What’s behind the recent outperformance of value?

In the past, value companies have outperformed when inflation and interest rates increase, as they tend to be less sensitive to changes in macro-economic conditions. For example, value outperformed in the high inflation, rising rate environment of the late 70s and 80s.

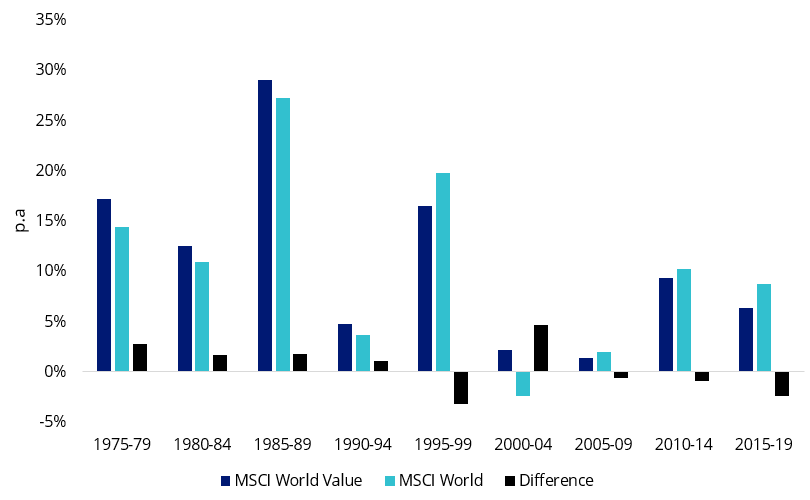

Chart 1: Five year per annum performance comparisons

Value outperformed in the high rate/high inflation environment of the 70s and 80s.

Source: MSCI, VanEck. Past performance is not a reliable indicator of future performance. You cannot invest in an index.

Let’s start with what ‘value’ investing is

Established in the 1930s by Benjamin Graham and David Dodd, value investing uses indicators such as dividend yields and low price-to-book, or price-to-earnings ratios to identify companies where the business potential is not reflected in the share price. It is an approach that has many professional supporters, including Warren Buffett, the founder of Berkshire Hathaway.

By way of contrast, growth investing is a stock-buying strategy that looks for companies that are expected to grow at an above-average rate compared to their industry or the broader market. Over the past decade there was a large shift to growth investing as advances in technology accelerated, including the advent of new technologies such as the cloud, mobile platforms and software as a service.

Both growth and value investing can lead to profitable results. Warren Buffet, one of the most highly regarded value investors of all time has pointed out that the two strategies are intrinsically linked. In his 1992 Berkshire Hathaway letter to shareholders he wrote, “in our opinion, these two approaches are joined at the hip: growth is always a component of the calculation of value, constituting a variable whose importance can range from negligible to enormous.”

The current environment

Like other developed markets, Australia’s inflation is currently running at over 7% and interest rates are expected to rise at least a few more times in the next six months. The economic environment should continue to support companies with more of a value tilt, including cyclical stocks with pricing power. Companies that can maintain or increase their prices, and therefore margins, without turning away customers will be the winners, as the price of goods and services rise, along with wage costs.

According to Professor Tano Santos of Columbia Business School, “Over the last decade low interest rates and high appetite for risk have fueled outperformance for growth, now that those things have changed, interest rates are on the way up, and the appetite for risk is not what it once was, of course value is coming up as investors look more closely at the underlying quality of the business operations of the firm. Certainly, this market is more conducive to a successful value investing strategy.”

During times of inflation, companies with solid earnings can boost profit margins by raising prices, and value companies, which tend to be more mature, have earnings and margins to improve. It is much more difficult for non-profitable companies to increase prices. So, in the current environment a sound investment approach could be to seek out established, profitable companies.

“We prefer value over growth in the middle of a perfect storm of higher rates and weakening fundamentals says Savita Subramanian, BofA Securities Head of US Equity and Quantitative Strategy.

Solita Marcelli, Chief Investment Officer at UBS Global Wealth management agrees, “We continue to prefer large-cap value stocks, which should see continued support from higher interest rates.”

By contrast, growth stocks, including tech companies that are yet to make a profit, could see the tailwinds that favoured their record run in the pre-COVID era continue to weaken. In such an environment, value stocks can mitigate risk by providing a margin of safety, shielding portfolios from macroeconomic headwinds.

There are two main reasons value stocks have outperformed recently

1. Lower ‘duration’

Value stocks generally have lower ‘duration’ versus growth stocks. Duration is typically used in finance to describe the relationship between yields and prices in fixed income assets such as bonds or the time it takes to breakeven on an investment. It can be used to describe how long it takes, in years, for an investor to be repaid a bond’s price by the bond’s total cash flows, for example.

Duration can also be applied to equities by considering a company’s cash-flow. Long duration companies realise a higher proportion of their cash flows far into the future. Many technology companies, that are not yet profitable, for example, would be long duration.

Many growth stocks experience negative cash-flow, ploughing money back into the business to grow it, with the hope it will turn a profit in the future. While, value companies, which are generally well established, pay a higher portion back to shareholders, their valuations are more tied to current and near term expected earnings. This lessens duration risk. So, when stubborn inflation persists, central banks increase policy rates, as we are seeing now and this is adversely impacting the present value of future earnings therefore it is desirable to hold companies where valuations are tied to the near team earnings. Value companies generally provide this.

2. Value tends to be less concentrated

Advanced value strategies also tend to result in more sector diversification than a growth strategy. This is because growth strategies generally lean towards a handful of sectors, which have recently experienced earnings growth, this can result in sector and company concentration. For example, the MSCI World Growth Index is currently heavily weighted towards prominent American Information Technology companies. Seven of the top ten holdings by weight are Information technology companies. While Apple, Microsoft, Alphabet and Amazon alone make up over 25% of the entire index.

By way of contrast, advanced value strategies such as MSCI’s Enhanced Value methodology target ‘cheap’ companies by comparing valuations of companies in the same sector. This results in proportionate sector exposure. Exposure to cyclicals such as energy and utilities have also been a tailwind for performance.

As macroeconomic conditions have deteriorated, value will likely be better positioned than growth to withstand downturns.

Value abroad

A number of international value companies have performed relatively well in 2022. Metlife is up by 21% for the year while food processing company Archer Daniels is 42% higher year-to-date and Glencore is up over 51%.

This contrasts with many Australian and international tech shares, Afterpay owner, Square is down 45% year to date. International tech companies haven’t fared any better, Facebook owner Meta has dropped over 71% and Amazon is down over 46%.

In a year when macro-economic uncertainties have de-rated equities markets around the globe, including the strongest companies run by the best management teams, value indices have fallen less than their tech counterparts. Over the twelve months to 31 October the tech heavy Nasdaq composite fell by 15.64%, while the MSCI World ex Australia Enhanced Value Index has risen by 2.36%.

According to Bloomberg, given that the latest down cycle for value in US large caps has been savage and long drawn out there could be plenty of room for up cycle ahead.

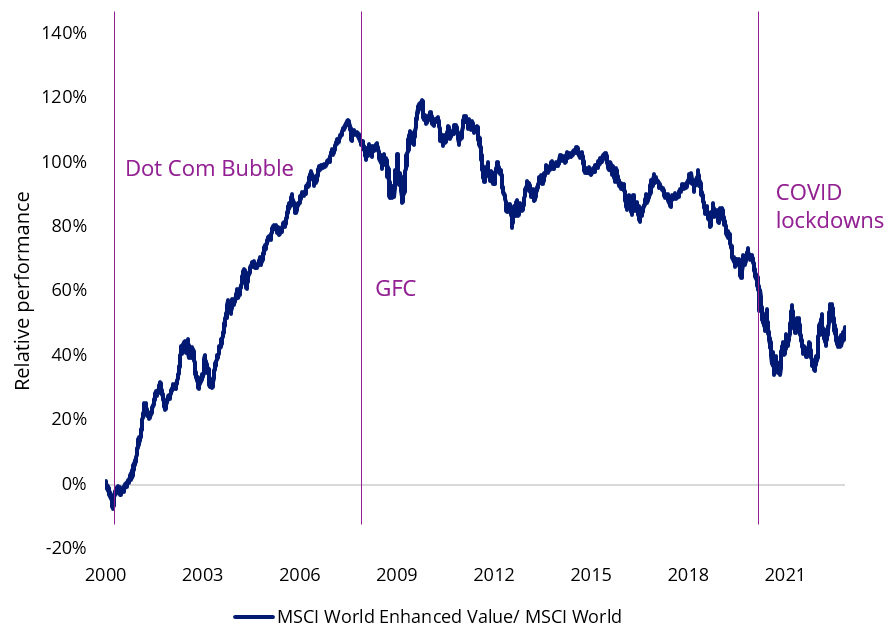

The US represents over 70% of the MSCI World Index. In the chart below when the blue line is rising, the MSCI World Enhanced Value Index is outperforming the MSCI World Growth Index. You can see value, after underperforming for a long period of time, could be ready to rise.

Chart 2: Is Value ready to grow again?

After lagging since 2008, value stocks have started to outperform.

Source: MSCI, Bloomberg. Past performance is not a reliable indicator of future performance. You cannot invest in an index.

Despite what has been a ‘volatile’ market we are excited about the return prospects ahead.

Investors seeking to tap the current ‘value’ trends may wish to consider the VanEck MSCI International Value ETF (VLUE) which tracks the MSCI World ex Australia Enhanced Value Top 250 Select Index (VLUE Index).

VLUE has exposure to MetLife, Archer Daniels and Glencore.

VLUE has outperformed the MSCI World ex Australia Index by 6.50% for the 12 months ending 31 October 2022. For the month of October 2022, VLUE returned 9.23% while the MSCI World ex Australia Index returned 7.81% (source: Morningstar), an excess return of 142bps as the value factor came storming back. Though we always caution, past performance cannot be relied upon for future performance. For updated performance click here.

Should value continue to outperform, ETFs provide investors a way to gain exposure, both here and abroad.

Key risks

An investment in VLUE carries risks associated with: ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the PDS for details.