Decarbonisation is one of the great challenges of the 21st century, and electrification has risen as our weapon of choice to tackle the transition. The metal most synonymous with electrification is copper. From wind turbines to solar panels: when it comes to clean energy, copper is everywhere. Despite this, most experts agree that copper supply will fall short of 2050 net-zero targets. So, what’s going on?

1. The Copper Tsunami, Are We Prepared?

In an interview with Bloomberg, Freeport CEO Richard Adkerson was asked whether the current copper supply would be sufficient to meet demands in the long term. The answer? A simple “No”. Adkerson went on to explain that even if producers and recyclers attempted to increase output as copper prices rose, there would be no easy solution for the time it takes to develop or expand new and old mines.1

This is corroborated by the International Energy Agency (IEA), which states a single copper mine takes on average 17 years to go from discovery to production, presenting a significant question about the ability of suppliers to ramp up should demand exponentially increase.2

S&P Global Market Intelligence projected in 2022 that annual global copper demand will nearly double from 25 million to roughly 50 million tonnes by 2035.3 Last year, global copper mine production sat at approximately 22 million tonnes, short of even the 25 million tonnes of demand we saw in 2021.4,5 Forecasting for future growth, the supply and demand gap is likely to widen. Assuming mining output continues to grow at a rate of 2.69%i annually (as it has done for the past decade), global output will reach a mere 31 million tonnes, a far cry from the 50 million figure that we’d need as previously mentioned.

2. Mining Giants Sharpen Their Shovels

Global mining giants are fully aware of copper’s supply and demand dilemma ahead and have started making acquisitions aimed at shoring up their production of the metal.

BHP moved to acquire OZ Minerals in 2022, and has since received Brazil’s competition regulatory approval, meaning only a shareholders vote is left before the transaction is complete. Prior to the acquisition, BHP was the 4th largest producer of copper in the world, producing 1.6 million tonnes in 2022.6 The addition of OZ Minerals will immediately boost BHP’s copper production by about 7%, helping it rival Swiss commodities giant Glencore which currently sits at third place. On the reasoning behind their acquisition, BHP stated that growth in its “future facing” metals exposure was essential in capitalising on the global megatrend of decarbonisation and electrification.7

Rio Tinto, the world’s leading producer of iron ore, also made significant forays into copper in late-2022, completing its $3.3 billion acquisition of Turquoise Hill and giving the company a 66% stake in Mongolia’s Oyu Tolgoi, the world’s largest known copper deposit.8

Outside of acquisitions, both BHP and Rio have been aggressively offloading coal exposures from their portfolios since mid-2010s, with the intent of reducing their reliance on the waning future of dirty energy. These and many other moves by industry titans are sure-fire indicators of a global recognition toward the impending wave of copper and battery metal demand.

