by Swetha Ramachandran – Investment Manager

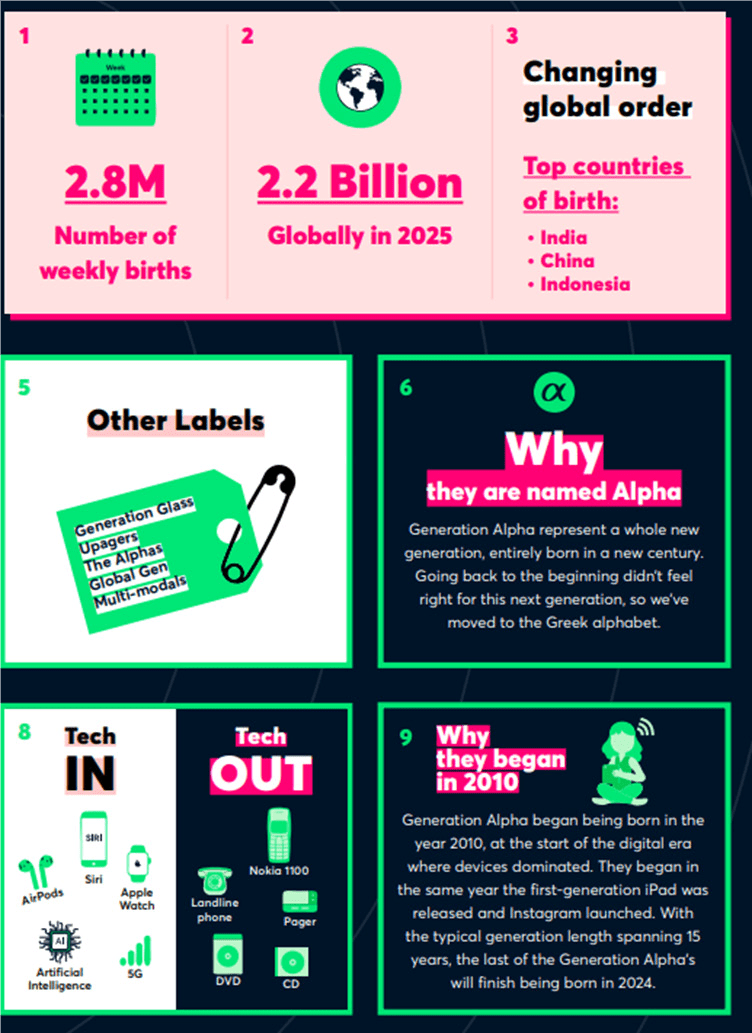

With Gen X (those born from 1965-1980), Gen Y (more commonly known as ‘millennials’, born between 1980 and 1995) and Gen Z (1995-2010) taken, the first generation born entirely in the 21st century – from 2010 to 2024 – will have the distinction of being named Generation Alpha.

Chart 1: Generation Alpha (born between 2010 and 2024)

Mark McCrindle, a demographer who named this generation, estimates Gen Alpha will comprise over 2 billion young consumers by the middle of the current decade. As the first generation exclusively born in the 21st century, and the children of millennials, they are noted to have the following characteristics:

They are expected to be the largest generation ever, emerging while the world is experiencing the structural rise of Asia – which also coincides with where most of them are to be found – mainly in China and India, among the expanding middle class in these countries.

They are (obviously) digital: Gen Alpha is part of a world where TikTok, Roblox and Instagram are not disruptors but the established incumbents. Gamification is an essential part of their lives – from education to hobbies. This ties in with gaming platform Roblox suggesting that children under 12 comprise roughly half of the daily active users on the platform.

They are sustainable: While important to millennials and Gen Z consumers, it is expected that Gen Alpha will resonate especially strongly with sustainability, given they will be growing up entirely under the threat of the looming climate emergency. Already, 81% of Gen Alpha parents are noted as saying their children have influenced their shift to a sustainable consumption behaviour.

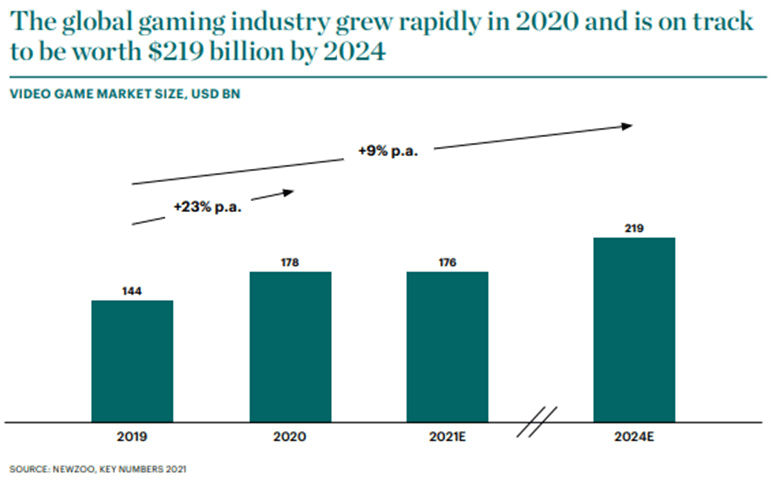

Expected to be the largest generation ever, they are also expected to be the generation with the largest spending power ever. A study by Deloitte (2021) cites academic research that shows children start recognising brands, relating to them and even expressing preferences from as early as the age of three. It is no surprise that consumer brands are already finding ways to engage with these future consumers and to try to win their loyalty through the media on which they are most active – for instance, through video games, an industry which in 2021 was already two thirds the size of the global personal luxury goods industry. Games can offer attractive opportunities as a platform for brands to engage with younger consumers as well as to create hype in a way that would be difficult to replicate “IRL” (in real life). Balenciaga in December 2020 launched its Autumn / Winter collection entirely in a video game format (Afterworld), which saw players travel through a wonderland-style future world, passing avatars dressed in ripped jeans and metal-armour boots along the way.

Chart 2: The global gaming industry is estimated to grow to USD 219 billion in 2024

More recently, Moncler entered the in-game merchandise market by selling accessories and skins on Fortnite at prices ranging between USD 8-18. In the world’s largest luxury market, China, Burberry designed outfits for the Honor of Kings characters, one of the most popular video games there. The new skins developed for the game, and available only for Chinese players, feature the brand’s signature trench coat and tartan.

The significance of fashion and luxury to gaming is that virtual outfits are key to gaming culture – providing a way to ‘dress up’ avatars in the virtual world. That young Gen Alpha gamers are making this connection at an ever-earlier age offers luxury brands the opportunity to connect with a future generation of consumers who may choose an increasingly virtual means of self expression, through virtual fashion and NFTs, for example. Brands that can seize on these opportunities nimbly yet thoughtfully can likely secure their longevity in a fast-changing environment. Gaming also has the potential to play into luxury brands’ sustainability efforts, as they provide numerous opportunities for individuals to try on and wear garments ‘virtually’. They could also offer companies the opportunity to ‘pre-sell’ items to gamers that are produced after they are sold, to minimise production waste and offer a real-time feedback mechanism to brands on what consumers are seeking. We believe not all brands will be able to equally capitalise on these opportunities – Kering, Moncler, adidas and LVMH are ahead of the pack in their gaming-related ventures at present. Identifying the potential beneficiaries as well as bottom performers from changing trends and consumer behaviour is the key to maximising the investment potential of the sector, in our view.