by Jay Sivapalan – Head of Australian Fixed Interest, and Dinesh Kuhadas – Credit Analyst

Key Takeaways

- In the midst of the pandemic, the airport sector was heavily sold-off as investors pulled back from the sectors worst hit

- Research and company engagement, along with conviction to look beyond temporary crises can reveal strong investment opportunities which only present themselves in periods of market panic.

The COVID-19 pandemic challenged credit investors with a shock that hasn’t been experienced in our lifetimes – even sound, defensive ‘core national infrastructure’ businesses experienced revenue falls of more than 90% overnight. Even in the context of 100 years of corporate data, which includes The Great Depression, it’s hard to fathom such a dramatic shock.

The air travel industry, and more specifically major Australian airports senior secured debt, was caught in the eye of the storm, with nervous investors withholding capital having experienced severe mark-to-market losses. In the pandemic environment, which included lockdowns, international border closures and a shift to virtual meetings, investors were concerned about the future recovery of air travel.

In our experience, amid the peak fear and volatility lie some of the greatest investment opportunities for investors. The key to identifying these opportunities is to have already done the groundwork on assessing the company, engaging with management to stress test worst case scenarios and their response, and most importantly to look beyond the crisis and work through the issues at hand.

Every crisis is unique and, with the benefit of hindsight, the opportunities that they provide may appear obvious. However, in the midst of the chaos, a high level of conviction in backing proprietary research and investing in a contrarian manner is required to capture these opportunities.

