For a sector which has historically generally been less volatile than the broader equity market, listed A-REITs have not demonstrated that quality, at least over the last 12 months. In fact, whilst volatile the sector bias has been to the downside. Accordingly, it is probably a good time to have a look at the reasons why this is occurring to determine if there indeed is value in the sector and if so where that value lies.

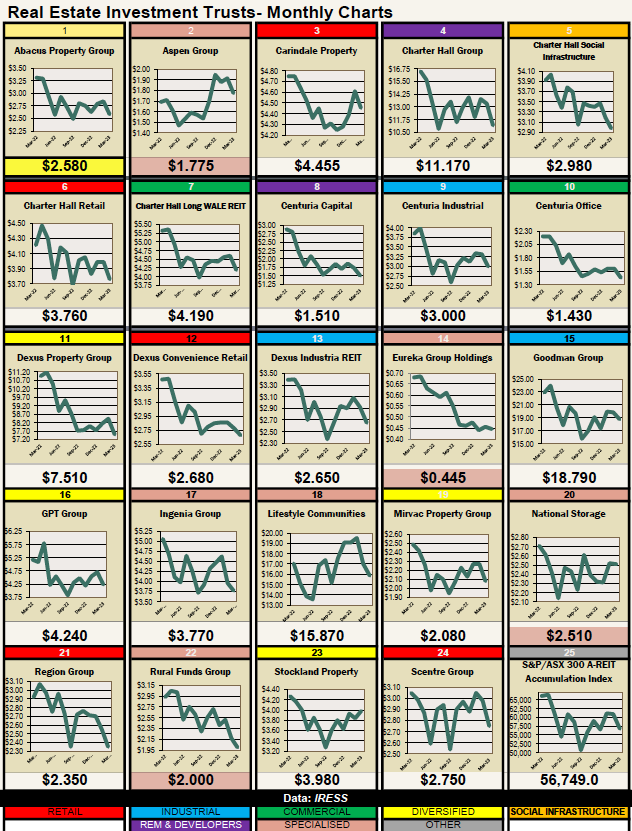

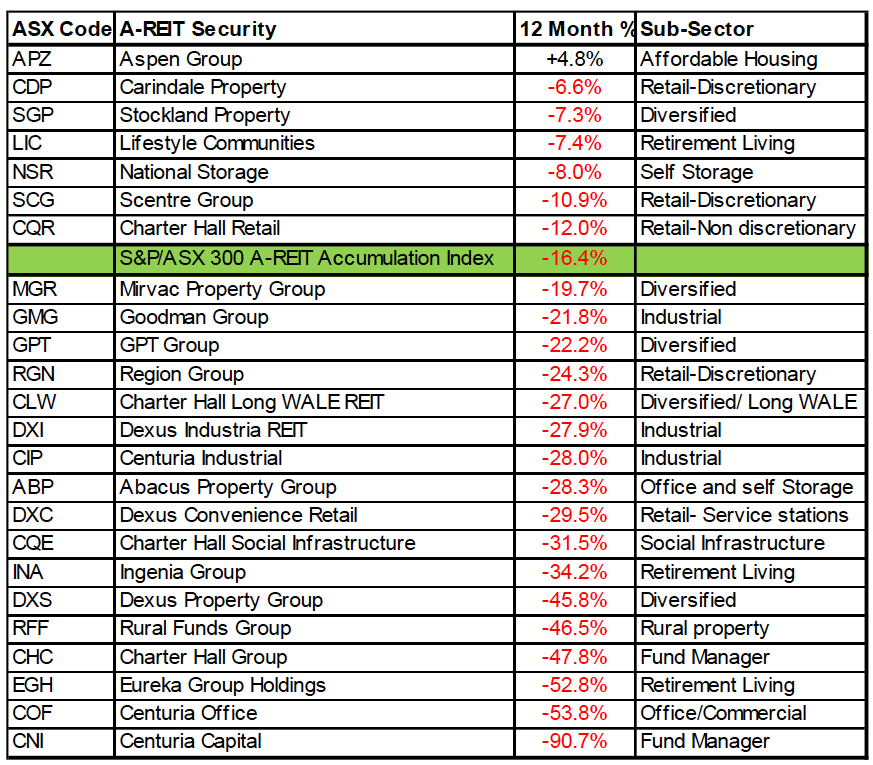

Please refer to the following Dashboard which displays the month end prices of 24 REIT securities as well as the S&P/ASX 300 A-REIT Accumulation Index, over the 12-month period ended 31 March 2023. Except for one security (Aspen Group-ASX: APZ) which ended the period higher (+4.8%), the remaining 23 stocks all ended lower as the benchmark Index fell 16.4%. Interestingly, only 7 stocks managed to beat the Index with the remaining 17 stocks performing worse. The appended table lists 12 month returns in descending order:

