by Wendy Chen – Senior Investment Analyst

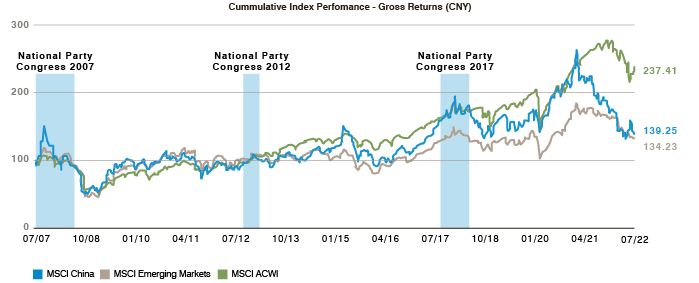

2022 started on a muted tone for China following a 22% and 50% dive, respectively, for the MSCI China index and KWEB (a proxy for China internet stocks listed in the US) during the regulation tightening cycle in 2021. Amid mounting concerns about the country’s stance amid the Russian-Ukraine war, China indices hit an all-time-low, though this was quickly followed by the highest trading volume and price rebound for one day following the encouraging speech from Vice Premier Liu He. Trading in the second quarter was dominated by reopening excitement as Shanghai stepped out of lockdown in June, though the third quarter saw positive sentiment fade as pandemic restrictions resurged. Negativity peaked at the commencement of the National Party Congress (NPC) in October with another all-time-low for the market. Yet the historic V-shape trading day repeated itself as the market’s initial negative reaction towards President Xi’s sweeping victory was quickly overtaken by optimism about a policy easing cycle to boost economic growth under the new leadership. This pattern of outperformance also coincided with our historical observation of Chinese equities’ relative strength following the Party Congresses.

Figure 1: China equity performance (July 2007-July 2022)

The fourth quarter marked the inflection point

China surprised the street with an early conclusion of its three-year Covid-zero policy, with a full domestic relaxation of Covid restrictions on 7 December and international travel restrictions dropped from 8 January 2023. Such a drastic U-turn before the end of winter was beyond the market’s best expectations, as even the positive consensus predicted an easing of domestic Covid restrictions around April 2023 (following the 2023 National People’s Congress) and a broad reopening to the rest of the world expected only in the second half of 2023. In addition, most expected a zig-zag exit out of Covid zero to accommodate vaccination progress and medical resource building, hence such an abrupt reversal raised questions about the foundation of Covid policy decision making. In our view, the successful succession of top leadership paved way for a renewed policy cycle, while the expedited timing was likely boosted by both the sloping macroeconomic reality and unprecedented civil movements.

Trading China’s reopening in 2023

Initial hiccup from reopening: lessons from Asian neighbours

Markets welcomed the long-awaited exit from Covid-zero policy, with a robust boost to Chinese equities beginning in early December – the MSCI China index and KWEB index rallied 23% and 43%, respectively, in just over a month. As the Covid-zero and property deleveraging have arguably been the two major hurdles facing the Chinese economy and hampering investability, the one-step removal of Covid restrictions and gradual loosening of property restrictions have no doubt reshuffled investment sentiment into 2023.

Such drastic removal of all Covid-related restrictions amid the winter flu season and less-than-satisfactory vaccination led to mounting Covid cases across the country along with worries about a hospital run. Yet the peaking of Covid infections in China seems to be happening faster than most expected: most major Chinese cities are likely to reach the infection peak by 20 January, before the Chinese New Year season, according to data scientists’ models, backtested with Taiwan and Hong Kong data.

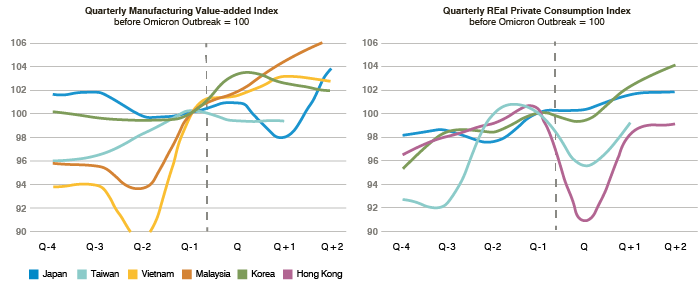

Despite the temporal impact on mobility and consumption from rallying infections, we find most investors are looking beyond the fourth quarter with a well-expected weak November and December. Looking at the reopening experience in other Asian countries, recovery from the consumption hiccup caused by surging cases is likely to occur within a quarter’s time (see charts below).

Figure 2: Reopening experience from Asia peers suggests smooth recovery on supply chains, while recovery from the initial hiccups on consumption amid rising cases is likely to occur within a quarter

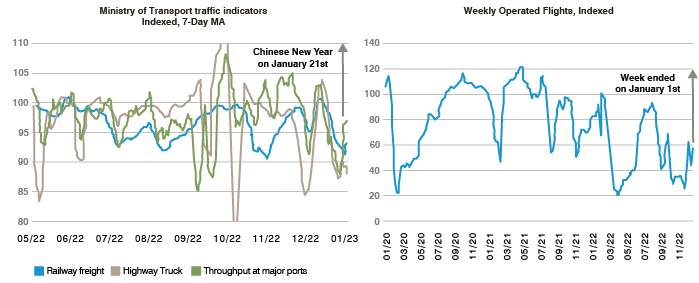

Moreover, the initial impact on supply chains, which is a greater concern for China and global trade, is not particularly visible from Asian neighbours’ experience. We expect the reopening to benefit logistics first as the traffic bottleneck is removed, followed by the resumption of the manufacturing industry as workers recover from infection, and then a revival of consumption and tourism as consumer mobility resumes, paired with an earlier kick-off of Chinese New Year promotions in late January. Although surging Covid cases and an earlier 2023 Chinese New Year than usual could affect consumption sentiment in the first quarter, mobility and logistics indices of major cities are rebounding swiftly, indicating a recovery is on track and leading to improved guidance for the second quarter (see charts below).

Figure 3: Heading into 2023, Chinese mobility started to rebound and is likely to exceed its previous height with the first unrestricted Chinese New Year

Return of consumerism: bottom-up driven

We see this round of consumption recovery upon China reopening to be more organic than stimulus-driven. Arguably, the past three years of mass Covid testing and restrictions on business activities have exhausted room for fiscal policy, which means a lower likelihood of dispatching consumption vouchers, as we witnessed in Hong Kong. While the real estate stimulus policy is gradually being rolled out by central government, the consumption boosting missions are likely to be handled at a local level, with local authorities no longer needing to waste fiscal capacity on meeting Covid related KPIs. The People’s Bank of China may remain accommodative in the early stage of reopening, but is likely to gradually become more mindful of reflation risks.

The return of China’s growth story is likely to keep its interest rates and stock earnings up and support the currency, the RMB. The repair of investor sentiment seems to be underway, with HK and China equities having leaped significantly since early December. The feast is not just for Chinese equities: even before China officially announced its reopening, global stocks that are exposed to Chinese consumers and tourists, namely Hong Kong consumption, Macau gaming, ASEAN tourism and Japan tourism, already saw the trough and rally pattern in November before the Chinese market did, anticipating the boost from one of the world’s largest consumer groups being unleashed after three years of border closure.

Click here to view the Disruptive Strategist newsletter in full.