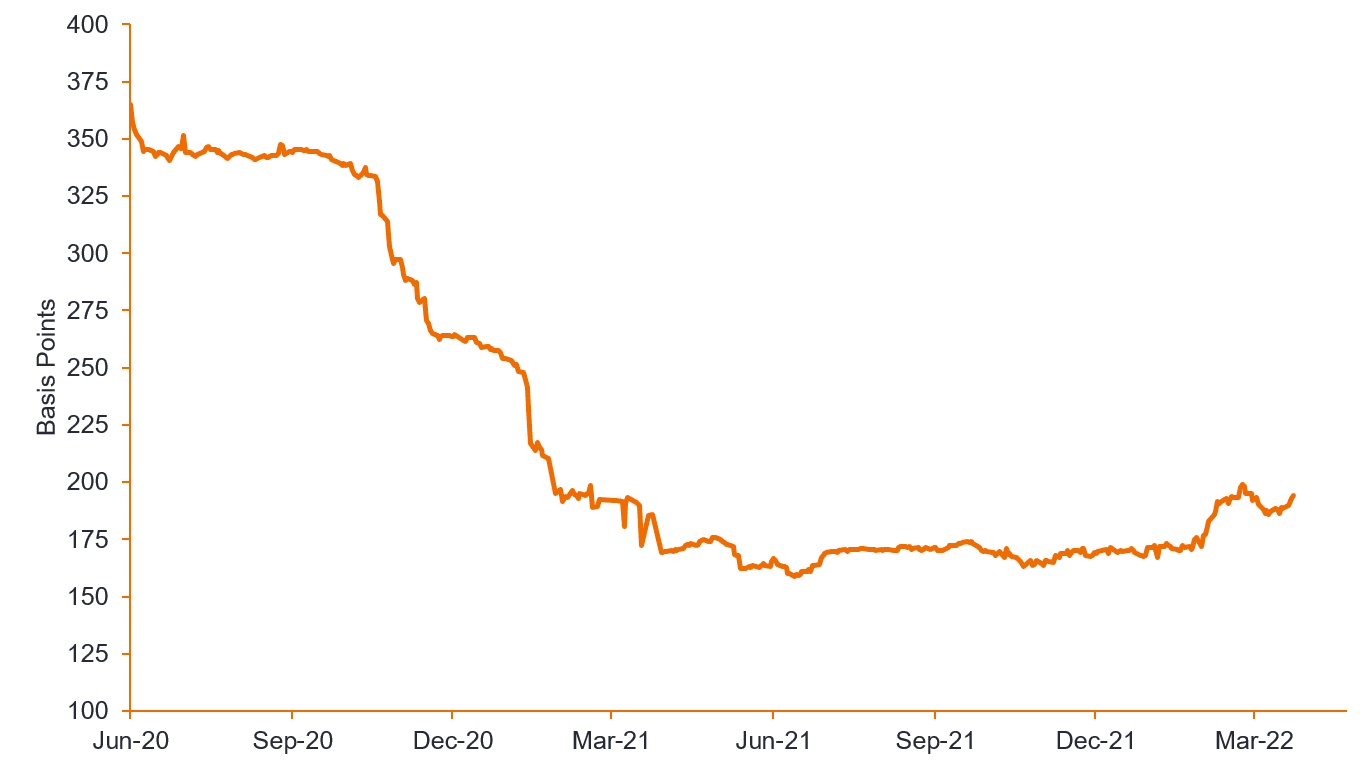

To illustrate the scale of the opportunities that presented themselves through the pandemic, Brisbane Airport senior secured debt with a 10-year maturity has delivered investors a total excess return of around 20%. Now that the storm has passed and normality is returning, the opportunity seems obvious, particularly given it is a highly defensive core infrastructure asset. However, in the eye of the storm, the decision to invest needed strong conviction and confidence in the company’s stability.

