by Jian Shi Cortesi – Investment Director

What caused the property slowdown?

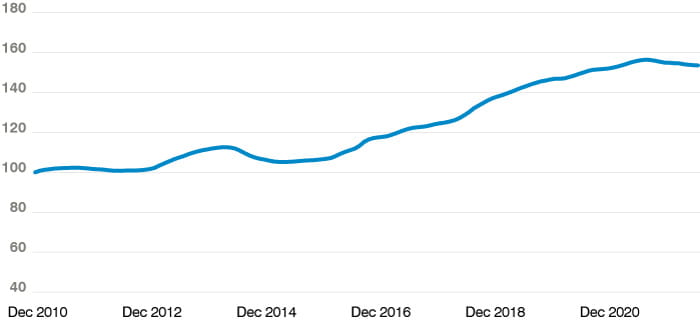

Between 2010 and 2020, China saw a strong property market, with property prices in the top 70 cities rising by 60%. This led some home buyers to complain about the affordability of property, and the government became concerned that this could lead to a property bubble.

As a result, in 2020 and 2021, some cities in China tightened home purchase restrictions in an attempt to cool off the housing market. At the same time, the government instructed banks to tighten lending criteria to highly leveraged developers. The combination of these measures led to liquidity issues for some high risk developers, some of which have defaulted on their debt. In the past 12 months, we have seen prices tilt lower (see figure 1).

Figure 1: New home prices in China’s top 70 cities

What are the key risks in the Chinese real estate market?

Troubled developers have halted construction of some projects. Sentiment has become quite negative for the sector, leading to tighter financial conditions. Home buyers are also cautious about the property price outlook and have become less eager to buy homes, which could lead to further deterioration of the sector. These risks, if not controlled, could spill over to the whole financial sector.

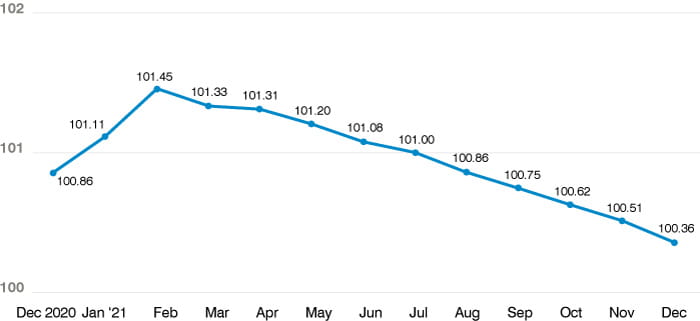

Figure 2: National Real Estate Climate Index

National Real Estate Climate Index: The national real estate climate index follows the theory of economic cycle fluctuation, based on the business cycle theory and business cycle analysis, using time series, multivariate statistics, econometric analysis, taking real estate development and investment as the benchmarks, selecting related indicators such as real estate investment, capital, area, sales, excluding the impact of seasonal factors, including random factors, compiled by adopting the growth rate cycles method. Typically, the most appropriate level of national real estate climate index is 100, the moderate level is between 95 and 105, the lower level is below 95, and the higher level is above 105.

Are we seeing high risks for mortgages?

Mortgage underwriting in China is relatively conservative. First time home buyers normally pay a down payment of a minimum of 20-30%, while second time home buyers are generally required to pay a down payment of 40-70% of the value of the property. There is no subprime mortgage lending. As a result, Chinese households are not overly leveraged, and household income is growing. This provides a substantial cushion for the repayment of outstanding mortgages, in our view.

What about the mortgage boycott?

In China, homebuyers often purchase new homes from developers’ plans and begin making mortgage payments before the projects are finished. As some troubled developers halted construction on certain projects, homebuyers announced they would stop making mortgage payments until construction resumes.

The mortgage boycott is only related to those projects which have been halted. Importantly, this is not homeowners unable to pay mortgages due to financial troubles, which we saw during the 2008 financial crisis in the US.

According to S&P Global research, the impacted mortgages could amount to 0.5-1.5% of total bank loans.1 This should be manageable, in our view. In addition, home buyers should start paying their mortgages again once construction resumes. Recent policies have focused on ensuring the completion of halted projects.

What measures has the government rolled out to support the property market?

- Regulators have reduced mortgage interest rates for first time home buyers.

- Many cities have loosened home purchase restrictions to encourage home buying.

- In July, the Chinese authorities promised to establish an initial rescue fund of USD 11.8 billion (80 billion yuan), which could grow to 300 billion yuan, according to Reuters. This is aimed at resolving the debt crisis and restoring confidence in the property sector.

- Chinese officials said in July that banks and other government departments will meet reasonable financing needs of real estate developers. The Ministry of Housing, the Urban-Rural Development, the central bank and other departments will support local governments to ensure the delivery of buildings, protect people’s livelihoods and maintaining stability.

How does China deal with troubled developers’ projects?

It is estimated that there are 97,000 developers in China, and every year a few hundred go out of business. In the past, the projects of those troubled developers were handled mainly through restructuring or liquidation.

The majority of the projects were resolved through restructuring, whereby the government helped find a stronger developer to act as a partner or to take over the projects. In the case of liquidation, assets were auctioned off and the proceeds were used to compensate home buyers and other creditors. As expected, the above measures need time and could take months or even years.

In summary, what is your assessment of the impact of the property slowdown?

Given the above factors, we see very low probability of the property slowdown leading to systematic risks in China’s financial system. However, the boom years for the property sector are likely now behind us. Some experts estimate annual new home sales are likely to decline to 1-1.2 billion square meters in the coming years from 1.6 billion square meters in 2021. This will be a drag on the GDP growth rate.

With that said, mortgage payment burdens have to a certain extent crowded out other discretionary spending. If mortgage payments take up a smaller portion of consumers’ income, we believe this could lead to more spending in other areas.