by Robert M. Almeida – Global Investment Strategist / PM

In Brief

- Soaring policy rates have made cash a competitive asset again, prompting an overdue de-rating of risk assets.

- But just because yields are higher, that doesn’t mean risk is lower.

- The recent shift from yield-scarcity to abundancy is exciting, but one that needs to be approached carefully as higher rates make the operating environment more difficult and economic and financial stress comes with the territory.

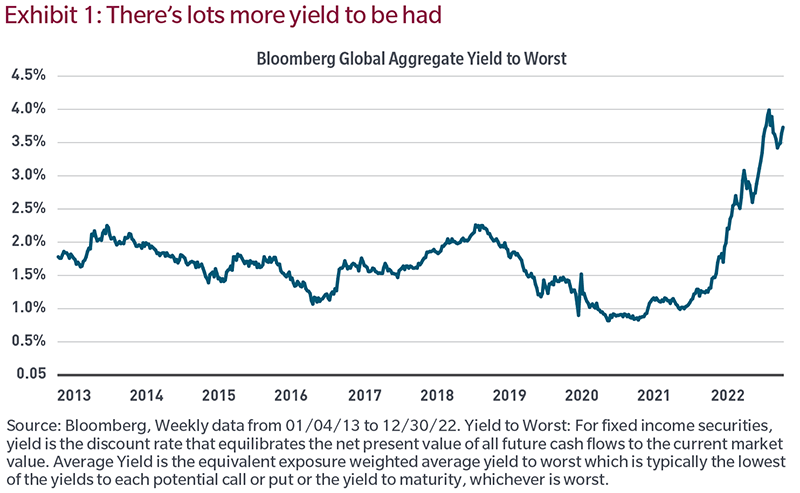

Years of weak economic growth and quantitative easing caused interest rates to compress, creating a scarcity of yield throughout the 2010s. However, all that was reversed last year as central banks belatedly took action to contain stunningly high levels of global inflation.

Soaring policy rates resulted in cash becoming a competitive asset again, which in turn prompted an overdue de-rating of risk assets. At the same time, higher sovereign bond yields combined with wider credit spreads creating an abundance of yield.

A coming shift in focus

Whether inflationary pressures decelerate more slowly or quicker than expected, central banks are moving closer to peak overnight rates. And from our perspective, the combination of relatively high yields and normalized credit spreads has made fixed income quite attractive. So much so that the multi-sector income portfolios that I manage are overweight fixed income and underweight equities.

However, as 2023 progresses, we expect the market’s focus to shift from inflation, interest rates and duration fears to concerns over the slowing global economy, earnings, profits, bond defaults, bankruptcies and the like.

And just because yields are higher, it doesn’t mean risk is lower. The business environment has changed in many ways over the past few years. For example, from a cash flow generation standpoint, the most acute and obvious challenges are higher interest expense and labor, both of which dramatically lower the profit calculus.

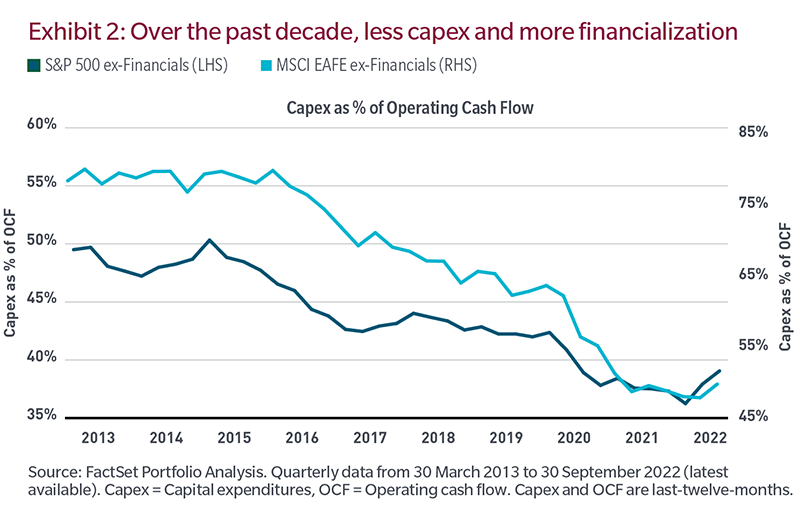

Less acute, but no less important, is what we believe will be rising capital intensity that will add to the list of business challenges.

Taking a step back, the economic stagnation of the 2010s was a function of corporate savings exceeding investment. Given the low-growth environment, companies diverted capital away from productive projects to financialize returns through higher dividend payouts, stock repurchases and mergers and acquisitions. At the same time, globalization allowed companies to outsource production to lower-cost countries, further driving up profitability. All this resulted in a global fall in capital intensity throughout the decade, as illustrated in Exhibit 2.

But the world has changed. Customers, employees and investors are demanding different behavior from companies in many areas. Among them are greater respect for the environment and supply chains that respect human rights. Simple steps to reduce greenhouse gases require capital, not to mention the considerable costs associated with updating 100+ year-old electricity grids and large, costly green projects. And moves toward deglobalization and onshoring will require capital. In our view, years of underspending will turn into years of increasing spending. And all of this alters tomorrow’s profit margin trajectory relative to the one of the 2010s and I don’t think investors have taken that into account.

What you see isn’t necessarily what you’ll get

The average yield on a US high yield bond is close to 10%. How many of those leveraged borrowers have projects that will generate a return above 10% in an environment of weakening demand, materially higher-operating costs and increasing capex? Under those circumstances, companies that are able to acclimate themselves to a higher interest rate environment while outearning their elevated capital costs will tender for their cheaply priced bonds, while those that are unable to do so will likely default. As a result, those 10% yields may prove ephemeral. In other words, they’re “fake yields”.

The shift from yield-scarcity to abundancy is exciting, but one that needs to be approached carefully. The intent of higher policy rates is to reduce inflation and aggregate demand. Put simply, higher rates make the operating environment more difficult for companies and economic and financial stress comes with the territory.

While corporate leverage ratios and interest coverage look “normal” today, that is in large part a function of elevated trailing profits. And I don’t believe that’s the right way to think about it. Debt and financial leverage matter most when the balance sheet is stressed. As profits and margins reset lower, the timing and magnitude of which I’m uncertain, we think there will be financial stress and credit events. As a result, weaker enterprises who took on more debt than they can handle may fail to deliver their promised bond yields.