Staying local carries risks

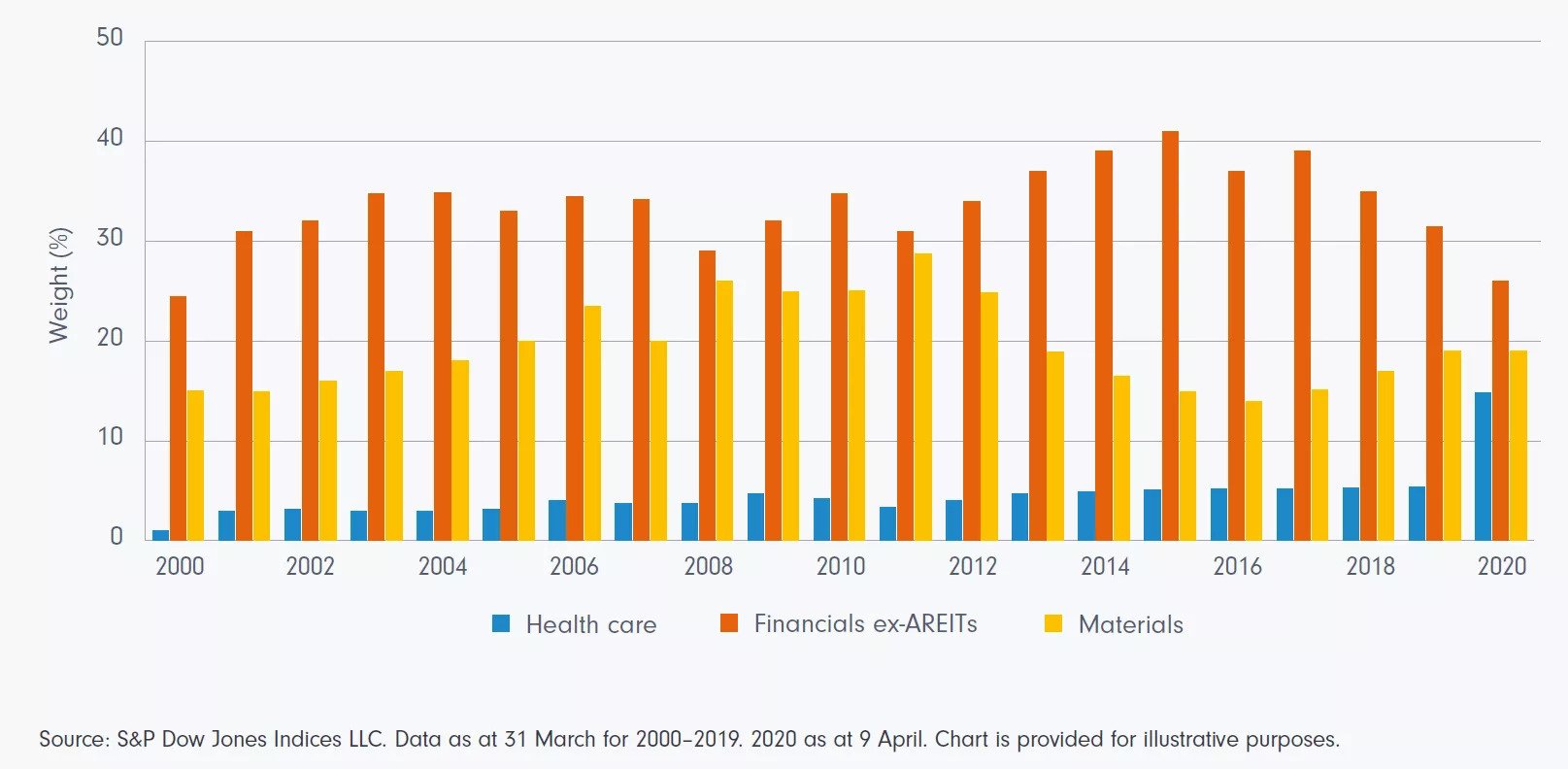

When it comes to success stories, the ASX includes many brands that have made their mark. Companies like BHP and Commonwealth Bank are among the largest in the ASX by market capitalisation. These businesses belong to two industries, financials and materials, that account for roughly half of the ASX by market capitalisation. 1

While healthcare now makes around 11% of the ASX 2002, a portfolio heavily weighted to Australian equities can carry concentration risk and limit diversification. These risks can be even more significant for two sectors vulnerable to regulatory change (financials) and trade (materials).

Top three sectors by weight in the S&P/ASX 200 from 2000 to 2020

And, while this relatively recent change in sector composition has helped to reduce concentration risk, if you only invest in Australian shares you will miss out on meaningful exposure to sectors such as telecommunications, media and technology (TMT) and consumer discretionary.

In the Fidelity Global Equities Fund3 some well-known large cap companies in those sectors we’re invested in include Microsoft, Apple, Amazon and Cisco. Likewise, the Fidelity Global Demographics Fund3 invests in well-known consumer goods companies such as cosmetic company L’Oreal and luxury brand LVMH, home to high-end luxury brands such as Louis Vuitton and Moet Hennessy.

Less-known quality companies benefitting from the growth of high-end domestic brands in Asia include Li Ning, which can be found in the Fidelity Global Emerging Markets Fund3. Li Ning is one of the leading sports brand companies in China and founded by world-class gymnast Mr Li Ning.

Investing offshore also gives you exposure to accelerating themes in ESG with the opportunity for long-term growth, such as companies in the Fidelity Sustainable Water & Waste Fund3. Demand for products and services in these areas is being driven from visible predictable mega trends such as climate change, urbanisation and population growth. Furthermore, it gives investors the opportunity to align to their ESG values by investing in companies aiming to create a cleaner environment.

Striking a balance between global and domestic

An allocation to both Australian and global equities can bring investors a broader choice of investment opportunities. Importantly, this blended approach to equities can also reduce volatility and enhance potential portfolio returns.

Because assets don’t always have a strong correlation to each other, global and Australian equities can both play an important role in diversifying the overall risk of the portfolio.

ENDNOTES

1 Source: ASX as at 27/08/21

2 Source: ASX as at 27/08/21

3 Holdings in these portfolios are correct as at 30/08/21 and are for illustrative purposes only and should not be considered a recommendation to buy those stocks