by Holon Staff Writers

Investors know that cryptocurrencies have been falling heavily. Bitcoin alone is down almost 70% from its peak, and this crypto correction has triggered all sorts of misinformation.

Social media algorithms and click bait addicted bloggers have done their best to spread misinformation and reward alarmist statements, both pro and anti-cryptocurrency, leading to confusion and even anger. But where does that leave advisors and investors who are simply looking for rational and fact-based information for their clients? Let’s start with Bitcoin; go back to the basics, and set all talk of Ponzi schemes and get-rich-quick offers aside, to fade away with the zealots and the finfluencers – they’re not worth your time.

Amid this misinformation, investors need to remind themselves of the huge underlying value of Bitcoin, blockchain and crypto. That means going back to basics. Below we answer 6 simple questions to help remind investors of the huge opportunities and value in the space.

First off, some definitions for clarity. When we say Bitcoin is a ‘cryptocurrency’ we mean:

A digital or virtual currency that is secured by cryptography, which makes it nearly impossible to counterfeit or double-spend.

With ‘cryptography’ being simply a fancy term for a code based, secure way of communicating.

And when we mention ‘digital asset’ we mean:

Generally anything that is created and stored digitally, is identifiable and discoverable, and has or provides value.

So for the purposes of this short piece, a cryptocurrency like Bitcoin is simply a type of digital asset (Other examples are photos, manuscripts, documents, data, etc.).

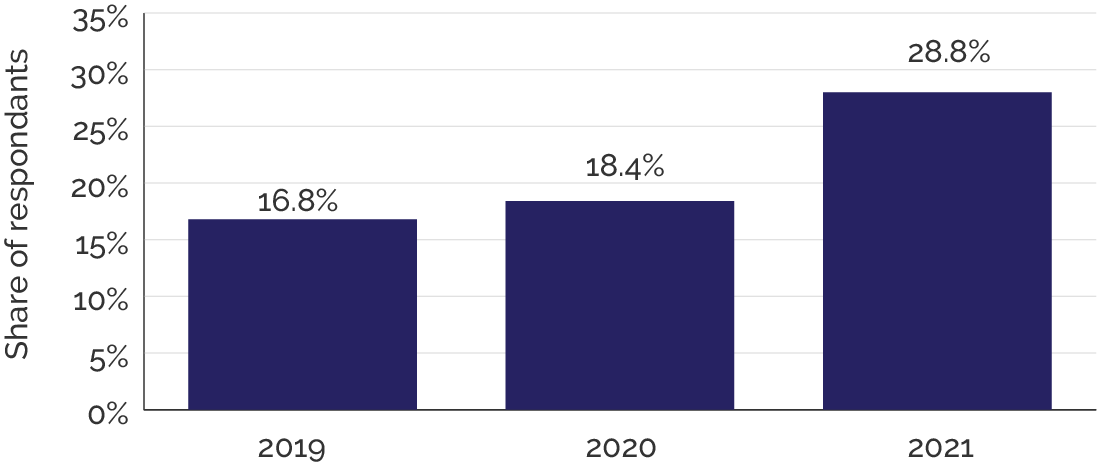

One more calming fact: Bitcoin and cryptocurrencies are still very much in their infancies (Figure 1), so if you feel like you have been left behind, you haven’t.

Figure 1: Estimated percentage of Australians who own cryptocurrency from 2019 to 2021*

Source: Statistica

Source: Statistica

*Survey of 2,000 Australians

1. What are the origins of Bitcoin?

In 2008, an unknown author published the white paper, “Bitcoin: A peer-to-peer electronic cash system” which laid out a technical solution for what is known as the double spend problem. The double spend problem is a problem that we face in the digital world when we try to send money from one person to another; the problem lying in the question of ‘how can we have confidence that the sender of the money has not already previously spent that someone and therefore is trying to send a fraudulent transaction?’.

The good news? With the introduction of Bitcoin, a breakthrough occurred in which a distributed and decentralised system comes to an agreement (consensus) on the validity of all transactions.

