by Sarah Shaw – Portfolio Manager / CIO and Greg Goodsell – Global Equity Strategist

2022 outlook

While the pandemic in all its forms will prevail longer than was initially hoped, the effective development and deployment of vaccines and treatments means the world will increasingly move to an environment of living with and managing the virus – reverting from a pandemic to an endemic. We continue to believe that the global economy will ultimately emerge stronger for the experience. The huge amount of fiscal and monetary stimulus is still to be fully deployed in economic terms with, of course, much of that spending focused on badly needed infrastructure investment around the globe. All this investment will be a strong positive for the global economy over coming years, improving efficiency, productivity and output. In addition, many of the changes that have been forced on businesses by the pandemic will, we believe, lead to a stronger, more efficient economic environment post the virus. As such, we remain generally positive on the economic outlook for 2022 and beyond.

However, the two key factors dominating economic discussions and providing some near-term threat to a generally robust outlook as we enter 2022 are COVID-19 (again) and evolving inflationary pressures.

COVID-19/Omicron variant

We believe the global economic recovery is continuing, although the Omicron wave has likely pushed out the timing of the full recovery. However, once we move to a more stable environment where we learn to live with the virus, infrastructure in all its forms remains integral to a sustained economic recovery and returning society to ‘situation normal’. We have consistently maintained that there is no global growth recovery without roads, railways, pipelines, power transmission networks, communication infrastructure, ports and airports.

While the ongoing COVID saga keeps pressure on equity markets, we continue to believe it represents a unique buying opportunity for infrastructure investors. The infrastructure investment thematic has not been derailed by COVID, but rather has been enhanced by the pandemic – huge government stimulus programs are fast-tracking infrastructure investment (in particular the energy transition), increasingly stretched government balance sheets will see a greater reliance on private sector capital to build much-needed infrastructure, and the interest rate environment remains supportive of infrastructure investment and valuations.

Global inflationary forces

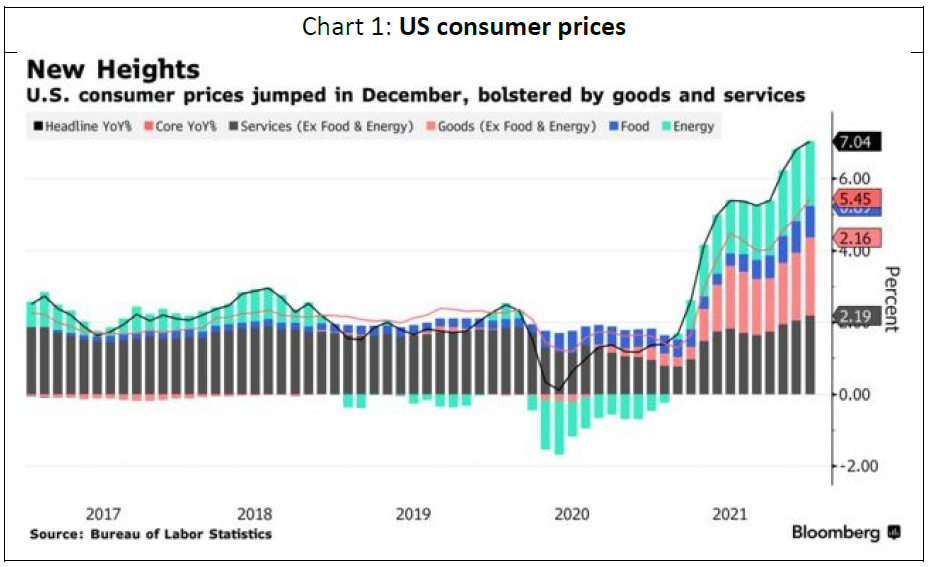

Over recent months, global inflation has been emerging as a key economic risk. In the US in December 2021, consumer prices accelerated at the fastest pace since 1982, hitting 7% (annualised), bolstering expectations that the Fed will increase rates in March. The US is not alone, with inflation picking up around the world and seeing interest rates already on the move (Brazil, UK) or with expectations of moves in 2022.

Broadly, the price increases are being driven by a combination of supply chain disruptions, causing critical supply shortages of key items (such as computer chips), together with the huge global monetary stimulus pushing up the amount of money in the global economy, with inflationary forces being the consequence (e.g. Australian house prices). Importantly, we are also seeing real wage pressure in certain industries and markets as a result of the combination of COVID disruptions and job rotations as stimulus flows through. This is compounding near-term inflationary pressure.

Central banks are already beginning to tighten monetary policy in an attempt to curtail these inflationary forces. After its January 2022 Fed meeting, Chair Jerome Powell said the Fed is ready to raise rates in 2 months. He spoke after the FOMC communicating that it would hike ‘soon’ and then shrink its bond holdings. Mr Powell declined to rule out tightening at every meeting this year, said officials may have to move sooner and faster on shrinking the central bank’s US$8.9 trillion balance sheet, and warned there’s a risk of a prolonged period of surging prices.

The risk now is that if the Omicron variant continues to spread, this may itself lead to a crimping of global growth just as central banks take their feet of the stimulus pedal, compounding the slowdown.

Ultimately, we believe central banks will act prudently and cautiously in easing policy. We are also of the belief that they may let inflation run somewhat ahead of target over the short to medium term to assist in the reduction of headline nominal government debt to GDP levels.

But just at the present, uncertainty prevails and caution is warranted. In this regard, infrastructure is an asset class that can do well in an inflationary environment and we believe it is a sensible portfolio allocation at the current stage of the economic cycle. As discussed in a number of our previous Global Matters articles, many infrastructure stocks have built-in inflation protection, either directly linked to tariffs or indirectly through their regulatory construct.

As such, in an inflationary scenario some parts of the infrastructure universe, namely User Pays, may enjoy the perfect storm over the short/medium term –interest rates supportive of future growth, economic activity flowing through to volumes, and explicit inflation hedges through their tariff mechanisms to combat any inflationary pressure they may experience.

In contrast, Regulated Utilities can be more immediately adversely impacted by rising interest rates/inflation because of the regulated nature of their business. The flow-through of inflation is dictated by whether the Utility’s return profile is ‘real’ or ‘nominal’. If the Utility operates under a real return model, inflation is passed through into tariffs much like a User Pay asset. This model is more prevalent in parts of Europe and Brazil, for example, and limits the immediate impact of inflationary pressure – and in fact can positively boost near-term earnings. In contrast, if the Utility is operating under a nominal return model, it must bear the inflationary uptick reflected in certain costs until it has a regulatory reset, when the changing inflationary environment is acknowledged by the regulator and approved to be incorporated in new tariff/revenue assumptions. This nominal model is the standard model for the US Utility sector. As such, those Utilities in a real model will weather inflationary spikes a little better than their nominal peers.

However, in terms of interest rates shifts, the issues for both real and nominal models are consistent. For a Regulated Utility to recover the cost of higher interest costs, it must first go through its regulatory review process. While a regulator is required to have regard for the changing cost environment the Utility faces, the process of submission, review and approval can take some time or can be dictated by a set regulatory period of anywhere between 1-5 years. In addition, the whole environment surrounding costs, household rates and utility profitability can be highly politically charged. As a result, both the regulatory review process and the final outcome can be quite unpredictable.

The differences between User Pay and Regulated Utility assets should see certain sub-sets fundamentally outperform during a rising inflation/interest rate period due to a more immediate and direct inflation hedge. At 4D we remain overweight User Pay assets and, within the Regulated Utility sector, favour those with real returns. However, should the market overreact to the economic outlook we would use it as a buying opportunity across all sectors.

Key ongoing macro themes

While COVID/Omicron and inflation expectations dominate current day-to-day equity market discussions, there are a number of other important investment thematics in play that will impact decisions for decades to come. Many of these themes are long-term positives for infrastructure investment. Over the past 6 years 4D has addressed a range of such issues and we revisit a number of them in the Annexure so as to provide more detail on our current portfolio thinking and positioning.

However, in summary, current investment forces that we at 4D find particularly interesting include the:

- re-opening trade – capturing the stimulus and pent-up consumption around the world;

- global need for infrastructure investment;

- emerging middle class, which offers a huge opportunity with infrastructure both a driver and a first beneficiary of improved living standards;

- global population growth but with changing demographics – the West is getting older, but much of the East younger;

- active positioning for inflation/interest rates – with current overweights to the inflation trade;

- emerging markets – the recent underperformance of emerging market infrastructure equities is not warranted given the attractive earnings fundamentals and long-term sector dynamics; and

- energy transition – environmental and climatic challenges underpins the need for even more spend on infrastructure.

What could derail our outlook?

While we are generally optimistic regarding 2022 and beyond, there is no doubt that we have had a couple of tumultuous years. There are a number of residual factors that could adversely affect our view, including:

- whether COVID-19 vaccines are effectively deployed globally and in a timely manner, delivering the expected health benefits and leading to subsequent economic recovery;

- governments and central banks prematurely taking their feet off the ‘go’ pedal before the global economy has the opportunity to properly get back on its feet;

- the actual shape of the economic recovery, which is crucial, remains to be fully seen (V, U, L or W);

- President Biden is unable to make diplomatic progress and we see renewed Chinese/US tensions on a variety of issues: trade, Hong Kong, South China Sea, COVID-19 origins;

- the current standoff with Russia and the Ukraine could deteriorate further, dragging in Europe and potentially NATO involvement;

- longer-term, how all the massive global fiscal stimulus (much of which will be sourced from central banks) is paid for;

- the question of whether ‘Modern Monetary Theory’ will earn its stripes; or will too many dollars chasing too few goods see currencies devalue and inflation escalate (‘Monetarism’ and Milton Friedman’s economic theories)?;

- whether inflation comes back faster than anticipated, forcing central banks to act ahead of plans via interest rate increases; and

- if so, these rate increases could place pressure on borrowers of all types who, given recent history, would be very unaccustomed to a rising interest rate environment.

We continue to monitor the near and long-term trends and will actively position accordingly as events unfold.

Conclusion

In terms of investment opportunities, we’re still spoilt for choice, with significant value having emerged across the entire infrastructure universe as a result of the ongoing pandemic and increasing macro concerns. Despite the near-term concerns, we remain generally optimistic about the global recovery story. Our portfolio remains diversified, with a strong bias to attractively valued, high quality names with solid balance sheets and superior management teams. We remain overweight User Pay and real return Utilities in the current inflationary environment, while capitalising on significant long-term thematics across the portfolio.

DOWNLOAD ARTICLE HERE.