A-REITs are not investments typically associated with ESG investing, yet more and more REITs are promoting their ESG quality. It is worthwhile understanding the ESG performance of REITs.

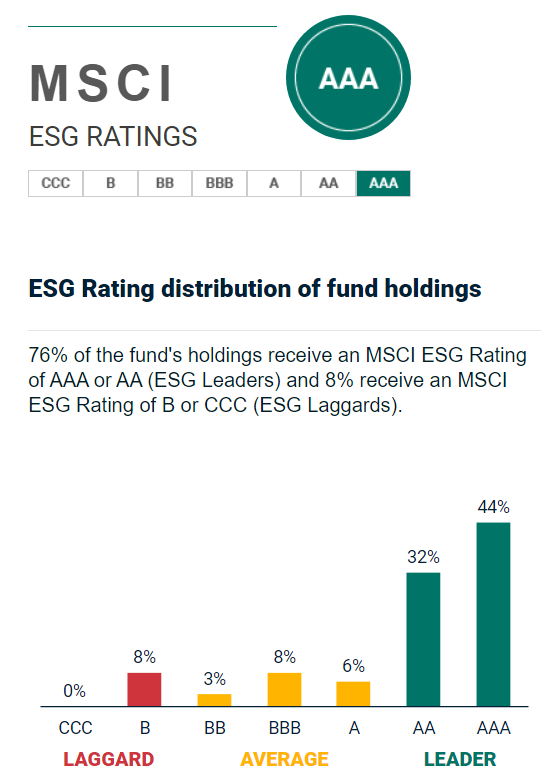

We examined the ESG aspects of the A-REITs in the VanEck Australian Property ETF (ASX: MVA). 76% of the fund’s holdings receive an MSCI ESG Rating of AAA or AA (ESG Leaders). It’s important to note that the index that MVA tracks does not take ESG factors into consideration. MVA itself is not an ESG fund and therefore does not screen for ESG securities.

Source: MSCI

On a high level, most A-REITs companies have done well from the environmental perspective. According to CLSA’s research, employee engagement and opinions are becoming key considerations for the social element. Lastly, governance is actually the key for the sector – the leading ESG researcher Aaron Yoon found that high-ability managers are able to allocate resources to ESG in a way that enhances shareholder value, using MSCI ESG Ratings and Glassdoor employee ratings of senior managers as signals[1].

E

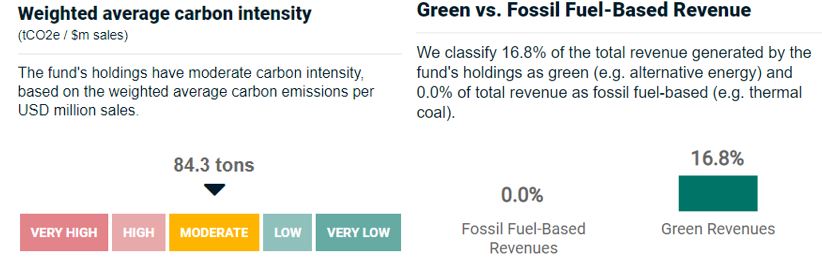

By the MSCI ESG Carbon Metrics, the weighted average carbon intensity of MVA is 84.3 tons per USD million sales, which is considered moderate. The constituents have no exposure to fossil fuel-based revenues, and 16.8% of the total revenue is generated from green or alternative energy, i.e., from energy efficiency, green building, pollution prevention, sustainable water or sustainable agriculture.

Source: MSCI

The fund is also in line with the Paris agreement’s goal of limiting global mean temperature increase to below 2°C in the year 2100, compared with pre-industrial levels.

On the stock level in the large-cap space, Goodman, Mirvac and Dexus are stand-outs as they have achieved carbon neutrality in 2021 through sourcing renewable electricity and purchasing carbon offsets. In addition, Mirvac, Dexus and GPT have also made the most significant effort in terms of reducing emisson intensity in the past two years.

| CHC | GMG | MGR | DXS | GPT | SGP | VCX | SCG | |

| Carbon Neutral Target (Net Zero) | 2030 | 2025 | 2030 | 2022 | 2024 | 2028 | 2030 | 2028 |

| Carbon Neutral achieved | n/a | 2021 | 2021 | 2021 | n/a | n/a | n/a | n/a |

| % renewable energy | 74 | 65 | 84 | 100 | 40 | 25 | 8 | 19 |

| Emission Intensity (Scope 1 &2) | ||||||||

| 1yr change % | -10.5 | n/a | -22.9 | -21.5 | -16.7 | -9.7 | -8.8 | -7.6 |

| 2yr change % | -17.5 | n/a | -31.8 | -29.5 | -45.7 | -28 | -22 | -20 |

Source: CLSA. CHC = Charter Hall, GMG = Goodman, MGR = Mirvac, DXS = Dexus, GPT = GPT, SGP = Stockland, VCX = Vicinity, SCG = Scentre

S

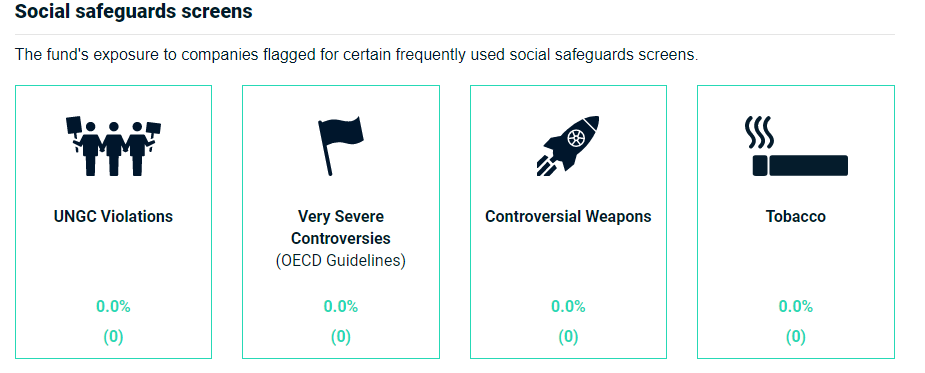

From the social perspective, MSCI provides social safeguards screens. As most investors would expect, the A-REITs sector has no exposure to the below segments that adversely impact societies in general.

