by Peter Aquilina – Head of ESG / Senior Investment Analyst

A cornerstone of our investment process is company management meetings and site visits. This helps us to better gauge managements’ strategic thinking, operational capability and financial expertise. It also help us gauge feelings towards the local infrastructure sub-sectors, politics and economy.

Online video conferencing facilitated meetings with company management teams around the world during the COVID pandemic. However, nothing beats being on the ground, meeting management teams, and seeing the opportunities and challenges impacting companies, sectors and countries first-hand. In November, we returned to the United States for the first time in three years to get a feel for the region post-COVID. It allowed us to review the overall economic and political environment, identify some of the risks and opportunities for our universe, and consider investment prospects for 2023 and beyond.

Introduction

Being the largest economy in the world, the likelihood of a global recession is heavily influenced by the US’ economic prospects. With soaring inflation combined with the US Federal Reserve aggressively lifting interest rates in an effort to slow inflation, it seems the US economy is in a precarious position. The unemployment rate is still very low at 3.7% (in October 2022) – which would imply economic strength – but the outlook for 2023 remains uncertain.

In this economic context, the US held its mid-term political elections, which included the election of sitting members of Congress – the House and the Senate – as well as many state-based governors. Going into the mid-terms, the Democrats held the balance of power in Congress which made it easier for them to pass legislation. But with the economy in an uncertain position, it was thought that the Republican Party would win back many seats in both houses of Congress. For 4D, the outcome could have significant ramifications for US infrastructure companies in our investment universe.

Economy – will inflation lead to recession?

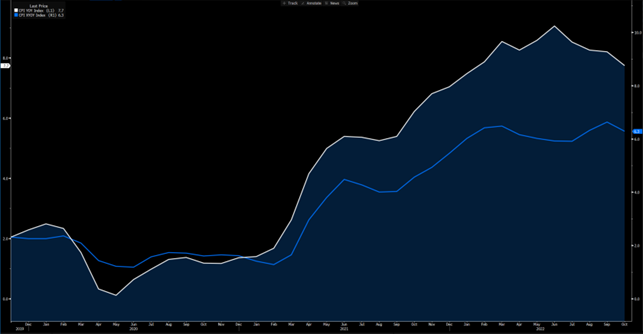

The likely biggest immediate risk to the US economy is soaring inflation. For the month of October 2022, annualised inflation was 7.7%, compared to 8.2% in September 2022. Inflation excluding food and energy was 6.3% annualised in October 2022, compared to 6.7% in September 2022 (depicted below) – so although decreasing month on month, inflation was still stubbornly high.

Some data in the US and Euro zone in November pointed to a mild weakening of price pressures, with the US job market remainingresilient (while more jobs are good for workers, they’re not so great for inflation). Federal Reserve Chair, Jerome Powell, said the size of interest rate increases would shrink, and that it’s ‘plausible’ the economy could skirt a downturn – although the window of opportunity for this scenario has narrowed. Mr Powell did balance his comments about the forthcoming rate decision with a pledge that the Fed would not relinquish its fight against inflation until price pressures had slowed to a level more in-line with its longstanding 2% target. Economists surveyed by Bloomberg this month saw a 65% chance of recession in the next year based on the median estimate. A Bloomberg economics model puts the probability at 100%[1].

The major concern in an inflationary environment is central banks pushing up interest rates too far, leading to an economic slowdown and financial hardship for the populous.

Source: Bloomberg data – YoY US CPI (white line) and YoY US SCPI ex food and energy (blue line)

Further information on specific sub-sectors can be found in the PDF version of this article.

Politics

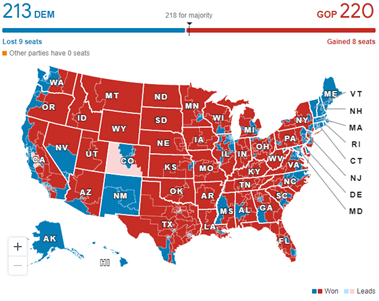

The US mid-term elections were held on 8 November 2022. Prior to voting, polls indicated the potential for a ‘red wave’ with the Republican Party to win a strong majority in both the House and Senate, taking control of Congress.

On the day of the election, early counting indicated that the red wave wasn’t eventuating, and as at the time of writing this article, Republicans hold a slim majority in the House by 220 / 213.