Business Profile: A world before COVID-19

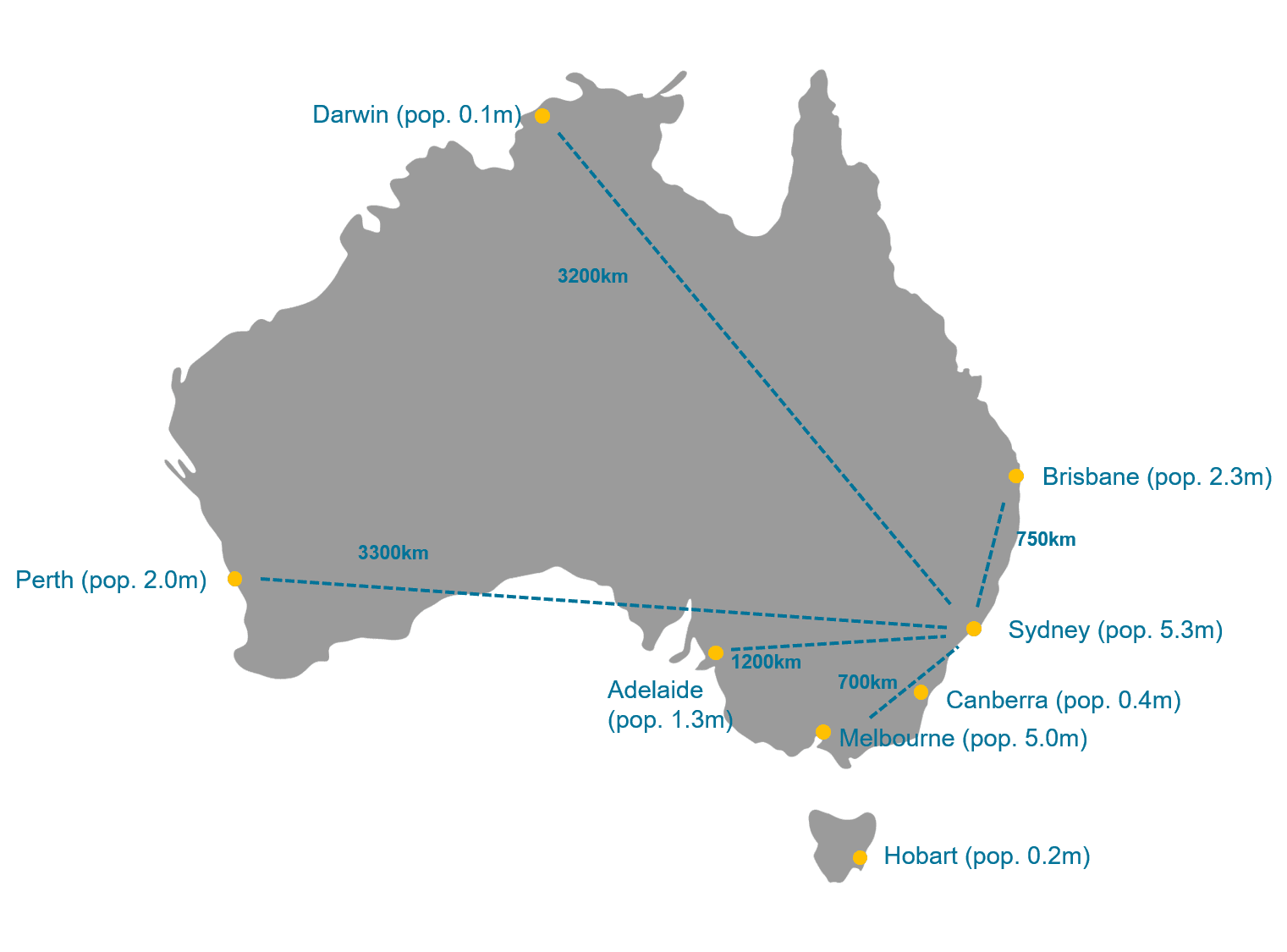

Australia’s unique geography as an island continent, with widely dispersed capital cities, makes air travel a necessity. Prior to the pandemic, Australian capital city airports were considered high-quality, defensive, essential infrastructure assets, with favourable medium-term growth outlooks. However, as Airport debt had previously traded expensively (reflecting their quality), we were only modestly invested in the sector.

Chart 1: Australian capital cities’ distance from Sydney

A ‘once in a lifetime’ pandemic

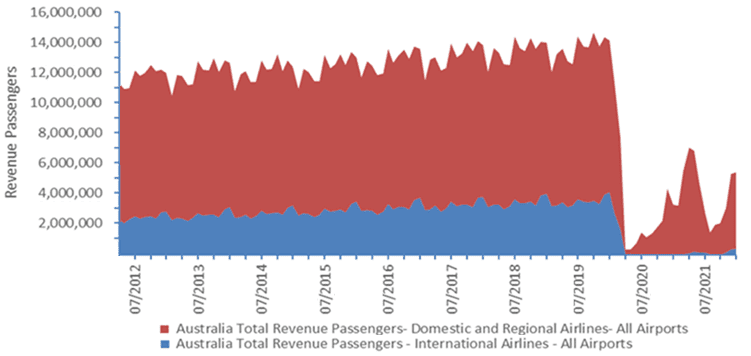

Fast-forward to early 2020 and Federal and State Governments’ initial pursuit of a COVID-19 elimination strategy led to both International and Domestic border closures, resulting in air travel dropping to de-minimis levels (Chart 2). The overnight loss of revenues resulted in a severe earnings and cashflow shock to the airport sector.

Chart 2: Monthly revenue from passengers

Source: Bloomberg, Department of Infrastructure, Transport, Regional Development and Communication. As at 31 January 2022.

Management profile: Swift and decisive action taken by high-quality management teams

In response, management teams swiftly enacted broad packages of measures to preserve liquidity while continuing to ensure safety of passengers, staff and other stakeholders. Operating expenditure was reduced proportionately with falls in activity levels to an extent previously not thought possible (via shutting entire terminals), while capital expenditures were cut to “essential only” settings. Productive discussions took place with key banking relationships, resulting in the raising of additional stand-by liquidity facilities and the receipt of covenant waivers for existing debt facilities. Financial arrangements including “in-the-money” cross currency swaps were re-set to temporarily reduce debt service and shareholder support was sought and obtained through the cessation of distributions. Potential for additional direct support was also discussed as part of contingency planning. Debt and bond holders were pro-actively provided with frequent and regular operational updates so that information asymmetry was minimised.

Investment process in action

As existing debt investors, we internally debated two items. Firstly, whether our existing investments remain capital-stable. And secondly, whether the crisis presented an opportunity to extend exposure to the sector at its “darkest hour”. And if that was the case, how we could best achieve this in a risk-managed fashion, with downside protection.

Our investment process was multi-faceted. We contacted all the airports and vigorously challenged their management teams’ assumptions around passenger recovery profiles. We assessed liquidity positions, forward capex plans, and undertook stress testing under more conservative recovery assumptions than management and the market anticipated, particularly around the shape of the international passenger recovery. We liaised directly with credit ratings agency analysts and gained comfort that they would be taking a patient approach with regards to ratings actions. We also reviewed listed airport equity research, from which we gained comfort that long-term infrastructure equity owners considered the pandemic a “bump” in their decades-long investment horizon, and would therefore be willing to stand behind their investments. Collectively, this gave us comfort that the airports could “trade-through” the immediate crisis, and that our existing senior secured investments were still viable investment opportunities.

