by Bhaskar Sastry, CFA and Adrienn Sarandi

Key takeaways

- Trees provide a multitude of services, including protecting us from climate change and biodiversity loss, yet the rate of deforestation is unprecedented

- Governments are taking firm action to address deforestation through agreements at COP26, regulation and strengthening carbon markets

- Investors have a unique role and responsibility to contribute to addressing deforestation.

This series of ESG Primers examine key sustainability challenges that humanity is facing and will continue to face in coming decades. The first primer in the series focussed on biodiversity loss and we now concentrate on deforestation.

READ THE FULL WHITEPAPER HERE

We are witnessing the relentless destruction of one of Earth’s most precious assets – its trees. Humanity’s growing need for certain products, notably beef, soy and palm oil, threaten to strip our forests away with catastrophic consequences.

The rate of global deforestation has multiplied in recent decades. An area the size of India and Nigeria has been lost through deforestation since 1990 (UN, 2021).

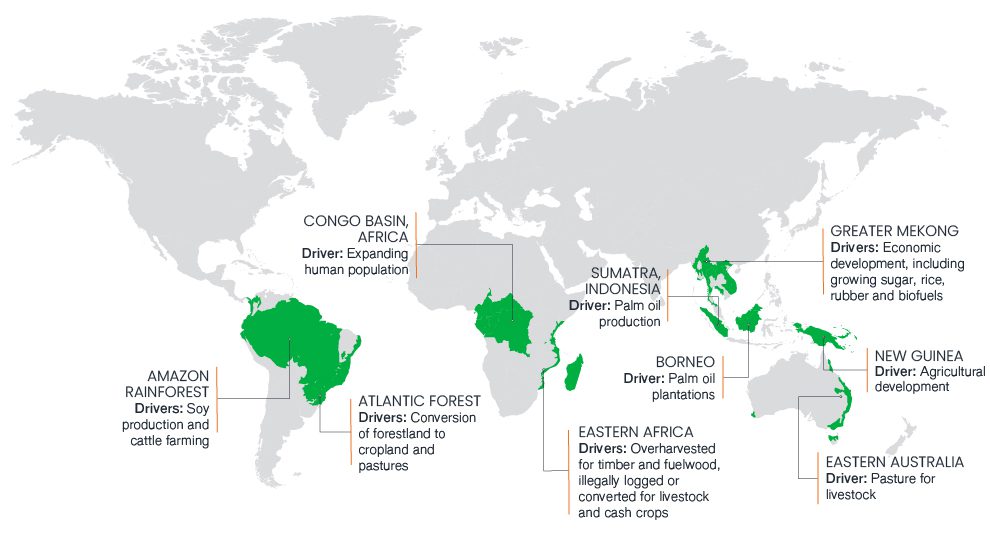

The map below shows areas of the world most impacted by deforestation:

Figure 1: Where is deforestation happening?

Source: WWF (2015). Shading is for illustrative purposes only

The vast majority (95%) of deforestation today occurs in countries in the tropics, notably in South America and South-East Asia. However, research shows that demand from developed countries for beef, soy (the majority of which is fed to cows), palm oil and timber products, including paper, drives much of the world’s deforestation1.

Why should we care?

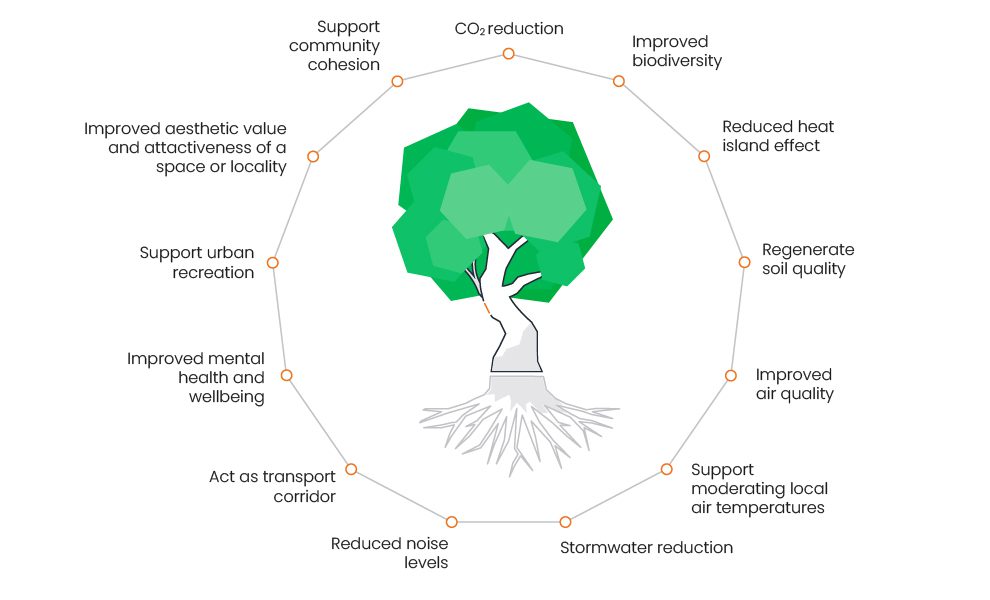

Figure 2: Multiple benefits of trees and green infrastructure

Source: UN Biodiversity / Greenpeace, February 2022

Deforestation has serious economic implications at local and global levels as it:

- Exacerbates climate change and detracts from climate mitigation efforts. The WWF estimates that deforestation and forest degradation account for approximately 15% of global carbon emissions1 – more than the combined emissions from all the cars, trucks, planes and ships globally2.

- Destroys animal and plant habitats and degrades soil, reducing the number and variety of local species

- Means we miss out on climate adaptation. Tree foliage provides a valuable canopy, evaporation from the leaves cools the underlying area and tree roots protect against droughts by storing groundwater.

- Increases the likelihood of the emergence of diseases as with COVID-19.

Marking a line in the soil

COP26 in November 2021 represented a much-needed step forward in global efforts to tackle deforestation. Over 140 countries representing 90% of the world’s forests signed the ‘Glasgow Leaders’ Declaration on Forests and Land Use’, to halt and reverse forest loss and land degradation by 2030.

Agreements at COP26 are also expected to strengthen the transparency, reliability and liquidity of voluntary carbon markets – a key lever to tackle deforestation and climate change. This should result in higher-quality credits, greater demand for offsets as companies aim to meet net zero goals and higher prices of carbon offsets.

Regulators are also starting to take firm action on deforestation risks. The European Commission has released plans to ban imports and exports of certain commodities and products derived from forests unless they can be shown to be “deforestation-free” and produced in accordance with applicable laws. The Sustainable Finance Disclosure Regulations (SFDR) and EU Taxonomy will also focus on reporting on exposures to and management of deforestation and biodiversity loss for in-scope investors.

The challenge is that disclosures on deforestation and biodiversity-related issues is lacking, but the work of the Taskforce on Nature-related Financial Disclosures (TNFD) is expected to improve on this.

Companies have a responsibility to understand and disclose deforestation risks in their operations and supply chains. This includes agricultural companies and companies that rely on paper products and timber. Consumers can push for change in their dietary choices by eating less beef that comes from areas of unsustainable deforestation, and buying responsibly sourced meat, palm oil and soy.

Investor considerations

Deforestation is as a financially material ESG risk that investors should factor into equity and corporate credit analysis. Understanding where forest loss is greatest and what is driving it allows investors to better understand the products, companies, industries and countries with the greatest impact on – and exposure to – deforestation.

Food production and the agriculture sector have the most impact on deforestation, particularly through the production of beef, soy and palm oil. Analysing risks in these companies’ operations and supply chains is essential to determining the attractiveness and creditworthiness of an investment opportunity.

Effective investor engagement is critical to ensure such companies consider their dependence and impact on deforestation. Market-leading companies disclose relevant risks and have strategies in place to evidence how they intend to mitigate or offset their impact on nature. However, the volume and quality of deforestation-related disclosures are still in their infancy. Pushing for better disclosures in natural capital-related risks and opportunities is vital and should urgently follow climate change-related disclosures.

Investors should accept that deforestation could have a direct impact on the long-term value of their portfolios. Equally, we believe investors have a unique opportunity to help preserve and rebuild forests through their capital allocation decisions and active ownership practices. When governments, regulators, companies, consumers and investors prioritise the importance of nature, systemic change can happen.

1 ‘Deforestation displaced: trade in forest-risk commodities and the prospects for a global forest transition’ (Pendrill et al., 2019)

2 Deforestation and forest degradation’ (WWF, 2022)

3 Deforestation and climate change’ (The World Counts, 2020)