Source: The Associated Press

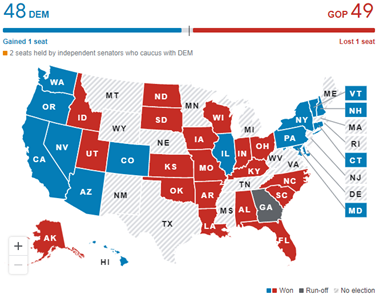

In contrast to the Republican lead in the House to date, the Democrats have actually gained a seat in the Senate.

Source: The Associated Press

With the Democrats losing the balance of power in the House, it will be more difficult for them to implement federal legislation at least until the next election in 2024. This means any legislative changes will need bi-partisan support, which has been difficult in the recent past. Getting support from Congress to lift the debt ceiling will be of particular concern for a number of reasons:

- Without Congress raising the debt ceiling, the US Treasury cannot issue additional debt to pay its obligations and fund its operations, and must use cash on hand and incoming revenues. Once these measures are exhausted, the US maybe illiquid.

- When the US came close to not raising the debt ceiling in 2011, stock markets fell more than 10%, and the debt of the US government was downgraded by S&P from AAA to AA+.

- Currently, the debt ceiling is around US$31.4 trillion. US government debt, which is not precisely comparable since some debt is excluded from the debt ceiling calculation, stands at $31.3 trillion. Most estimates have the debt ceiling being reached in early 2023[2]

In this context of economic and legislative uncertainty, 4D were keen to understand the ramifications for infrastructure companies and their investment prospects looking forward.

Oil and gas midstream sector – fundamentals much improved

Most oil and gas midstream companies have experienced a change in market sentiment over the course of 2021 and 2022. Uncertainty caused by the COVID pandemic, and the collapse in oil and gas commodity prices in the first half of 2020, saw proactive management teams take action to improve free cashflow. This included cutting dividends, reviewing investment pipelines and strengthening their balance sheets in an accelerated fashion. The subsequent jump in commodity prices, combined with the improved financial stability of companies, resulted in significant share price appreciation since the start of 2021, driving total returns for Williams Co (+84.9%); Targa Resources Corp (+182.8%); Cheniere Energy Inc (+187.6%) and Kinder Morgan (+53.3%). The scenario played out largely in line with 4D Infrastructure’s expectations outlined in our March 2020 Global Matters article, The impact of the oil shock on North American midstream assets. While we continue to like the sector, in some cases we think the market appreciation moved ahead of fundamentals, and we took the opportunity to lock in profits and reallocate capital.

In the context of global efforts to move economies away from fossil fuels, the latest conversations with management teams were focused on longer-term prospects for the commodities they transport and strategic positioning to ensure longevity in their business models. Management stressed the importance of fossil fuels, in particular gas, in the transition to net-zero – which suggests decades of ongoing demand. They also outlined that natural gas had a role to play post-2050 when used in conjunction with carbon capture or to produce low carbon hydrogen (‘blue hydrogen’). 4D favours the midstream players exposed to gas over other commodities for these reasons.

Midstream management teams highlighted projects they were exploring, which were not only complementary to their core competencies, but would help extend the longevity of business models in a low/no carbon world. These projects were economically supported by the recently legislated Inflation Reduction Act (IRA), and were focused on hydrogen development, storage and transportation, participation in the value chain of carbon capture and sequestration (CCS), participation in renewable natural gas (RNG) and projects with other biofuels and renewables.

Further information on the midstream sector and specific companies can be found in the PDF version of this article.

Utilities – short-term headwinds, but long term looks bright

4D attended the pre-eminent annual utilities conference, the EEI Financial Conference, from 13-15 November in Hollywood, Florida. We attended meetings with fifteen utility companies from all over the US, across electricity, gas and water.

Messaging from utility management teams centred on short-term headwinds related to inflationary pressures increasing costs, difficulties in managing customer bills, concerns around regulatory risk, increased interest rates exposure, and some concerns around financing pension liabilities. Some companies communicated confidence in managing/mitigating these headwinds, while others communicated the expectation that they would negatively impact short-term financial performance.

In contrast, the medium- to longer-term investment proposition for utilities remains very attractive as a result of investment opportunities presented through the energy transition away from fossil fuels to clean/renewable alternatives; as well as to support reliability and security of supply in light of an aging network and increased environmental challenges.

We came away more comfortable with the structural long-term growth thematics underpinning the sector, while remaining cognisant of the near-term macroeconomic overhangs, as discussed in more detail below. As a result, we remain very targeted in our approach to US utility exposure focussing on high quality management teams in regulatory attractive jurisdictions that are in a position to capitalise on the structural thematics while mitigating near-term negatives.

