[raw]

US stocks closed mixed Friday, with the technology-heavy Nasdaq Composite ending higher as the Dow Jones Industrial Average and S&P 500 index slipped, after a stronger-than-expected June jobs report. All three major benchmarks booked weekly gains, with the Nasdaq leading the way up.

Looking ahead this week, investors won’t know what to focus on with the US second-quarter earnings season beginning on Thursday-Friday, reports due out from six major banks, and the June consumer price index due for release with expected central bank rate rises.

With earnings season about to begin, the stock market could finally get its moment of truth. The S&P 500, after all, has dropped 18 per cent in 2022 and is mired in a bear market. Yet that decline largely reflects the effect of higher bond yields, which force valuations lower, triggering sell-offs.

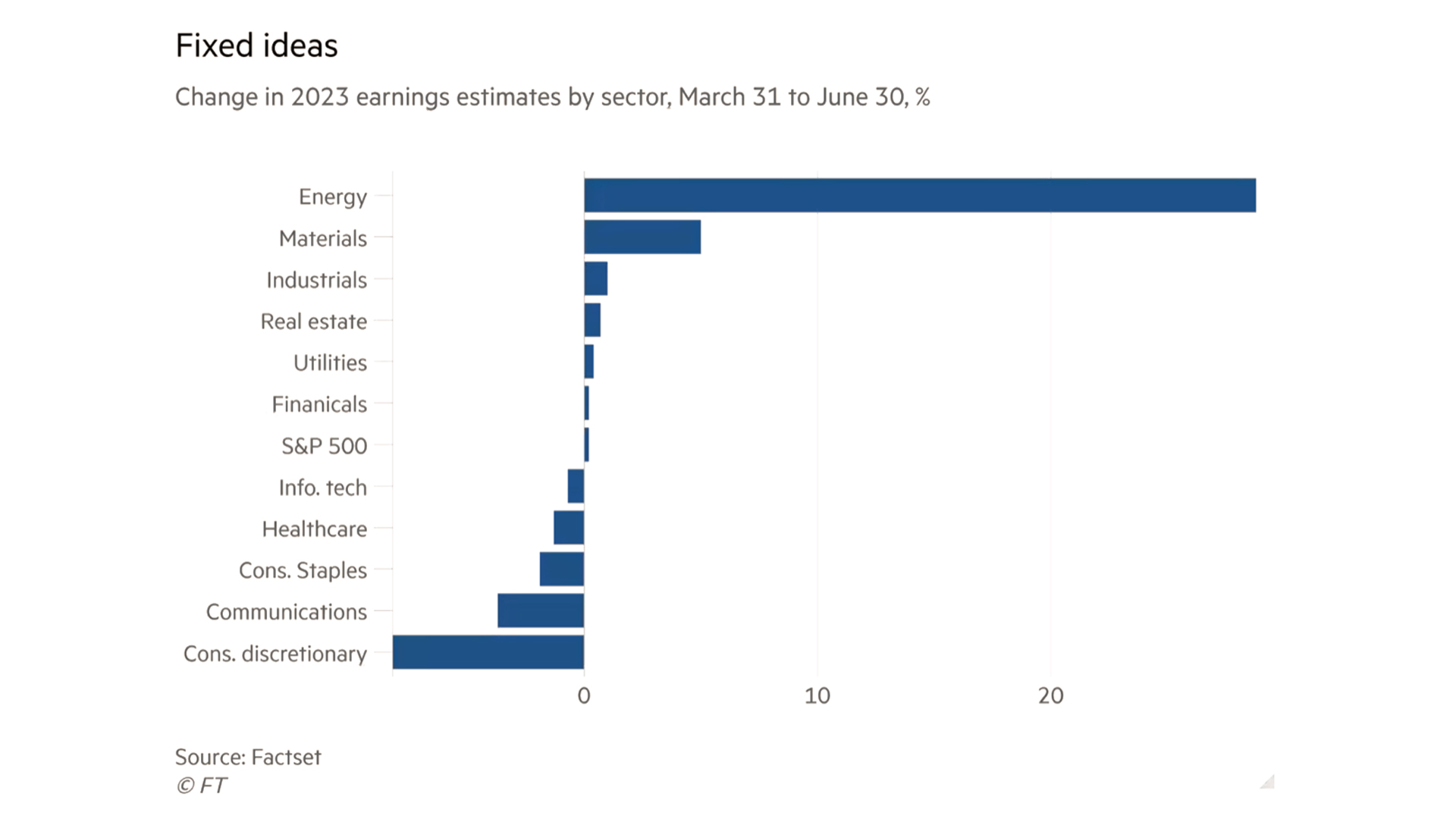

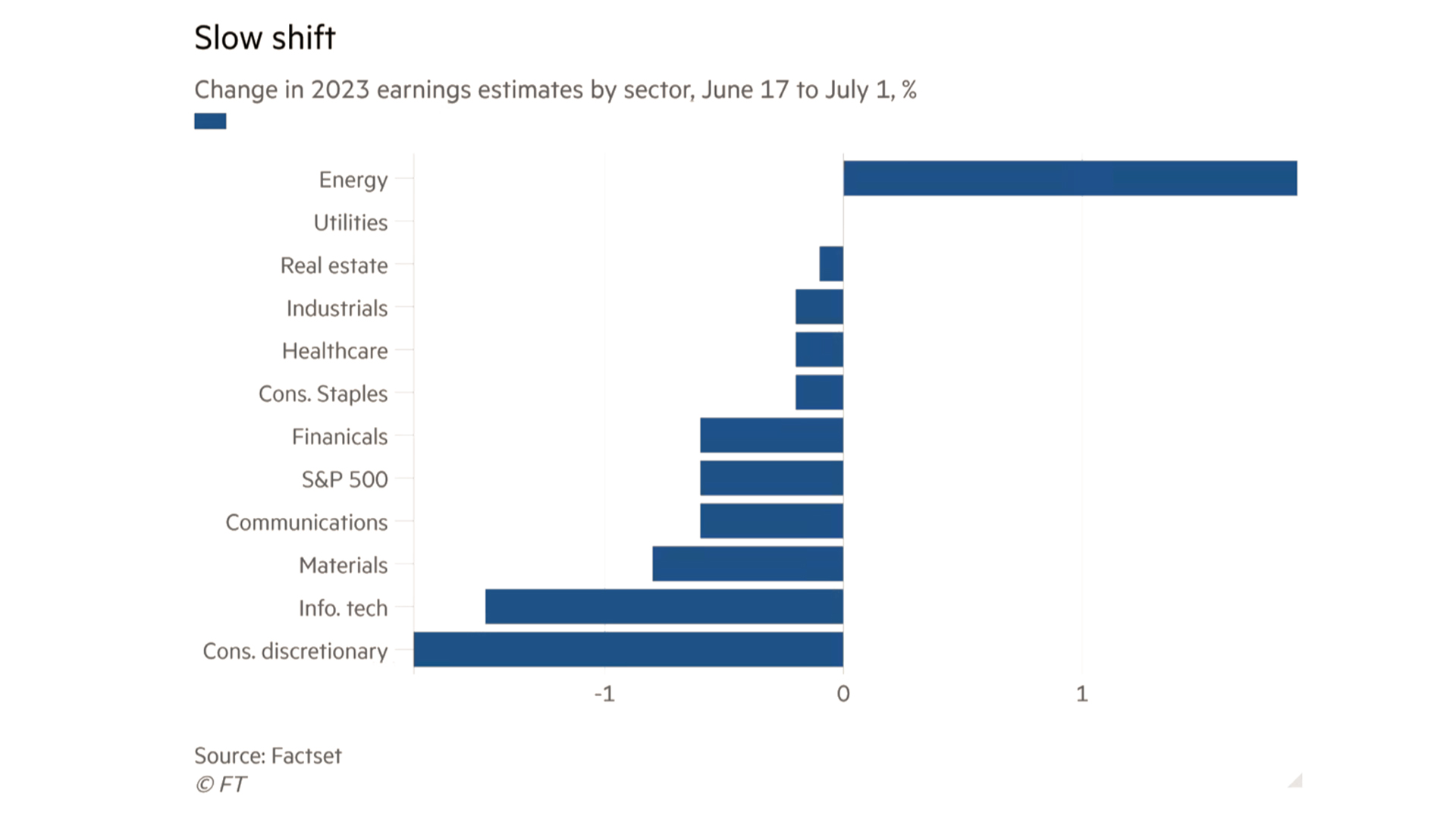

