by Karen Chan – Portfolio Manager

A Case for Continued Allocation to Private Growth

An often asked question is where investors should deploy capital in 2023. Despite the global macro environment, geo-political tensions, volatile public markets and recessionary fears, the first few months of the year has seen some green shoots boding for more positive sentiment. It is possible that recessionary fears may be averted or a softer landing within reach with equity markets posting strong gains in January (ASX 200 up 6% and NASDAQ Composite up 10.7%), the Reserve Bank of Australia indicating inflation has likely peaked, global central banks expecting to reach peak rates in the coming quarters, China emerging from its zero-COVID policy, and Europe experiencing a milder winter than expected. There is even talk of the IPO markets re-opening!

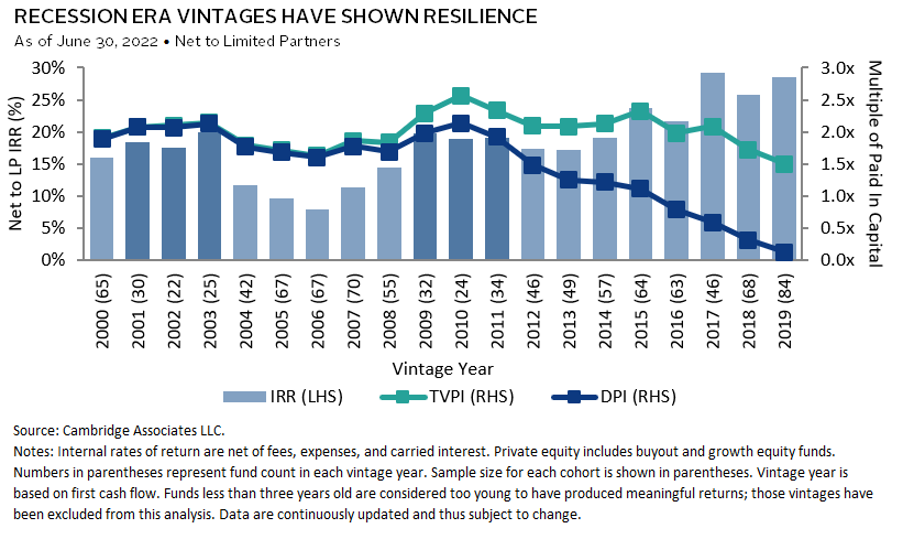

The rate environment has changed dramatically since 2022 with the RBA cash rate reaching 3.35% in February after 9 successive hikes and similarly, the Federal Reserve raised its cash target to 4.5% – 4.75%, a level not seen since 2007. These levels while much higher than what we have been accustomed to, is really a return to a more normal world where there is a cost to capital. Against this backdrop, some investors are tempted to diversify away from private growth assets into other asset classes. However, in our view, considered portfolio construction ensures better performance over a longer horizon. In the longer term, a diversified portfolio including private assets as well as executing a vintage diversification strategy will deliver higher returns with less volatility. Rebalancing during a downturn may have the unintended consequence of missing out on outperformance as asset prices recover. Decision making for capital allocators and investment managers may also be impacted by panic and fear of further losses, further compounding negative investment choices. Based on data from Cambridge Associates which considers private equity returns, post-recession vintages have outperformed on a number of different metrics such as the Internal Rate or Return (IRR), multiple of money invested which is represented by the Total Value to Paid in Ratio (TVPI) as well the capital that has been returned to fund investors following an exit, also known as the Distributed to Paid-in Ratio (DPI).

‘Alternatives’ and in particular, private growth assets provide low correlated returns and the current environment is conducive for sourcing outstanding investment opportunities. Provided there is a suitable entry price, later growth stage companies are also further de-risked as investment risk is more execution related given the capital raised is to further step-up growth, take market share or expand product offerings. The private markets is an area which is difficult to access for the average investor or even institutional investor who may need to rely on investment managers to help provide unique access through sourcing opportunities via their proprietary networks and deal with information flows which can be asymmetric.

Private valuations have also compressed throughout 2022 and this has become more pronounced in later stage growth companies offering a more attractive valuation entry point. According to recent Pitchbook data – in the US, capital demanded versus what was actually fulfilled reached new heights in 2022, particularly in late stage venture where the ratio was 3.5x, venture growth 2.5x and early stage is at 1.4x. This reflects a recent flight of capital from crossover funds and other ‘tourist’ capital providers as well as the inability of such companies to access public markets. This indicates the market has largely shifted to an ‘investor market’ where investors have the ability to set terms as the ‘private for longer’ thematic is prolonged with a backlogged IPO pipeline.