Source: MSCI

Internally, employee engagement and opinions also provide some insights of how the A-REITs companies operate. By a simple average of the ratings from Seek and Glassdoor, results show Scentre and Mirvac have the most satistified employees, whereas Charter Hall and Dexus are the laggards.

On the other hand, Charter Hall has done well in retaining employees with the lowest staff turnover rate and the highest employee engagement over the past four years on average. Dexus, however has shown weakness in these two metrics. Goodman and Mirvac haven’t publicly disclosed relevant data, which should be improved.

| Staff turnover (%) | CHC | GMG | MGR | DXS | GPT | SGP | VCX | SCG |

| FY22 | 20 | n/a | n/a | 24 | n/a | 24 | n/a | n/a |

| FY21 | 16 | 6 | n/a | 18 | 22 | 17 | 23 | 18 |

| FY20 | 10 | n/a | n/a | 30 | 12 | 17 | 18 | 27 |

| FY19 | 18 | n/a | n/a | 21 | 18 | 21 | 17 | 19 |

| Employee engagement (%) | CHC | GMG | MGR | DXS | GPT | SGP | VCX | SCG |

| FY22 | 88 | n/a | 80 | 70 | n/a | 82 | n/a | n/a |

| FY21 | 90 | 80 | n/a | 71 | n/a | 83 | 61 | 85 |

| FY20 | 93 | n/a | n/a | 83 | n/a | 82 | 64 | 84 |

| FY19 | 87 | n/a | 90 | 81 | n/a | 83 | 68 | 84 |

Source: CLSA, company annual reports. CHC = Charter Hall, GMG = Goodman, MGR = Mirvac, DXS = Dexus, GPT = GPT, SGP = Stockland, VCX = Vicinity, SCG = Scentre

G

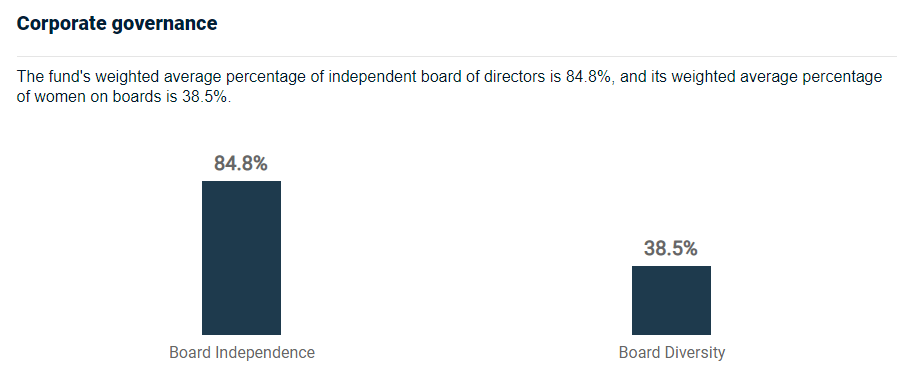

Governance is equally crucial, as good governance acts as a driving force in the company’s performance in environmental and social aspects. The real estate sector in Australia has done well in terms of the board independence and board gender diversity (above 30% threshold).

Source: MSCI

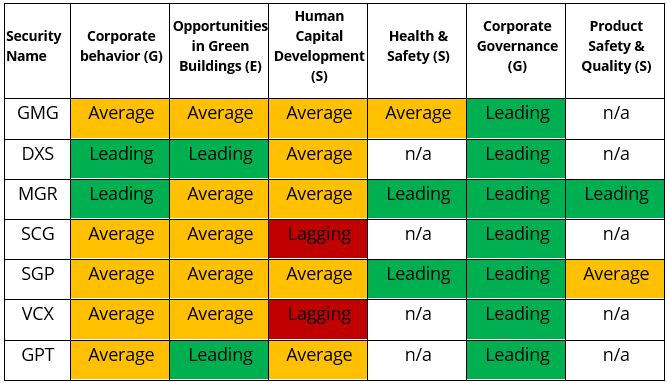

The following are key issues that are material to the real estate management & services industry. Compared to industry peers most A-REITs companies are leading and/or on par, apart from the human capital development segment for Scentre and Vicinity.

Source: MSCI. CHC = Charter Hall, GMG = Goodman, MGR = Mirvac, DXS = Dexus, GPT = GPT, SGP = Stockland, VCX = Vicinity, SCG = Scentre

From the global point of view, there are also evolving frameworks to help evaluate and improve the sustainability performance of real estate assets. For instance GRESB is an internationally recognised benchmark assessing the ESG performance of property sectors globally based on self-reported data. In its 2022 Real Estate Assessment Results, Oceania continues to lead the way, well ahead of the global average with a GRESB Score for the region of 81.

Source: GRESB

[1] Do high-ability managers choose ESG projects that create shareholder value?

Key risks

An investment MVA carries risks associated with: ASX trading time differences, financial markets generally, individual company management, industry sectors, country or sector concentration, political, regulatory and tax risks, fund operations and tracking an index. See the PDS for details.