The GDP growth target was set at 5%, but it undershoots market expectations. While growth is important, the government needs to balance out other policy objectives such as financial stability. Looking at the previous years of economic goal setting (excluding 2020 with no goal set, and 2021 and 2022 COVID underperformance), since 1996, 75% of the time growth was under-promised, but over-delivered.

Source: Xinhua news, ANZ Research

We think investors don’t need to be overly concerned with the lower-than-expected 5% growth target for this year. It should be seen as a base-line rather than a goal.

Source: Bloomberg

Among the leadership reshuffle, we think the newly appointed Premier Li Qiang generally comes across as pragmatic and pro-business. He expressed in the meeting the “unwavering support” for private enterprises to grow and thrive. This is potentially an upbeat signal for privately-owned businesses in China post the regulatory crackdown in the past few years.

Li said boosting domestic demand, a reference to consumer spending and business investment, would be the government’s top priority this year, while imports and exports would steadily increase. The government’s higher employment target for this year — of around 12 million new urban jobs — suggests that officials are paying attention to the unemployment issue, especially among younger workers. The growth of government-funded infrastructure investment, on the other hand, is likely to slow as new issuance of special local government bonds is forecasted to be lower than expected.

The People’s Bank of China (PBoC) Governor Yi Gang was reappointed, enabling policy continuity amid risks of inflation, as the country continues it reopening. He was one of the first to warn the upside inflation risk back in April 2022[1].

Given the fallout of Silicon Valley Bank and the ripple effect on the broader US and European Financial sector, together with relentless central bank hikes in the US and Europe, we would argue that the PBoC is prudent not over stimulating the economy. Ultra-loose monetary policies during the pandemic years in the developed economies created sticky inflation problems, hence China’s central bank may take note and pause for now, to wait and see if organic recovery comes through to drive growth this year.

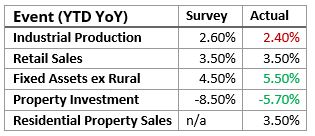

A slew of economic data has also been released for Jan and Feb 2023 (two months’ worth of data combined due to CNY holiday).

Fixed Asset Investment (FAI) and Property Investment started on a high note as a policy push came through and the property market stabilised, both above market expectations. In particular, the recovery in residential buildings sales (3.5%YoY in Jan and Feb vs. -28.3%YoY in 2022) is ahead of property investment (-5.7% vs. -10.0%). As reiterated by the Government Work Report in the Two Sessions meeting, Beijing is trying to engineer a stable transition towards a new development model while avoiding “disorderly expansion” of the sector. Being a major contributor to the country’s GDP, China’s real estate sector requires further stabilisation so that consumer confidence can recover, and people become more willing to spend money again.

All in all, we think sectors such as consumption, especially services-based such as travel and leisure, clean energy and domestic tech will continue to benefit from the reopening and structural tailwinds this year.