by Benjamin R. Nastou, CFA – Portfolio Manager / Natalie I. Shapiro, Ph.D. – Portfolio Manager / Trisha Guchait – Quant Research Analyst

In the last 30 years, the United States has experienced a prolonged period of low and stable inflation, which has been accompanied by falling interest rates, and expanding multiples and profit margins creating a favorable environment for stock and bond investors. This low inflation environment has been challenged post-Covid, as the Consumer Price Index, which measures the average change in prices over time, rose as a result of supply chain disruptions and surging demand, reaching the highest level since 1990. With the recent prolonged spike in inflation, it is important to understand the effects of higher inflation on traditional investment portfolios.

Inflationary spikes are a concern for investors, in both stocks and bonds (especially those more reliant on fixed income). For bond investors, inflation lowers the purchasing power of cash flows, and is typically accompanied by rising yields and falling bond prices. For equity investors inflation is typically accompanied by falling multiples and may also be associated with compressed profit margins, both of which challenge equities.

However, while stocks and bonds have been challenged during inflationary periods, commodities and other real assets have performed well during these periods and may potentially play an important diversifying role in portfolios.

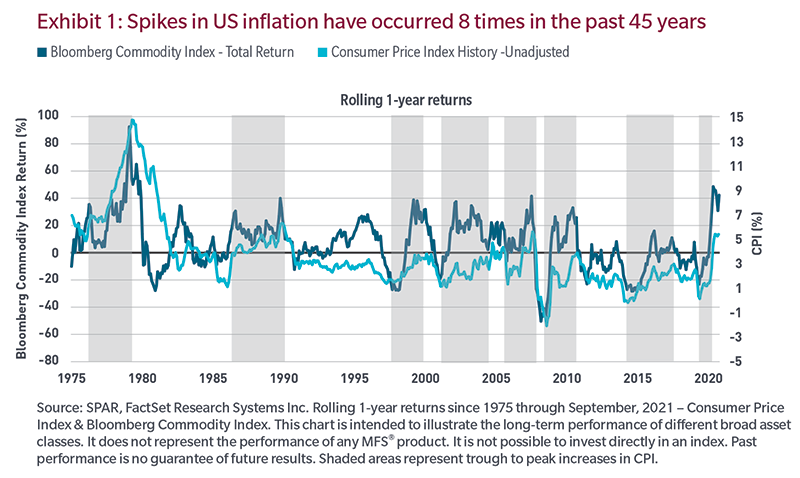

During periods of high inflation such as the 1970s, which had a 6.8% average inflation rate, commodities tended to generate large positive returns. While we do not foresee a return to the extended high inflation of the ’70s, we do believe that shorter- term spikes in inflation, such as those highlighted in the shaded regions in Exhibit 1, may have significant impacts on portfolios, particularly for those investors with shorter time horizons who are unable to weather significant drawdowns. During the periods shaded below, commodities were strongly correlated with inflation. Commodity investments were beneficiaries in these types of inflationary environments and posted strong returns.

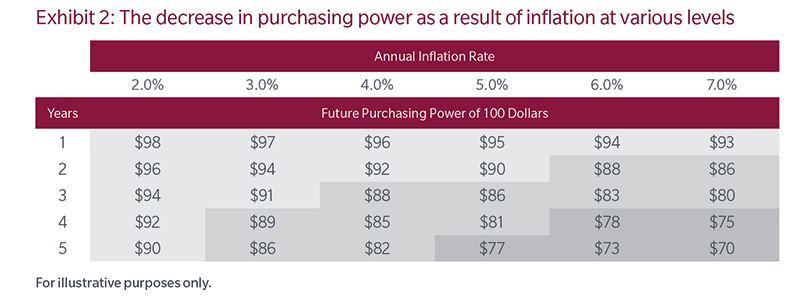

Over the short term, unexpected spikes in inflation tend to weigh on consumer sentiment and acts as a source of volatility in the markets. Over the long term, high inflation diminishes the purchasing power of accumulated wealth. In Exhibit 2 we highlight the generally modest impact that low and moderate inflation can have over the shorter term (1 to 2 years) and the more significant impact that higher inflation can have over both the short and long term.

