by Sarah Shaw – Global Portfolio Manager and Tasneef Rahman – Senior Investment Analyst

Company management meetings and site visits are integral to our investment process. After two long years of COVID restrictions, endless Zoom calls and minimal face-to-face interaction, it was great to travel across Europe and meet infrastructure companies, regulators, brokers and peers.

While virtual meetings have clearly been a revelation, being on the ground and seeing the opportunities and challenges impacting individual companies, different sectors and countries first-hand is still unmatched.

This was a particularly unique trip given the breadth of headline issues facing both Europe and the UK – including the Russia-Ukraine war, lingering COVID issues, the ongoing energy crisis, rampant inflation, travel chaos and a worsening economic environment.

Politics

Politicians across Europe are scrambling to deal with the fall out of the COVID pandemic, the Russia-Ukraine war, the associated energy crisis and growing inflationary pressures/growth issues – all of which are driving a weaker economic outlook and rising interest rates. While the Eurozone member countries are all facing similar challenges, we believe certain countries are responding better to these than others.

Significantly, the current energy situation has highlighted the need to balance environmental and social targets. Governments are scrambling to uphold their net zero aspirations while ensuring their populous have access to affordable power as they approach winter.

Economics

Volatile. That’s how we would describe the current economic environment and expect it to remain so for the foreseeable future. All the numbers suggest that growth has stalled as inflation bites.

A recovery in activity after COVID, supported by monetary and fiscal policy, ongoing supply chain disruptions and the Russia-Ukraine war has seen headline inflation spike. This has caused central banks around the world to react, increasing short-term economic pressure.

However, maybe it’s not all doom and gloom – employment, worked hours and unemployment readings reflect a strong recovery in the labour market. Total employment was at a record high in Q1, while worked hours remain just 2% below Q4 2019. This should support consumption and demand in the short term, but will too be at risk if the economic outlook continues to deteriorate.

While the data and outlook are not robust, our experience as we travelled through the various markets was one of consumption. People were travelling, they were eating out, they were spending. After two years of lockdown, a poor economic backdrop was not derailing consumers’ willingness to spend. While this may be short lived, we do believe it provides some support going forward and the re-opening of Asia could add a further boost once domestic trends have played out.

Infrastructure

While much is happening across the infrastructure landscape, and strategies have shifted over the past two years, this trip really highlighted some strong thematics including:

- Travel: the pent-up demand is real and causing chaos across the airport network – horrible user experience but supportive for investor earnings and valuations.

- Energy: the Russia-Ukraine war has created/highlighted significant issues for the energy sector. While these are unlikely to be resolved quickly, creating near-term challenges, the investment opportunities are significant and being fast tracked.

We touch on each of these below, as well as wrap up a few other sector dynamics.

Airport industry

We saw and experienced first-hand the well-publicised travel chaos that has recently plagued the airport sector. We had flights delayed, spent hours in customs and security lines, almost missed flights and, worse still, Sarah lost her luggage, spending a few very frustrating hours at Heathrow tracking it down.

As a user, the experience was not a pleasant one. However, as an investor, there were some significant positive takeaways.

Faster than expected traffic recovery

Airports report traffic numbers monthly, so it was already evident that the listed EU airports were tracking better than earlier guidance suggested. This positive momentum was confirmed by all the management teams, and, a number have subsequently increased their traffic guidance and brought forward their timelines for recovery to 2019 levels. As expected, it is the tourist and visiting friends and relatives (VFR) traffic that has recovered fastest, while business travel continues to lag – although not by as much as originally anticipated (Zurich highlighted that corporate travel was 26% of the total in 2019 and today is >20%).

Certain airports, particularly in popular summer destinations such as Greece and Spain’s Balearic Islands (Ibiza, Mallorca) are already well above pre-pandemic levels. Importantly, this traffic recovery has happened without the return of the Asian tourist as core Asian markets, such as China, are still subject to travel restrictions. This gives us confidence of ongoing solid traffic trends into 2023, despite the economic overhang.

