By Matt Peron – Director of Equity Research

Key Takeaways

- Equity markets have yet to indicate that the US economy is at risk of experiencing “demand destruction” in the face of accelerating inflation.

- Consumers appear well positioned to weather this bout of inflation given high levels of household savings and the degree to which the US economy has lowered its energy intensity.

- Should current policy tightening efforts fall short, we believe companies with pricing power and those catering to higher-end consumers may prove most resilient in this environment.

Accelerating inflation has rightly caught the attention of policy makers and investors alike. Expectations that rising prices would cool during the latter half of 2021 proved misplaced as annual US inflation, as measured by the Consumer Price Index, rose 7.9% in February. The core reading, which strips out volatile food and energy, climbed 6.4%. Both are multi-decade highs. The risk that a rapid rise in prices poses to the US – and global – economy is perhaps best illustrated by how quickly the Federal Reserve (Fed) has pivoted toward overtly hawkish policy, with the US central bank now forecasting the equivalent of seven 25 basis point (bps) rate hikes this year.

The blunt instrument of higher policy rates is not the only factor that gets a vote in the future trajectory of prices. An economic maxim is ‘the cure for higher prices is higher prices’. In more conventional parlance, economists refer to this phenomenon as demand destruction, the notion that prices can rise by such a degree that consumer behaviour is altered, thus removing a catalyst for any additional step up in inflation. A contemporaneous Google search will show that demand destruction is top of mind for market participants these days, especially with respect to the jarring rise in energy prices.

An anecdotal gauge for measuring the potential for demand destruction is signals from equity markets. Not only do investors vote with their sell orders on sectors that may be at risk of slowing earnings growth, but also some management teams revise forward guidance based on their expectations for customers’ tolerance of higher prices. What are these signals presently telling us about the possibility of pinched consumers cutting back on purchases? They have not reached that point – yet.

While acknowledging that inflation has already entered consumers’ psyches, several factors lead us to believe that prices still have some room to run before shoppers’ behaviour is altered to the degree that it itself becomes a headwind to growth. Household balance sheets remain strong, and historical precedent indicates that current prices at the pump and other rapidly rising costs can be tolerated – albeit begrudgingly – by consumers. Still, the degree to which prices have risen and the fact that two-thirds of US economic activity is based on consumption means the situation merits monitoring, especially given the glaring inaccuracy of recent inflation forecasts.

Make up your mind

Conventional wisdom was that early 2021 inflationary pressure was due to the low base effects of 2020 lockdowns and would eventually roll off. More recently, the pandemic has also been cited as the cause of inflation due to supply disruptions in key industrial inputs – among them semiconductors and labour. Possibly hoping to be forgotten by policymakers has been the material effects of $4.8 trillion of liquidity that the Fed has injected into the economy since the onset of the pandemic. While extraordinary support was merited during the depth of economic lockdowns, we were concerned that the magnitude of this stimulus would result in the unintended consequence of inflation and that the lagging nature – typically over a year – of these initiatives would mean attempts to rein in accelerating prices would prove a day late and more than a dollar short. All these inflationary ingredients were present even before Russia’s incursion into Ukraine sent prices on certain energy and materials products on a near vertical trajectory.

Regardless of the cause, elevated inflation is here, and it is up to equities investors to figure out how to navigate this environment. Coincidentally, data on both the sector and individual company level can provide important clues about how inflation is evolving and how consumers are reacting to these developments.

A likely suspect

Energy prices’ contribution to inflation cannot be ignored. They rose 25.6% compared to February 2021 and are a main driver of overall inflationary pressure. How much more consumers can bear elevated energy costs depends upon both their duration and the degree to which they keep climbing. With respect to duration, the absence of Russian products in global markets does not bode well. When reviewing company-level plans for capital expenditure, there are virtually no short-cycle projects that can be quickly brought online to meet existing demand.