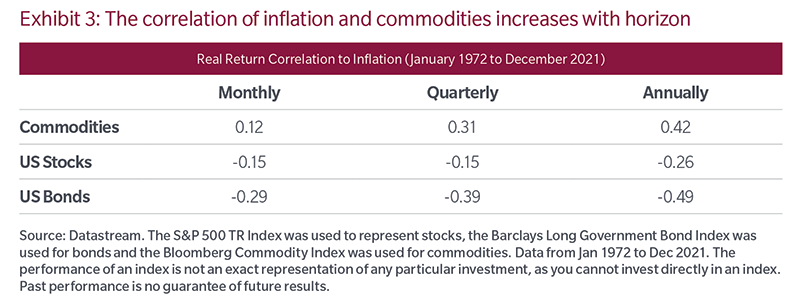

Investors tend to overlook the need to have an inflation-hedging component in their investment portfolio. While predicting in inflation spikes is nearly impossible, historically commodities have provided some protection against rising inflation given their positive correlation. In Exhibit 3 we provide the correlation of commodities, US stocks and US bonds with inflation over monthly, quarterly and annual periods since 1972. Notably, the correlation of commodity returns with inflation has been positive, even more so over 1-year periods. In contrast, the correlation of equity and bond returns with inflation is negative across all time frames. The increasing positive correlation between commodities and inflation as the return horizon increases suggests that the inflation protection that can be derived from commodities is more meaningful over longer time horizons. The increasing negative correlation between stocks and bonds and inflation as return horizon increases suggests that inflation is more detrimental to stock and bond investors over longer time horizons.

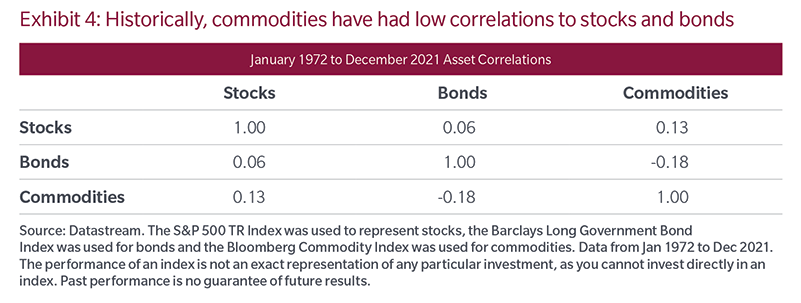

In addition to being a good inflation hedge, commodities can act as an effective diversifier when allocated strategically. Commodity investments have historically had a low correlation with stocks and bond returns, and they may offer high positive returns when rising inflation results in poor performance for stocks and bonds. Exhibit 4 shows the low correlation between commodities and stocks and the negative correlation between commodities and bonds.