Further information on the short-term risks, structural opportunities and specific companies can be found in the PDF version of this article.

Communications towers – demand for data

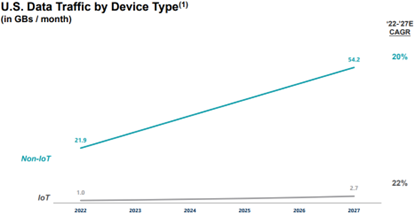

The US communications tower industry is currently experiencing a renaissance period of growth, primarily driven by the massively growing end customer demand for data. This demand is driven by customer utilisation of audio streaming, video conversations and video streaming. Below is a forecast of US data demand out to 2027.

Notes: IoT is based on M2M module connections, traffic and data usage; Non-IoT includes everything other than M2M modules (e.g. smartphones, tablets, laptops, and feature phones). Source: Ericsson Mobility Report June 2022, Altman Solon Research and Analysis

The Mobile Network Operators (MNOs) are the retailers who provide the end customer with mobile access to data and make payments to tower companies for utilisation of space on their towers. The MNOs have been rolling out the latest 5G technology on communications towers to satisfy the increasing data demand. The rollout of 5G facilitates increased mobile data speeds for the end customer, and also allows tower companies to negotiate increased payments from MNOs. Growth in payments from MNOs associated with 5G is compounded by contractual annual price escalation of between 3-4%, and increasing utilisation (or ‘tenancy’) of tower space due to the introduction of the fourth major MNO player in the US, Dish Communications. The combination of these three dynamics is growing individual tower earnings at high single digit rates with little associated capital investment. This dynamic could continue for five to ten years, depending on individual company characteristics.

The build out of the US towers sector is largely complete, having hit national capacity requirements. Therefore, discussions with US towers companies centred on strategic positioning to deliver growth outside of the domestic towers market. This is where strategies diverge widely.

Further information on specific companies can be found in the PDF version of this article.

Conclusion

Travelling through the US in early November 2022 was invaluable in getting a better understanding of the short- and longer-term considerations affecting infrastructure companies in our investment universe. Central to this were near-term concerns regarding inflation, increasing interest rates, the health of the economy and potential regulatory risk. However, longer term, the investment strategies of companies remain robust and exciting.

Oil and gas midstream companies are experiencing somewhat of an Indian summer in their business cycle, driven by improved financial health, strong free cashflow generation and strong global demand for commodities they utilise. The key consideration is what their longer-term business model looks like, and how management teams re-align strategies to best prepare them for a net-zero world. Most companies are making progress to re-align businesses, the success of which is company-specific and will play out over the next decade. With the sector re-rating, we are more targeted in our exposure, and are prioritising quality and value with exposure to commodities with longevity such as Williams Co.

Regulated utilities communicated their exposure to short-term inflationary pressures and the ramifications this could have on 2023/24 earnings expectations. They outlined how they intended to at least partially mitigate the negative impact on earnings – through cost cutting and regulatory recovery. Longer term, they were enthusiastic about the potential for strong growth for decades to come, driven by investment in the energy transition and to support grid hardening. While we are positive about the long-term investment thematic, in the current environment we have limited our exposure to those companies that can continue to execute and deliver on guidance such as NextEra and CMS.

The communication towers companies outlined the expectation for strong domestic growth supported by the rollout of 5G technology and the introduction of a fourth major MNO player in the market. Like other infrastructure sectors, they were focused on mitigating the negative impacts of higher interest rates and costs in the short term, and longer term were strategizing how to best position for growth, be it in international markets or by supporting the rollout of small cells. We continue to favour the fundamentals and strategy of SBA Communications.

Overall, the strong defensive characteristics of US infrastructure companies in 4D’s universe placed them well to withstand the economic challenges which could eventuate over the coming 12-24 months. We believe companies with strong management teams and investment fundamentals are better placed to navigate these challenges and deliver consistent attractive earnings growth for up to decades in the future.

[1] Bloomberg: Fed Staff Warn Chance of Recession in Next Year Is Now Near 50%; Matthew Boesler – 24 November 2022

[2] Forbes: Debt Ceiling Risk Looms for Markets in 2023; Simon Moore

The content contained in this article represents the opinions of the authors. The authors may hold either long or short positions in securities of various companies discussed in the article. This commentary in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader.