There is, by weight, 7-10 times more graphite than lithium in a lithium-ion battery, making it the largest component. Little surprise then, that global demand for graphite is expected to grow sevenfold between now and 2035.

Yet, when you research the topic of electric vehicle batteries, you will find much discussion about the soaring demand of lithium and how it and selected other cathode battery components such as cobalt, nickel and, to a lesser extent, manganese, are the driving force behind the electric vehicle movement. Rarely does graphite rate more than a passing mention, at best.

One potential reason for this is that EV demand as a percentage of total graphite demand is less than 50%. However, Benchmark Mineral Intelligence (BMI) believes this will change in 2023 as EV demand surges, thereby materially impacting the price of graphite in the same way it did when EV demand exceeded 50% of total demand for nickel, cobalt, and lithium.

So what, precisely, is graphite?

Graphite is a grey, crystalline form of carbon that can occur naturally or synthetically.

With its high natural strength and stiffness, light weight and excellent conductive properties for both heat and electricity, along with the fact that it is cheap and plentiful, graphite is the best available anode material on the market and BMI considers it will still comprise 90% of the anode by 2030.

The only notable alternative material to graphite at present is lithium in metal form, called lithium metal. Although lithium metal has an extremely high energy density, is it a is very expensive substitute.

Currently, natural graphite is around US$$8,000-11,000 per tonne, whilst synthetic graphite is US$20,000 per tonne. In comparison, lithium carbonate is currently sitting at around US$70,000 per tonne.

Hence, this makes it a deterrent for most EV battery makers.

When comparing natural and synthetic graphite, each has distinct properties, along with advantages and disadvantages.

Natural graphite is mined, then processed into an end-use product in ceramics, renewables, and battery market.

The initial processing starts by separating the graphite rich flakes from the heavier waste rocks. This can turn the graphite content from around 5% to approximately 95%.

However, in order for the graphite to be suitable for the battery industry, it must be refined to 99.5+% purity, and ground up into a specialised form known as spherical graphite.

Natural graphite is primarily mined in China, Brazil, Mozambique, Russia, and Norway.

Synthetic graphite is produced by utilizing fossil fuel industry byproducts such as petroleum coke, needle coke or coal tar pitch, and then converted into graphite through a process known as graphitization. Depending on the purity of the feedstock, purification may not be required.

From a performance standpoint, EV automakers prefer synthetic graphite due to its superior battery longevity and fast charge turnaround.

Another benefit is the ease at which synthetic graphite can be refined to a high purity compared to that of natural graphite.

However, due to its power-intensive processes that require heating at approximately 2500 degrees Celsius, synthetic graphite can leave a massive carbon footprint, with every 1 kilogram currently produced in China estimated to pollute roughly 17 kilograms of CO2e.

Meanwhile, the production process of converting natural graphite to its final form for the anode material of the EV battery requires less energy. It is also cheaper, with natural graphite being roughly half the cost of synthetic graphite.

The responsibility lies with EV manufacturers to figure out a way to balance the cost-efficiency of natural graphite and the high-performance of synthetic graphite.

China currently dominates the global graphite sector, producing 64% of the mined natural graphite, 69% of global synthetic graphite and 100% of the global spherical processed per annum.

In the US, there is no graphite production and they have historically imported 100% of its EV battery grade anode materials. While the U.S. can obtain natural graphite from Canada, Canada only produced 8,600MT in 2021 – a minuscule amount compared to China and Brazil, with those two countries producing 68,000MT and 30,000MT respectively in 2021.

In Europe, the only notable producing graphite countries are Russia, Ukraine, and Norway – and with the turbulence resulting from the Ukraine conflict likely to continue into the foreseeable future, the natural graphite importation from this region into Europe is shaky. This leaves Norway as Europe’s only safe bet; however, like Canada, they produce far less than what is required.

Both Europe and the U.S. have also made their intentions clear that they want to shift from a Chinese-based supply chain.

And with difficulties and sovereign risks in the large deposits of graphite in Africa, Europe and the U.S. will continue to produce a large amount of synthetic graphite.