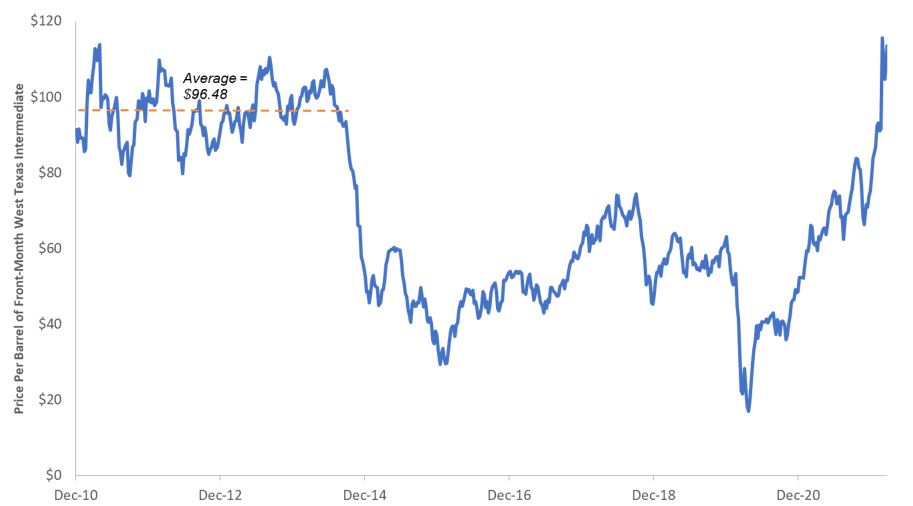

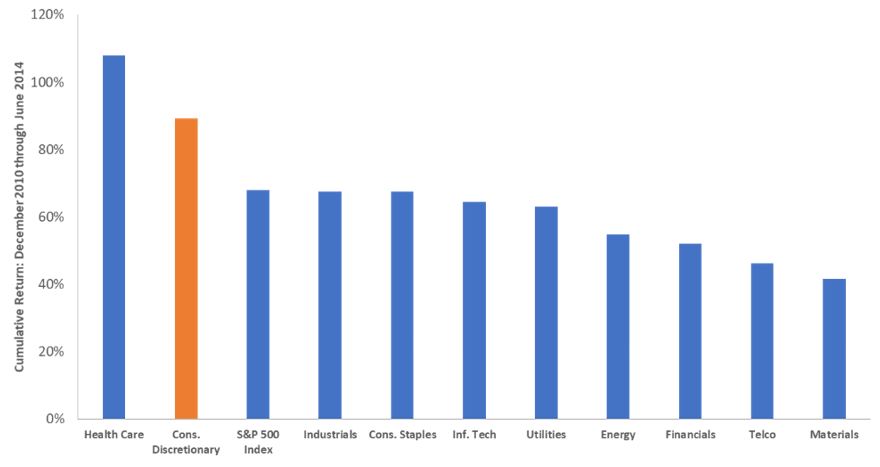

Consumers have weathered worse without being compelled to alter consumption patterns. Energy consumption in the US tends to be inelastic, meaning consumers are relatively insensitive to rising prices. Between 2011 and the July 2014, crude as measured by West Texas Intermediate, averaged nearly $100 per barrel. If consumers had felt the need to compensate for higher gasoline prices by scrimping elsewhere, the most likely target would have been discretionary purchases. Yet during this period, the consumer discretionary sector outperformed the broader S&P 500® Index and was the stock market’s second-best-performing sector.

Price per barrel of West Texas Intermediate Crude

In the not-too-distant past, consumers and businesses tolerated an extended period of roughly $100 per barrel oil prices …

Source: Bloomberg, as of 25 March 2022.

Cumulative total return by S&P 500 sector: January 2011-June 2014

… yet despite the elevated energy costs during that period, the consumer discretionary sector outperformed broader US equities.

Source: Bloomberg, as of 25 March 2022.

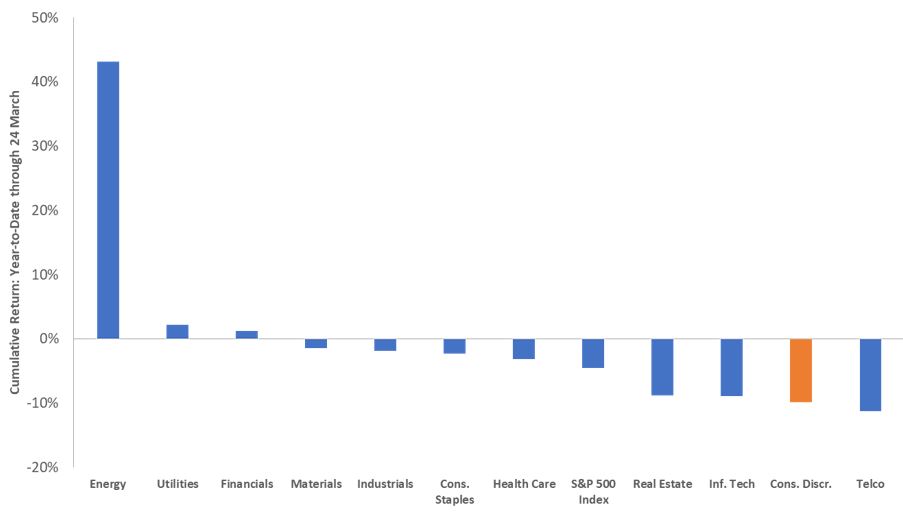

Cumulative total return by S&P 500 sector: year-to-date 2022

Given the 2011-2014 episode and the fairly weak historical link between relative consumer discretionary performance and oil prices, we are cautious to draw the conclusion that this year’s discretionary underperformance is directly related to consumers having to prioritise outlays in the face of high energy costs.