3. Copper Threatened by Rocky Geopolitics

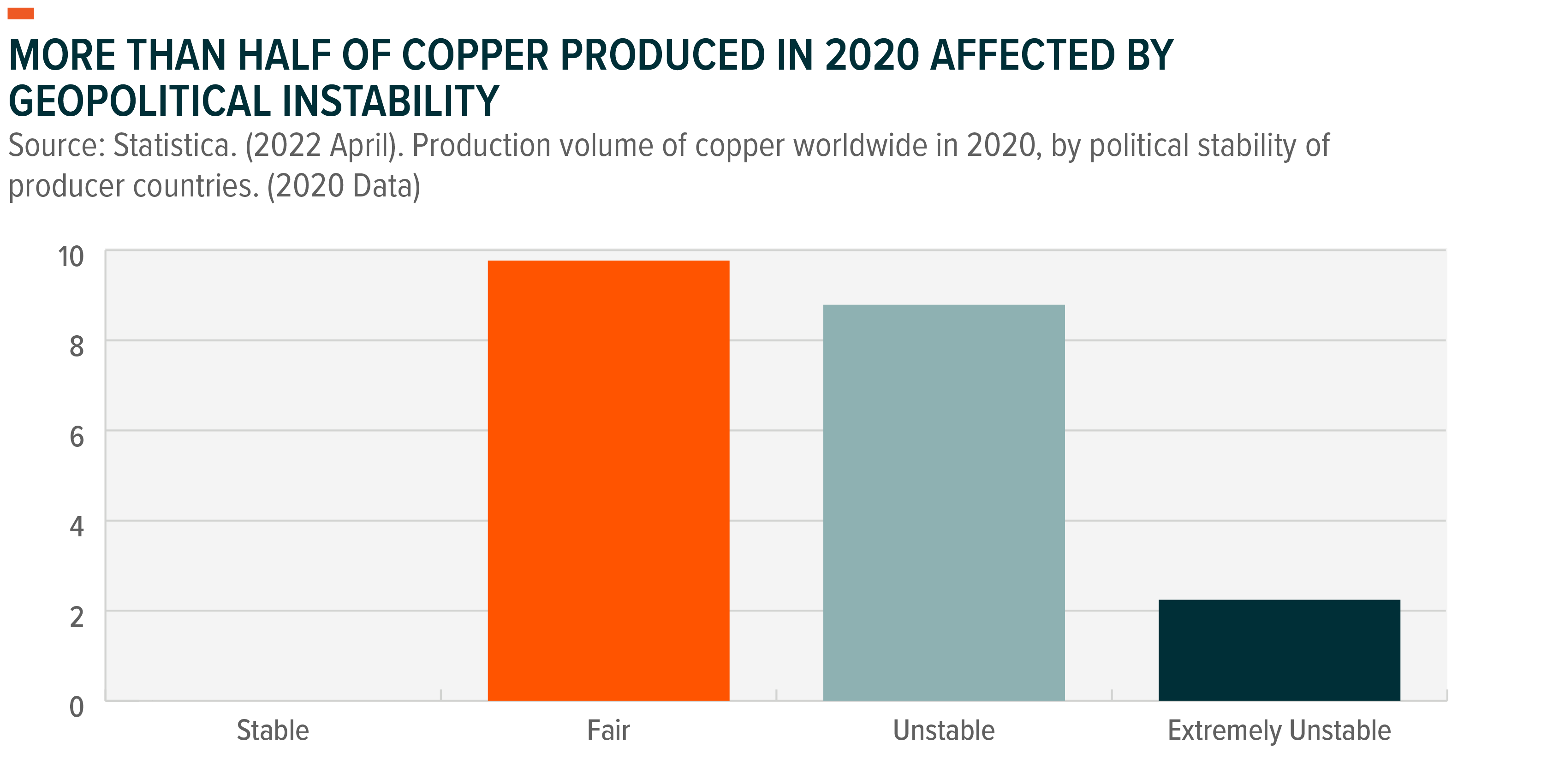

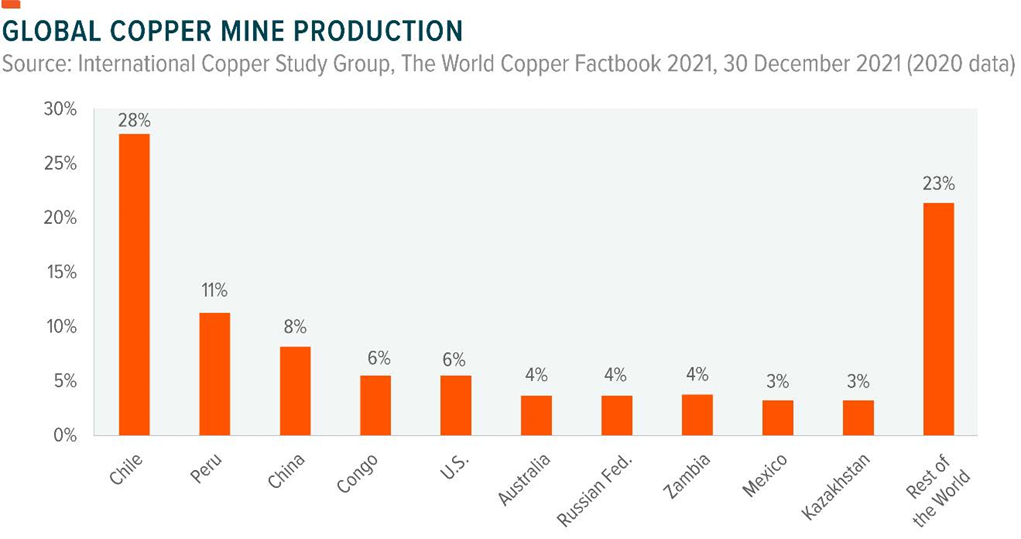

Geopolitics is a major contributing factor to the shortfall in global copper supply. This is highlighted in the below chart which shows the national stability of copper producing nations. Of the 20 million tonnes of copper produced in 2020, more than half were from nations categorised as “Unstable” or “Extremely Unstable”.9 As such, geopolitics should be a factor of consideration when contemplating the global ability to fulfil copper demand over both short and longer terms.

Since December 2022, Peru, the second largest copper producer in the world, has been rocked by political turmoil. The nation has experienced daily rioting, meaning supply chains across the country have been crunched. In January, experts estimated roughly 30% of Peru’s production was at risk.10 Multiple world-leading mines such as Glencore’s Antapaccay and MMG’s Las Bamba – combining for 2.5% of global copper output, were either shut down or restricted by protestor roadblocks.11 In the same week, copper prices rallied more than 20% on fears of supply constraint as China also looked to re-open.12

While the concerns in Peru have begun to subside, the disruptive effects of even a single nation’s upheaval cannot be overstated, and geopolitics remain an ongoing risk for global copper supplies in the future.

Investing in Copper, The Eternal Metal

Given copper has played an essential role in many of humankind’s greatest technological advancements. It seems fitting that as the world heads into a new age of clean and renewable energy, copper supply is a major concern that may affect the speed of our progress.

Still, there is a notable investment thesis for those looking to capitalise on the mismatched supply and demand dynamics. Copper miners and producers present a compelling opportunity for investors who wish to capture both the battery metals growth narrative and decarbonisation megatrend. As copper prices rise due to higher demand, miners stand to make higher margins for their produce. Investment in expansion and development will also naturally accelerate as the supply shortage becomes apparent, and producers will be motivated to innovate, potentially bringing even higher profits and returns.

Related Funds

WIRE: For those wishing to invest in the energy transition through copper miner exposure, Global X Copper Miners ETF (WIRE) provides a way to do so. WIRE provides access to a global basket of copper miners which stand to benefit from being a key part of the value chain facilitating growth in major areas of innovation such as technology, infrastructure and clean energy.