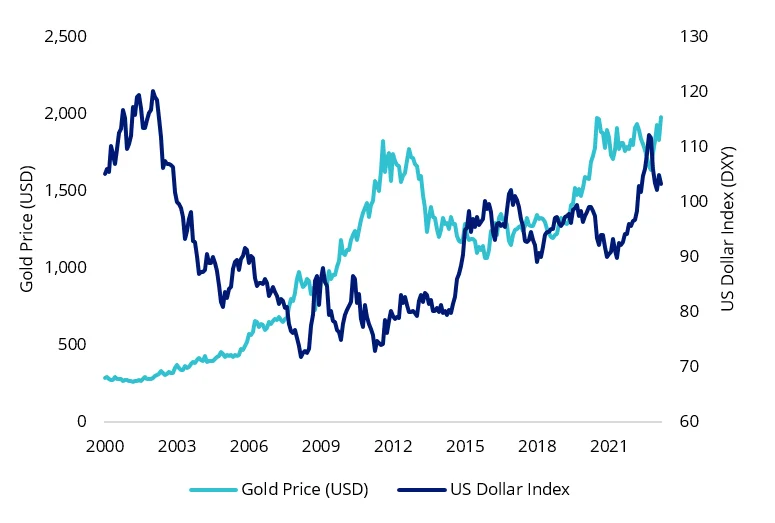

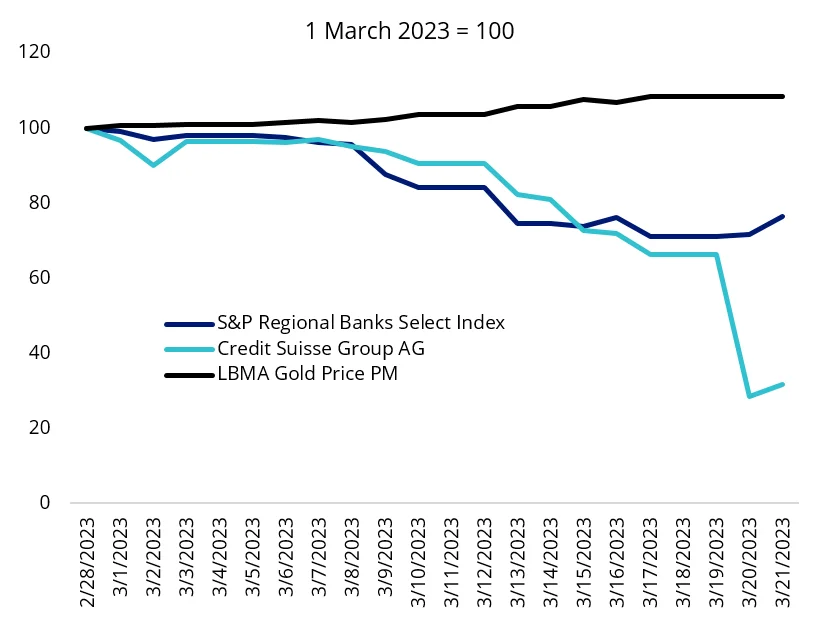

Gold’s safe haven appeal is back in force, as investors flocked to the yellow metal following the Silicon Valley Bank (SVB) collapse and Credit Suisse bail out, pushing gold prices up.

Chart 1: Gold benefitting from financial instability

Source: Morningstar, Macquarie Strategy, to COB 21 March 2023

Gold prices have also been boosted from the big drop in US government bond yields and a decline in the US dollar (as measured by the DXY Index). Lower bond yields reduce the opportunity cost of holding a metal that pays no income. A weaker dollar lifts the price of commodities that are denominated in the US currency.

Chart 2: Gold prices have also been boosted by weakness in the US dollar (DXY)

The Fed indicates that rate cuts are not in scope until 2024, contrary to what markets believe following the the SVB fallout. Our view is gold would be a beneficiary if the Federal Reserve (Fed) paused interest rate increases in response to problems in the banking system.