Source: Bloomberg

Although the ultimate duration of this period of elevated energy prices remains unknown, prices for crude and refined products are lower than the 2011-2014 period in real (inflation-adjusted) terms. Looking forward, there is no magic number as to when demand destruction kicks in. Often mentioned are $150 per barrel of crude and a $5.00 national average at the pump. The reality is, however, that prices are drifting higher and at some point, consumers may be forced to prioritise expenditures.

Exacerbating the situation is that lower-income households will be most acutely affected by sustained higher energy prices as a greater percentage of their monthly outlays are allocated toward energy. A similar dynamic is facing emerging market consumers. In Europe, households and businesses are receiving a secondary gut punch in the form of higher utility costs given their greater reliance upon Russian energy exports. The takeaway for investors is that discretionary sectors that cater to these cohorts may be most exposed to forced changes in consumer behaviour.

In a sign that energy demand remains steady, the margins – or cracks – for refiners between their crude input costs and the revenues derived from end products have thus far held up. Should demand falter, we would expect to see refiner margins narrow.

Rainy day funds

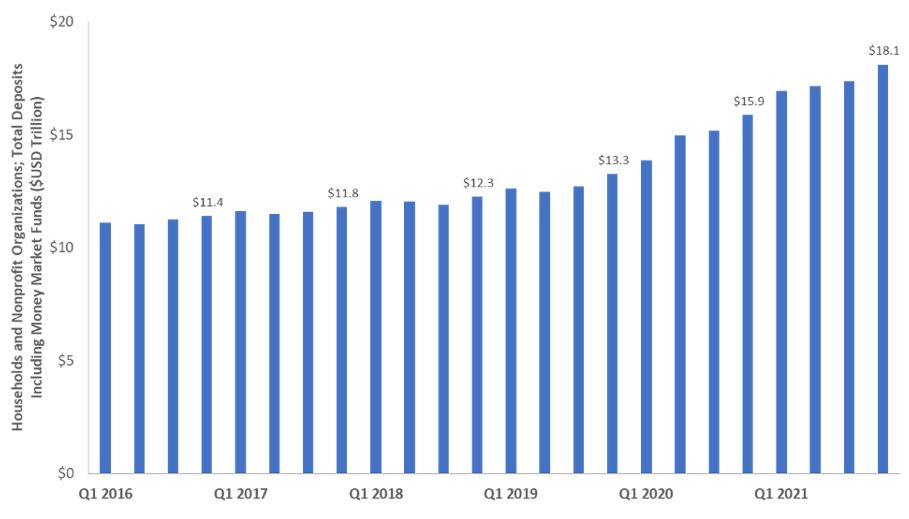

Another factor that leads us to believe that the economy is not yet at risk of seeing a curtailment in consumption is the robust health of household finances. Although consumers’ monthly savings rates have recently slid as the most generous period of fiscal stimulus is behind us, the cumulative effects of these extraordinary programs have left consumer balance sheets at historic levels. As of the fourth quarter 2021, cumulative household savings have reached a record $18 trillion. This cushion has, thus far, enabled households to weather the current bout of inflation.

Household and nonprofits’ savings

Since the end of 2019, household and nonprofit institution savings levels have risen by more than $4 trillion, likely creating a shock absorber for higher utility bills and prices at the pump.

Source: Federal Reserve, as of 31 December 2022.

