by Simon Webber – Lead Portfolio Manager

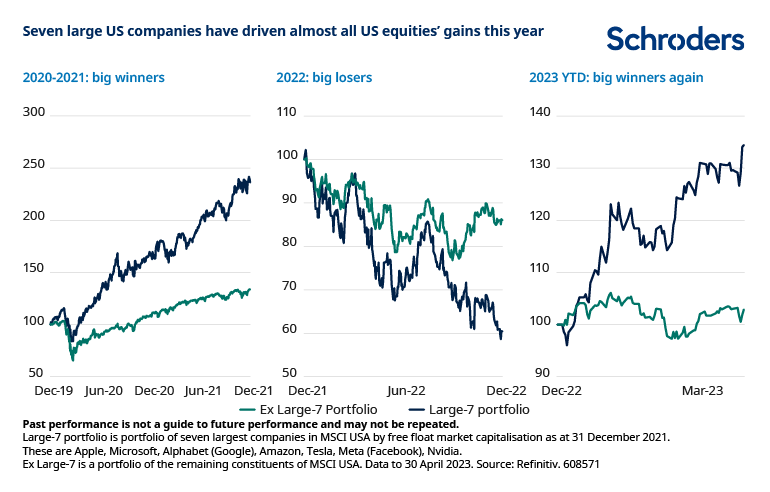

Big tech has enjoyed a resurgence this year. Seven large US companies (Apple, Microsoft, Alphabet, Amazon, Tesla, Netflix and Nvidia) have collectively returned 34% in the four months to 30 April 2023. Excluding these stocks, the remainder of the MSCI USA index has returned just 3%.

The Big tech stocks were “pandemic winners” in 2020 and 2021 amid strong demand for their products. They then experienced a difficult 2022 amid concerns over rising inflation and higher interest rates. That’s because higher rates mean their future profits and cash flows are worth less today.

Inflation is still elevated though, and rates have been rising so far this year, so what’s behind the renewed rally for US big tech?

The better performance can to some extent be explained by improving fundamentals, although it is a complex picture. Companies like Microsoft and Nvidia are enjoying very strong business trends. Those two companies are also thought likely to be clear winners of the generative AI revolution. Apple has also recently reported very resilient quarterly earnings, showing it is proving more robust than other more commoditised companies in the consumer electronics sector.

What’s more, following the pressures experienced last year, some of the other members of this group – Amazon, Alphabet, Meta and Netflix – have now discovered the merits of cost-cutting. There is lot of potential to take out costs in those companies following the huge hiring spree of the previous three years. This could be either through headcount reductions and in some cases by reducing the compensation paid to some of the expensive talent they have as the labour market softens.

So, we can say that fundamentals have been improving with regards to either the top line (i.e. sales/revenue) or bottom line (i.e. improving operating efficiency/cost-cutting to enhance profitability) for members of this big tech cohort. However, that’s not necessarily the whole story.

Part of what’s going on in markets is a growth rotation. The banking sector stress we have seen this year has been a catalyst for a rotation away from value parts of the market and back into growth stocks.

That’s because the bank stress is contributing to tighter lending conditions, alongside interest rate rises. If the Federal Reserve were to pause its rate hikes, that would reduce a headwind for growth stocks like technology.

This rotation has been a lot more pronounced in the US, which reinforces the view that it may well be to do with concerns over the economy and more cyclical parts of the market.