China’s rapid shift away from COVID-zero has been a key market focus since late last year. With the world’s second largest economy now open for business, there are a number of asset classes and sectors that traders and strategists are watching closely. The case for investing in China’s reopening is compelling, but it may be volatile. Here are some ways investors can access the opportunity.

The cashed up Chinese consumer

Chinese consumers are cashed up and ready to spend, according to the Wall Street Journal, individuals in China took out half a billion in new loans in 2022, less than half of what they borrowed a year earlier. Instead they accumulated cash in 2022 at a record pace, pushing household deposits to an all-time high of $2.6 trillion.

So, when consumer confidence returns this will propel spending higher.

Importantly for investors, Carlos Diez from MarketGrader says, the time to reposition China exposure towards consumption and services is now, before the recovery in consumer confidence is fully priced in.

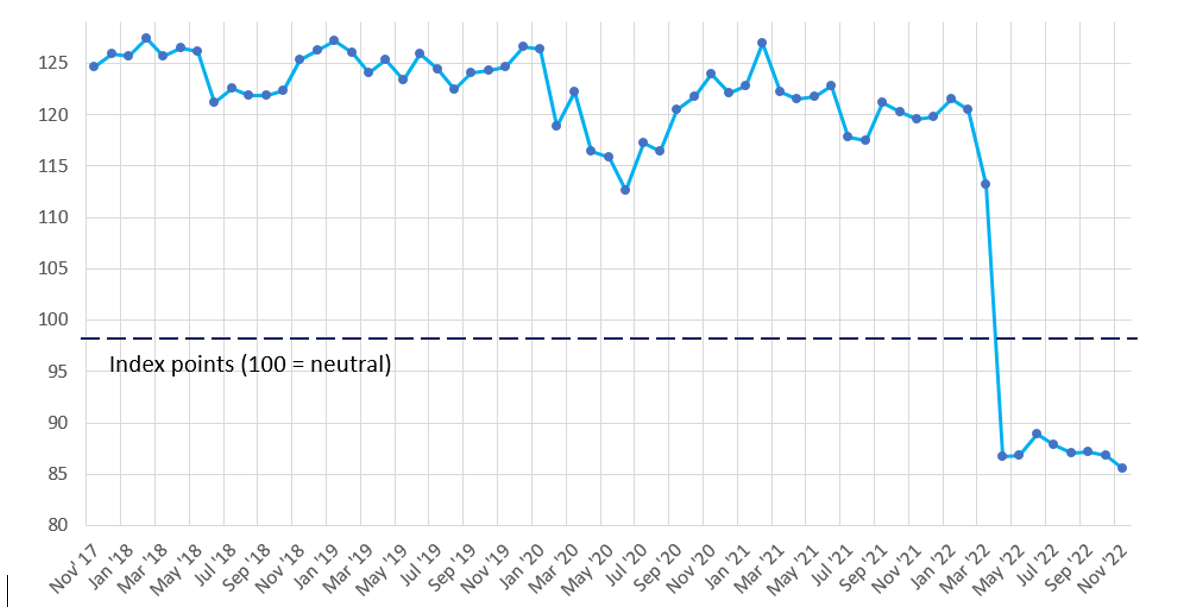

Chart 1: Consumer Confidence Index in China, November 2017 to November 2022

Source: National Bureau of Statistics China; Trading Economics

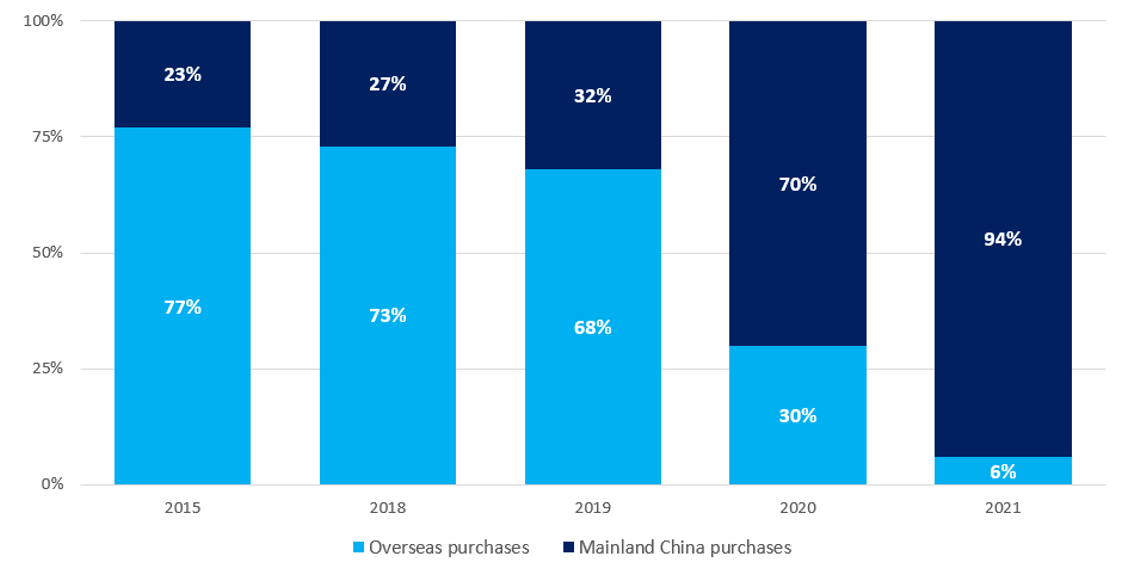

Diez sees, “consumption surprising to the upside in the second half of 2023 once confidence recovers. Furthermore, there will be a gradual transition from foreign to ‘indigenous’ brands.”

Chart 2: Domestic and overseas distribution of Chinese consumption of luxury goods between 2015 and 2021

Source: China Luxury Report 2021 Bain & Company.

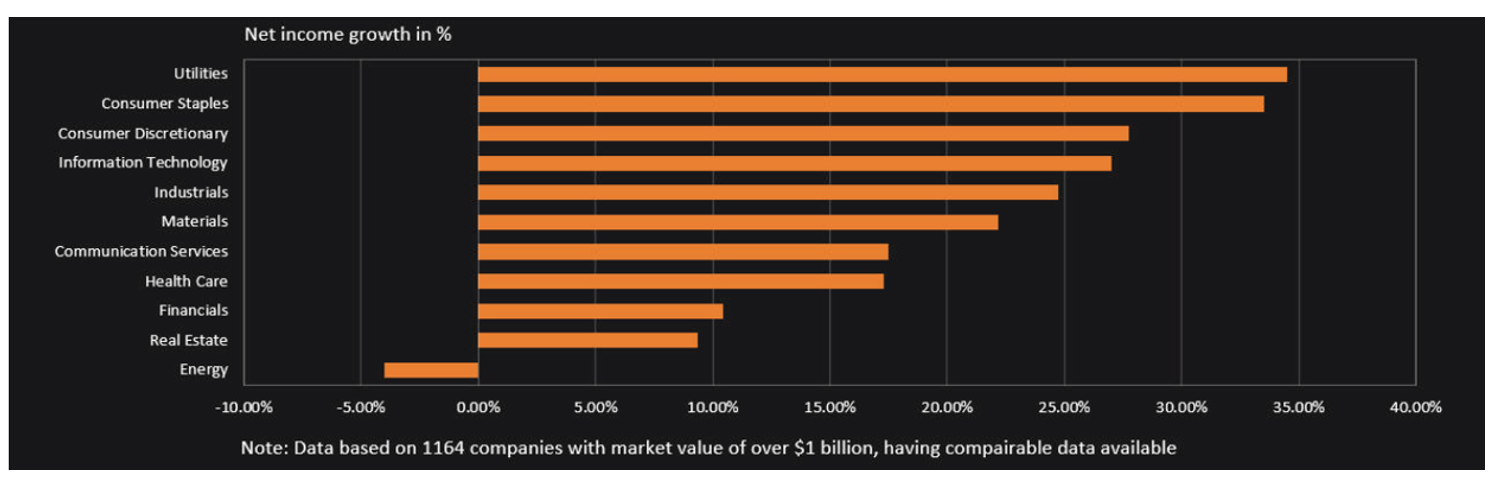

Earnings per share for public companies in China’s consumer sectors are projected to grow by more than 25% in 2023.