Earnings estimates, however, remain relatively firm – although it appears there have been some downgrades across the sectors for 2023 when viewing the date since mid June.

Across the sectors – no real winners with commodity prices under pressure and companies in the aluminium and copper sectors struggling.

Best-performing thematics included battery stocks, tech, new energy companies and hydrogen stocks.

Last month in the hydrogen space, the US Department of Energy’s Loan Programs Office issued its first loan for clean-energy tech since 2014, guaranteeing a loan of $504.4 million to the Advanced Clean Energy Storage project in Utah that will convert renewable energy to hydrogen to support the power grid in the Western US.

In stocks related news, Twitter shares fell 5.1 per cent following news that Musk will withdraw his bid for the company. It appears that that both parties are headed to the courts with two possible outcomes, and they are very different. Firstly, Musk might have to pay a $1 billion reverse termination fee for unjustifiably walking away from the deal. Or, secondly, a court might order “specific performance”, meaning that Musk would have to fund his entire $33.5 billion equity commitment and buy Twitter.

In Musk-related company news, PayPal Holdings shares fell more than 2 per cent after a broker downgrade.

Tesla Inc rose 2.5 per cent after shipping a record 78,906 vehicles in China last month.

On the economic front, Friday’s June jobs data surprised on the upside with 372,000 new jobs created last month, much better than the 250,000 in market forecasts. That continued what has been a strong year for jobs growth in America and will make it easier for the Federal Reserve to again lift rates by 0.75 per cent at its next meeting on July 26 and 27. The US jobs result for June was a case, as one US analyst put it of “good news being bad” for the markets because it means another big rise in US interest rates.

