Notwithstanding bouts of volatility, the Australian economy has remained resilient over recent years, with its equity market delivering solid investment returns in line with its peers.

Dividend yields (on average) now exceed pre-COVID levels, making the market more attractive to income investors, and providing further support to share prices of companies that pay dividends.

But averages can be misleading; a more detailed analysis reveals that these dividends have become highly concentrated in a few well performing sectors. This concentration has offset the declining dividends from companies in other sectors of the Australian economy.

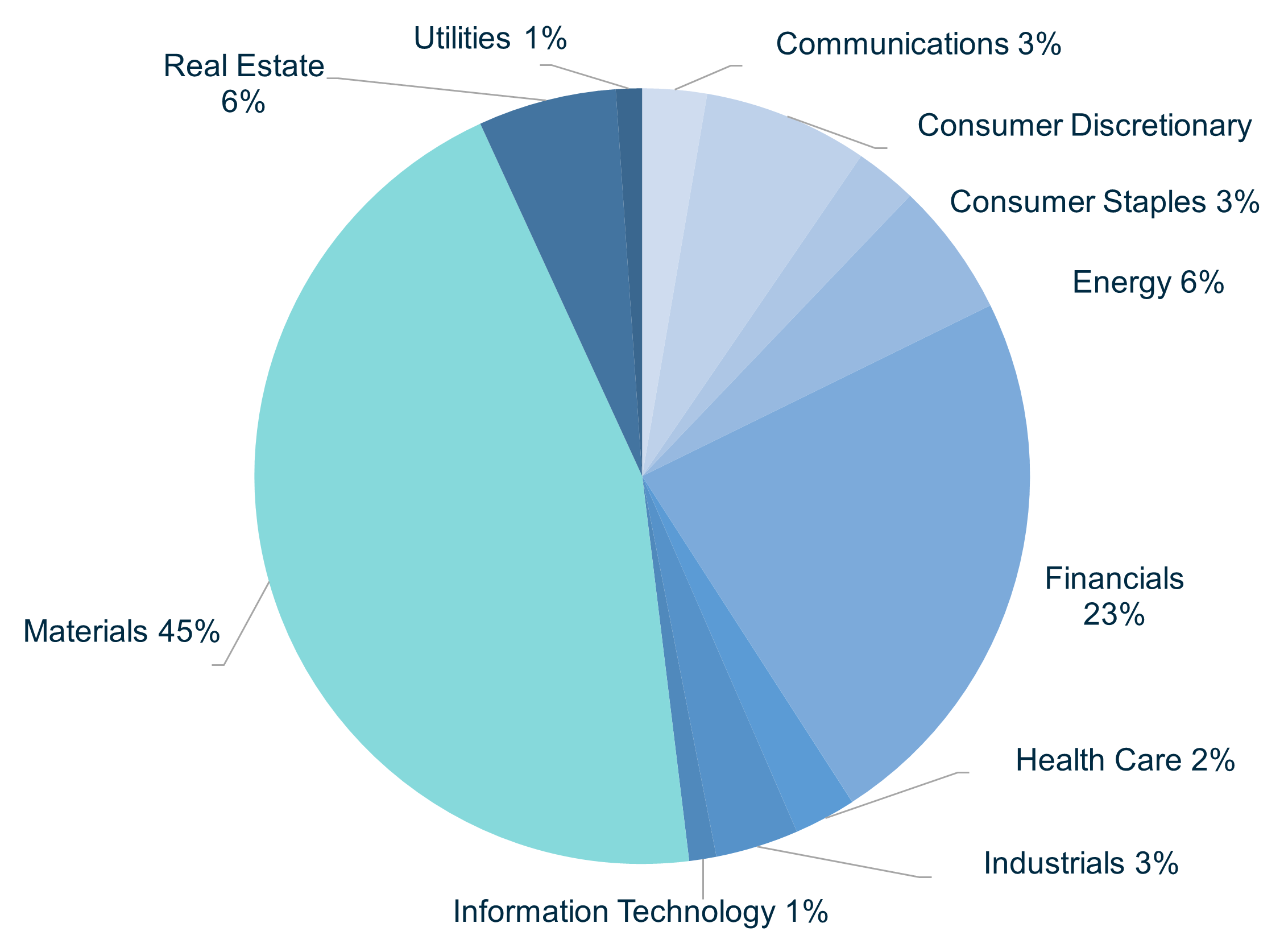

The Materials sector now accounts for 45% of total dividend payments in the Australian ASX All Ordinaries index, up from 28% at the end of 2020. Including financials, real estate and energy sectors brings the total to 80% of total dividends paid in Australia.

Cyclical industries expand and contract in line with economic cycles. The sustainability of dividends (and share prices) in these sectors is closely linked to the health of the domestic property market, and global demand for commodities. Property is highly sensitive to interest rates, which are now rising. Commodity prices – especially iron ore, LNG and coal – are highly sensitive to global GDP and China’s real estate market and industrial production, which are now slowing, even as China lowers interest rates.

Dividend payments by these companies (and hence also the overall Australian share market) are particularly vulnerable to a downturn in either property or commodities.

Investors who diversify some of this risk by gaining exposure to high quality innovative companies which are growing earnings across a wider spectrum of the global economy, may be well placed to absorb such downturns.

The below chart shows the small scale of the Australian share market compared to the equity universe.

MSCI Global Index by Country

Source: MSCI

Source: MSCI

The below chart reveals how benchmark aware investing in the Australian share market brings a highly concentrated portfolio, with more than 50% invested in financials and materials.

It delivers much lower exposure to high growth companies in the technology and consumer discretionary sectors than are found in the global share market.

Sector breakdown of Australian and Global share markets 31 July 2022

The chart below illustrates how Australian dividends are even more highly concentrated: 80% of dividend payments in Australia come from materials, financials, real estate and energy.

ASX All Ordinaries Index – Weighted Dividend Yield – 31 July 2022

Source: Bloomberg

Global equities do not generally pay attractive dividend yields, nor do they generate Australian franking credits. Yield hungry investors have therefore relied on the Australian share market, and the sectors mentioned above, to deliver an attractive dividend yield.

So how can a Listed Investment Company (“LIC”) structure – as used by ASX-listed Pengana International Equities Limited (ASX:PIA) – provide greater sector diversification as well as a franked dividend stream?

The LIC structure of PIA provides the company with more control over the distribution of taxable income compared to traditional unit trusts. This is because there is no requirement to pay out all taxable income to investors at the end of each financial year. This allows a listed investment company the flexibility to smooth dividend payments to investors from year to year.

Further, as an Australian company, PIA pays tax on its taxable income, thereby generating franking credits, which can then be passed on to investors when PIA pays its quarterly dividends.

PIA’s global share portfolio is well diversified, typically investing in about 70 quality growth companies, with overweight positions in the healthcare, technology and industrial sectors. The company currently has profit and franking reserves which supports a fully franked dividend of 5.4cps per annum, paid quarterly, through to FY2024. When franking credits are included, this equates to an effective dividend yield of approximately 6.5-7%, based on recent share prices.

For responsible investors, PIA’s portfolio is governed by a robust ethical framework which includes 12 comprehensive negative screens and an ongoing engagement program. This makes PIA the largest international ethical LIC on the ASX.

In Summary

Rising inflation, higher interest rates and slowing economic growth all pose separate threats to the attractive dividends currently being paid by Australian companies.

Over 80% of Australian dividends are paid from companies in just four sectors, forcing many portfolios of income-oriented investors to be highly concentrated.

The share prices of these companies are exceedingly sensitive to dividend payments, and the resulting concentration of shareholder focus (potentially leaving them under pressure if dividends falter).

Many income investors have effectively been forced to choose between meeting their income requirements with shareholdings in potentially overvalued companies and appropriately diversifying their equity exposure.

Using its unique structure as an internationally-focussed listed investment company, shareholders in Pengana International Equities Limited (ASX:PIA) have been able to:

-

- Gain exposure to a professionally managed and diversified portfolio of high quality and growing global businesses, and

- Receive a fully franked dividend, paid quarterly, and which equates to a yield of over 7%1

1 Based on 26 August closing share price of $1.00, grossed up for franking credits at a 25% company tax rate. Updated yield (based on share price) is available on our company website: www.pengana.com/PIA