Key Takeaways

- Investors have seen an explosion in choice in recent years as asset classes such as private equity, venture capital and crypto expand along with dedicated funds that target specific sectors or themes.

- Specialized strategies may provide a false sense of diversification during booms. However, when the flow turns, subtle differences are usually overwhelmed. You cannot diversify your way out of a single investing style.

- Different markets are seeing boom-bust cycles at different times, creating opportunities as indiscriminate flows lead to market inefficiencies.

Over 100 million Americans, more than 40% of the country, watched the final episode of the TV show M*A*S*H in 1983. This viewership record still holds today. Despite growth in population, only about 50 million Americans saw the end of Friends. More recently, The Big Bang Theory and Game of Thrones each attracted roughly 20 million viewers within the first three days of their finale airing, or about 6% of Americans. Part of this decline is technological – it is easier to catch up on missed episodes. But the bigger reason is the explosion in channels and content. Instead of everyone watching the same shows, our TV viewing is customized.

This divergence is also true for social media, politics and even investing. For decades, most Americans considered the “market” to be the Dow Jones index. This slowly shifted to include the S&P 500, NASDAQ and international bourses. Bond choices expanded to include mortgages, corporates, structured products, etc., helping make the Chair of the U.S. Federal Reserve into a high-profile public figure. This explosion in investing choice has continued as asset classes such as private equity, venture capital and crypto expand along with dedicated funds that target specific sectors or themes.

Consequently, the experience of different market participants varies widely based on what investing “show” they are watching. Passive holders of large-cap U.S. equity indices have enjoyed stellar returns over the last few years. Commodity and value funds are outperforming lately but previously lagged. Conversely, small/mid-cap tech, meme stocks, crypto and biotech have fallen sharply over the past few months.

Specialists often have a false sense of diversification during booms. Last year, I spoke with tech-focused investors who viewed social media, e-commerce and enterprise software as entirely distinct categories, and crypto funds that were hedging by buying a range of altcoins and non-fungible token (NFTs). However, when the flow turns, subtle differences are usually overwhelmed. You cannot diversify your way out of a single investing style.

For example, eventual outcomes for biotech companies are broadly uncorrelated – the probability that company A successfully develops a new drug is generally unrelated to company B’s chances. Yet the stock price of over 90% of the 188 companies in the S&P Biotech index have fallen year-to-date. Likewise, a well-known tech-focused ETF invests across a variety of themes including electric cars, software, medical, internet and more. Remarkably, every single one of its 42 stock positions dropped in January.

Meanwhile, even as correlation within factors has risen, correlations between factors have fallen. Out of the S&P 500, the most growth-like companies are assigned to the S&P Pure Growth Index and the most value-like companies are assigned to the S&P Pure Value Index.

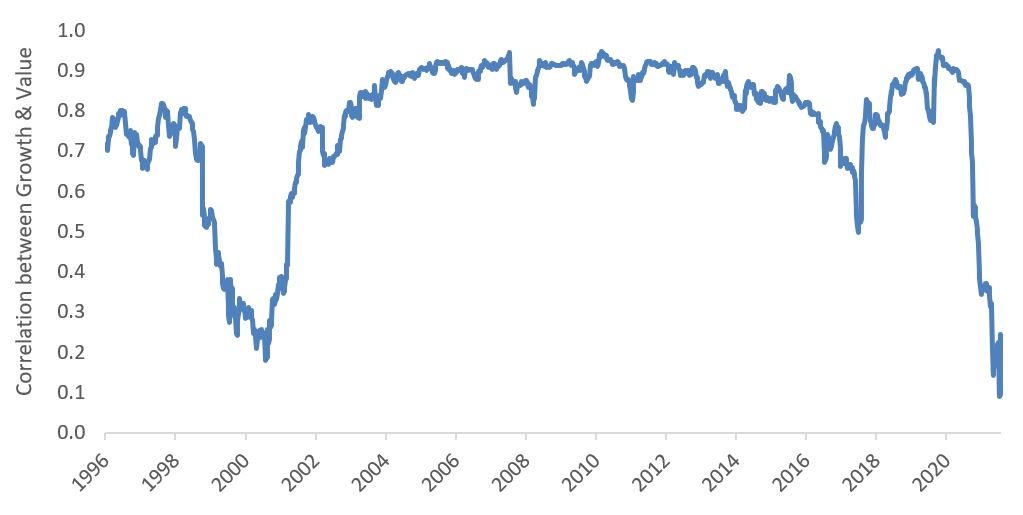

The graph below shows the rolling one-year correlation between the S&P Pure Growth and S&P Pure Value indices since inception. These growth and value indices are at an all-time low correlation of nearly zero – i.e., entirely uncorrelated. This is astonishing as each of these companies is not only a large-cap U.S. stock but also a constituent of the S&P 500. Still, these two factors are moving independently.

Exhibit 1: The correlation between growth and value stocks is at an all-time low

Source: Bloomberg, S&P, Janus Henderson, July 1996 to January 2022. Note: One-year rolling correlation between weekly returns of the S&P 500 Pure Growth and S&P 500 Pure Value indices.

Source: Bloomberg, S&P, Janus Henderson, July 1996 to January 2022. Note: One-year rolling correlation between weekly returns of the S&P 500 Pure Growth and S&P 500 Pure Value indices.

This decline in cross-asset links can be observed elsewhere, too. For example, stock-bond correlation is close to zero now as well, after being negative for most of the last 20 years. Other traditional relationships have weakened, e.g., commodities hit an all-time high despite U.S. dollar strength – a historically unusual outcome. In equities, emerging markets are up in 2022 so far, bucking the U.S. decline.

The singular “risk-on/risk-off” investment universe where the relationships between stocks, bonds, commodities and the U.S. dollar were generally stable is being replaced by an investing multiverse. Different markets are seeing boom-bust cycles at different times as capital and attention from retail and institutional investors moves around.

Positively, this shift creates new opportunities as indiscriminate flows lead to market inefficiencies. Last year, there were multiple bubbles where the prices of some assets were pushed up to unsustainably high levels. Equally, their subsequent collapse likely means that some assets are undervalued.

Over a single generation, our nightly TV watching options expanded from a handful of scheduled prime-time network shows to thousands of choices from around the world being available instantly. Similarly, rather than fixating on a particular sector, diversifying across strategies potentially benefits from both lower cross-asset correlations as well as rapidly changing market flows.