s time to maturity shortens, its yield tends to fall in order to match the lower yields of the shorter-dated bonds. The steeper the yield curve, the lower the yield must fall to reach the appropriate level for a shorter-maturity security.