The ongoing spectre of inflation means there have been few places to hide outside of cash – which paradoxically does worst during inflation. And therein lies the irrationality and opportunity markets can present.

Central banks have responded – not only by lifting short-term interbank lending targets on reserves / ESAs (the cash rate), but also jawboning markets in line with Mario Draghi’s “I’ll do whatever it takes” rhetoric.

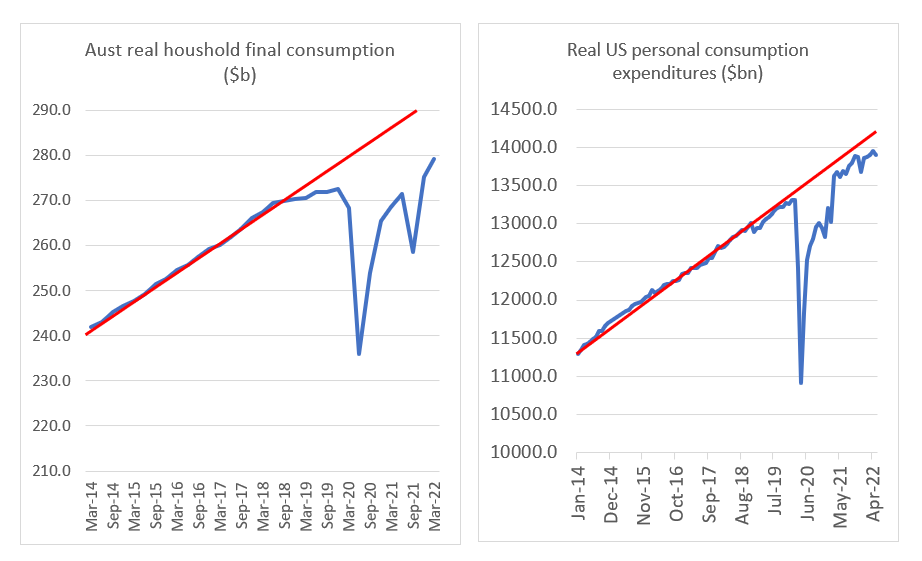

The problem is, interest rates only help in regulating demand, and most of the data suggests excess demand is not responsible for inflation. By almost any measure, real underlying demand for goods and services is either in-line or below pre-pandemic levels across most inflation-affected economies.

Source: ABS, St Louis Fred, Quay Global Investors

So, apart from the fear of inflation rollicking markets, we now have to deal with potential policy error and recession. Currently, US 1Q GDP growth has been confirmed at -1.6%, and the Atlanta Fed GDP tracker is pointing to -1.0% for 2Q[1]. In other words, the US may already be in a technical recession.

The impact on REIT pricing

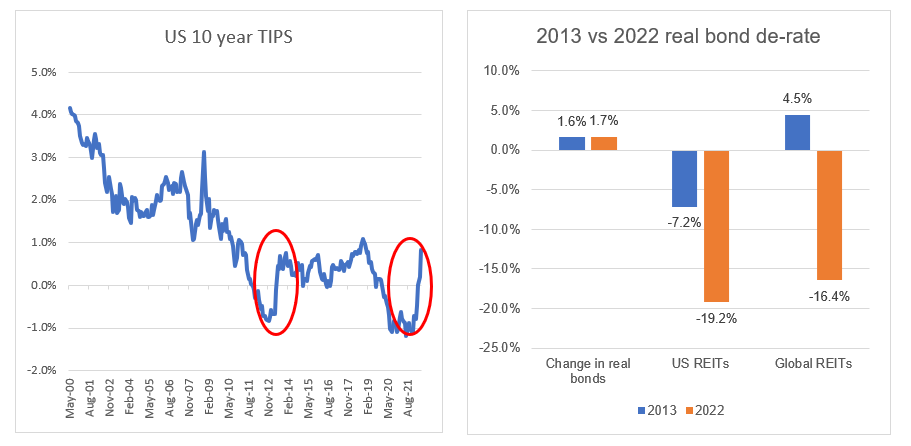

In May, we published the article, What does the REIT equity risk premium tell us about the sector? It was a reminder that increasing interest rates to combat inflation is not necessarily a major risk for REIT pricing. However, the short-term pricing of the sector is influenced by “real interest rates”. This is supported by the fact that real estate capitalisation rates are a proxy for a real rate of return. Therefore, the proper interest rate benchmark is not the cash rate or the long bond yield, but the real long bond yield. As the chart below highlights, the increase in real US interest rates has been significant over the past few months – severely impacting listed REIT prices. However, recent real bond yield movements like this are not an anomaly.

Source: Bloomberg, Quay Global Investors

As is almost always the case in markets, we can look to history and see similar events and market impacts. In this case, the re-rating in US real interest rates is similar in magnitude as the “taper-tantrum” of 2013. However, as highlighted in the second chart above, the price impact on REITs in 2013 was far less severe in US REIT terms, and indeed still yielded a positive return for global REITs (in AUD terms).

It’s also important to observe the current real bond yield is near its post GFC highs – suggesting real long-term interest rates are above “a neutral setting” and could well be peaking. All of which suggest the near-term price impact of real interest rates on REITs prices may be overdone. Emphasis on “may”.

The impact on REIT valuation

The current inflation / interest rate cycle has a very different impact on REIT valuation (as opposed to prices). From a valuation perspective, the current high level of inflation and interest rate settings (if sustained) are a positive for medium to long-term real estate investors.