Stress presents opportunity

At this point we re-analysed the operational and credit metrics of the individual airports, seeking to find the airport that could lead the domestic recovery once state borders re-opened, regardless of the indefinite nature of the international borders.

This process identified Brisbane Airport, which is an award-winning airport benefiting from significant travel within the state from fly-in fly out (“FIFO”) resource industry demand, together with internal tourism. Once state borders re-opened, we assessed that Queensland would benefit disproportionately from domestic tourism while international borders remained closed. In the interim, we also assessed that cashflows would be supported by rental income from the airport’s large commercial property portfolio. Brisbane Airport had a relatively more modest forward capex profile following the recent completion of its second runway. Lastly and crucially, it had upcoming maturities to attend to, coinciding with peak COVID-19 fear, which set up a scale opportunity.

Investing in peak-fear: Corner-stoning Brisbane Airport’s debt refinancing

Following further discussions with management and undertaking additional detailed stress testing and financial modelling, we received approval from the Credit Committee to cornerstone Brisbane Airport’s bond refinancing. In addition to compelling pricing (Swaps + 365 basis points (bps)) for a BBB rated bond, we were able to secure additional favourable terms on behalf of our investors. This included a 100bps coupon step-up should the airport be downgraded into sub-investment grade, together with a make-whole premium at 50bps should the expensive bonds be refinanced early post-pandemic. The former provided downside protection, while the latter provided significant upside convexity for our investors.

Business profile: Life in a post-COVID World

The Australian aviation sector has continued to be impacted by pandemic-induced lock-downs and border closures, into 2022. A key supportive development has been the development and wide-spread roll out of vaccinations. Today, over 90% of the eligible Australian population has been double-vaccinated and booster programs have been rolled out. Therapeutics have been developed for post-infection treatment and the domestic health system is more advanced and experienced as it relates to preparing for and handling future outbreaks. These have combined to create a mind-set shift among government, industry, businesses and the public, to move to a “living with COVID” setting.

While the public’s confidence in air travel has returned, we understand that significant risks still remain, as evidenced by the shut-downs during the Delta variant outbreak in the middle of 2021 and the subsequent Omicron outbreak, which put strong domestic passenger recoveries on hold. A key learning has been just how strongly domestic travel demand bounces back when health situations get back under control. Today, all Australian domestic borders have re-opened and forward domestic bookings are anecdotally back to pre-COVID levels. Seat capacity has come back in tandem, with Qantas forecasting domestic capacity increasing to 90-100% of pre-COVID levels by the end of the 2022 financial year.

The International travel recovery is more uncertain, as various nations are at different phases in dealing with the pandemic. However, Australia’s International borders have very recently re-opened, with significantly reduced quarantine and other requirements dependent on a traveller’s port of departure.

While we keep an open mind as to the emergence of new virus strains and subsequent controls, we can observe that the Australian aviation sector is significantly better placed today than at any time over the past two years.

Financial profile: Bruised but not harmed

While liquidity remains very strong across the capital city airports, financial profiles continue to be pressured due to reduced aeronautical earnings. That said, management actions have allowed for strong free cashflow generation, even from the internationally exposed airports like Sydney and Melbourne. As an example, in the half-year to 31 December 2021, domestic flying was effectively restricted to the months of July and December (due to Delta and Omicron), while international flying was effectively shut down. Notwithstanding, Melbourne Airport was able to generate not only positive EBITDA, but was also able to break-even on operating cashflows after paying interest. Likewise, Sydney Airport (31 December 2021 year-end) was able to generate positive operating cashflows in 2021.

An important development for the sector, was Sydney Airport’s take-private acquisition by a consortium led by IFM which closed recently. At approximately 23.5x the enterprise value multiple (based on 2019 EBITDA), this demonstrated the strong investment demand for high-quality infrastructure assets from long-term, experienced global infrastructure investors. This transaction provides evidence that long-term investors are viewing COVID as a “bump” over the long-term horizon of their investments. It also provides debt investors with confidence that should the recovery continue to be bumpy, shareholders are likely to continue to “stand behind” their rare and valuable investments.

From a ratings perspective, our liaisons with credit ratings agency analysts have indicated that while they have been willing to be patient, downward ratings migration risk will be likely in the event of another broad-based lock down. While we are cognisant of this risk, our assessment is that the risk of senior secured airport debt falling into sub-investment grade is low.

