by Tom Tao and James Halse

Japan is home to many well-run, globally dominant businesses, but this fact is often obscured behind headlines that call attention to a stagnant economy, declining population and scandals at large corporations. Discerning investors who are willing to dig a little deeper will be richly rewarded with a plethora of globally competitive companies that often play a crucial role in their respective value chains. Some of the best businesses in Japan are those that many investors have never heard of, making obscure products that dominate a market most investors have never thought about.

Take manufacturer Hoya’s glass substrates for hard disk drives (HDDs) for example. I (Tom) remember my first laptop in 2005. It was a clunky Compaq with 80GB of HDD storage capacity and the HDD would sometimes make a loud rattling noise. Fast forward to 2022, that big old clunky HDD is long gone from our laptops, replaced by the faster but more expensive flash memory or ‘solid state drive’ (SSD). The HDD market, thought to be having its sunset moment because of this dynamic has, however, found a new growth angle in data-centre applications. Due to the explosion of data creation (i.e. endless videos of cats, dogs and babies), the hyperscale data-centre companies (Google, Amazon and Facebook) all need a way to store data efficiently and economically.

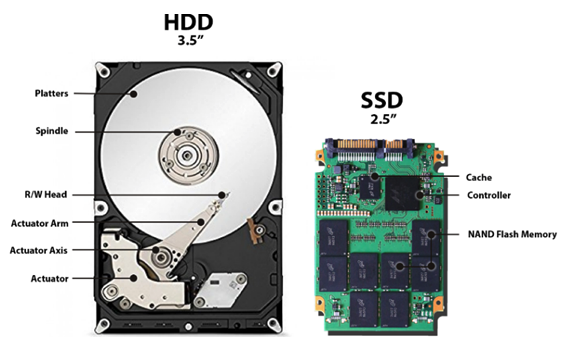

Fig. 1: HDD vs. SSD

Source: CyberHoot

A HDD comprises a stack of disks on which bits of data are stored. Disks are made out of either aluminium or glass. An HDD unit typically has 8-9 disks. However, HDD manufacturers such as Seagate and Western Digital have been trying to pack more disks into a hard drive to increase storage capacity. We are pushing the limits of this approach, and the industry is expecting to introduce 11-platter in the near future. Glass is thinner, more rigid and heat resistant compared to aluminium, so is growing in adoption as HDD manufacturers seek to continue increasing the capacity of their drives. This bodes well for Hoya, as it is the only glass substrate provider in the world.

Hoya’s expertise in precision glass has also carried it into other niche verticals. Its mask blanks are used as a base material for photomasks, which are used to transfer circuit patterns onto silicon wafers in the manufacturing process for making semiconductor chips. The design of the mask causes light to shine through in a defined pattern to “print” the circuit pattern. When one considers how tiny transistors have become (IBM’s latest chips have transistors smaller than a strand of human DNA, allowing for an incredible 50 billion transistors on a fingernail-sized chip), one soon realises how small the margin for error is in the quality of the glass used in making the photomask!

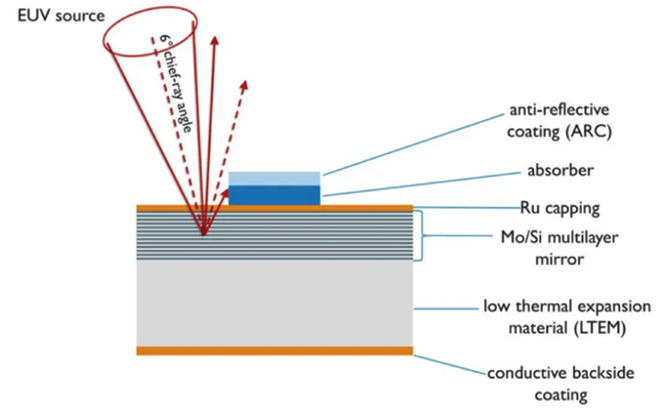

Fig. 2: Cross-section of an EUV mask

Source: semiengineering.com

Hoya has 60% market share globally in the sales of such photomask blanks.[1] It is also the sole supplier of leading-edge extreme ultraviolet (EUV) mask blanks for the two main chip foundries Taiwan Semiconductor Manufacturing (TSMC) and Samsung, with products specifically designed to fit each customer’s process. It is very difficult for a competitor to enter the market because Samsung or TSMC would have to change its production method and process substantially, and incur substantial extra time and cost. It is no wonder then that Hoya earns superb operating margins of 50% in its Information Technology division,[2] where the financials are reported for its HDD glass substrate and photomask blanks businesses.