Higher retail spend per passenger (SPP)

Traditionally, Asian and Russian passengers tended to be the highest spending airport users. With much of Asia (particularly Chinese travellers) still limited by border restrictions, and Russia under sanction, traditional thinking would suggest SPP would drop. However, positively, SPP has been relatively robust, and even higher in certain airports – with management suggesting a more carefree attitude towards spending post pandemic as the reason. As one European airport CEO put it, “cheap Europeans are spending again”. How long this effect will remain is uncertain, but for now it continues to be a tailwind for airports’ earnings recovery. And over the medium term, we expect the return of the Asian tourist to further support the SPP.

Operational issues are not homogenous

Delays at airports caused by staff shortages and strikes amidst the travel recovery have been well publicised. However, the operational issues are not homogenous, with some airports seemingly unaffected as existing service levels are maintained. While we had to endure hours long queues at some airports, at others we breezed through in minutes. Nevertheless, all operators were confident that operational issues were a temporary blip (at least on their side), and most would be smoothed out by Q3 with execution on hiring / retraining plans for staff and technology upgrades at security points. From a user perspective, we applaud Zurich for their continued efficiency, and Spain for a relatively seamless experience. Importantly, neither of these airports laid off significant staff during COVID, hence they are not facing the hiring issues of their peers. But, this did come at a cost with higher cash burn through COVID.

Check-in desks at Zurich Airport are a stark contrast to most others in Europe. Source: 4D

Cost inflation

With disruption from strike action, rising labour and energy costs, the ability to pass inflation through into tariffs is another key concern for investors. Here the different macro, labour dynamics and regulatory frameworks give certain airports an advantage over others. Heathrow is in a strong position with a real rate regulatory model. Zurich is also better insulated due to relatively low Swiss inflation. Those with large capital projects/investment plans arguably face greater risk around cost/budget overruns. Frankfurt, Zurich and AENA are all undertaking investment programs. Those with annual resets, such as Frankfurt, should have a shorter time lag to reflecting inflationary pressure.

All airports are facing the operational energy cost headwind (although not a big cost driver) and risk of higher fuel prices being passed through to ticket prices. While this is a concern as air traffic has historically been more closely correlated to GDP growth than fuel prices, we are still monitoring the risk of both.

Rail/sustainable travel

A recurring long-dated concern from management teams and industry participants is sustainable travel. Certain short haul routes are particularly at risk, given the EU’s push to limit flights on short haul destinations and rail alternatives as part of its Sustainable and Smart Mobility Strategy. Naturally, there’s also a strong focus by airport operators to cut CO2 emissions and reduce exposure to energy costs with more onsite generation. The upside to this shift is the ability to reallocate less profitable short haul slots to meet long haul demand, improving the overall per passenger profitability of the airport. This is not immediate but is being strategically planned for by the airports.

Utilities

This subsector has been at the forefront of investors’ minds. On the one hand, you have concerns around European energy supply and high power prices amidst the Russia-Ukraine war. On the other, it continues to be one of the fastest growing infrastructure subsectors, with opportunities afforded by the energy transition. It’s worth noting that 4D only invests in operators with majority regulated or contracted earnings stream, so we are not as exposed to the current volatility of pricing.

Security of supply

Utilities acknowledge difficulty in diversifying energy supply, with the major risk being Russia completely shutting off gas ahead of winter. Southern Europe is less exposed to a complete shut-off of Russian gas compared to Northern Europe, with direct pipeline connections to North Africa and Central Asia through Spain and Italy, as well as LNG regasification infrastructure (particularly in Spain). Importantly, Spain has no direct exposure to Russian gas so is largely insulated on the supply side (not price though). Italy has been effective in finding alternative sources for much of its Russian dependence, positioning them relatively well ahead of winter. By contrast, the German situation remains a very real concern.

