Since the start of the year Chinese equities have faced a series of headwinds, compounded by the US Fed rate hikes, driving capital outflows in the first quarter. However, we believe that Chinese equities have been oversold and investors may do well to reassess and consider investing in fundamentally sound companies as part of their strategic/tactical asset allocation.

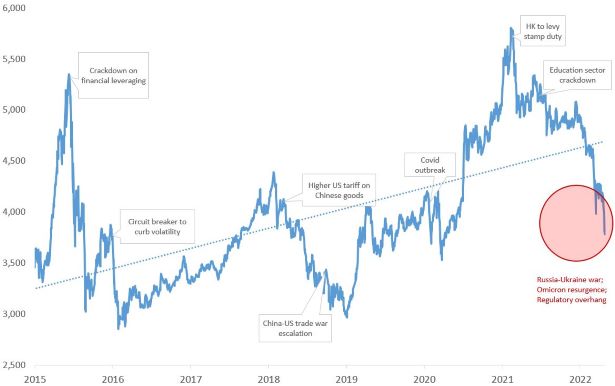

Mark Twain once said history doesn’t repeat itself, but it often rhymes. Since China’s last stock market crash in 2015, short-term turbulence has persisted yet the extent of the drawdowns have been far less pronounced and overall trending upwards.

Chart 1: Major events in the CSI 300 Index

Source: Bloomberg as at 26 April 2022

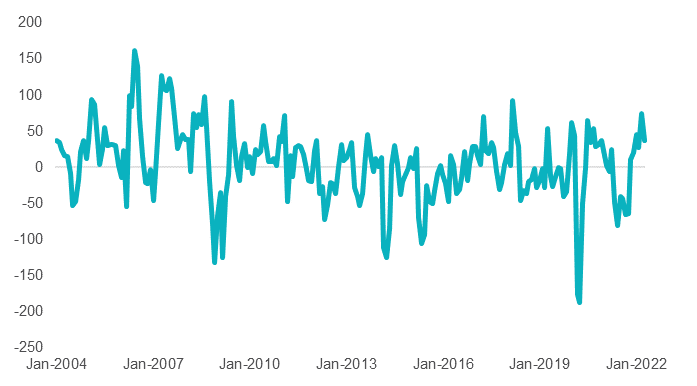

The chart below measures the data surprises relative to market expectations; a positive reading indicates the data releases have been stronger than expected. The Chinese economy has shown resilience so far with a moderate degree of monetary easing.

Chart 2: Citi China Economic Surprise

Source: Bloomberg as at 26 April 2022

The fundamentals of Chinese equities look compelling with lower debt leverage, and higher earnings and sales growth compared to developed markets.

Table 1: Performance comparison between Australian, international and Chinese equities

| Fundamentals | Australian Equities |

International Equities |

CSI 300 | China A50 | Chinese New Economy Sectors |

| ROE | 15.76 | 23.17 | 18.23 | 21.76 | 25.32 |

| LT Debt to Capital | 36.57 | 39.77 | 16.58 | 14.54 | 5.17 |

| Historic 3Yr EPS Growth | 11.2 | 15.7 | 27.5 | 24.3 | 45.7 |

| Historic 3Yr Sales Growth | 4.2 | 9.5 | 21.2 | 18.5 | 31.8 |

| Price to Earnings | 14.8 | 18.2 | 13.1 | 12.9 | 13.7 |

| Price to Book | 2.33 | 2.89 | 1.76 | 1.83 | 2.94 |

| Price to Sales | 2.64 | 2.21 | 1.32 | 1.52 | 2.52 |

Source: FactSet, as at 25 April 2022. Australian equities is S&P/ASX 200; International equities is MSCI World ex Australia Index; China A50 is FTSE China A50 Index; Chinese New Economy is MarketGrader China New Economy Index. Past performance is not a reliable indicator of future performance.

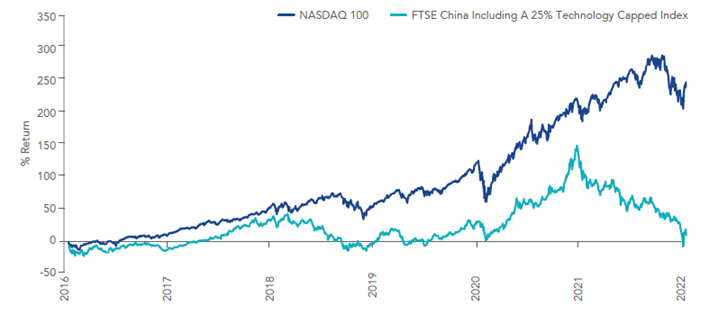

In our most recent quarterly economic outlook, the VanEck ViewPoint, we wrote about why Chinese tech may be the place for value hunters.

Chart 3: NASDAQ 100 and FTSE China A tech index

Source: Bloomberg.

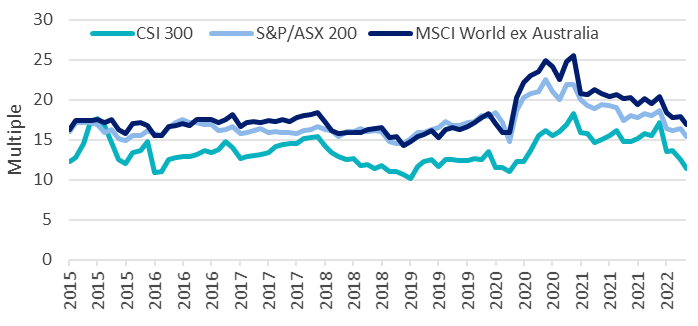

The forward P/E also look attractive. China A-shares is currently trading at close to 30% discount vs developed markets.

Chart 4: 12-month Forward P/E

Source: Bloomberg as at 26 April 2022

We would not underestimate the volatility in the market – domestically Shanghai and Jilin have ongoing lockdown which raises concerns on the supply chain disruption, now adding Beijing into the mix. The recovery path is likely to get worse before it gets better in the coming months. Having said that, we believe that the Chinese equities might be close to an inflection point with better coordinated economic policies.