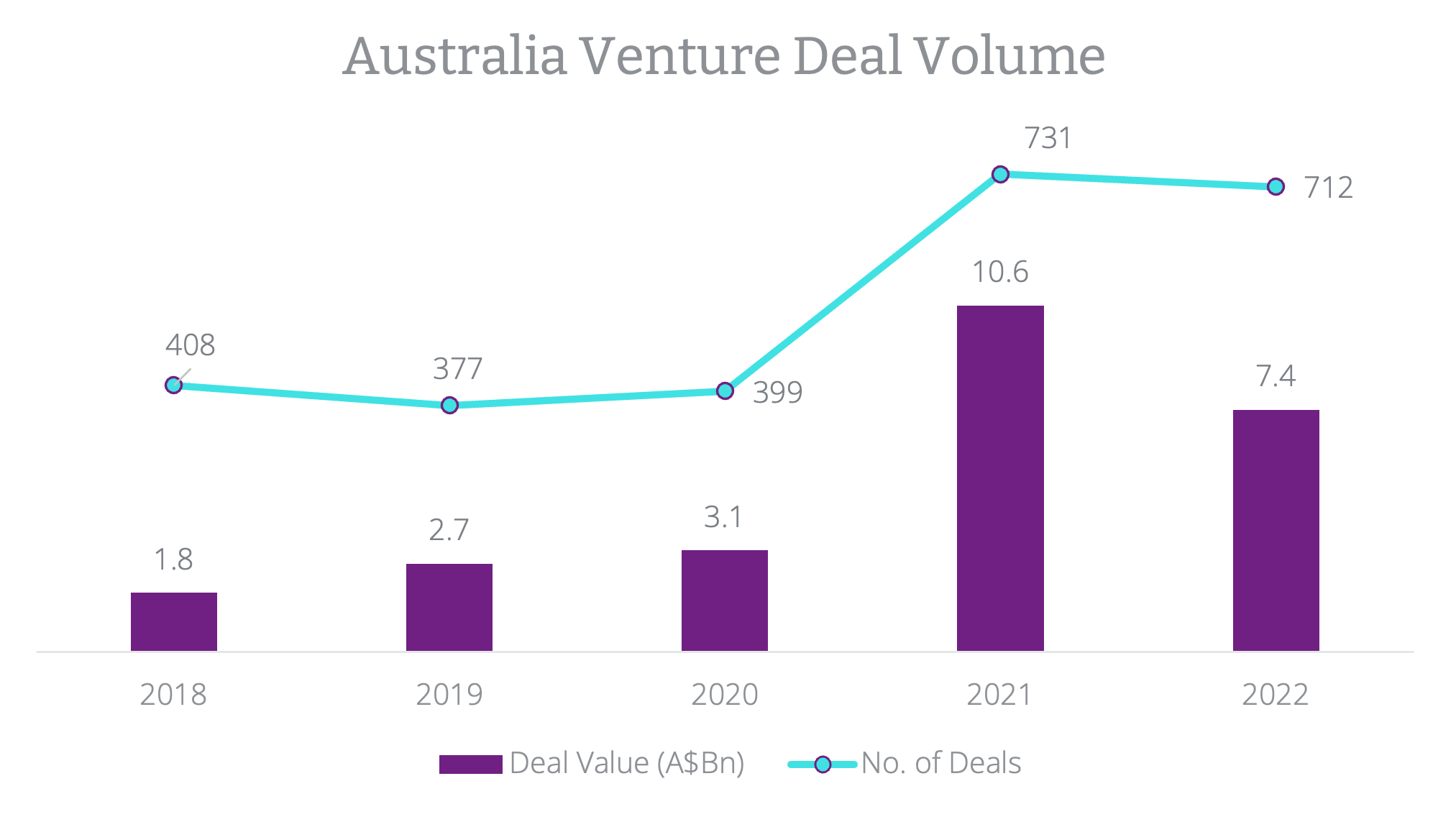

In Australia, we experienced similar trends. According to Cut Through Venture and Folklore Ventures’ 2022 State of Australian Startup Funding Report, the Australian market saw 712 announced deals and A$7.4bn funded. While there was a 30% drop from 2021 based on deal value, funding levels were materially higher than each of the years from 2018 to 2020.

Source: Cut Through Venture and Folklore Ventures’ 2022 State of Australian Startup Funding Report.

While this demonstrates a robust ecosystem with over 800 investors participating in funded deals, international investors who were active in 2020-2021 were noticeably absent. Median deal sizes (serving as a proxy for valuation changes) at the Angel/Pre-seed, Seed and Series A stage were -19%, +20% and +20% respectively, while Series B median deal sizes fell by circa 30%. Despite this data, more than 30% of Australian investors surveyed indicated that valuations have decreased by 30% or more. As we shift to a ‘buyers market’, we are finding that the pipeline is still one of the strongest we have ever seen and quality companies continue to be funded. The difference is that investors now have more time to conduct proper diligence to make a decision, face less competition and no longer have to chase sky high valuations but can set appropriate valuations and terms enabling companies to focus on rational and sustainable growth.

Further, history has shown that great companies can be founded or thrive through difficult times such as immediately post-GFC, with the likes of great companies like Airbnb (2008), Uber (2009), Slack (2009), Square (2009) and Whatsapp (2009) emerging. Where capital is not free-flowing and sentiment is mixed, companies need to buckle down and focus on product market fit, return on investment (ROI) on each dollar spent and unit economics. Investing is hard and the founders and management teams we back face the same challenge of how they allocate their dollars into the areas which provide the best return for their shareholders. Now is the time where we will see the best companies emerge as the era of free capital disappears. For example, Amazon (1994) listed in 1997 and saw its value erode by 90% from the peak during the dotcom bubble but emerged stronger from the public market rout as it transitioned to profitability in the fourth quarter of 2001 and continued on its strong growth trajectory. Closer to home, Atlassian was founded in 2002 just after the dotcom bust and grew profitably and sustainably before taking its first outside capital in 2010.

At Perennial Private Investments, we will remain invested in the private markets and view 2023 to be a great vintage year for investors who can find trusted managers who demonstrate a ‘through the cycle’ playbook such that they:

- Have an edge through unique deal access or information

- Conduct robust due diligence to identify the highest quality teams solving massive problems

- Exercise entry price discipline

- Lean in to provide portfolio support to navigate through uncertain times