by Chris Marx, David Wong and Robert Milano

Equity investors have sustained significant losses this year and are facing a long list of new uncertainties. But despite recent market disruptions, there are still good reasons to stay invested in stocks as an integral part of a long-term investment plan—and good ways to reduce the risks that come with investing in equities.

1. Equity markets generally rise over time.

It can be unnerving to ride the roller coaster of market volatility, and there are still formidable risks ahead. But the facts speak for themselves: equities have historically paid off for patient investors in the form of long-term price appreciation. In fact, trying to get in and out of the market can be costlier than sticking it out through challenging times, which we address in point #10 . While the S&P 500—the standard bearer of US large-cap equity performance—has experienced periodic bouts of volatility throughout history, the long-term upward trend is clear (Display).

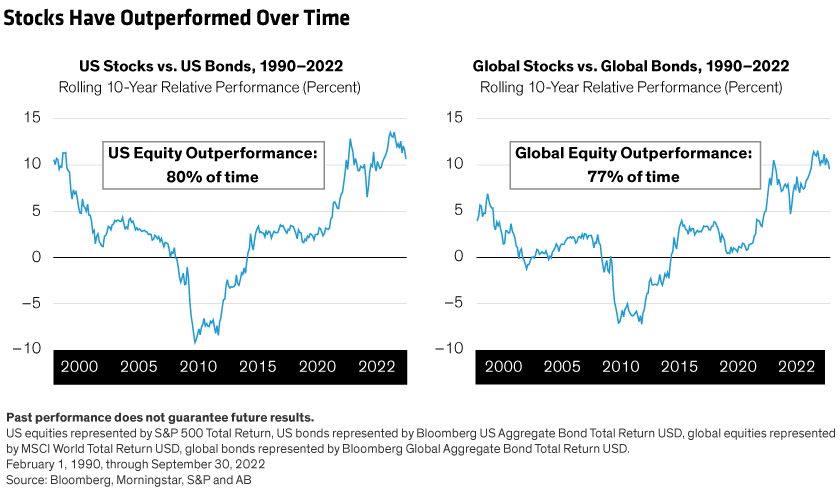

2. For long-term investors, equities are still the best way to grow capital.

Fixed-income allocations are a foundational component of a diversified investment strategy and can provide ballast when equity markets take a turn for the worse. Over an extended period, however, stocks still provide more attractive long-term growth potential. In fact, looking at rolling 10-year periods from 1990 to present, large-cap stocks outperformed US investment-grade bonds roughly 80% of the time, while large-cap global stocks outperformed global investment-grade bonds more than three-quarters of the time (Display).

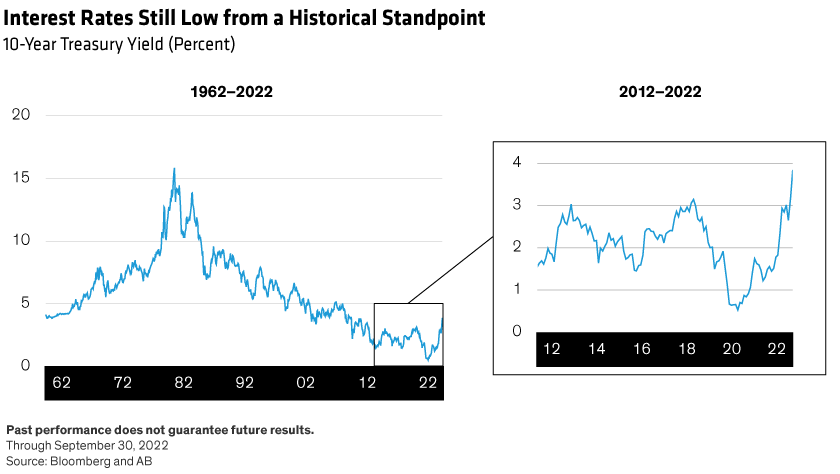

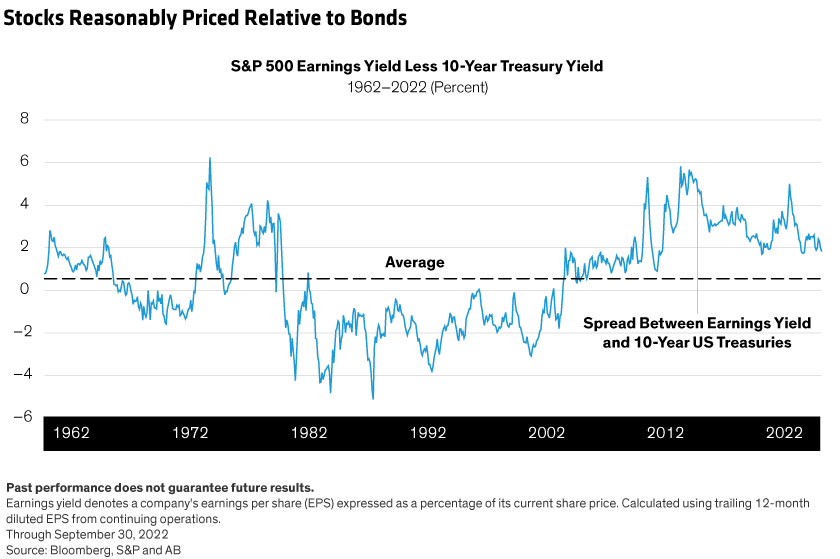

3. Interest rates are still relatively low, while stocks appear reasonably priced.

Although interest rates have risen sharply over the past two years, they’re quite low from a historical perspective (Display). And while higher rates could put the brakes on economic growth, we believe there’s little risk that rates will climb to the highs seen in the early 1980s. Currently, fed funds futures imply that the fed funds rate will top out slightly above 5% by mid-2023. Even in the context of higher rates, however, the earnings yield of stocks exceeds both its own long-term average and the 10-year Treasury yield (Display). Translation: we believe stocks still look reasonably priced relative to bonds.