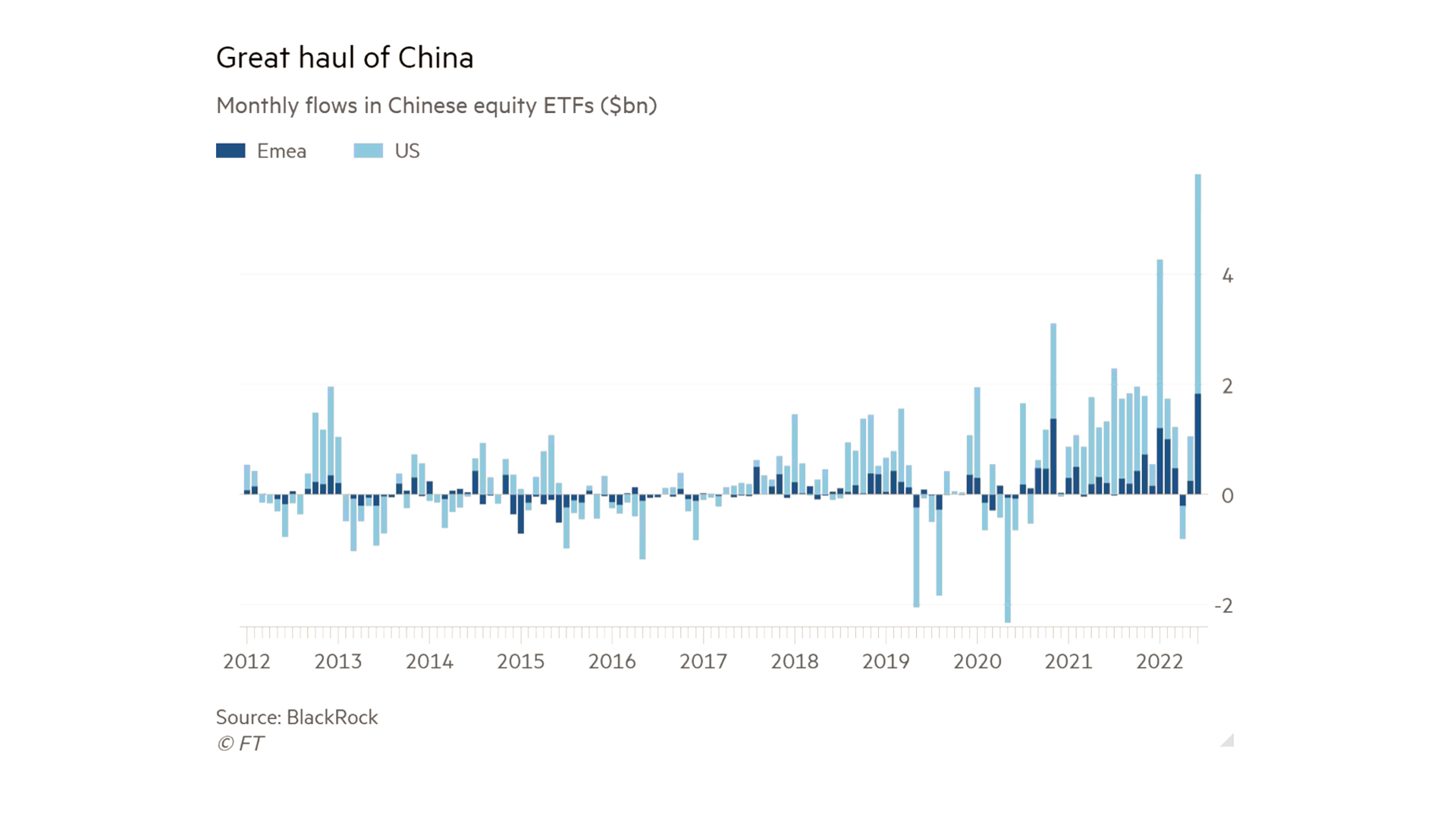

In fund flow news, the latest flow data highlighted dash to cash and biggest inflows to global bond funds in 14 weeks, with treasuries and government bonds the big beneficiaries. It appears China is a major beneficiary of new flows as US and European investors poured record sums into the Chinese market, with record flows of $5.8bn into listed Chinese ETFs – with the expectation of China stimulus to support markets post slowing growth due to COVID and real estate related defaults.

Figures around the globe

US markets closed mixed. The Dow Jones fell 0.2 per cent to 31,3385, the S&P 500 lost 0.1 per cent to 3,899 and the Nasdaq gained 0.1 per cent to 11,635.

Across the Atlantic, European markets closed higher. Paris added 0.4 per cent, Frankfurt gained 1.3 per cent and London’s FTSE closed 0.1 per cent higher.

Asian markets closed mixed. Tokyo’s Nikkei added 0.1 per cent, Hong Kong’s Hang Seng gained 0.4 per cent and China’s Shanghai Composite lost 0.3 per cent.

On Friday, the Australian sharemarket rose 0.5 per cent to 6,678.

Commodities

Iron ore is trading 0.7 per cent lower at at $US114.05 a ton.

Iron ore futures are pointing to a 3.7 per cent fall.

Gold gained $2.60 or 0.2 per cent to US$1742 an ounce.

Silver was up $0.05 or 0.3 per cent to US$19.24 an ounce.

Oil added $2.62 or 2 per cent to US$104.79 a barrel.

On the London Stock Exchange, Rio lost 0.5 per cent, BP gained 0.3 per cent and Shell added 0.5 per cent.

Currencies

One Australian dollar at 7:10 AM has strengthened compared to the US dollar on Friday, buying 68.51 US cents (Fri: 68.40 cents), 56.99 Pence Sterling, 93.24 Yen and 67.32 Euro cents.