A closer examination of the data reveals that fund managers and REITs with exposure to office/commercial assets were amongst the worst performers over the year (Centuria Capital, Centuria Office and Charter Hall Group). Also, at the bottom of the table, Eureka Group Holdings undertook a capital raise and has traded below the issue price since the raise. Fund managers enjoyed a positive period of growth in the lower interest environment brought about by Covid. Having regard to the higher interest rate setting now in place, it is expected that property-focused fund managers will likely find it difficult to grow their business (funds under management). An additional Covid impact came from the “working from home” (WFH) aspect brought about because of several lockdowns. Whilst the number of employees who worked from home at the peak of the lockdown periods has diminished, physical occupancy of commercial office space is unlikely to resume to pre-covid levels. Accordingly, the demand for additional space from growing businesses appears to have eased somewhat, raising concerns regarding the outlook for rents. REITS exposed to commercial property have been punished by investors when adding to the mix that higher interest rate negatively impact on property valuations.

As a consequence of the RBA’s 10 increases in the Overnight Cash Rate in as many months, the market is pricing the REIT sector at a level which implies circa 20% declines in asset values. Hence the prevailing current discounts to Net Asset values. The problem with this assumption is that there has been little in the way of meaningful physical transactional activity to back up this conjecture.

In a continuation of the flight to higher grade buildings with greater tenant amenity, take-up for prime grade assets featured across Melbourne, Brisbane & to some extent Perth. Leasing activity in 1Q23 has remained relatively stable & physical occupancy of office space seems to be improving albeit market vacancy remains at historical highs. It appears that WFH is slowly abating in Sydney & Melbourne, with the latest unemployment rate remaining low at 3.5%. Having regard to cost-of-living pressures there remains the risk of recession & increased unemployment which would likely lead to rising/elevated vacancies & incentives. In spite of Perth’s prime net absorption, its prime vacancy rate rose 1.6% to 16.6%. Elsewhere in Sydney & Melbourne, both prime markets recorded 1Q23 incentive increases of 0.3%, to 34.8% & 39.6% respectively.

Expectations are that incentives will remain elevated given competition for tenants.

Summary

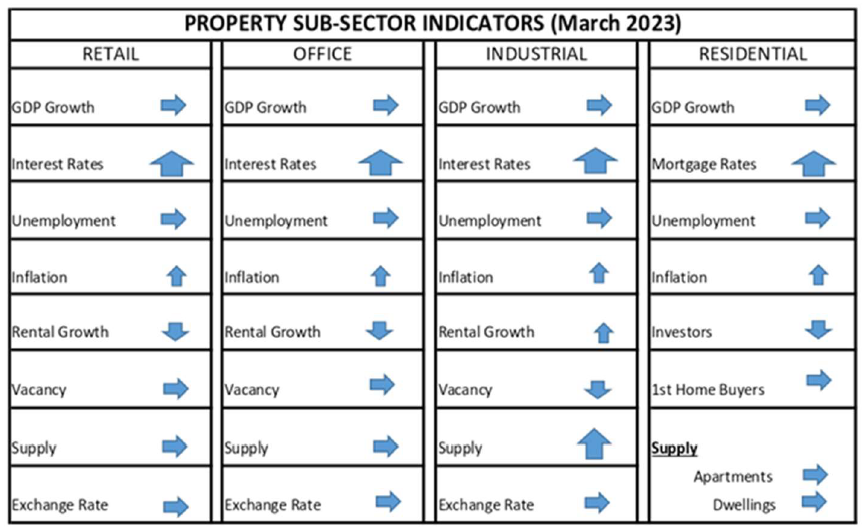

Until such time that interest rates stabilise, the sector will likely continue to remain under pressure. However, the underlying sub-sector asset classes are expected to behave differently.

Office

The small amount of transactional evidence indicates a 5% to 10% discount to book values with a lack of evidence for upper tier assets.

Retail

Transactional evidence indicates retail assets are trading close to book value.

Industrial

Ongoing demand for facilities providing sound sector support.

Whilst seemingly offering value in the A-REIT sector, investors seem to be sitting out of the market awaiting interest rates to settle as well as an increase in transactional activity, particularly in the office market. In the meantime, several opportunities in the non-tradional property sub-sectors offer relative value. These include seniors/retirement living, rural property and service stations. Lifestyle Communities (ASX: LIC), Ingenia (ASX: INA) and Eureka Group Holdings (ASX: EGH) are considered to offer value in the seniors living/retirement space. Rural Funds Group (ASX: RFF) for exposure to rural property and Waypoint REIT (ASX: WPR) and Dexus Convenience Retail REIT (ASX: DXC) for service stations.