Chart 3: Breakdown by sector for Chinese companies’ net income growth in 2023

Source: Reuters Graphics.

Access China’s millennial consumers

China has the largest millennial population in the world and this younger demographic differs from their predecessors in two important ways:

- They received financial support from their elders and grew up with improved technology and digitalisation

- They consume more, are less price-conscious and seek instant gratification

The “young generation” in China, those born in the 1980s, ’90s and the first decade of the 2000s, are poised to become a dominant force in the country’s consumer market, according to management advisory firm Boston Consulting Group (BCG).

In fact, the emergence of a more free-spending generation as a major consuming class is one of three megatrends BCG expects to drive a 55% expansion in China’s consumption spending over the next five years. BCG said that consumption within the under-35 set is growing at 14% annually, double that of their elders.

Members of the young generation also outspend their parents and grandparents as well—by as much as 40% in many product categories. Over the next five years, their share of total consumption will reach 53% from its current level of 45%.

One other important thing to keep in mind when considering Chinese younger consumers is that they tend to be college-educated and more sophisticated than other shoppers in the country.

They also LOVE their brands. According to BCG’s research, they tend to recognise more brands than their peers in the US, they often advocate for them either personally or online, and they form stronger emotional bonds with them. We think domestic brands are set to benefit more than international brands on Chinese consumers’ rising preference for local products and designs. One brand tipped to gain from the millennial spending is Biem LF.

Biem LF

China’s high-end golf wear brand Biem LF has seen its shares climb by 19% per annum over the last 5 years. The high-end apparel company is the first fashion company listed on the China A share market. The brand targets Chinese high-end consumers, who enjoy golf culture and tend to dress in smart casual attire.

According to analyst Michelle Leung of Xingtai Capital “ It’s an example of how Chinese companies are taking advantage of the demand for highly tailored, high-end products from young, wealthy consumers.”

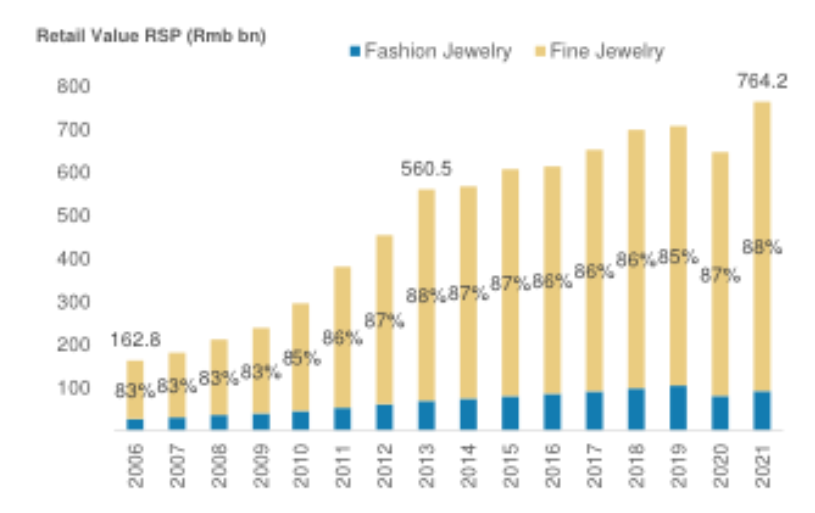

Chow Tai Seng Jewelry

Chow Tai Seng Jewelry is one of China’s top five jewellery retailers, with a franchise model and a focus on lower-tier cities and online channels which should drive better-than-market growth. We see structural growth of the jewellery market given the consumption upgrade and premiumisation trends. The business is also likely to benefit more than international brands based on Chinese consumers rising preference for local products and designs.