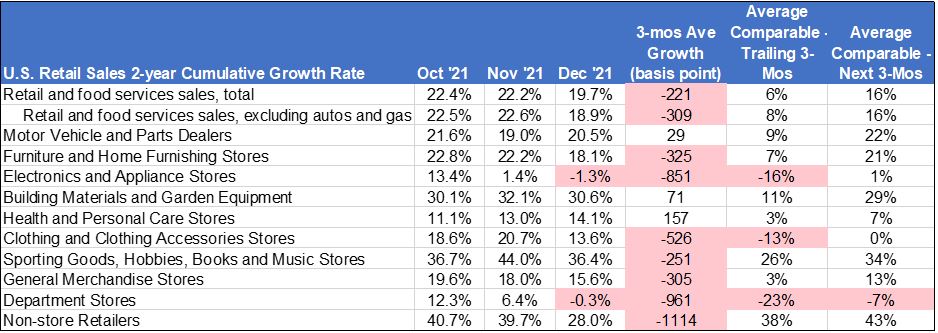

An indicator that peak stimulus has passed is the recent deceleration of retail sales in an array of categories. To compensate for the upheaval caused by pandemic-related shutdowns, we looked at two-year growth rates to gauge which segments have experienced the most deceleration. As of December, this rate for retail sales ex automobiles and gasoline was 18.9%, well below November’s 22.6%. There is some noise in these data, as holiday purchases were likely pulled forward to the October/November period, thus meaning the post-holiday figures may have only fallen back to longer-term trends. Furthermore, there are only so many things consumers can buy, and we are not alone in believing that at some point, purchases will shift from the goods that buoyed retail over the past two years toward services such as travel and entertainment. Any potential dip in sales of goods over the next few months may reflect, in part, this transition rather than solely alarmed consumers snapping their wallets shut.

Two-year US retail sales growth rates

Retail sales have thus far proven resilient in the face of rising energy costs, with recent weakness in certain pockets likely the result of purchases being pulled forward during the holiday season rather than consumers feeling pressured to cut back on discretionary purchases.

Source: U.S. Census Bureau, as of 31 December 2022.

Still, some retail data points flash signs of caution. Deceleration has been particularly notable in department stores, electronics and appliance stores and non-store retailers. The path does not appear any easier as the hurdle – as measured by two-year comparables – for upcoming months is considerably higher across many retail segments in contrast to those of last autumn.

A canary in the coal mine

To-be-determined is whether the sequential slowdown in these categories is the result of pulled-forward purchases or inflation beginning to bite. Should the latter be what’s unfolding, one would expect consumers to first cut back on nonessential purchases. And this is largely how the market is interpreting it. Year-to-date, through March 24, the consumer discretionary sector has returned -9.8%, well below the -6.0% of the S&P 500 Index. Yet, we believe it is too early to draw firm conclusions that lower prospects for discretionary stocks are directly tied to rising inflation. Other contributing factors are also likely at play. Entering the year, the sector’s forward price-earnings (P/E) ratio sat well above its long-term average and was exposed to the risk of multiple compression in the face of rising interest rates (its full-year P/E ratio fell by as much as 24% before slightly rebounding). Also, categories that include goods might see earnings and multiple pressure, although that may be offset, to a degree, by strength in experiences-related sectors. The takeaway for investors is that a cocktail of inflation, rising rates and multiple compression represents a risk to consumer-related stocks – and equities markets more broadly – until the ultimate cadence and ending point of monetary tightening are established.

As previously stated, in the 2011 through mid-2014 period of high oil prices, consumer discretionary was the second-best-performing sector. There have been periods of inflation-induced demand destruction, namely the late 1970s and the years preceding the Global Financial Crisis, but notably, consumers’ finances were nowhere near as healthy as they are at present and the US economy was substantially more energy intensive, meaning consumers and businesses were much more vulnerable to an uptick in oil prices.

Based on our conversations with management teams, we have been able to tease out some potential risks and opportunities within the retail sector, should inflation remain elevated. Given the ability of higher-income consumers to absorb elevated food and energy prices, we believe that companies catering to this market segment are better positioned to sustain margins. The same holds true for companies with pricing power, meaning they can pass along higher input costs to customers. We are more circumspect on companies exposed to low-end wage inflation. Physical retailers already face staffing challenges, and absent any meaningful growth in the labour force, we foresee the bidding war for workers to continue. Part and parcel with stimulus checks is the pulling forward of certain purchases. Retailers focusing on durable goods such as appliances, as well as other home-centric categories, may be vulnerable to revenue air pockets caused by this phenomenon. Lastly, higher transportation costs have the potential to exacerbate lingering supply chain disruptions as retailers have come to rely upon higher priced alternatives – such as air freight – to get products to market. Should this trend continue, current estimates for discretionary sector operating margins could prove too optimistic.

Looking forward

Nearly 8% headline inflation has forced the Fed to react. Given the delayed effect of rate hikes – along with still very low levels – the point at which tighter policy begins to constrict growth is likely some ways off. Yet the tempering effects of demand destruction likely remain relatively farther on the horizon as well. An unprecedentedly level of consumer savings will likely enable households to tolerate a relatively extended period of higher prices. The question is how long will this stand. Supply disruptions, wage pressures, fiscal largesse and commodities upheaval have all contributed to the inflationary backdrop. Corralling these forces stands to be tall task and investors should be prepared for how a sustained period of elevated prices will reverberate through equity markets.