2. What problem does Bitcoin solve?

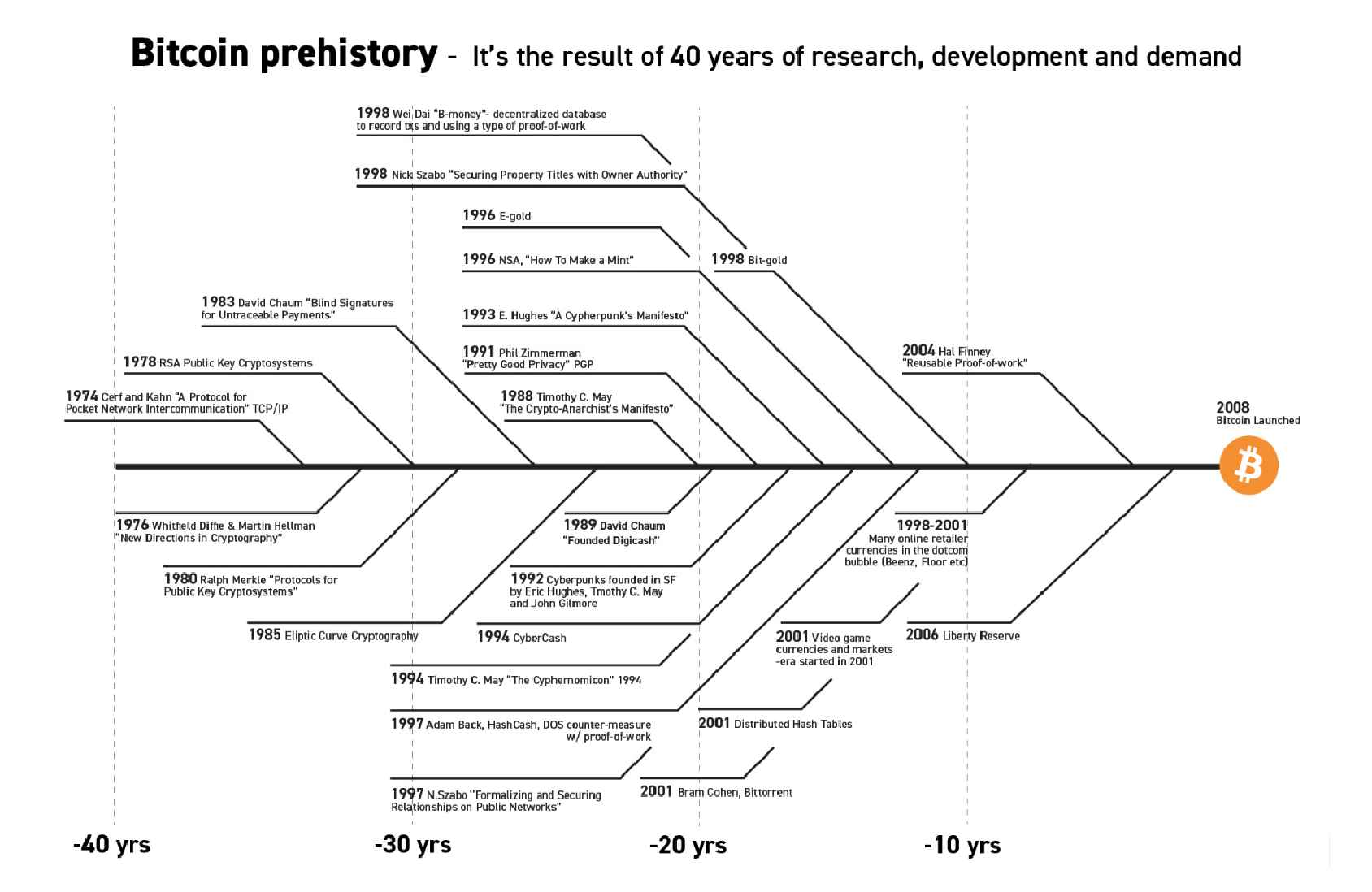

Bitcoin is not a solution in search of a problem as you may have heard – it is indeed a solution to a problem that people have been trying to solve since the earliest days of the internet. How to make money natively digital. Bitcoin is born from 40 years of development and research (Figure 2) and it was only a matter of time before someone would crack the code.

