Critical minerals and rare earth elements are essential to the make-up of many current technology devices, including aerospace, satellites, LCD screens and computer monitors. However, their impact will be most profound in the movement toward renewable energy, serving as key ingredients that will power clean energy for many years to come.

With the understanding that electric vehicles, solar and wind technologies are expected to soar over the coming decade, there are serious concerns that the demand for some critical minerals will surpass the current sources of supply, creating bottlenecks and straining the supply chains.

In addition, many of these supply chains are currently dominated by China, and – as seen with how the current Ukraine-Russia conflict has affected oil and gas prices – being overly dependent on one nation’s materials poses a geopolitical risk.

Governments and industries all around the world have recognised the problem, and agree that action is needed to diversify and strengthen these global supply chains.

What are “Critical Minerals”?

According to Geoscience Australia, a critical mineral is a metallic or non-metallic element that has two characteristics:

- It is essential for the functioning of modern technologies, economies, or national security and

- There is a risk that its supply chains could be disrupted

The risks that could come to these critical minerals occur when processing or mineral production is dominated by a single body, limiting its availability. Other risks include market immaturity, political decisions, social unrest, natural disasters, mine accidents, geological scarcity, pandemics, and war.

The term ‘critical minerals’, however, is fairly fluid. Each jurisdiction has a different set of minerals in mind, based on certain geopolitical risk and their level of economic or strategic importance, and will formulate this list reflecting the concerns and technological needs of a society at a given moment in time. Hence, they are subject to vary.

For example, Canada has copper (Cu) on their list but Australia does not, due to the fact that Canada does not produce much copper and Australia does. For similar reasons, Australia has manganese (Mn) on their list but the EU does not.

In regard to Australia’s critical mineral list, Geoscience Australia states that the minerals have been selected by “assessing Australia’s geological endowment and potential with global technology needs, particularly those of partner countries such as the United States, United Kingdom, Japan, India, South Korea and Canada”.

Of particular importance, though, is where jurisdictions want society to go in the future, so minerals such as lithium (Li), cobalt (Co), rare earths, and graphite (C) and manganese (Mn) are featured on most of the lists created, as they are pivotal ingredients in the make-up of significant renewable energy devices.

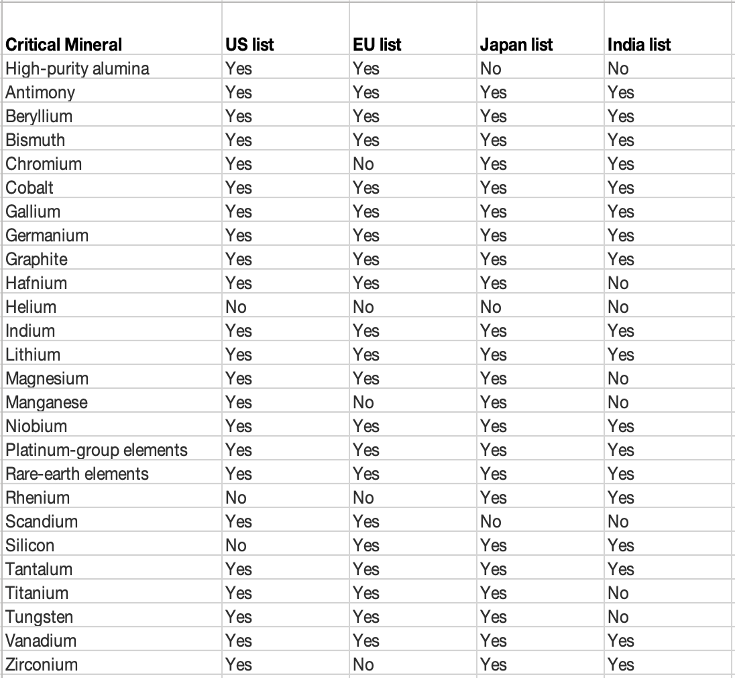

Below is the full list of Australia’s critical mineral list for 2022, and whether or not they are featured on the critical minerals lists of the U.S., EU, Japan, and India.

Source: Australian Government – Geoscience Australia, Critical Minerals at Geoscience Australia

What are “Rare Earths”?