Chart 4: China jewellery market size since 2006

Source: Morgan Stanley. Not a recommendation to act.

The Electronic Vehicle (EV) sector

China’s rapidly growing EV industry is forecast to further consolidate its global dominance this year. According to The Financial Times Chinese consumers will buy around 8 million to 10 million EV’s in 2023, up from record sales of 6.5 million vehicles last year and 3.5 million in 2021. This compares with record sales of 3 million in Europe and 2 million in the US.

China’s domestic consumption of EV’s is rapidly growing, “China is expected to have the largest overall sales with 35% year-on-year growth in 2023, after two years of extremely rapid growth … To put this in perspective seven out of every ten electric vehicles are now sold in China, ” said Neil Beveridge, an analyst with Bernstein in Hong Kong.

Raymond Tsang, a China auto expert with Bain said, “The Chinese homegrown EV players are really getting better in terms of their performance and the product portfolio [ . . . ] You are seeing not only that the Chinese products are cheaper, but they’re actually better in the eyes of many customers.”

“The market share of Chinese brands in the domestic EV segment edged higher from a staggering 78 per cent to 81 per cent last year.” According to the Financial Times the pace of growth means China is on the cusp of hitting 50% of car sales to be EVs by the end of 2025, becoming the first major economy to do so.

Carlos Diez, MarketGrader CEO says “subsidies will continue to favour semiconductor manufacturing, electric vehicles and clean energy projects. While eliminating dependence on foreign technology is still a critical goal.”

The companies tipped to win in the new EV era are a handful of Chinese car manufacturers that are outperforming their foreign rivals.

BYD

BYD recently overtook Tesla as the world’s top EV maker. The Warren Buffett backed company expects sales of plug-in vehicles to reach 3 million units this year after selling more than 1.85 million last year, according to the Financial Times. Investment Bank Citi said this estimate was conservative.

The recent electric vehicle boom in China has helped BYD and fellow Chinese battery manufacturer CATL reach a worldwide market share of 50%.

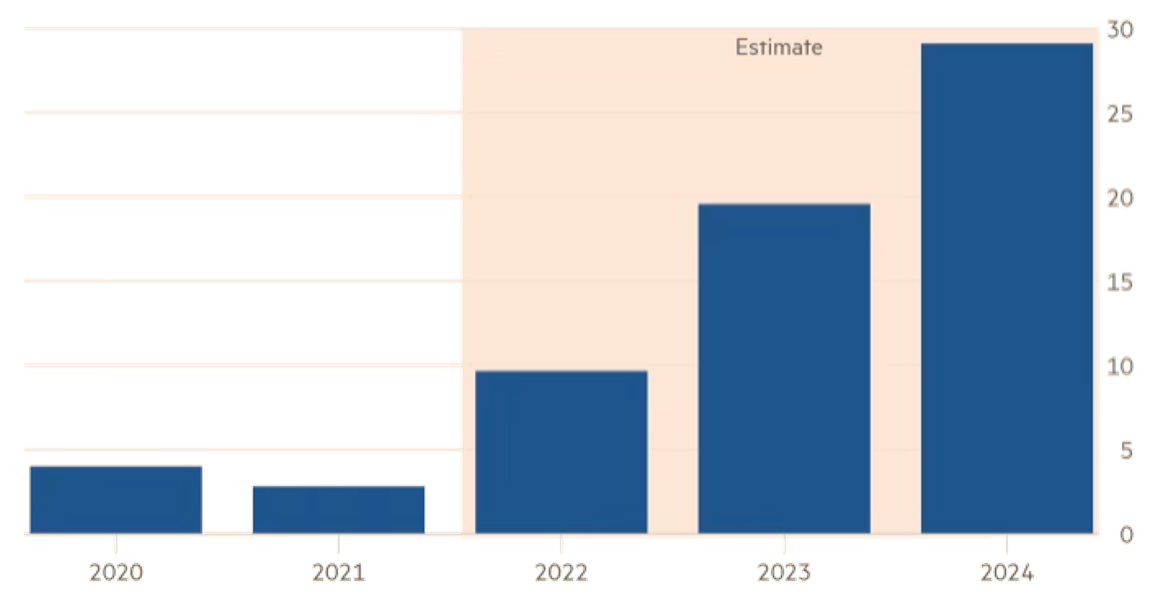

Chart 5: BYD earnings forecast to triple by 2024

Source: Citi, FT. Not a recommendation to act.

CATL

Chinese battery manufacturer CATL is the largest EV battery manufacturer in the world with market share of 37.1% up from 32.2 % in 2021. The company is the lead supplier of Tesla batteries.

CATL and BYD have extended their dominance over global supply, with the companies reaching a combined market share of 50% leaving South Korean and Japanese rivals lagging behind.

The Financial Times has reported that Kevin Shang, an energy storage analyst at consultancy Wood Mackenzie, said “CATL’s strengths in technology development, supply chain control, economies of scale and relationships with carmakers had given it the upper hand.Moreover, CATL has ridden out some of the pressures that battery manufacturers are facing from spiraling raw material prices, with net profit almost tripling in the second and third quarters after an unexpected drop in the first.

The Australian angle

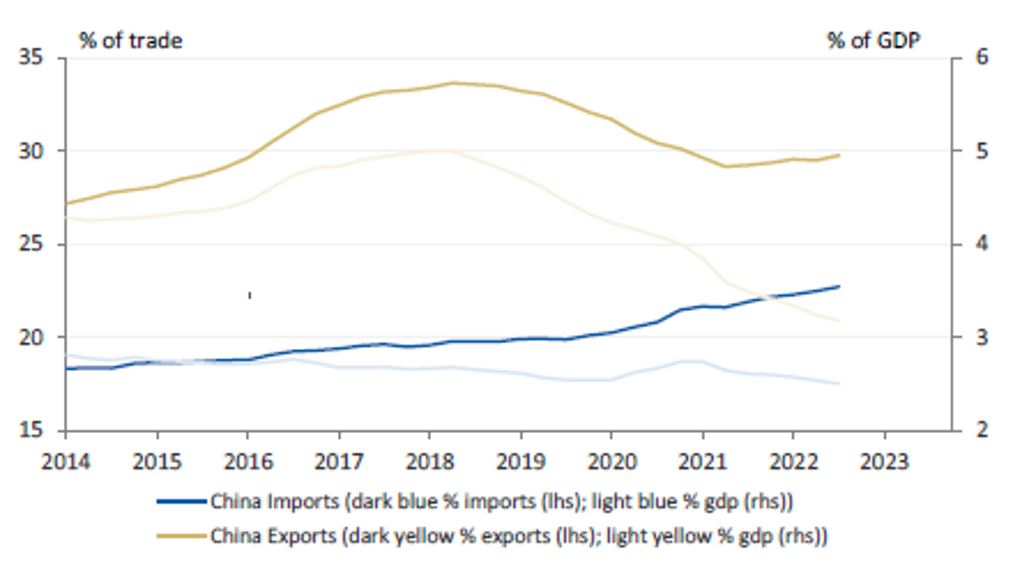

The reopening of a country with 1.4 billion residents offers investment opportunities, particularly within Australian sectors that have high revenue exposure to China. The country makes up around 30% of Australia’s total exports and 23% of total imports. China remains Australia’s largest trade partner by a significant margin, despite its exposure falling somewhat in the last few years.

