The price of oil has been on a wild ride. From 2020’s despair with nowhere to store unwanted production and sub-US$20/bbl price, to today’s depleted inventories and a US$90/bbl price. In the meantime, Glasgow Climate summit re-iterated that the world needs to re-direct energy investment from fossil fuels like oil to renewable sources.

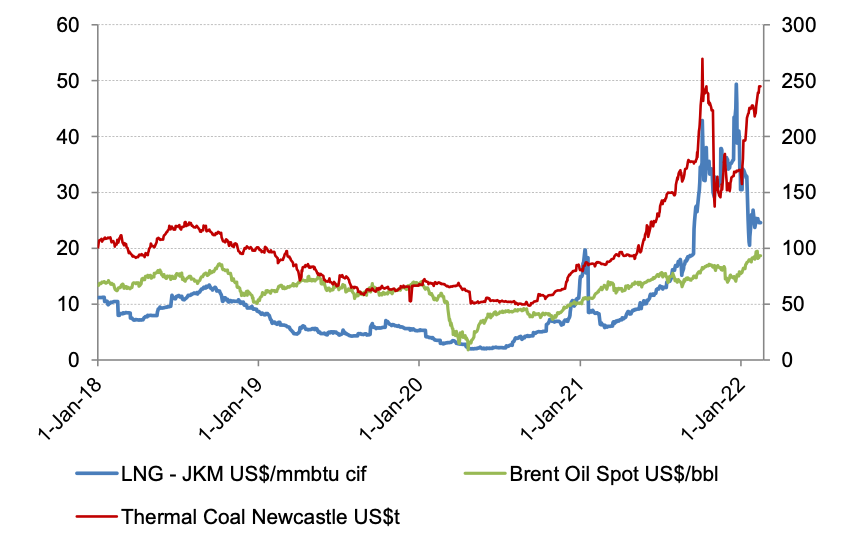

While geo-political and supply chain issues have stoked some commodity price rises, the sky-high prices for liquefied natural gas and thermal coal and the multi-year highs for the oil price suggest something more fundamental.

The sheer volatility of pricing and the negative strategic signalling of climate directives has seen both fossil fuel producers and investors wary about stay-in-business investment, let alone expansion spending.

Perhaps this is a way to shock a transition of the energy system, but it does come with consequences.

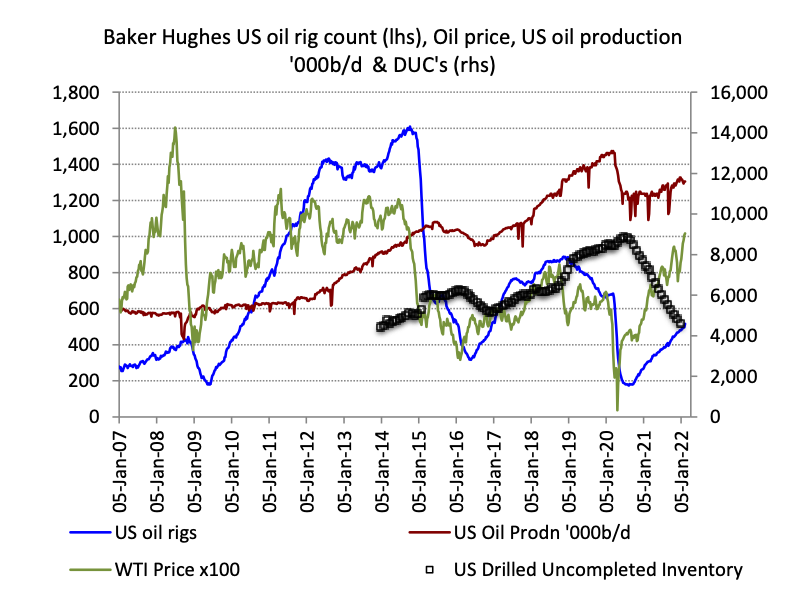

Chart 1 – US producer restraint – profitability focus versus volume

Sources: FactSet, EIA

Within Chart 1 there appears to be a behavioural change of US oil producers. Despite oil prices being much higher than early 2020 when US production reached 13 million bbl/day (mb/d), US oil-focussed drilling effort is only operating at two-thirds rate of 2019 levels – see the blue line. Many producers are reacting cautiously to boosting investment, with oil drilling rates have risen 14% in the last 3-months. This comes as producers’ unexpected cashflow windfall has enabled capital budgets to rise. However, much of this bounty is being applied to debt reduction, higher dividends and share buy-buys.

The recovery of US oil production in 2021 has relied heavily upon “DUC”s – that is Drilled Un-Completed wells. These are past discoveries not fitted-out for production. The DUC inventory has fallen over 4,600 wells or 45% from the start of the pandemic and is falling 4% per month. Though the US drilling effort is rising it must soon accelerate, or US oil production recovery will stall and potentially fall given the steep depletion rates of shale oil wells.

The high oil price is calling for more investment, but will the producers and their investors listen?

We think yes.

However, with world oil consumption back to pre-pandemic levels of around 100 mb/d – the lagged response of the US and other oil producers is giving room to OPEC & Russia to claw back market-share and still see oil prices remain strong, for now.