Figure 2: Bitcoin prehistory, 1974 – 2008

Source: danheld.com

Source: danheld.com

3. What does Bitcoin mean for money?

Great question, as Bitcoin has much more scope than most realise. These trusted third parties we’ve mentioned are none other than banks, and we all know how important their role is in society. This is why it is so important to understand anything that potentially threatens that position. Bitcoin is more than just a means to help transact online. By removing the trusted third party it has opened the door for money itself to be issued in a fundamentally different way to what it has been historically.

Bitcoin raises the question around whether monetary policy today should be left in the hands of a few central entities. We are today seeing some of the issues that arise when central banks make policy errors, when interest rates are artificially compressed for too long and inflation runs too hot. The idea of removing these entities is not too farfetched. For much of history it has been gold that’s been used as a means of relative value, Bitcoin would be a transition back to a similar monetary philosophy, with the added benefit of being digital.

4. So is the whole blockchain just about money?

One more definition before we continue: blockchain.

A blockchain stores information electronically in digital format, and collects information together in groups, known as blocks, forming a chain of data known as the blockchain. The innovation with a blockchain is that it guarantees the fidelity and security of a record of data and generates trust without the need for a trusted third party.

It’s important to remember that Bitcoin is a cryptocurrency, while blockchain is a distributed database. Bitcoin is powered by blockchain technology.

Now, there is a school of thought that believe blockchain’s only use case is to operate money in a decentralised and peer-to-peer manner (i.e., Bitcoin). We believe this to be short sighted, preferring the alternate school of thought, that Bitcoin’s innovation has opened an entire asset class based on a decentralised infrastructure.

