The buzz around the “metaverse” has gone into overdrive as the technology that could make it a (virtual) reality draws closer and internet giants make big bets on its success. But is it all it’s cracked up to be? And does it ‘meta’ for investors?

This time it could be different

We’ve been here before. Back in 2003, an application called Second Life promised a new way of living virtually, using avatars to shop and socialise digitally. While many big brands rushed to open virtual stores, Second Life never attracted more than a million regular inhabitants.

More recently, video games such as Fortnite and Roblox have created metaverses for their online players, and hosted virtual concerts featuring stars such as Ariana Grande and Travis Scott that have attracted many more attendees than in-person shows. One Korean tech company already has hundreds of millions of metaverse users.

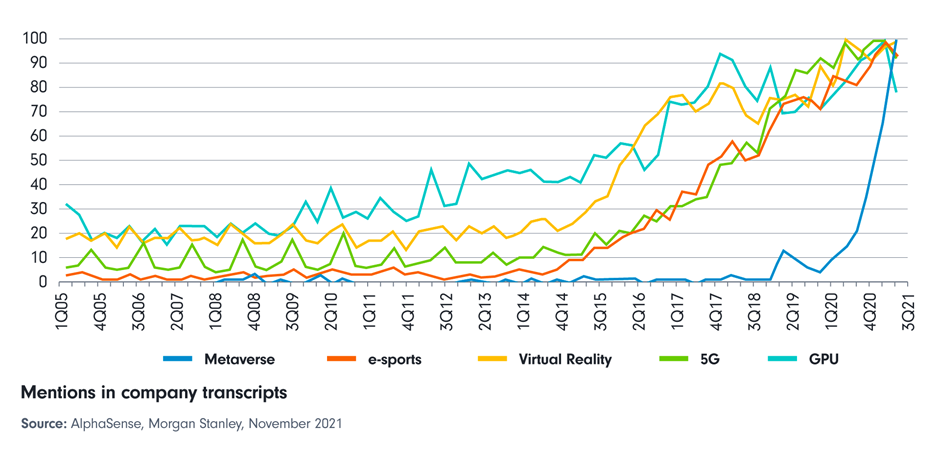

Now Facebook, which recently rebranded as Meta, is developing its version of the metaverse. The question is whether the site’s billions of users will embrace it. The current excitement, combined with a big increase in virtual socialising thanks to the pandemic, suggests it’s a possibility. Mentions of the metaverse in company meetings have accelerated at a far faster pace than that of previous technological trends (see chart 1).

The pull of its metaverse, Facebook hopes, will be the merging of the digital and physical worlds. Rather than consuming the internet through panes of glass, the metaverse will be accessed via high-tech virtual or augmented reality (AR) headsets that project realistic, interactive images onto your physical surroundings.

This world is ‘persistent’ which means that it continues to exist and develop even when there are no people interacting with it. Virtual reality (VR) headsets already allow people to immerse themselves in the digital environment of games, but now AR is taking this one step further by superimposing objects onto the ‘real’ world.

Why does this matter? Because while the metaverse may be overhyped over the short term, we think that over the long term it could well be the future of the mobile internet. Ten years ago, the internet evolved from something people viewed via a desktop web browser to an always-on mobile connection that was with you wherever you went. Now the metaverse will make the mobile internet jump out of peoples’ pockets and become a digital layer that can enrich and enhance the surrounding world.

The possibilities are endless. Consumers can use headsets to teleport to the Olympics, change the view outside their window to a Caribbean beach, or box with Mike Tyson. The metaverse will also bring to life the internet of things and could even issue its own money.

Back to reality

The potential may be impressive, but the technology needs to improve before the metaverse is widely adopted. AR headsets require enhanced computing power, battery life, projectors, and frame design to become commercially viable, and that will take time to develop.

There are also ethical concerns. Despite Facebook’s pledge that the metaverse will be an open and diverse space, it is unclear how internet giants might work together to achieve this and whether the gaming industry will be able to shake off its troubled history with inclusivity. There are fears the metaverse could exacerbate a two-tier system that excludes those without internet access, while the immersive nature of the metaverse means it could be even more addictive than 2D mobile apps.

Implications down the supply chain

Caution required, then. But those firms that manage to crack these technological issues and avoid getting weighed down by ethical and regulatory quandaries could be on the cusp of a multi-decade growth story.

Technology hardware firms will be the first in line to benefit should US giants like Apple launch branded pass-through virtual reality (VR) headsets in the next two to three years (Facebook has already launched one but has more ambitious versions in the pipeline). The initial boost to revenues will probably be limited, given the headsets are expected to cost about US$3,000 and be out of reach of many. Nonetheless, the integration of hardware and software should eventually support higher valuation multiples for some firms.

Suppliers of key components like dedicated processors, sensors, and display drivers could be early beneficiaries. Companies that produce 3D sensors could see their valuations improve as headsets become less reliant on cameras, while firms producing processors for 3D graphics and the AI engines necessary for crunching real-time data could also garner more attention. Any firm that can solve the problems associated with see-through lenses would be highly sought after.

Software and apps will probably develop in parallel to hardware and headsets as products are adopted by a broader market. The companies delivering these will perhaps be best placed to take advantage of the metaverse (apps and platforms typically have higher margins than commoditised technology hardware) with advertisers sure to follow. Gaming platforms that have already expanded into the metaverse should begin to see a bigger financial impact as the spending power of their younger audience rises.

Asia could become a metaverse powerhouse

US firms are not alone in wanting to be part of the metaverse. Several Chinese businesses, including Tencent, Netease, and Baidu, are embracing it too. Tencent is a shareholder in Fortnite-creator Epic Games, which has its own 3D gaming engine, and appears well placed to build different ways for customers to translate 2D activities such as ordering dinner, buying tickets, purchasing insurance, and seeing the doctor into a 3D world. Despite recent increases in regulation in China, the government appears generally supportive of metaverse development (although it will likely impose restrictions on underage content).

Meanwhile, a partnership of more than 400 Korean companies, including Samsung, have formed the Korea Metaverse Alliance. One Korean tech firm already has 200 million metaverse users and 700,000 creators. Asia is also home to a large proportion of global VR and AR component and headset makers, meaning the region could become a powerhouse for metaverse hardware as these technologies develop and demand for them grows.

Conclusion

Back to our original question: does the metaverse matter for investors? We think it does. Maybe not immediately – it will take time for the technology to evolve, costs to fall and the metaverse to move into the mainstream. But it already seems to have gained much greater traction globally and among the big tech players than previous incarnations. And, over a longer time horizon, it could have a big impact on companies across the global technology supply chain, and eventually on the rest of the 2D economy. The metaverse is not the next internet. It is the future of the current one.