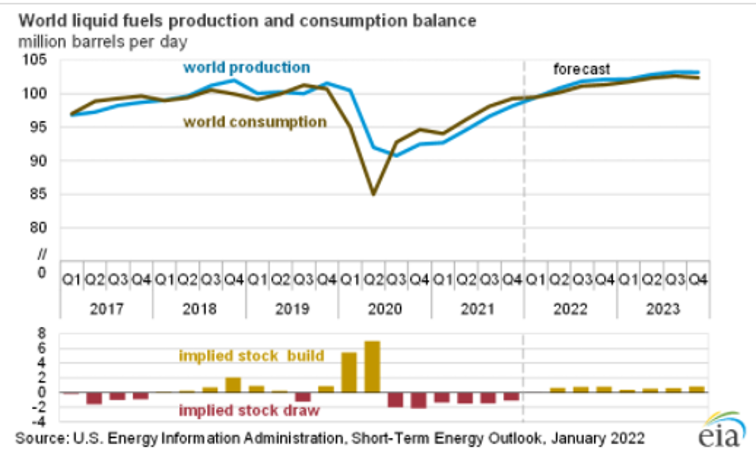

Chart 2 – A precarious balance. Logistics matter

After the initial collapse in oil demand due to the pandemic in JunH2020, the oil market has been producing below consumption (see the EIA chart bars above) as OPEC plus Russia cut quotas and US and Canadian producers throttled output.

Global oil consumption has now virtually normalised. The US Energy Information Administration (EIA) predict that OPEC + Russia as well as rebounding North American oil output growth will be more than sufficient to meet the increasing needs in 2022-23. This may prove to be the case.

However, excess oil stocks have been consumed and are now uncomfortably low. It means that there remains risk of regional, if not global shortages, with even minor interruptions to output flow or clogged logistics. The issues don’t stop with crude oil as the International Energy Agency (IEA) stated “the global refining industry has underperformed relative to demand for the past six quarters, and this is set to continue for most of 2022”.

Oil and oil products markets are wisely weighing this precarious balance until buffer inventories are rebuilt. An oil price at US$90/bbl is the market’s way of incentivizing action for higher output and higher storage in a world increasingly vexed by supply interruptions and geopolitical tension. Of course, high prices also impact consumers’ behaviour, and painfully economic activity with a lag.

OPEC plus allies to the supply rescue?

Since the 2020 commodity price lows, the Brent Oil price has lagged many commodities like iron ore, coal and LNG. That is until recently, as it has risen over 34% since early Dec 2021 is currently trading about 29% above its 10-year average. Interestingly US crude markets fundamentals have seen rapid tightening with West Texas Intermediate price rising 41% since December 2021 and is trading 40% above its average.

While current oil prices are now at levels ordinarily high enough to draw a supply response, we are baffled to see that OPEC plus its allies like Russia have stuck to its gradual 0.4 mb/d per month quota rise. However, by January 2022 OPEC’s production under quota was 0.9mb/d. Perhaps the real issue is under-investment within OPEC as some of its members are struggling to meet output quota let alone increase output. As President Biden called for, key producers like Saudi Arabia need to step up output now.

We think that once the Northern Hemisphere’s seasonal consumption peak demand has passed, there is potential for oil prices to post a pull-back. However, with OECD inventories of crude at 7-year lows, the price downside seems modest until oil inventories are actuallyrebuilt.

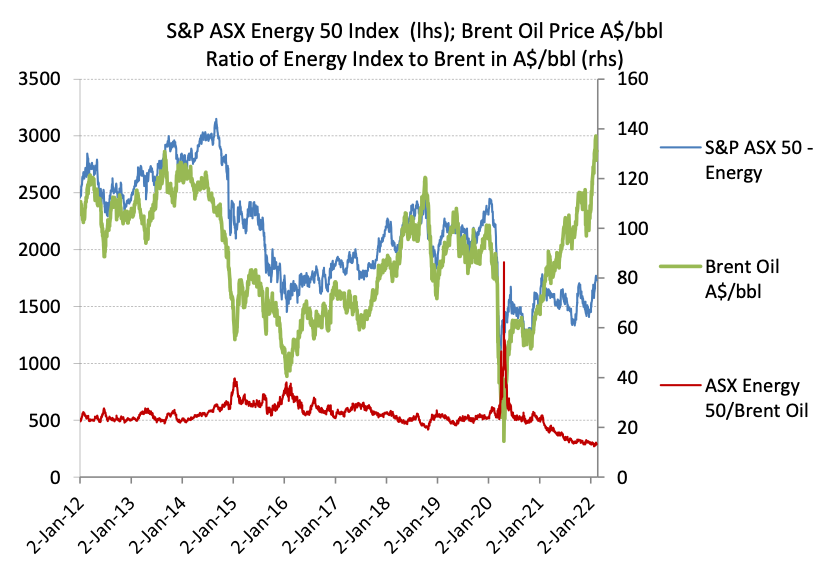

Chart 3 – De-rating energy stocks stymies needed investment

Source: FactSet

The observed hesitancy of producers re-investing in oil, gas and coal production capacity may in part be due to the stock market’s significant de-rating of energy stocks. Technically, if you invert progressively lower trend Price to Cashflow ratios, this signals a higher hurdle discount rate for new investment. A shrinking pool of bank funding for fossil fuels is added pressure. Responsible company managers rightly need to question the wisdom of new fossil-fuels investment versus debt reduction, boosting dividends and buybacks.

In Chart – 3 above we observe that the Australian energy shares (blue line) have markedly lagged commodity prices such as like oil, which has risen to all-time highs in Australian dollar terms. The result is the red line where the ratio of Energy Index to Oil price continues to trend down – a clear signal that investors want to harvest cash flow and not re-invest!

Under-pricing energy stocks can prolong the potential for high energy prices. On this basis there may be a longer duration trade in fossil-fuel energy stocks than implied by the timid market ratings for these stocks.

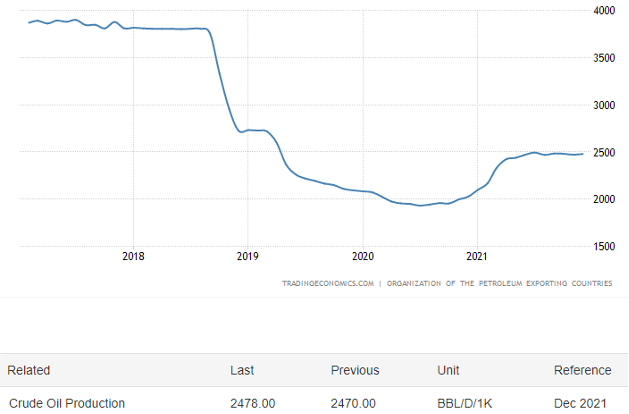

Chart 4 – What could change? – E.g., Lifting Iran Sanctions

Iran production – monthly ‘000b/d

Geopolitics is always a factor in oil markets such as currently with Russia’s military threat in Eastern Europe. The situation is potentially highly destabilizing to both supply and World demand.

An Iran – West Government agreement lifting of sanctions for guarantees on nuclear limitations could boost supply 0.5 mb/d within 3-months and progressively add up to ~1.2 mb/d in about 2 quarters thereafter.

Despite the lags of production growth, the optics of the policy change would likely have an immediate effect sobering impact on oil prices – perhaps US$15/bbl or more.

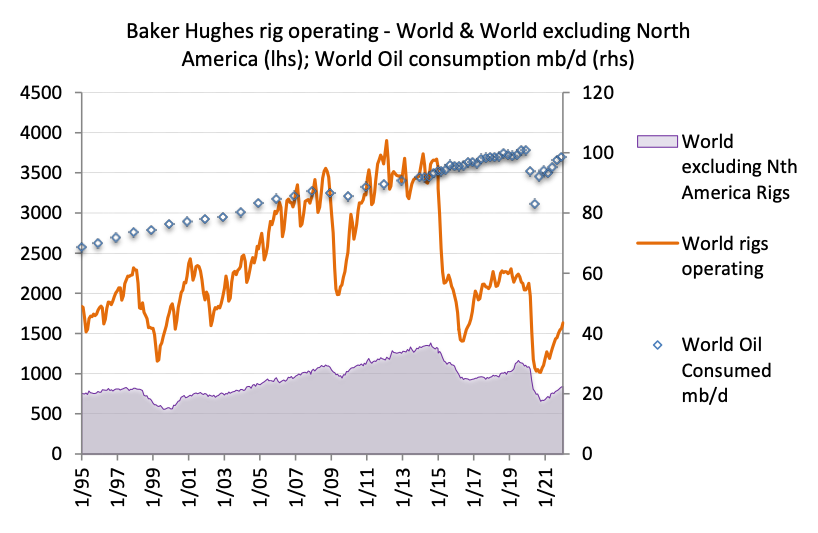

Epilogue – Chart 5 – the global drilling effort needs to accelerate

Sources: Baker Hughes, IEA

Since the turn of the millennium, oil demand has risen 30% or over 22 mb/d. However, the Baker Hughes total international rigs activity (orange line) sees the current drilling effort at or below levels of 1995 to 2003. The purple shaded area includes OPEC members. Insufficient drilling opens the question of the real ability of OPEC to actually sustain higher production levels without a clear rise in investment.

High energy prices are countered by higher investment and a consumption transition

There may be a seasonable price reprieve coming from rising oil prices. However, continued mis-pricing fossil fuel energy producers has contributed to the inadequate investment in global drilling, refining and logistics. This leaves the world vulnerable to future bouts of oil, LNG and coal price volatility with a range of consequences including goading more aggressive Central Bank policies. See Chart -6 below.

Investing in new low-emissions applications and changing energy consumption patterns are essential for climate stability goals but will take time. A balance of investment is needed across the whole energy system for years to come. Otherwise, the chaos of high and unstable fossil-fuel energy prices can threaten the post-pandemic global economic recovery. Worse, such instability can increase the costs of transitioning energy systems and exacerbate existing political and social tensions.

Chart 6 – avoiding an oil price spike like for coal & gas is critical for global stability

Source: FactSet