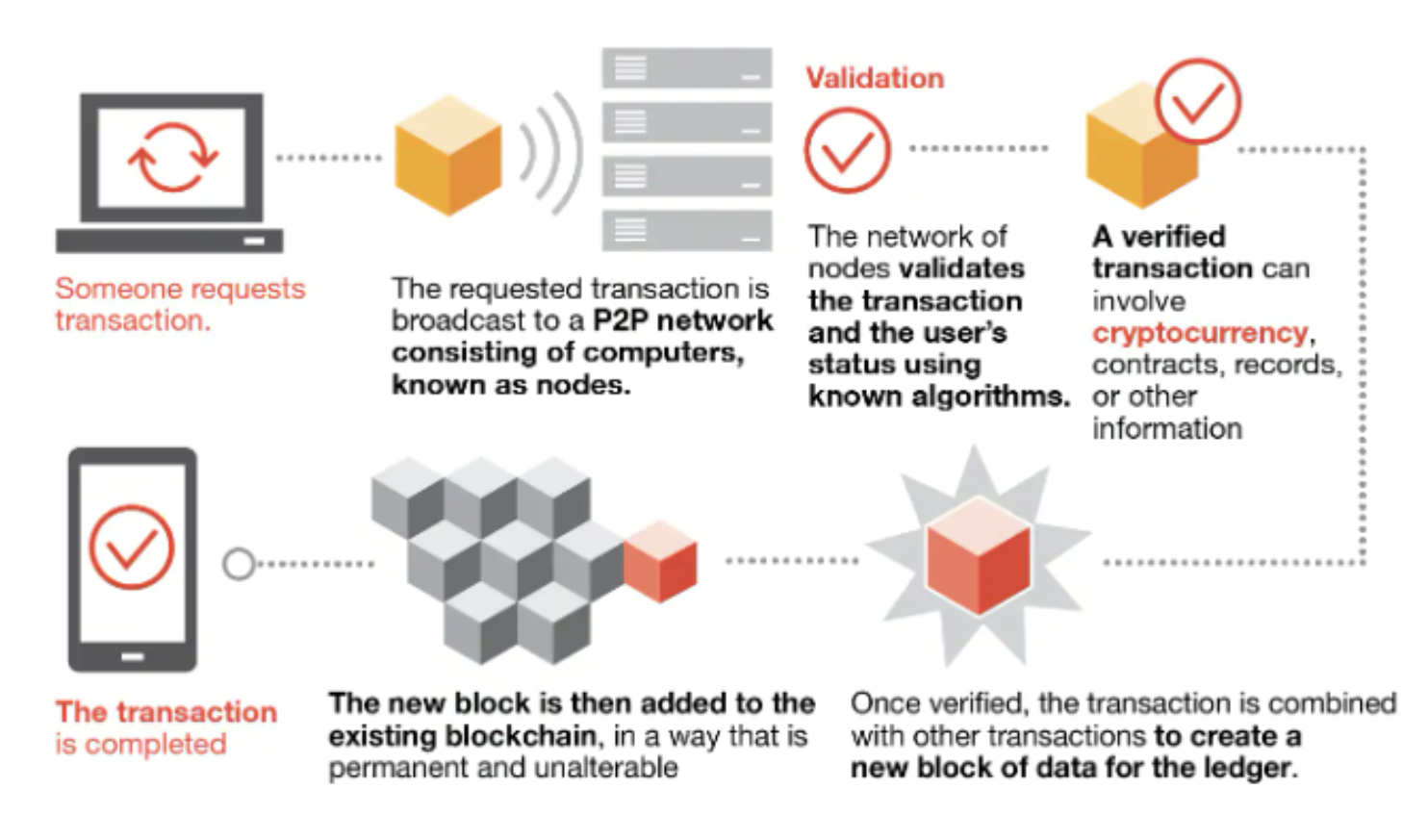

So blockchain is much more than money (Figure 3). ‘Decentralised consensus’, or a set of principles and techniques that allow participants on a distributed network to arrive at perfect agreement on a shared document or database, has the potential to transform how many digital services are provided. Systems built upon decentralized consensus methods are inherently tamper-proof, censorship-resistant, and permissionless.

For financial transactions alone this could mean significantly lower counterparty risks, lower compliance costs, faster settlement times, etc.

Figure 3: A typical transaction on the blockchain

Source: PWC

5. What else can blockchain be used for?

Other real world uses could be the creation of digital IDs, managing property titles, voting securely, etc. The possibilities are almost limitless.

Blockchains also have the ability to coordinate large cohorts of people. Filecoin, for one (as we’ve discussed here), is enabling a global decentralised network of businesses to build a faster and cheaper internet and thus compete with the global Mega Caps of today. Filecoin uses Blockchain and cryptocurrency to incentivise businesses globally to build the infrastructure required for this better internet.

Ultimately, we are still seeing the use cases and benefits of how blockchains can improve society. The internet is a good comparison; it took many years of development before we started seeing the value created by entrepreneurs. As investors the critical part to understand with any digital asset project is the value proposition; if it is strong enough it will attract users.

6. So is it investable?

In a word, yes. Critics will often question the fundamentals of cryptocurrencies, and this has largely stemmed from looking at Bitcoin as a “non-productive asset” like gold. Bitcoin generates no revenue or cash flow for holders and thus can leave investors (particularly equity investors) scratching their head as to why?

Because Bitcoin has solved the idea of digital scarcity – the idea that a digitally native asset can be coded to have an immutably (permanently) limited supply – and thus can satisfy the desire for a reliable, long-term store of value. Beyond Bitcoin, blockchain and crypto assets are being designed with the intention of driving real value back into the coin itself. This is important to understand, as many other crypto assets are ‘productive assets’ providing some form of cashflows to users or holders of the coin.