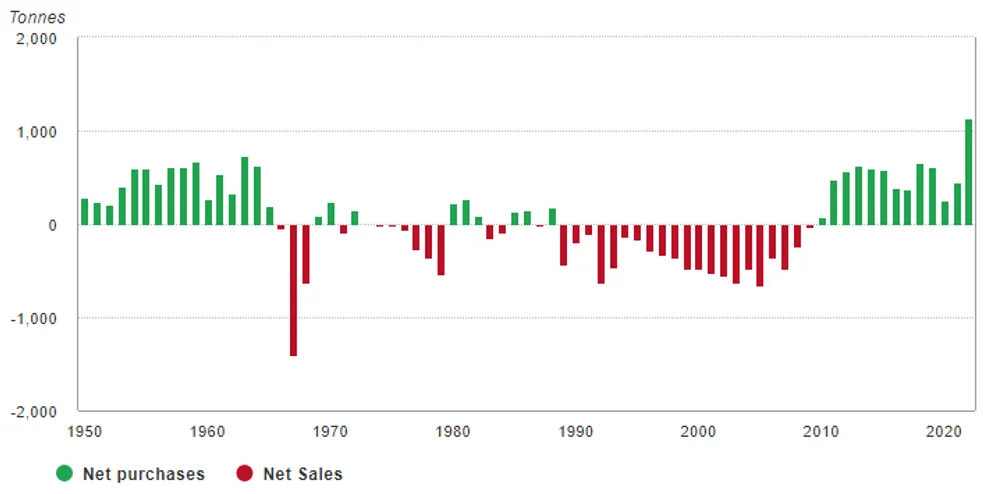

The World Gold Council recently said, though not without risks, a good case for gold remains in place for 2023 driven by: elevated geopolitical risk; a developed market economic slowdown; a peak in interest rates, and risks to equity valuations. In addition, continued central bank buying can’t be ruled out.

Central bank buying in 2022 was the highest on record.

Chart 3: Central bank demand for gold rose in 2022

Source: World Gold Council

It’s not just the gold price that has benefited from the current crisis in confidence.

Gold miners

Gold miners stand to benefit from the current instability as their balance sheets remain strong and they typically rise more than the gold price in an upswing. If inflation remains elevated for several years, the financial system will not be able to return to normal for an extended period. This could create a favourable environment for gold miners.

As gold equities have been underperforming the gold price over the past few years, gold equities remain historically cheap relative to the price of bullion.

Gold miners tend to outperform gold bullion when the price rises, and underperform when the gold price falls. This has been true this month, with VanEck’s Gold Miners ETF (GDX) returning 14.04% so far in March, compared to the 8.46% rise of the LBMA PM Gold Price.1 (All returns as at 20 March 2023, source LBMA, Morningstar.)

ETFs are an efficient way for investors to access gold investing.

Accessing gold with the specialists

VanEck’s global leadership in gold investing stretches more than 50 years, encompassing gold equites and bullion across ETFs and active funds.

Two ETFs for portfolio considerations:

- NUGG – accessing physical gold, that ‘delivers’

- GDX – investing in a diversified portfolio of gold mining companies

| VanEck Gold Bullion ETF (ASX: NUGG) | VanEck Gold Miners ETF (ASX: GDX) |

|

|

Below we outline the risks of each type of exposure to gold, owning gold bullion and owning gold miners:

Differences between gold miners and bullion

|

Gold bullion |

Gold miners |

|

| Insurance costs | Gold must be insured, as it can be stolen. | None |

| Storage costs | Gold bullion has to be vaulted in a safe location. | None |

| Correlation to currencies | High – The value of gold is priced in relation to the US dollar, therefore monetary, fiscal and – as we are finding out now – defence, policies, are a major contributor to the fluctuation in currencies and therefore gold. | Low to medium as gold miners are able to hedge their cash flows, thus mitigating the risks of currency movements. |

| Supply constrained / exploration | Mine output is dropping and ore grades are getting lower and lower. | Some miners are mining existing deposits. Some also explore and they may find gold, or there may be no gold. It might also be uneconomical to mine the discovered deposit. This is a risk of owning miners. It is worth noting that the rate of finding new gold deposits has been falling, therefore supply of new gold is finite supporting the share price of miners currently mining high grade gold. |

| Artificial ownership risks | High – There is more ‘paper’ gold than physical gold and these artificial securities, owned by banks and hedge funds, can distort the price of physical gold. | Low |

| Income | No | Miners pay dividends to investors |

| Management risks | Not applicable | Like owning any publicly traded company, The quality of management, is a risk of owning gold miners. |

| Correlation to equity markets | Low | Higher than bullion, especially during an equity market downturn |

| Regulatory risks | No | Miners are subject to the rules and regulations of the country of the location of their mines and of the country they are listed in. |

| Geopolitical risks | The price of gold may rise if investors are uncertain about geopolitical issues affecting global markets. | The price of gold miners may rise if investors are uncertain, however, they may also fall, especially if the geopolitical risk directly affects the gold miner or its mines. |

While each gold strategy has its merit for portfolio inclusion, you should assess all the risks and consider your investment objectives.

Key risks

An investment in NUGG or GDX carries investment risk. These risks vary depending on the fund and may include gold pricing risk, currency risk, custody risk, Australian sourced gold bullion risk, ASX trading time differences, financial markets generally, individual company management, industry sectors, country or sector concentration, political, regulatory and tax risks, fund operations and tracking an index. See the PDSs for details on risks.