Growth in renewables, faster permitting and opportunities from REPowerEU

Renewable growth continues to accelerate in the face of the Russia-Ukraine war, both in Europe and the UK. Almost all the companies we met have said they’ve seen an improvement in permitting times for projects, although they acknowledge a lot more still needs to be done if ambitious decarbonisation and Russian independence targets are to be met. Also, with the REPowerEU push, new short-/medium-term opportunities have arisen for gas operators in storage, hydrogen and regasification.

Short-term divergence from the energy transition, potential rethink on nuclear

Countries are using more coal (and even delaying shutdown programs) to balance power prices for consumers, despite environmental aspirations. Similarly, views around nuclear energy have, or at least appear to be, changing in some countries as discussed earlier – this is a welcomed shift in the current environment.

Energy independence goes beyond Russia

The utilities are focussed on diversifying, not just energy supply, but also increasing independence in the supply chain. Specifically, there is an increasing push to develop more solar panels and reduce dependence on Asian and Chinese manufacturers, with a number of utilities developing their own manufacturing base. This includes Enel, that is currently developing a solar panel gigafactory in Sicily.

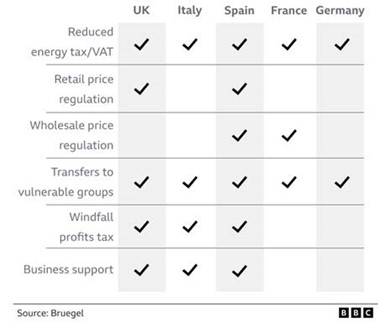

High customer bills and energy market intervention

This continues to be a key headwind for integrated utilities and energy suppliers. Government intervention, via price caps, windfall taxes etc. have dampened investor confidence and impacted utility margins. Nevertheless, under current measures, it’s clear the share price reaction to date has been overdone for a number of utilities, given the limited impact on earnings. Operators and industry participants in Southern Europe also feel certain measures, such as windfall taxes, could potentially be recouped in the future (as there’s precedent with similar past measures) as no actual excess profits are being made due to generation being forward sold at fixed prices and not benefitting from high market prices. Still, pureplay transmission and distribution operators, or non-retail exposed utilities, are clearly better placed against risk of government intervention and there is always the risk of new or more stringent action.

Summary of energy market intervention across Europe

As of 15 August 2022

Renewables returns

Utilities and developers are facing pressure on returns in the wake of cost inflation (some estimates of ~20%+) and supply chain challenges. However, contract/PPA prices are often accounting for these increased costs – so, many companies remain comfortable with their return targets. Larger developers also benefit from economies of scale in supply compared to smaller peers. There’s also an interesting trend for many developers to take on merchant exposure in the current power price environment, with several taking a view of higher for longer market prices.

Climate change

The ongoing heatwave in Europe is causing havoc, with adverse impacts on generation (wind, hydro) and even infrastructure networks (pipes, fire damage). Aside from lower generation output and subsequently higher energy prices, there is also the risk of increased capex and regulatory penalties for certain utilities which could impact returns (for example, UK water utilities are penalised for sewage and leakages). Over the medium term, transmission, distribution, and water networks could potentially see higher investment allowances to deal with the greater climate risk.

Diversity infrastructure/toll roads/rail

Stability in toll roads

French motorways are amongst the best performers globally post-COVID, with traffic in many roads above pre-pandemic numbers. Similarly, US toll roads and managed lanes have also recovered close to pre-COVID numbers and LATAM traffic numbers are also above 2019. Historically, toll roads have been one of the most resilient user pay assets in a lower growth environment, and with explicit inflation hedges, are a solid investment given the current economic outlook. The key risk is that the economic slowdown potentially limits the pricing power for certain roads in some regions. While concession contracts are clear, political intervention around tariff hikes can create near-term noise, even if the solution is net present value neutral to the operator. Markets to watch on this front are France and Italy – both of which have historically looked to prevent toll hikes in weak macro environments.