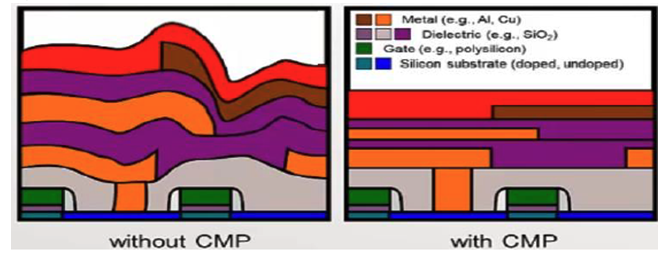

It is not only photomasks that need to be extremely flat and free of defects. Many component parts of the semiconductor production process require extreme manufacturing expertise to achieve the necessary tolerances. The silicon wafer itself must be polished to achieve an atom-level flat surface, which is done via the chemical mechanical planarisation (CMP) process. CMP uses a chemical slurry to smooth out the wafer, and for the chips with the most stringent demands, only ultrapure colloidal silica (UCS) meets the requirements for use in the slurry. Fuso chemical, has evolved into the sole supplier of UCS particles globally, and for its trouble earns a 45% EBIT margin in that business division.[3]

Fig. 3: CMP Process

Source: Dr Chris A. Mack, Adjunct Associate Professor, Lecture 30 Chemical Mechanical Polishing (CMP), July 2013.

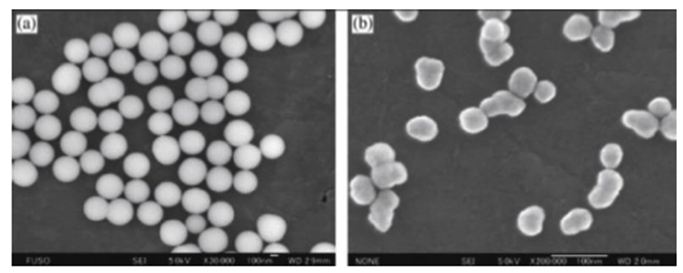

What makes Fuso unique is its ability to manipulate its particle’s dimensions: shape, size, or even surface chemistry. Its particles are beautifully round and are free of contaminants.

Fig. 4: Fuso particle (left) vs. standard colloidal silica particle (right)

Source: Advances in CMP Technologies

Fuso has various patents for its technology, but their strength also comes from having deep know-how where product quality is always consistent. As chips are getting smaller and more complex, the number of CMP steps will increase significantly and drive higher demand for ultrapure colloidal silica. This trend puts Fuso in a favourable position to continue growing sustainably as the only supplier of a highly profitable niche product.

We have mentioned two companies with very interesting and profitable businesses in niche markets, but the Japanese equity market provides many more similarly interesting investment opportunities. Part of our process involves uncovering and learning about such businesses, before determining whether the company’s stock is providing an attractive entry point at a given moment in time. Across Platinum’s funds in general, and in the Platinum Japan Fund in particular, we have invested in a number of little-known companies, that despite their low profiles, provide inputs integral to the functioning of many finished products we take for granted today.

[1] Source: Goldman Sachs estimate.

[2] Source: Company’s annual report for the year ended March 2022.

[3] Source: Company’s annual report, average for the six years to March 2022.

DISCLAIMER: This information has been prepared by Platinum Investment Management Limited ABN 25 063 565 006, AFSL 221935, trading as Platinum Asset Management (“Platinum”). While the information in this article has been prepared in good faith and with reasonable care, no representation or warranty, express or implied, is made as to the accuracy, adequacy or reliability of any statements, estimates, opinions or other information contained in the articles, and to the extent permitted by law, no liability is accepted by any company of the Platinum Group or their directors, officers or employees for any loss or damage as a result of any reliance on this information. Commentary reflects Platinum’s views and beliefs at the time of preparation, which are subject to change without notice. Commentary may also contain forward looking statements. These forward-looking statements have been made based upon Platinum’s expectations and beliefs. No assurance is given that future developments will be in accordance with Platinum’s expectations. Actual outcomes could differ materially from those expected by Platinum. The information presented in this article is general information only and not intended to be financial product advice. It has not been prepared taking into account any particular investor’s or class of investors’ investment objectives, financial situation or needs, and should not be used as the basis for making investment, financial or other decisions. You should obtain professional advice prior to making any investment decision. You should also read the relevant product disclosure statement and target market determination before making any decision to acquire units in the fund, copies of which are available at www.platinum.com.au/Investing-with-Us/New-Investors.