4. Despite pressure on valuations, earnings have held up so far.

While multiples have taken a hit over the past year, corporate earnings have held up relatively well, suggesting that the valuation excesses of the past bull market are undergoing a correction—particularly among unprofitable technology companies. To be sure, disappointments have begun to surface in third-quarter earnings reports, with strong results in the energy sector masking downgrades in other sectors. Ultimately, though, we believe a less-speculative environment could lend greater importance to company fundamentals. Active management can help uncover companies with strong cash flows, earnings and margin resiliency that are not only able to withstand market disruptions but are also positioned to outperform in a recovery.

5. Earnings declines in high-inflation environments have historically been mild.

Given the exceedingly tight labor market, analysts differ on whether the US economy is technically experiencing a recession. Still, concerns are mounting that tighter monetary policy could eventually trigger a US recession. Europe is also vulnerable to recession, given the region’s acute energy crisis. The silver lining is that peak-to-trough declines in corporate earnings during inflation-fueled recessions have historically been mild. In particular, during three inflationary periods covering 1990, 2001 and 2007, earnings declined just 15.3% from peak to trough. By comparison, earnings fell by nearly 45% during low-inflation recessions.1

6. A focus on quality companies can help buffer against the effects of inflation.

Rising inflation has the potential to erode the real value of investment returns. Fortunately, investors have a number of solutions they can put to use, including a diversified real-asset strategy. But one of the most effective approaches is to seek out quality companies with a wide economic moat, secular growth potential and strong pricing power—all of which can result in earnings resilience, even during inflationary periods. High-quality stocks can be found in a diverse range of sectors and industries, and include growth companies, as well those more sensitive to economic cycles.

7. Stocks have historically performed well in periods of moderate inflation.

This isn’t the first time investors have faced rising prices. Fortunately, the historical record is encouraging. Moderately high inflation has generally supported equity multiples, and equities have delivered solid returns during periods of moderate inflation for more than seven decades. So, if inflation ultimately settles down below 4%, we believe stocks should do well.

8. Today’s light positioning in equities could provide future technical support.

Because market sentiment around equities has turned negative, many investors have maintained a relatively light allocation in stocks, which has put a damper on investment returns. So far in 2022, globally distributed equity funds have seen significant outflows, with nearly consistent outflows from equity funds since June 2022. If investors detect that inflation is peaking and consumer sentiment improves, flows could reverse course, providing equities with much-needed technical support.

9. US stock buybacks have continued at a breakneck pace.

Continuing a trend that began after passage of the Tax Cuts and Jobs Act of 2017, US companies are repurchasing shares at a breakneck pace. In 2021 alone, S&P 500 firms bought back a record $882 billion of stock. Through August 2022, that figure has exceeded $500 billion. In addition to showing confidence in a company’s growth prospects, buybacks can support asset values by boosting a company’s earnings per share. As part of a broader capital return strategy that may also include dividends, stock buybacks can provide an additional layer of support against equity volatility.

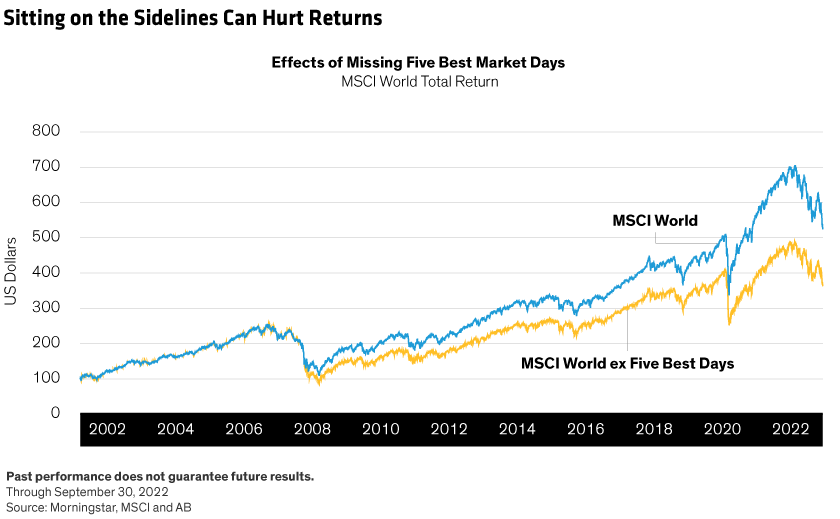

10. Staying the course is a proven strategy.

During periods of market turbulence, it can be tempting for investors to reduce equity exposure as the market is selling off. However, attempting to time the markets is a flawed strategy, as investors tend to react by selling after stocks have already fallen in value, thereby locking in losses. Conversely, it’s easy to miss the full benefit of a recovery if you don’t get in at just the right time.

Looking back two decades from October 1, 2002, through September 30, 2022, the MSCI World Total Return delivered an annualized return of 8.65%. Absent the five best market days of that period, however, its annualized return would have dropped 197 basis points to 6.68%. In dollar terms, sitting out those five days would have cut the total gain by $161 for each initial $100 invested over the 20-year period (Display).

It may seem hard to stay in the market when losses are mounting and uncertainty looms, but based on historical experience through multiple market crises, staying the course can be an effective route to benefit from a market recovery.

1.Source: Credit Suisse, “U.S. Equity Strategy: CS Guide to Recessions,” August 17, 2022

David Wong is Senior Investment Strategist and Head—Asia Business Development, Equities, Chris Marx is Global Head—Equity Business Development and Robert Milano is Product Specialist—Select US Equity and US Growth portfolios at AB.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to change over time.