Rail resilient despite operational issues

Getlink, the major listed rail operator in Europe, has seen a strong recovery in passenger volumes on Eurostar, helped by its high quality service offering and chaos at airports (our own experience saw lengthy queues but an on-time and comfortable service). Shuttle traffic is still ~20% below pre-COVID numbers, and are still challenged by bottlenecks related to post-Brexit checks. Interestingly though, market share has increased vs ferries despite ~20% increase in pricing, whilst ferries are also hindered by oil surcharges. The company’s Eleclink interconnector has benefitted strongly from high power prices / volatility, and will be a tailwind to earnings.

Contracting and inflation

There are likely to be some challenges, especially on fixed price construction contracts. A number of contractors have changed their approach in their orderbook with no new fixed price contracts being offered in the current environment. However, margin pressure on existing contracts remain.

Mergers and acquisitions (M&A) / growth

M&A is clearly topical for all concession owners/operators given the number of high-profile recent deals (such as Atlantia, JFK Terminal), potential sale of minority stakes (such as ADP, Schiphol, Getlink) and upcoming government tenders / privatisations (such as Brazilian airports, US managed lanes). Diversified infrastructure airport operators are increasingly challenging listed airports for assets. We see Getlink and Heathrow airport as near-term targets within the listed space, and in the longer term, we wouldn’t rule out someone taking a look at Ferrovial. As always, concerns around returns in the current environment of capex inflation, as well as inflated bidding in M&A processes involving competition from PE, are things to watch.

Communications

Sector consolidation and M&A

M&A and sector consolidation were topical throughout our meetings given the ongoing Deutsche Telecom Towers deal at the time, and concerns around listed operators such as Cellnex potentially overpaying for these assets. We were pleased to see Cellnex retain its discipline, even though it meant missing out on the DT portfolio. Also evident was focus on the motivations of MNO’s and their control over listed tower companies and governance / minority protections.

Impact of higher inflation and interest rates

Tower operator earnings are relatively shielded from higher inflation and interest costs given inflation linked contracts and largely fixed rate financing. Contract structure means some operators are better poised to benefit from inflation / inflation upside than others. Nevertheless, the long duration nature of these assets, has seen stock prices sell off which has created greater opportunities for long term value creation.

Remain overweight Europe

Despite a difficult macro backdrop in Europe and globally, and even with the headwinds discussed above, the trip actually reinforced our overweight to the region. We believe the share price corrections to date have been overdone, with the current regional turmoil offering significant opportunities as well as near-term risk. We have factored in the risk and believe the value proposition of the quality infrastructure names is too great to ignore. In summary:

- Airports: the recovery has been faster than expected, and while creating near-term user chaos, as an investor, we benefit from stronger earnings and a robust outlook even without factoring in a return of the Asian tourist.

- Utilities: near-term working capital pressure as energy prices remain elevated. However, as regulated operators, the earnings impact is minimal as proven by the utilities largely beating expectations at H1 reporting. Importantly, the real need to diversify energy sources has fast tracked sector investment, creating real growth opportunities.

- Communications: well insulated from the current macro environment and offering very attractive value, with potential upside from M&A.

- Other: roads positioned well for a slower growth/high inflation environment with resilient traffic and explicit inflation hedges, while rail is also benefiting strongly from the reopening trade.

As always, we maintain a diversified portfolio of high quality infrastructure names globally, and at the moment believe Europe is offering an incredible mix of quality and value despite near-term headwinds.

The 4D Global Infrastructure Fund’s investment objective is to identify quality listed global infrastructure securities, trading at or below fair value with sustainable, growing earnings combined with sustainable, growing dividends. The Fund seeks to deliver risk adjusted returns that outperform the benchmark OECD G7 inflation index + 5.5% per annum over the longer term.

The content contained in this article represents the opinions of the authors. The authors may hold either long or short positions in securities of various companies discussed in the article. This commentary in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader.