Australian investors love their bank hybrids. These sit between shares and bonds in a bank’s capital structure. This means that if the bank becomes insolvent, hybrid owners are paid after bond holders, but before shareholders. It also means, because of this risk, investors expect a higher return than bonds, but a lower expected return than shares.

Bank hybrids, are known as Tier 1 capital. Higher than them on the capital structure, but still lower than bonds are Tier 2 capital. Tier 2 capital is known as subordinated debt, because of its place in the capital structure you would expect Tier 2 to provide a lower yield than Tier 1, but it’s worth checking if the “1” is always higher than the “2”.

What is Tier 2 (subordinated debt)?

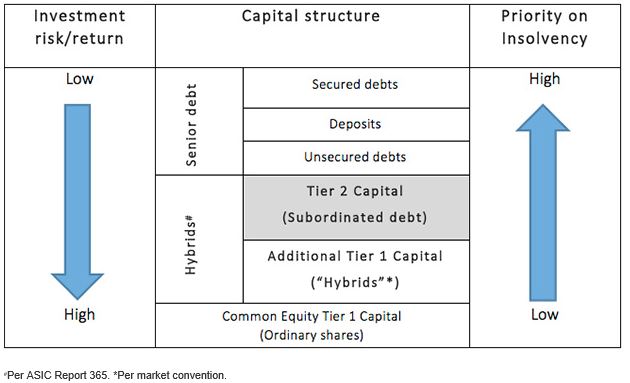

It is called ‘subordinated’ because it sits below ‘senior debt’ or traditional bonds in the capital structure, but it also sits above and takes priority over ordinary shares and Tier 1 (hybrids), in the event of insolvency. See the shaded area in Chart 1 below which provides a simplified example of the capital structure in a financial institution to illustrate how different securities issued by financial institutions rank in priority of payment in the event of collapse.

Chart 1. Simplified capital structure of a financial institution

You can see from the above chart that in the event of insolvency, priority is given to deposits and other senior debt. Shareholders get paid last, if at all.

Subordinated debt securities (also known as ‘subordinated bonds’) rank above ordinary shares and hybrids (additional Tier 1) but below senior debt, including traditional bonds, deposits and unsecured debt obligations. For this reason, subordinated bonds carry more risk than deposits and traditional bonds but are considered less risky than shares and other hybrids.

Two isn’t always higher than one, but it is now

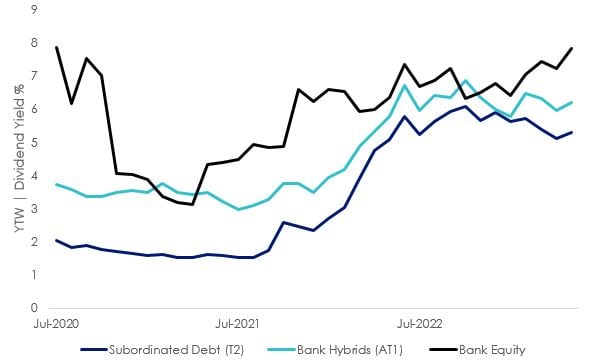

Right now, yields on subordinated debt are comparable to hybrids, despite its higher ranking in the capital structure. In other words, investors are potentially being rewarded (with higher yields) for less risk (higher in the order of insolvency).

The rising interest rate environment and corresponding increase in credit risk premium given the uncertain economic outlook has improved yields on corporate bonds. Australian subordinated debt yields are now similar to the 12-month trailing dividend yield including franking on Australian bank equity.

Chart 2: Yield comparison

Source: Bloomberg, Subordinated Debt (T2) as the iBoxx AUD Investment Grade Subordinated Debt Mid Price Index, Bank Hybrid (AT1) is an equally weighted basket of Westpac, ANZ, NAB, Macquarie and ANZ Additional Tier 1 Capital Securities live from March 2018, Bank Equity as S&P/ASX 200 Banks Index.

Subordinated bonds can now be accessed on ASX via the VanEck Australian Subordinated Debt ETF (ASX code: SUBD) and can be used to potentially enhance the return on the fixed income portion of an investor’s portfolio or as an alternative to Additional Tier 1 Capital securities.