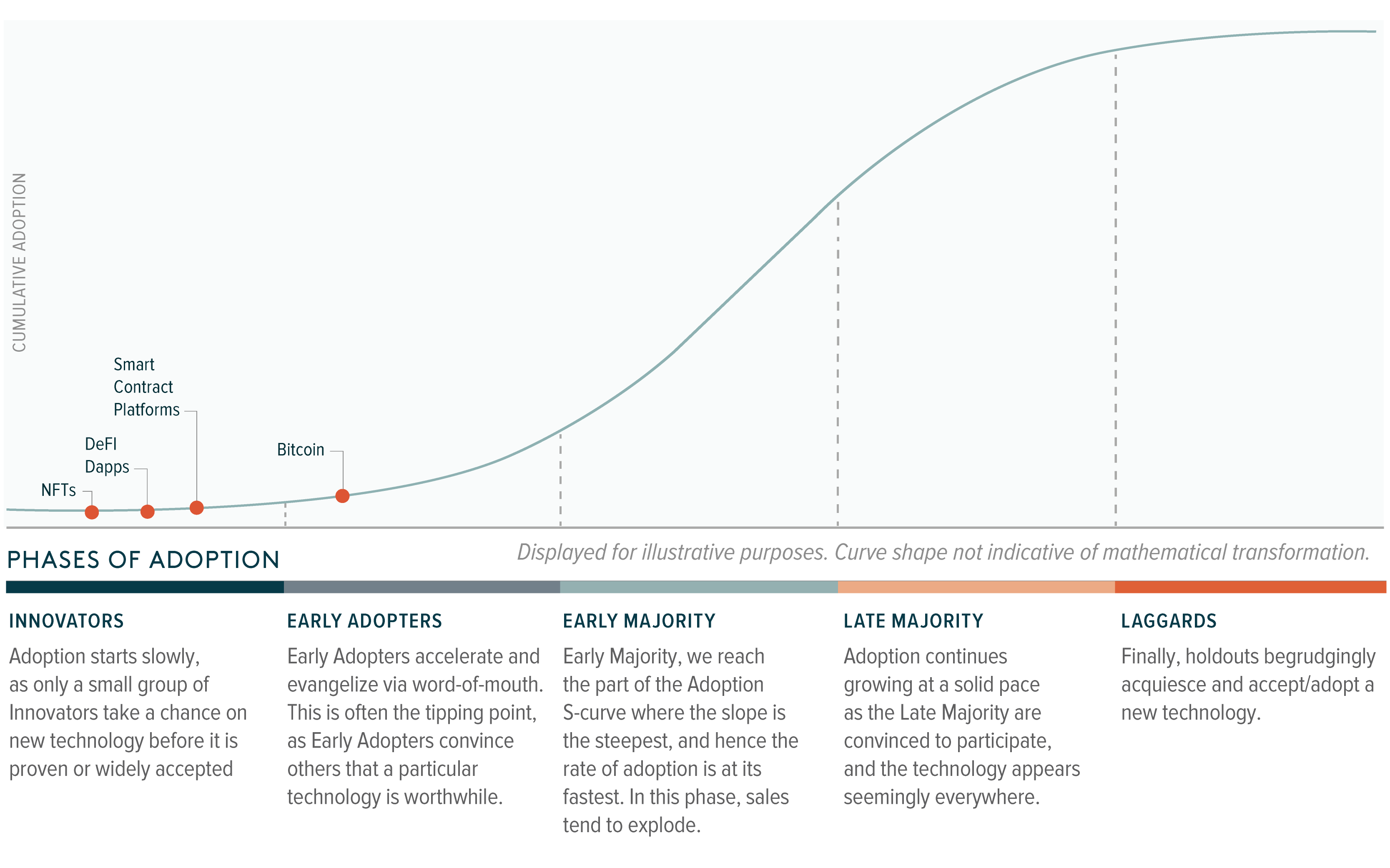

As cryptocurrencies continue to evolve within the digital asset class, we believe that they can offer diversification to investor portfolios, depending on their objectives. In our view, they now present a compelling case for a modest allocation as their adoption curve continues to rise (Figure 4).

Figure 4: Digital asset adoption phases as of 2022

Source: Global X

Source: Global X

We are the first to admit there are many challenges of investing in the digital asset space and there are still many risks. But as outlined above, Bitcoin, blockchain and digital assets provide both a value proposition and value capture for holders. This is an entire new asset class forming and the rarity of such an event can’t be understated. Most of all it’s important that as investors we pay attention to the evolution and adoption of cryptocurrencies, and ignore the hype and hyperbole.

Keen to learn more about digital funds? Visit Holon here