Chart 6: China remains Australia’s largest trading partner

Source: ABS, Morgan Stanley Research

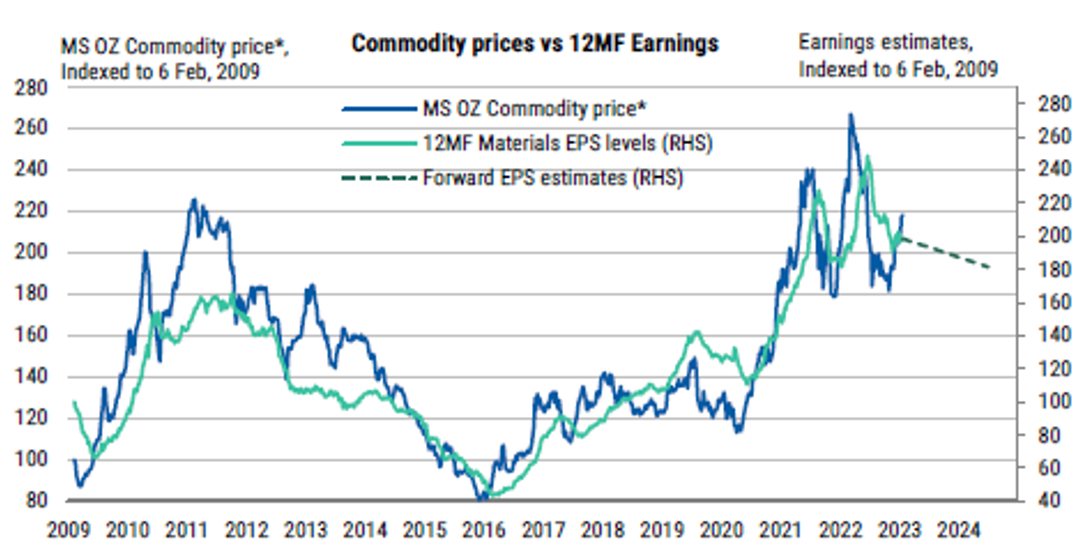

Australia is distinct globally in terms of economic links with China. Specifically, we see a tailwind to Australian resource sector earnings. Recent positive sentiment towards China has seen commodity prices move higher.

Chart 7: China reopening has supported prices for Australia’s key commodities

Source: Bloomberg, Morgan Stanley Research. *MS OZ Commodity price is a revenue weighted commodity price using MS Metals and Mining coverage.

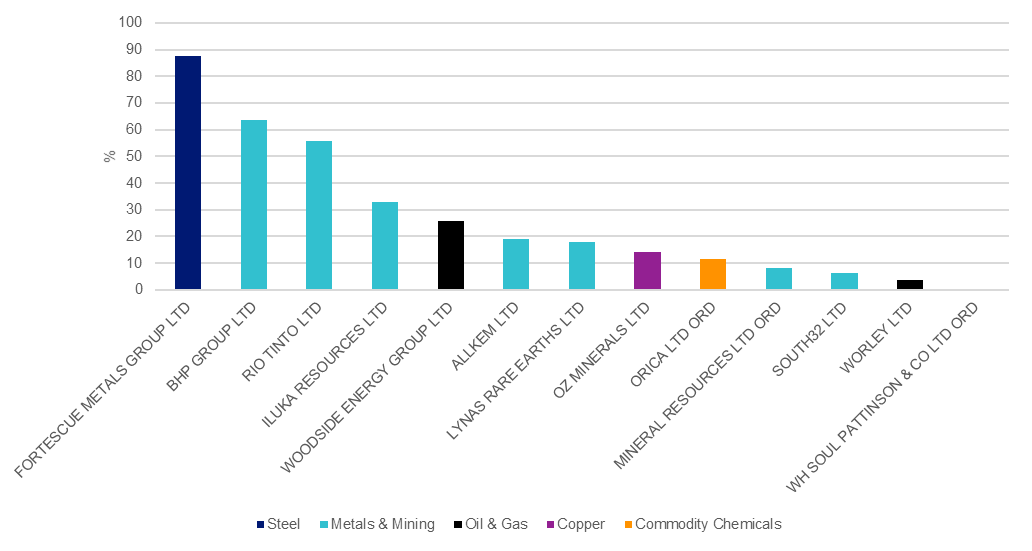

Despite geopolitical tensions, and Chinese sanctions on some major Australian exports, China remains reliant on Australian mining resources. 19% of Australian mining revenue is attributed to China, based on the constituent weighting of MVIS Australia Resources Index.