ESG: Operating with a changing social licence

Australian capital city airports are externally recognised as comparing well versus global peers on environmental metrics (Table 1). All have set Scope 1 and 2 carbon emissions reductions targets through to 2030, with Sydney and Melbourne airports aiming to reach carbon neutral sooner. Emissions arising from electricity usage will be reduced via usage of solar power generated onsite, purchases of electricity from renewable energy sources via power purchase agreements, and the electrification of bus / vehicle fleets. Continuous improvement on energy efficiency is a focus, as is reduction in water usage, increasing the use of recycled water and the minimisation of terminal waste to landfill.

Managing Scope 3 emissions is a longer-term challenge. The bulk of airports’ Scope 3 emissions are generated by airline customers. Qantas is the main customer operating out of all the Australian airports, and is a sector leader in terms of ESG. Most recently, the airline articulated a pathway to achieving net zero emissions by 2050, together with an interim target to reduce emissions by 25% by 2030. To achieve these targets, Qantas intends to increase the use of sustainable aviation fuels, increase fuel efficiency via fleet renewal, eliminate single use plastics, reducing waste to landfill and use carbon offsets. Australian airports will work with Qantas to achieve these aims and Scope 3 performance will improve in unison. Separately, airports will also aim to reduce Scope 3 emissions by offering green electricity to terminal tenants via embedded networks, seeking opportunities to improve the efficiency of airport operations, and longer-term planning to reduce congestion and improve airport connectivity for consumers.

Table 1: Australian airport ESG analysis

| ESG | Sydney Airport | Melbourne Airport | Brisbane Airport | Adelaide Airport | Perth Airport |

| Sustainalytics ESG Rating | 11.3 (low risk) |

18.8 (low risk) |

19.6 (low risk) |

10.4 (low risk) |

N/A |

| ESG Risk Rating Ranking – Sustainalytics | Rank & Percentile | Rank & Percentile | Rank & Percentile | Rank & Percentile | Rank & Percentile |

| Global Universe | 360/14,774 3rd |

2,855/14,774 20th |

3,263/14,774 23rd |

224/14,774 2nd |

N/A |

| Transportation Infrastructure | 19/169 12th |

91/169 54th |

101/169 60th |

224/14,774 2nd |

N/A |

| Airports Sub-Industry | 3/76 4th |

17/76 22nd |

25/76 33rd |

1/76 1st |

N/A |

| Global Real Asset Sustainability Benchmark (GRESB) | N/A | N/A | N/A | N/A | 5-star – top Australian Airport |

Source: Janus Henderson, Sustainalytics. As at 31 March 2022.

From a social perspective, the pandemic continues to pose the greatest risk. Airports have put procedures and processes in place to ensure as safe a return to flying as is possible. From a governance and regulatory perspective, the major Australian airports (excluding Adelaide) are monitored by the Australian Competition & Consumer Commission and the Productivity Commission to ensure they are not mis-using their monopoly power as it relates to aeronautical charges (which are charged to airlines and loaded onto ticket prices). While regulation is “light touch”, both airports and airlines are focused on bringing passenger numbers back up to pre-COVID levels as the main priority. Airport shareholders are generally experienced, long-term investors, including superannuation funds and pensions. ESG-sensitive and keenly aware of their social licenses, they bring Board Level ESG focus to the airports.

Rewarding investors

Investors who participated in the sector and during limited primary market issuance during the darkest hours have been rewarded with around 20% excess returns once credit spread narrowing and coupon income is taken into account. For what is ultimately a highly defensive core infrastructure asset, this represents strong returns for investors able to see beyond the storm, whereas others may have lost sight of long-term value when conditions were at their darkest.

Chart 3: Brisbane Airport 2030 Credit Spreads

Source: Brisbane Airport. As at 31 March 2022.

Looking ahead

Today, we are cautiously optimistic on the outlook for the Australian capital city airport sector. While health related set-backs and the rising costs of fuel have the ability to significantly impact demand for travel, our view is that the sector has troughed and continues to offer the potential for solid risk-adjusted returns over the medium-term.

Crises are an inevitable part of the investing journey, and our experience is that ongoing research and company engagement are vital to identifying opportunities that might only present themselves in the midst of turbulent financial conditions.