When looking at two ASX-listed graphite companies operating in the U.S., Syrah Resources (ASX: SYR) and NOVONIX (ASX: NVX), their valuations have followed two completely different trajectories this year. While Syrah’s share price has risen by 30% year to date, NOVONIX has seen its share price fall by 80% for the same period.

Given NOVONIX’s US-based operations ostensibly carry less risk than Syrah’s mine in politically unstable Mozambique, this disparity is surprising. Even more so considering the great strides being made by the U.S. to shift away from Chinese supply chains, with the Biden administration pouring trillions into the sector in the form of loans and grants to persuade U.S. based companies to produce locally.

NOVONIX is also looking to eliminate the carbon emission issues traditionally associated with the production of synthetic graphite, having superseded the traditional open-pit mines with the development of an enclosed furnace that operates at lower temperatures, making production quicker, more energy efficient and less polluting.

With China’s stated goal to reach 25% of global EV sales by 2025, the price of graphite should be surging.

So why isn’t it?

A lot of it relates to the fact that graphite is also a key component in traditional applications such as crude steel production. In the first seven months of 2022 – as continuous COVID lockdowns in China dampened the production output on construction sites – global crude steel production fell by around 6% year-on-year. This in turn resulted in a similar decrease in graphite demand for traditional steel-related applications such as refractories for natural graphite and electrodes for synthetic graphite.

According to S&P Global Commodity Insights, the weakened demand pressed down the benchmark spot-market price for coiled sheet steel by more than 20% from the start of July through to the end of September.

And as graphite’s traditional applications represent about 75% of the total natural graphite demand, it was no shock to see sluggish conditions in the graphite market.

However, cross-commodity price reporting agency Fastmarkets is forecasting consumption of natural graphite in the battery sector will rise to be on par with the amount used in the refractories sector in 2023, and to far exceed it in 2024.

By 2025, the natural graphite consumption in batteries is expected to exceed consumption from all traditional uses combined. It is also important to note how global projection figures expect demand for natural graphite to outpace that of synthetic over the remainder of the decade.

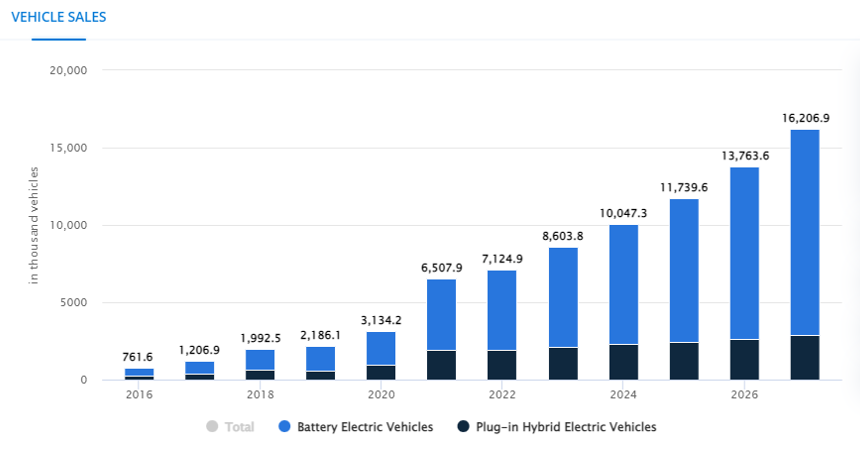

Source: ‘Electric Vehicles – Worldwide,’ Statista.

There is no doubt that graphite has been overlooked and undervalued within such an emerging sector.

However, with the Fastmarkets forecasts, in concert with the recent easing of China’s major lockdowns, the demand for the commodity should continue to strengthen from this year into the foreseeable future.

China’s reopening of its vast economy has already seen the prices of commodities exposed to the Chinese property sector rally – such as copper, steel, and aluminium.

And in the wake of the expected surge in the demand for graphite, as evident with coal companies last year, this increase in its price will lead to new graphite mines opening, as well as existing graphite companies expanding their operations to meet the ongoing demand.

However things pan out it will be an interesting and exciting year ahead for companies operating within the graphite space, even more so should the underlying price of graphite surge like lithium before it.