by Kevin Kruczynski – Investment Manager

Additive Manufacturing (AM), also referred to as 3D printing, has the potential to transform manufacturing, but has so far failed to live up to expectations. If we zoom back to the beginning of 2012, MakerBot’s latest home 3D printer had just won awards as the best emerging technology at the Consumer Electronic Show (CES)1 . The vision was clear; it was believed we were on the cusp of mass consumer adoption, every household was about to have a 3D printer and the ability to order goods and components online and print them instantly at home. Investor enthusiasm snowballed, and Gartner’s Hype Cycle had the technology approaching the dreaded “peak of inflated expectations”. Gartner’s assessment has proved to be quite accurate; the technology was at a developmental stage with a limited range of applications and printable materials – since this period AM, particularly from a consumer and investor perspective, has fallen off the radar.

This brings to mind Amara’s law “We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run” the first part of this has played out; but are we now underestimating the potential impact of AM going forward? Away from the limelight, advancements in materials science, design software and print technology has led to adoption across a wide range of industrial applications. The latest generation of computer aided design (CAD) systems, such as PTC Creo, now boast a range of tools to help optimise designs for AM, making it much easier to incorporate the technology. This, coupled with breakthroughs in printing with metals, carbon fibre, graphite and even wood, has expanded the range of use cases exponentially, making it possible to design stronger, lighter, and simpler components. Speed of production has also improved; the latest metal binder jet 3D printers are 100 times faster than previous generations.

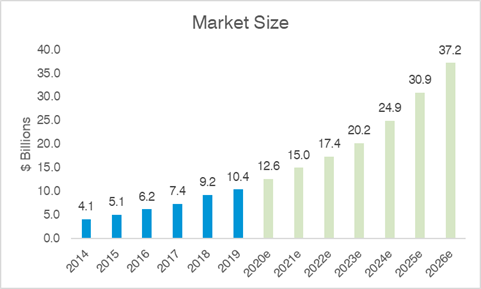

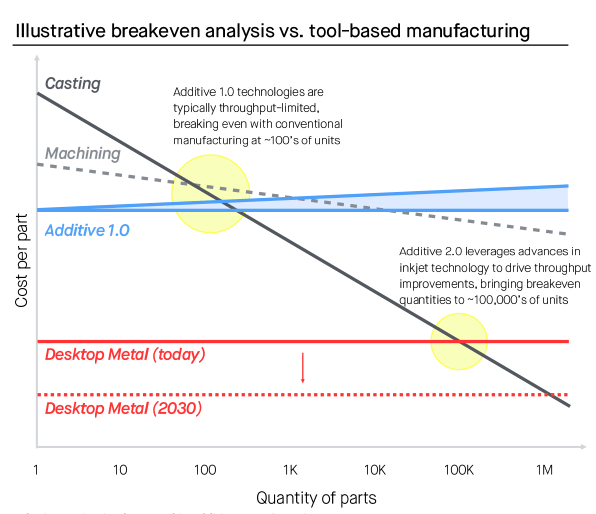

Looking at the cost profile presented by Desktop Metal in Chart 1 below, it is no surprise that AM has so far lent itself very well to industries that have relatively small production runs and highly bespoke requirements. As the cost profile improves with each advancement, the rewards are potentially vast in the USD 12 trillion global manufacturing industry. The early adopters were in high value applications that are less cost sensitive, such as dental labs, where each product needs to be customised for each patient. AM has also been popular within aerospace, where relatively low volumes of highly bespoke parts are required. The digital inventory also means fewer parts need to be kept in physical storage, which is attractive as the manufacturers need to guarantee availability of replacement parts over the life of an aircraft. Within the automobile industry, the principal use has been in prototyping, but the electrification of the global fleet is a catalyst for further adoption at the component level, as companies are investing in retooling and reconfiguring production lines at an unprecedented rate. An increased focus on environmental sustainability will also come into play, as AM leads to less waste and lighter components which help reduce carbon footprints and save money. A further tailwind is emerging from the unprecedented disruption in global supply chains in recent years, as trade tensions between the US and China, compounded by the impact of the Covid-19 pandemic have forced companies to question the reliability and sustainability of their global supply networks. This is already leading to a degree of deglobalisation and a push towards more local production and shorter supply chains. As these stars align, AM will likely build a critical mass and generate strong growth rates; as shown in Chart 2 by 2026, the industry could likely be 3 times what it was in 2019, and looking further out some estimates have it crossing USD 100 billion by 2030.

Rather than the consumer-driven revolution that was predicated a decade ago, we are seeing an industrial-led transformation leading the way. AM has a clear role to play in the emerging Industry 4.0 landscape, as industrial companies embrace automation, connectivity, data analytics and other technologies to help manufacturing become more reliable, productive and customer orientated.

Chart 1: AM has lent itself well to industries with relatively small production runs and highly bespoke requirements

Chart 2: By 2026, the AM industry should be 3 times what it was in 2019