Chart 8: Australia resources revenue attributed to China

Source: FactSet, as at 30 June 2022.

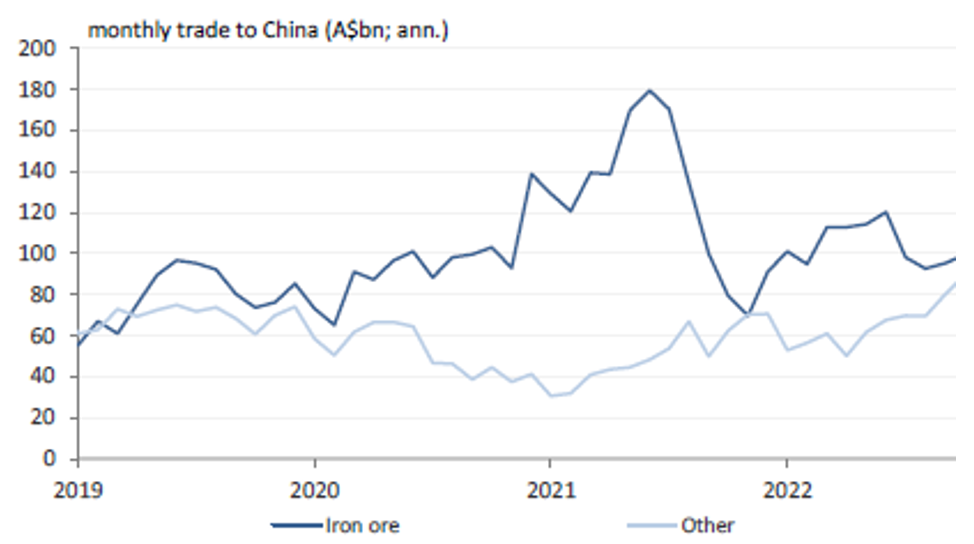

The lion’s share of Australia’s trade exposure to China remains in commodities, particularly iron ore, which is still worth more than all other merchandise exports put together.

Chart 9: Iron ore still represents the majority of Australian exports to china

Source: DFAT, Morgan Stanley Research.

Australian resource stocks could maintain their upward march this year if China’s demand for Australian mining resources heats up as the country continues to reopen. Chinese President Xi Jinping has cited infrastructure spending as the government’s main lever to rescue economic growth, like it was during the global financial crisis. The Australian resources sector could once again be a major beneficiary of this investment, as it was during the GFC.

The reopening of the Chinese economy brings with it a number of investment opportunities both here in Australia and within Chinese equities. While a global economic slowdown could hit the country’s exports, consumption is forecast to strongly recover in the home market.

One way to access China and China’s reopening is via ETFs. VanEck offers two China A-Shares ETFs: China New Economy ETF (CNEW) which provides exposure to the Chinese consumer companies mentioned above and VanEck’s FTSE China A50 (CETF) , which gives exposure to the 50 largest companies in the mainland Chinese market, including to the electric vehicle companies referred to above. While VanEck’s Australian Resources ETF (MVR) provides exposure to Australian resources companies.

For a more in depth discussion on China, including an macroeconomic overview, you can listen to last week’s VanEck China Symposium here.

Key risks

All investments carry risk. An investment in the ETFs mention above carry risks associated with: ASX trading time differences, China (CNEW and CETF), financial markets generally, individual company management, industry sectors, foreign currency, sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the PDS for details.