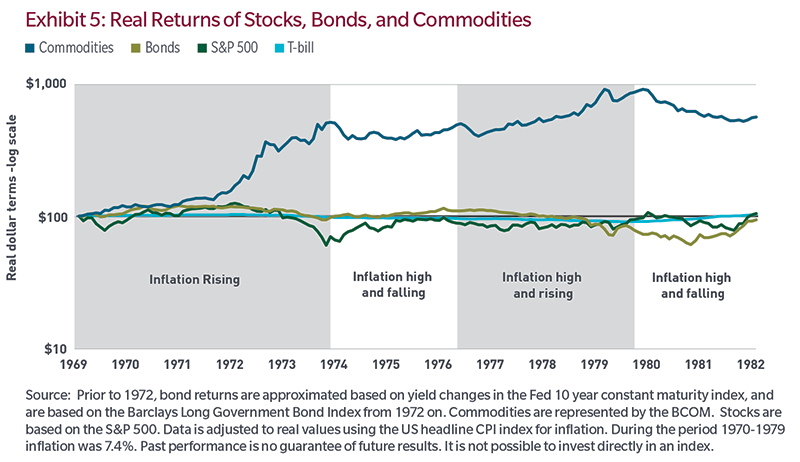

Exhibit 5 depicts a more detailed story of how commodities provided diversification to stocks and bonds during two large inflation shocks that occurred during the 1970’s. Please note that we use real returns in Exhibit 5 below. The real rate of return is calculated by subtracting the inflation rate from the nominal interest rate. Calculating a rate of return in real value rather than nominal value, especially during a period of high inflation, can provide a clearer picture of an investment’s return. The shaded regions of Exhibit 5 identify specific time periods where inflation was rising. During both of these periods of rising inflation, stocks and bonds experienced challenging performance, whereas commodities experienced quite strong performance. For the periods that are not shaded, where inflation was high and falling, stocks and bonds did a bit better, and commodities a bit worse.

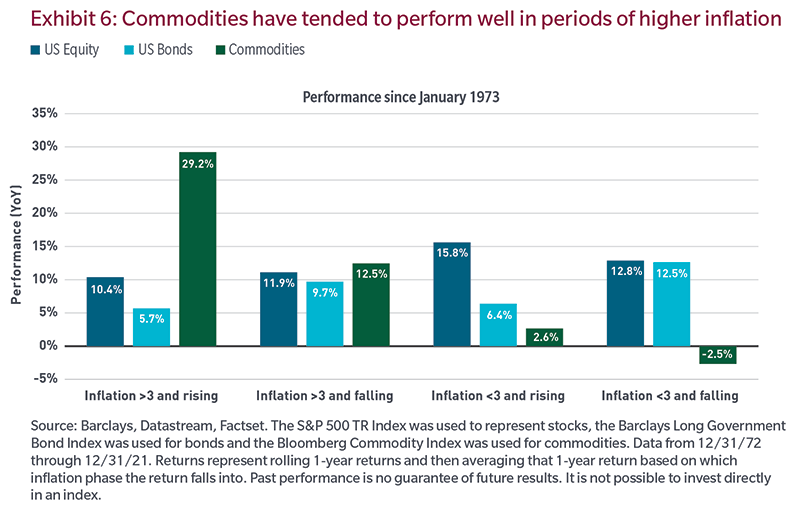

A long-term analysis can provide perspective on the behavior of commodities in periods of both high and low inflation, and in periods when inflation is rising or falling. Historically, the relative performance of different asset classes has been driven by the level and direction of inflation. Exhibit 6 illustrates four such scenarios: high and rising inflation, high and falling inflation, low and rising inflation, and low and falling inflation. We define high inflation as a CPI above the median of 3.0%.

We can see that in periods of higher inflation since January of 1973, commodities have outperformed stocks and bonds by a significant margin. In periods of high and rising inflation, commodities experienced an average return of 29.2%, outperforming equities and bonds by 18.8% and 23.5%, respectively. The outperformance of commodities was less pronounced in periods of high and falling inflation. Conversely, when inflation was lower than 3%, commodities underperformed both equities and fixed income significantly.

Investors have several ways to invest in commodities. One way is to purchase physical raw commodities, such as precious metals. Investors can also consider investing through the use of futures contracts or exchange-traded products that directly track a commodity index. These are highly volatile and complex vehicles that are generally suited for sophisticated investors. Another way to gain exposure to commodities is through mutual funds that invest in commodities. We believe for the average investor this is likely the most prudent way to allocate a portion of one’s portfolio to the asset class.

It’s worth noting that commodities are volatile and may not be suitable for every investor. They may lose money particularly during periods when inflation is low and falling.

Closing thoughts

Historically, commodities have generated positive real returns, have demonstrated a high correlation with inflation and a relatively low correlation with equities, thereby providing significant benefits to a broadly diversified portfolio. Investors should consider how an allocation to this asset class will potentially lessen the impact of inflationary spikes the economy may experience over time.

Endnote

1 National Bureau of Economic Research.

The views expressed are those of the author, and are subject to change at any time. These views should not be relied upon as investment advice, as securities recommendations, or as an indication of trading intent on behalf of any MFS investment product. FOR INSTITUTIONAL AND INVESTMENT PROFESSIONAL USE ONLY