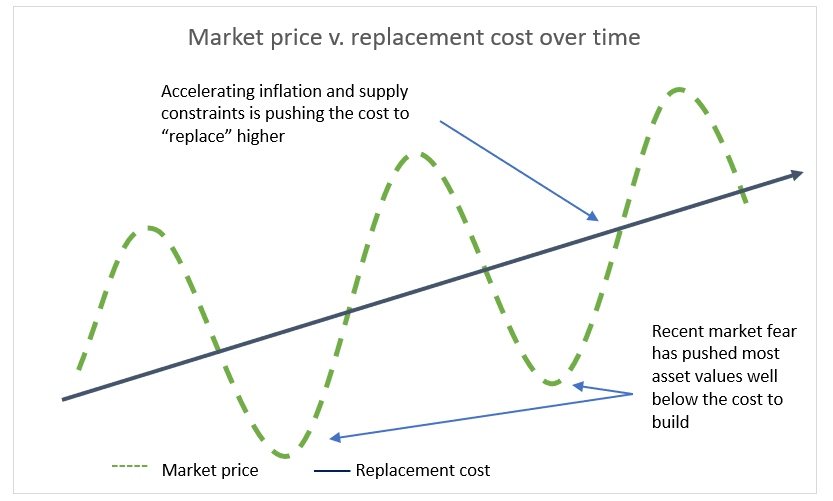

As we’ve previously highlighted, long-run pricing of real estate is anchored around replacement cost. Sentiment (via risk appetite or interest rates) swings prices above or below replacement cost over a cycle. But eventually, prices gravitate back to replacement cost over time.

Why?

When prices are below replacement cost, supply is naturally constrained (why develop assets for a loss?). Excess demand relative to constrained supply drives up rents and values until the development cycle can begin again – where prices are above replacement cost. Within this framework, the only unknown is time – how long until there is enough demand-supply imbalance to justify new construction.

We often depict this cycle via the image below:

Source: Quay Global Investors

In the current environment, we believe three dynamics are playing out:

- The recent performance of listed real estate companies has pushed their underlying real estate values to significant discounts to recent replacement cost.

- The sharply higher cost to build is underwriting higher “floors” for residential and commercial real estate for the next cycle.

- Central bank actions and language is dissuading developers and builders to supply markets that are already, in our view, undersupplied.

We have high conviction these factors will contribute in medium-long term pricing power in favour of existing owners of real estate. For these owners, the best strategy is to be patient and ensure balance sheets are robust.

What about the recession risks?

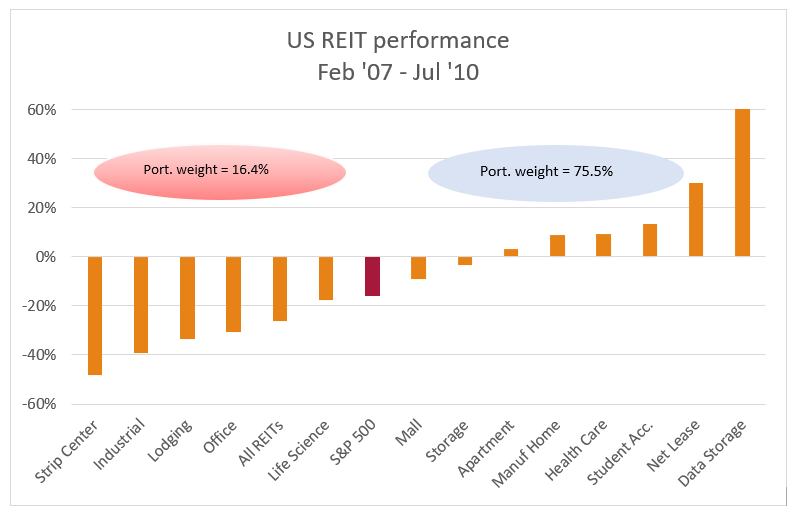

As mentioned, markets are now (rightly) pricing in the risk of a recession. Nothing is ever certain, however, when constructing the portfolio, we generally favour defensive real estate sectors since recessions are notoriously hard to predict. While price is always a factor (sometimes recession can be “priced in”), we have an overall bias toward businesses where cashflows are less cyclical.

The chart below highlights the performance of real estate sub-sectors for the last recession during 2007-2010 (we exclude the pandemic as it had unique effects on social-intensive real estate). The portfolio is currently positioned to traditionally defensive (needs-based) real estate.

Source: Green Street, Quay Global Investors.

Please note: Single family housing has been included as apartments. Total weights do not add to 100% due to cash and exposure to diversified REITs

Concluding thoughts

The first six months of the calendar year have been difficult for almost all investors. In our view, the pricing of risk assets is now beginning to reflect the risk of policy error (and recession), rather than any long-term anchoring of inflation expectations.

The speed and scale of the real interest rate movement has de-rated listed REITs (especially in the US). Meanwhile European REITs have been impacted by a third concern – a war in Europe and a potential energy crisis.

For long-term real estate investors, there is a silver lining. Most sectors are now trading well below replacement cost – in some case, 65-75% below (US office, German residential). At the same time the cost to build has risen sharply, underwriting higher values for the next cycle. Finally, central bank actions and rhetoric are dissuading builders and developers from building much-needed supply in key industries (e.g., US single family housing).

At Quay, we are approaching the current environment in three ways:

- Continue to tilt the portfolio toward needs based real estate (housing, health, storage) to minimise demand loss in the event of a recession.

- Focus on companies that have robust balance sheets and high levels of retained cashflow that can take advantage of any near-term opportunities and mispricing.

- Staying fully invested, and more importantly, patient.

The Quay Global Real Estate Fund invests in a number of global listed real estate companies, groups and funds. The Fund aims to generate a real total return of at least 5% above CPI per annum over a 5+ year investment horizon.

[1] https://www.atlantafed.org/cqer/research/gdpnow

The content contained in this article represents the opinions of the authors. The authors may hold either long or short positions in securities of various companies discussed in the article. This commentary in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader.