by Max Andrews – Business Developer / Analyst

ABARES forecasts that water prices will remain low for a third consecutive year due to the ongoing La-Niña.

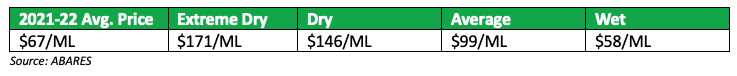

Figure 1: ABARES scenario analysis, Southern Murray-Darling Basin water allocation price FY23

It is forecasted that wet conditions are likely to continue in FY23. ABARES forecast that it is likely that another La-Niña will be present in FY23. Typically, more rainfall the better for agriculture.

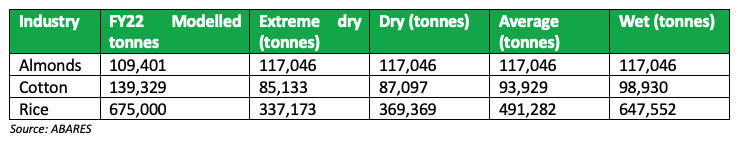

The impact of low water prices has a positive impact on the productions of crops in Australia, such as almonds, cotton and rice. We are expecting another strong rice crop in CY23 in Australia. Ricegrowers (ASX:SGLLV) had a significant in CY22, ~688k tonnes produced in Australia. This is compared to 54k and 45k tonnes produced in CY19 and CY20 due to droughts and very high water prices. We expect Ricegrowers to produce a similar amount of rice in CY23, although ABARES predicts a lower number of rice production in CY23 due to higher water prices in NSW Murrumbidgee.

Listed cotton player Namoi (ASX:NAM) is expected to experience lower throughput of cotton through its ginners even though water prices are at decade lows. This is because the cotton price has decreased by more than 20%. This is a headwind for NAM, we initially thought that NAM would continue to benefit from the La-Niña, however, as supply for cotton outgrew demand, supply will probably decrease in FY23.

We think Select Harvests (ASX:SHV) is set to benefit from continued La-Niña events with access to extremely cheap water in Victoria. Although, the varroa mite has proved to be a setback for SHV as there has been some restrictions on bees. Whereas Californian almond growers still seem to be in intense droughts, it is our expectation that supply in California tightens as cost of production remains very high California.

Figure 2: Irrigated commodity production scenarios for FY23

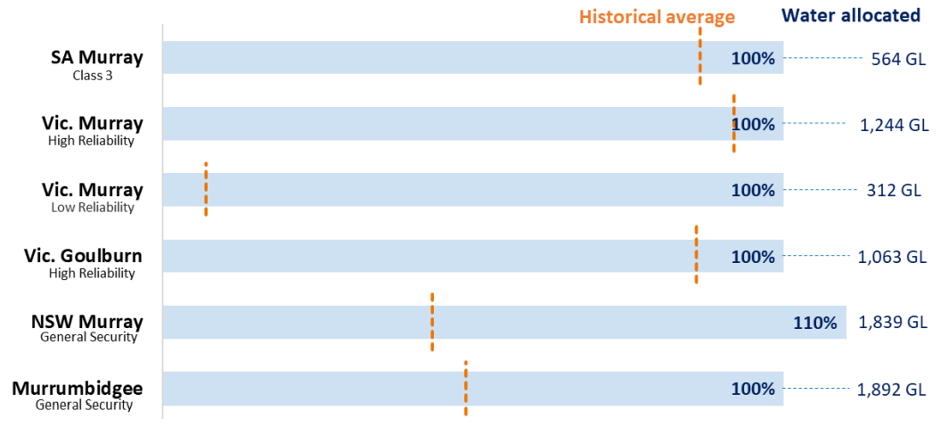

Figure 3: Water allocation scenario for FY23

Source: ABARES

Opening allocations in FY22 were above their historical average (See Figure: 3). All major entitlements were at full allocations during the period, a testament to the high storage levels. Even the Vic. Murray had full allocations since it was first established back in 2006.

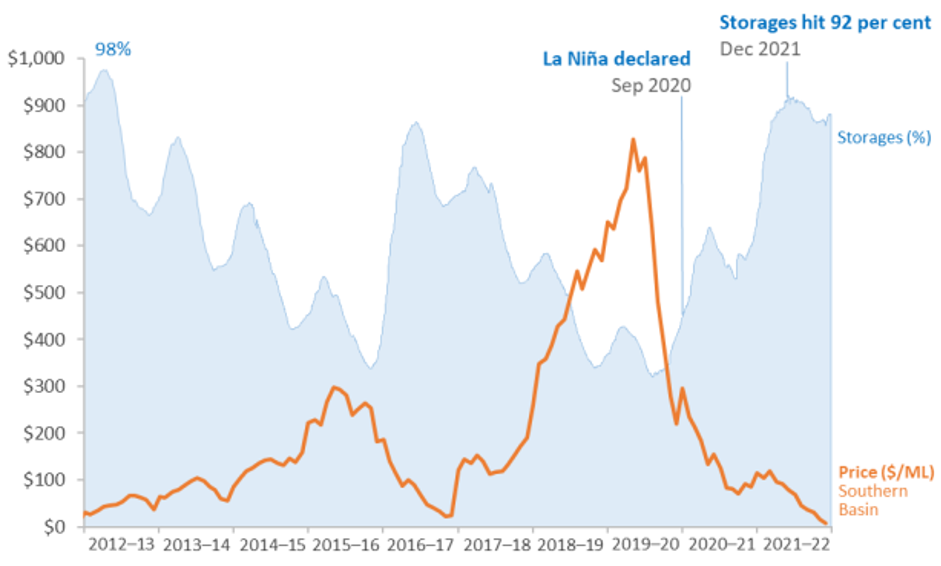

Figure 4: Water storages and average prices in the murray darling basin

Source: ABARES

Water storage peaked in December 2021, with the MDB reaching 92% capacity, the highest level in nearly 10 years. The high water storages levels reflected the price of water. The average price in the sMDB basin fell from $115/ML in 2021 to lows of $9/ML in July 2022. Some places in NSW had prices as low as $1/ML.

The amount of unused water carried over was the highest volume seen in a decade, as La-Niña meant irrigators were less reliant on set water allocations.

The AgFood Opportunities Fund is a Wholesale-only fund that invests in both listed and unlisted companies operating in the Agriculture and Food industries within Australia, New Zealand and the Rest of the World.