Gold has been used to store and grow wealth for centuries. Gold gave rise to the concept of currency and its popularity continues among investors today with gold being one of the most traded asset classes in the world and in 2023 it could make a comeback.

Support signs for gold

While interest rates trended higher and 10-year treasury yields rose above 4% for the first time since 2008, unlike the preceding months, the US dollar was unable to make new highs in October. Markets started wondering if rates could be nearing peak. This allowed the gold prices to stabilise above US$1,600 per ounce, having been under pressure from a high US dollar all 2022.

On 10 November, the US consumer price index for October came in at 7.7%, year-on-year, slightly below expectations and lower than the previous month (8.2%). This gave markets renewed hopes that the Fed may soon slow down the pace of rate hikes, causing the dollar to slide and helping gold trade as high as US$1,786.

The price fell back to around US$1,768 by the month’s end.

We expect the gold price to continue to consolidate around the US$1,750 level in the near term. If inflation remains at or near the current levels. A pause of the Fed’s tightening program would also likely be a strong catalyst for gold.

Gold may rally higher ahead of a Fed pause or pivot as the market anticipates the end of the rate hikes and/or if the Fed is no longer seen as being able to bring inflation down to its target range as quickly as currently anticipated. City Index market analyst, Fawad Razaqzada said in a recent note, “If gold manages to close above the $1,780 to $1,800 area, then that would be another bullish development, encouraging more bulls to step back in.”

Historically, physical demand for gold picks up in Asia and the Middle East when the gold price is weak. The current low gold price is no exception, as buyers in China, India, and UAE sense a bargain. According to Bloomberg, gold in Dubai, Istanbul and Shanghai is trading at a premium to spot prices in London. Over 527 tonnes have been moved out of New York and London vaults since April, while Chinese imports reached a four-year high in August.

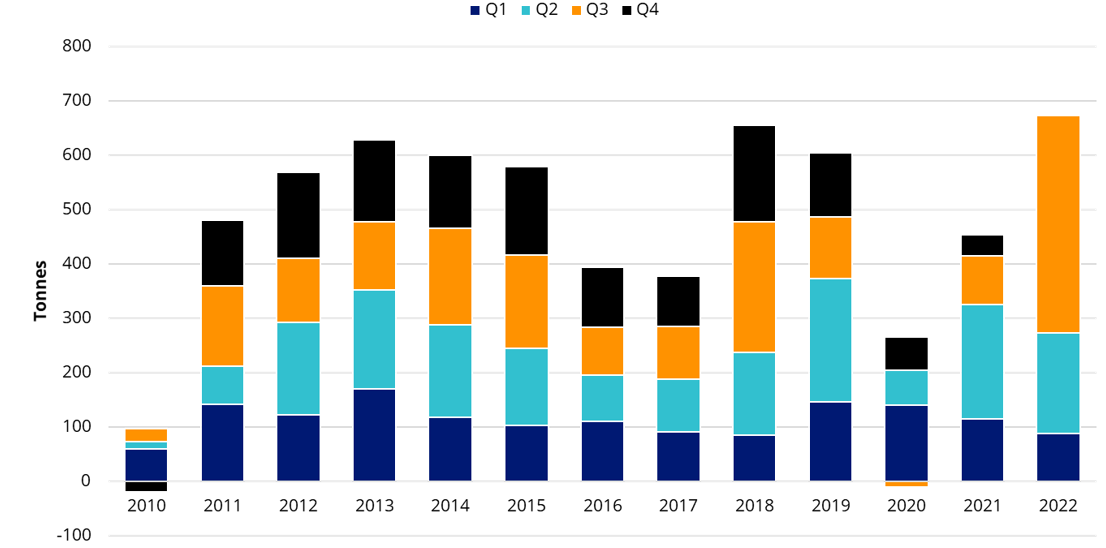

Another strong indicator, Central Bank demand is also strong, as the World Gold Council reports the banks bought 399 tonnes in the third quarter, the strongest quarter on record. This amount is nearly quadruple the amount of gold that was purchased the same time last year.

This physical demand may enable gold to find a floor around current levels.

Central bank gold demand

Source: World Gold Council. Data as of September 2022.

Taking a longer term view, experts are predicting gold will hit new records by the end of the decade, “We still expect to see record prices over the next, say, five years,” says Jeff Christian, founder and managing partner of commodities consulting firm CPM Group, as reported in Forbes.

As an asset class, gold is unique

The economic forces that determine the price of gold are different from the economic forces that determine the price of many other asset classes such as equities, bonds or property.

Because gold is a currency, its price does not behave like other commodities. It is also why gold equities do not behave like other mining shares.

Because of these unique qualities, many investors include both bullion and miners in their portfolio.

There’s room in your portfolio for gold bullion and gold miners – here’s why

Gold bullion tends to have a lower volatility profile compared to gold mining companies in both bull and bear markets, offering return potential and defensive characteristics. Physical gold has a low correlation to other asset classes as the economic forces that determine the price of gold are different from the economic forces that determine the price of many other asset classes such as equities, bonds or property.

By way of contrast, gold miners tend to outperform gold bullion when the price rises, and underperform if the gold price falls. At today’s gold prices, gold producers enjoy healthy margins, generating substantial free cash flow to allow them to continue to pay dividends and fund future growth.

Accessing gold via ETFs

ETFs are an efficient and low-cost way of investing in asset classes that can often be difficult to access and manage, such a gold. A gold bullion ETF, for example, can reduce the cost and burden of storage and insurance for an investor.

But not all gold ETFs are created equal. We think it is important that each investor be able to see a complete list of the gold the ETF holds and that the gold is vaulted in Australia. Further the gold should be Australian sourced and be 999.9 quality (highest purity). Ideally, you should be able to remove allocation to gold in the ETF from its vault and receive physical delivery of it.

Last week VanEck launched its Gold Bullion ETF (NUGG).

The gold bullion that physically backs NUGG, is held in a vault by The Perth Mint and is sourced from Australian gold producers whose operations adhere to the LBMA Responsible Gold Guidance.

In addition to liquidity on the ASX, NUGG gives investors the option of converting their NUGGholdings into physical gold from The Perth Mint.

A list of the allocated gold bars that make up the Fund’s assets will be made available on our website.

For investors seeking to also gain exposure to gold via gold miners, VanEck also has its Gold Miners ETF (GDX). The advantage of holding gold miners is that their price typically rises more than the increase in gold prices, as gold miners will add their own margins to gold production. Many miners pay dividends too, adding to the potential return.

GDX launched on ASX in 2015 and the recent launch of NUGG builds upon VanEck’s global leadership in gold investing that stretches more than 50 years, across bullion and miners, passive and active.

We recently launched a gold investing microsite. You can learn more about gold investing here.

As always, we recommend you speak to an investment professional to determine which gold investment blend is right for you.

Key risks of NUGG and GDX

An investment in NUGG or GDX carries investment risk. These risks vary depending on the fund and may include gold pricing risk, currency risk, custody risk, Australian sourced gold bullion risk, ASX trading time differences, financial markets generally, individual company management, industry sectors, country or sector concentration, political, regulatory and tax risks, fund operations and tracking an index. See the PDSs for details on risks.