According to Dr. Julie Klinger, author of Rare Earth Frontiers: From Terrestrial Subsoils to Lunar Landscapes, the term ‘rare earths’ refers to 17 chemically similar elements, consisting of 15 from lanthanide (atomic numbers 57 through 71 on the periodic table), scandium, and yttrium. The light rare earth elements consist of elements 57 through to 64, and heavy rare earth elements consist of elements 65 to 71.

They are grouped together due to the fact that they have fairly similar geologic and chemical characteristics. They do however have slight differences in atomic structure, which gives them differences in magnetic, optical, and metallurgic properties.

Rare earth elements are also included in many countries lists of critical minerals because they are so important for different technologies, principally due to their electrical or magnetic qualities.

Cerium (Ce), for example, is used to produce red lasers that are used in precision guided missiles or used to make the lenses in rose-coloured glasses.

Cerium is also what’s called a “doping compound”, meaning that it acts as signal booster. For example, trans-oceanic internet cables require a little bit of cerium to be applied about every 30 kilometres or so, in order to make the signal accessible. This helps make the global internet communications.

Yttrium(Y) and europium (Eu) are used in smartphone batteries and help to give the display screen colour and make vibrations when a notification is received.

Dysprosium (Dy) is used in control rods for nuclear reactors, and samarium (Sm) is used to treat lung cancer.

Where are they found?

The general impression is that rare earths are only found in a couple of the places in the earth’s crust in China, the U.S., or some other Nordic countries. However, global maps reveal that there are hundreds of potentially mineable deposits dispersed throughout the world, meaning that almost every country has rare earth elements somewhere in their subsoils.

Hence, the name is somewhat misleading, but has stuck since being coined thus in the late 1700s, at which point no one had seen them before and so they were assumed to be rare.

According to rare earth investing news, in 2022, China had the highest reserves of rare earth minerals at 44 million metric tonnes (MT), Vietnam was next with 22 million MT, then it was Brazil and Russia with 21 million MT, India at 6.9 million MT and Australia with 4 million MT.

The majority of lithium reserves and production come from Chile, Australia, China, Argentina, and the U.S.. Cobalt reserves and production mainly come from the Democratic Republic of Congo, Russia, Australia, Canada, and Cuba, and most of the graphite reserves and production are in China, Brazil, Mozambique, Russia, and Madagascar. Large quantities of manganese are produced in South Africa, Gabon, Australia, China, and Ukraine, while antimony (Sb) is mainly produced in China, Bolivia, Russia, and Tajikistan.

Why are they so key to the Clean Energy Transition?

Through their contribution to smartphones, tablets, laptops, and bank notes, rare earths and critical minerals already feature heavily in the lives of many of us.

However, various properties of some rare earths and critical minerals also make them integral to the shift toward a cleaner, renewable future.

Rare earth elements like neodymium (Nd), praseodymium (Pr), dysprosium (Dy), samarium (Sm), gadolinium (Gd), terbium (Tb), dysprosium (Dy), and holmium (Ho), are imbued with a powerful magnetism that will help create a high-tech future powered by clean energy.

This is due to the fact that a high magnetic field allows for a quicker turn in movement to create energy.

Neodymium is especially worth noting.

Neodymium is a soft and white element, that when combined with iron and boron, becomes a complete super magnet.

The crystalline structure of this alloy makes the neodymium magnet a super magnet. This is because the crystals or magnetic domains line up in the same direction when they are exposed to an external magnetic field.

And when creating a magnet, that is ideal, as the stronger the magnet, the better the magnetic domains all line up in the same direction.

Their light weight means that they also reduce the mass of electric motors and wind turbine generators.

The combination of these two features makes neodymium perfect for the make-up of these renewable energy devices.

According to the European Commission’s report on the role of rare earth elements in wind energy, the average magnet in wind turbines contains 28.5% neodymium, 4.4% dysprosium, 1% boron and 66% iron and weighs up to 4 tonnes.

Currently, in the UK, there are offshore wind capacity turbines of 10 gigawatts. The government aims to increase that figure to 50 gigawatts. This is huge, as it is roughly equivalent to the 65 gigawatts installed electricity capacity in the UK at the moment.

The U.S. has a goal of 30 gigawatts by 2030.

In regard to the critical minerals, lithium, nickel, manganese, and cobalt are key ingredients in the make-up of lithium-ion batteries – the gold standard of the current electric vehicle batteries.

Lithium’s light weight and high electrochemical potential allows the battery to store a lot of energy.

Manganese is an important stabilizing ingredient, nickel allows for higher energy density and greater storage capacity, whilst cobalt ensures that the battery does not overheat and helps to extend their overall life.

The electricity networks needed for wind turbines and EV batteries also require a huge amount of copper and aluminium, with copper being a cornerstone for all electricity-related technologies.

And with EVs having a compound annual growth rate of 30% and a significant number of wind turbines to be installed globally over the next decade, these ingredients will be fundamental in the transition to clean energy.

What are the risks associated with Rare Earths and Critical Metals?

Although they will be instrumental in the shift to renewable energy, rare earths and critical minerals also have some significant risks.

In regard to rare earth elements, the economic deposits may have anywhere from 2%-5% of concentration, meaning that 95%-98% of the aggregate and rock that is being dug up is not useful.

There has to be thousands of tonnes of material displaced to get a handful of kilos of rare earth elements.

Without stringent controls, the operation is highly polluting, and may result in radioactive exposures and waste generation.

In China, rare earth extraction and processes are particularly bad.

The largest rare earth mine in the world, in the city of Baotou, has a pond next to the mine to contain the waste, however the pond doesn’t line up properly and the sludge is seeping into the groundwater and moving towards the river, from which millions access their drinking water. This could potentially have a devastating impact, as the waste products released contain thorium – which causes pancreatic and lung cancer.

For critical minerals, cobalt, lithium, and nickel pose risks.

The Democratic Republic of the Congo produces roughly 70% of the world’s cobalt.

For years, severe human rights issues including child labour have been breached in the mining operations.

There are serious concerns about the Barroso Lithium Project in northern Portugal, which poses threats to the surrounding biodiversity.

Francisco Ferreira, CEO of Portuguese environment NGO Zero, believes there are technical concerns regarding the 800-metre quarry being so close to a populated village, stating that it will, “put the population and environment in risk of a disaster.”

In Serbia earlier this year, large protests by environmentalists forced the government to cancel a contract to extract lithium with mining giant RTZ.

This year geopolitical risks have caused fluctuations in the price of nickel.

Russia accounts for about 21% of global class one nickel production. As such, in March, the Nickel prices roughly doubled to unprecedented highs, with the war fuelling concerns of supply disruptions for the metal.

However, the largest concern for both rare earths and critical minerals is the fact that supply chains are completely dominated by China.

According to Forbes, China controls approximately 70-90% of global rare earth element production.

According to figures from Investing News Network and fdi intelligence, China is the leading refiner of cobalt, accounting for 70% of the total global supply, it refines around 65% of the world’s lithium processing and refining capacity and, it is the world’s largest graphite producer, accounting for 79% of world graphite mining in 2021.

And there are serious geopolitical risks associated with this as well.

In 2010, China had cut off all rare earth exports to Japan, to put pressure on them to release a detained Chinese fishing trawler captain, using their power of rare earths as a geopolitical tool.

Another issue with China’s control is the risk of bottlenecks.

If the jurisdictions around the world are serious about achieving their climate goals, they could run into a bottleneck when it comes to rare earth elements.

The president of China has stated that he wants the country to achieve carbon neutrality by 2060.

The EU, U.S., Australia and many more jurisdictions have similar goals.

In order for these goals to be achieved, China is going to have to make a lot of electric cars and wind turbines, requiring lots of rare earth elements, which could create significant bottlenecks for the global supply chains.

Conclusion

Governments all around the world have responded to China’s dominance in the supply chains of rare earths and critical minerals.

In September, the European Commission announced a legislative proposal of the Critical Raw Material Act, ensuring that Europe takes control of its supply chain of critical minerals like rare earths and lithium.

U.S. President Biden’s recent U.S. Inflation Reduction Act, states that at least 40% of critical minerals in US-made EV batteries must come U.S. miners or recycling plants, or mines in countries with free trade deals with the U.S.

While these are all steps in the right direction for reducing China’s influence, the simple fact that China can provide the finished goods at a much-reduced cost might prove the biggest stumbling-block of all.

For example, China offers a VAT refund on their exports of rare earths. This means that Chinese rare earth magnet producers have a 13% raw material cost advantage over their foreign competitors, enticing more foreign producers to set up shop in China.

Across the entire renewables spectrum, the separation, production, and refinery process is expensive and, China’s dominance allows them to vastly undercut their competitors on price.

This alone will make it very much a case of easier said than done when it comes to moving away from Chinese supply chains.